Camping Furniture Market Size 2025-2029

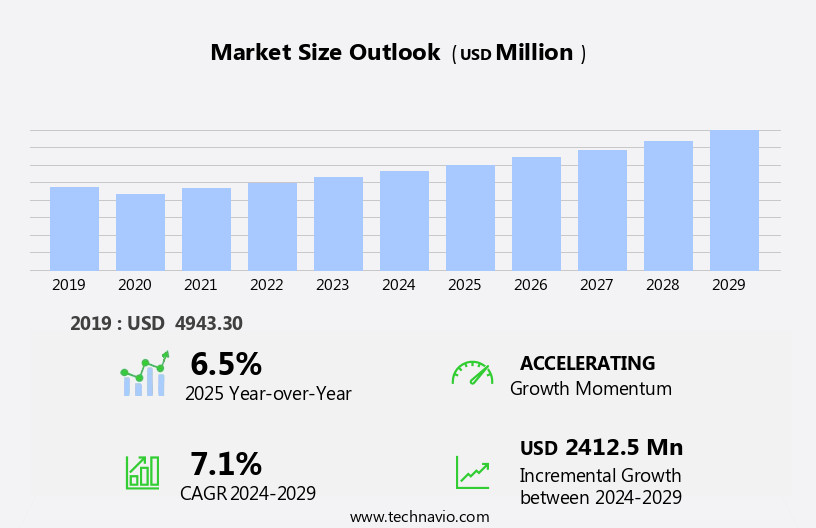

The camping furniture market size is forecast to increase by USD 2.41 billion, at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by government initiatives encouraging camping and the increasing diversity in camping programs. These initiatives have led to a surge in demand for high-quality, durable camping outdoor furniture anad camping equipment that can withstand various outdoor conditions. However, the market faces challenges due to unpredictable weather conditions, which can impact sales and consumer experience. Manufacturers must invest in innovative solutions, such as weather-resistant materials and versatile designs, to cater to the demands of the camping community and ensure customer satisfaction.

- Adapting to these market dynamics and addressing weather-related challenges will be crucial for companies seeking to capitalize on the opportunities presented by the expanding camping market.

What will be the Size of the Camping Furniture Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the growing demand for portable and lightweight solutions for outdoor enthusiasts. Foldable design is a key trend, allowing for easy setup and transport. Direct sales channels, such as e-commerce platforms, are gaining popularity, offering consumers convenient access to a wide range of camping furniture options. Camping cookware sets, made from robust materials like aluminum alloy, are essential for preparing meals during camping trips. Water bottles and filters or purifiers ensure a constant supply of clean water. UV protection and water resistance are crucial features for camping chairs and tables, ensuring comfort and durability in various weather conditions.

Portable stoves and folding tables offer compact designs, reducing setup time and increasing convenience. Adjustable height camp stools cater to different user needs, while sleeping pads and cots provide comfort and insulation. Retail channels, including outdoor recreation stores and wholesale distributors, offer a diverse range of camping furniture options. Eco-friendly materials, such as recycled plastics and natural fabrics, are increasingly being used in camping furniture production. Quality control and weather resistance are essential considerations for manufacturers, ensuring their products meet consumer demands and withstand the rigors of outdoor use. First-aid kits, carrying bags, and storage cases offer added convenience and functionality, ensuring campers have all the necessary equipment for a safe and enjoyable experience.

The market is a dynamic and evolving space, with ongoing innovation and development in product design, material sourcing, and supply chain management.

How is this Camping Furniture Industry segmented?

The camping furniture industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Camping chairs and stools

- Camping tables

- Camping cots and hammocks

- Material

- Metal

- Wood

- Plastic

- Textile

- Others

- Application

- Backyard/Garden Camping

- Car Camping

- Backpacking/Trekking

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

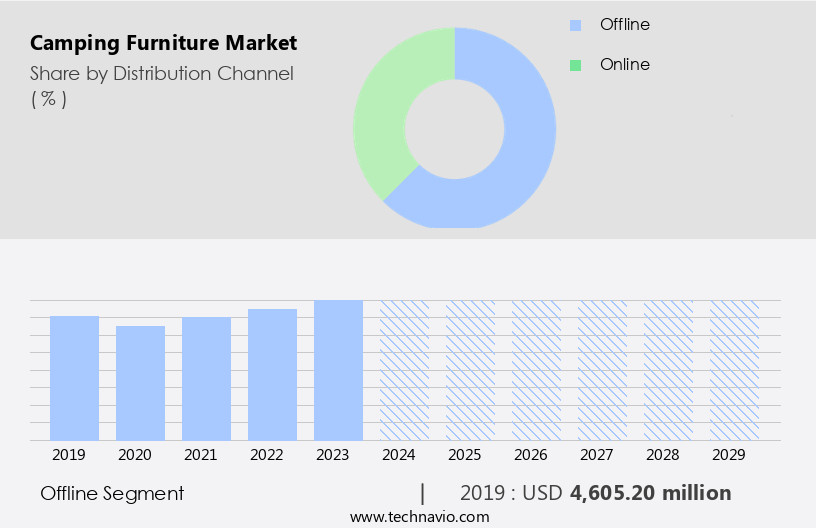

The offline segment is estimated to witness significant growth during the forecast period.

The market is characterized by the prevalence of foldable designs and compact structures, catering to the portable needs of outdoor enthusiasts. Direct sales through e-commerce platforms and brand websites have gained traction, offering convenience and competitive pricing. Water filters and purifiers are integral components, ensuring safe drinking water during camping trips. Adjustable height folding tables and portable stoves facilitate easy setup and save space. Material sourcing from eco-friendly and sustainable resources is a growing trend, with an emphasis on quality control and weather resistance. Aluminum alloy and recycled materials are popular choices for their durability and lightweight properties.

Product design focuses on UV protection, insect repellent, and flame retardant features. Camping cookware, cots, and outdoor furniture are essentials, often sold as cookware sets or in combination with camping chairs and camping tables. Wholesale distribution networks streamline the supply chain, reducing costs and ensuring timely delivery. Easy setup and storage are crucial factors, with carrying bags and storage cases facilitating transportation and organization. First-aid kits, sleeping bags, and sleeping pads complete the camping essentials. Portable furniture, such as camp stools and camp lights, add comfort and functionality to the camping experience. Weight capacity and UV resistance are essential considerations for various camping gear.

The Offline segment was valued at USD 4.61 billion in 2019 and showed a gradual increase during the forecast period.

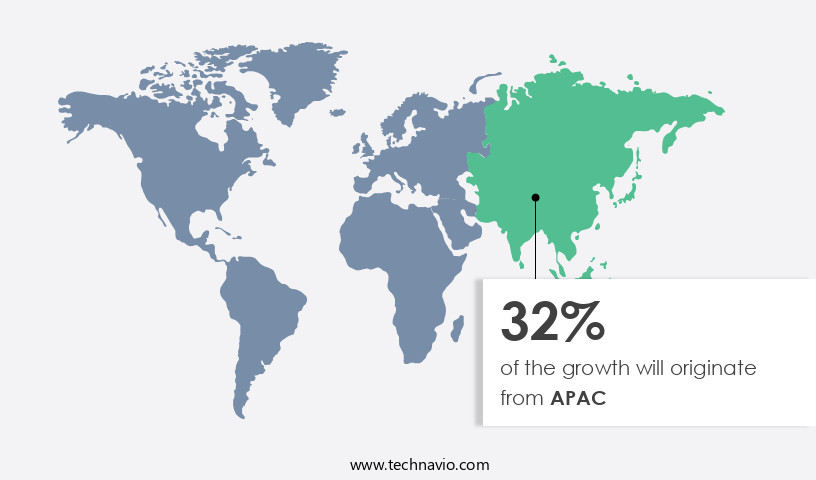

Regional Analysis

APAC is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing significant growth due to the increasing popularity of outdoor recreational activities, particularly among the younger demographic. With a rising preference for traditional camping experiences, the demand for portable and compact camping gear, including folding tables, adjustable height chairs, and lightweight camping stoves, has surged. Material sourcing for eco-friendly materials and robust construction, such as aluminum alloy, is a priority for many manufacturers. Water filtration and purification systems, as well as insect repellent, are essential additions to camping equipment. Wholesale distribution channels and easy setup features are also key factors in the market's success.

Camping cookware, sleeping bags, and outdoor furniture are essential items, with an emphasis on weather resistance and UV protection. The market for camping furniture is further fueled by the availability of portable and compact designs, such as foldable chairs and tables, which allow for quick and easy setup. First-aid kits, storage cases, and camp lights are also popular additions to camping gear. The use of recycled materials in camping furniture production is a growing trend, as consumers increasingly prioritize sustainability. Camping cots, sleeping pads, and camping chairs offer weight capacity and comfort, while cookware sets and portable stoves enable campers to prepare meals in the wilderness.

Flame retardant materials and UV resistance are crucial considerations for camping furniture, ensuring safety and durability. The market caters to various retail channels, including outdoor recreation stores, camping gear retailers, and online marketplaces. Quality control and supply chain management are essential to meet the growing demand for camping gear. Overall, the market for camping furniture in North America is poised for continued growth, driven by the increasing popularity of outdoor recreational activities and the desire for convenient, portable, and eco-friendly camping gear.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global camping furniture market is witnessing significant expansion, driven by evolving camping furniture market trends and the increasing desire for comfortable outdoor experiences. Portable camping furniture, particularly camping chairs and folding camping chairs, are crucial contributors to the expanding camping furniture market size and robust camping furniture market growth.

The demand for lightweight camping furniture is high among backpackers, while the rise of glamping furniture caters to a more luxurious outdoor segment. The market is fueled by increased participation in outdoor recreation camping furniture. Consumers prioritize durable camping furniture that can withstand various conditions. Growth is particularly strong in the North America camping furniture market and Asia-Pacific camping furniture market. The versatility of camping tables and comfortable camping cots is also boosting sales. Innovations like quick-assembly camping furniture and inflatable camping furniture are highly sought after. Leading camping equipment manufacturers are focused on providing compact storage camping furniture and weather-resistant camping furniture to meet diverse end-user needs.

What are the key market drivers leading to the rise in the adoption of Camping Furniture Industry?

- Government initiatives significantly drive the market growth by encouraging camping activities.

- Camping has gained popularity as a cost-effective and immersive outdoor recreational activity. Governments worldwide have taken initiatives to encourage camping, leading to an increase in participation. For instance, European governments offer affordable camping and caravan accommodations, ensuring accessible green parks and spaces for families. In the US, campers can make reservations for campsites through government sites, which offer lower accommodation prices compared to private travel agencies. The US government also provides financial support for the development of campgrounds and camping infrastructure. Outdoor enthusiasts require essential camping gear, such as water bottles, camping cookware, camping cots, insect repellent, and sleeping bags.

- Wholesale distribution channels offer these products at competitive prices, making them accessible to retailers. Product design plays a crucial role in the market, with aluminum alloy being a popular material due to its durability and lightweight properties. The market dynamics are harmonious, with a focus on providing high-quality, robustly constructed camping furniture to cater to the growing demand. Retail channels continue to play a significant role in the distribution of these products, ensuring they reach consumers efficiently and effectively.

What are the market trends shaping the Camping Furniture Industry?

- Camping programs are increasingly embracing diversity as the new market trend. This inclusivity ensures a more representative and engaging experience for a broader range of participants.

- The market is experiencing significant growth due to the increasing popularity of outdoor recreation among consumers of all ages. Older demographics, in particular, are drawn to non-strenuous nature-based activities, making camping an attractive option. Service providers catering to this demographic prioritize eco-friendly materials, ensuring quality control, and offering weather-resistant and water-resistant camping furniture. These providers emphasize the camping experience rather than just offering stand-alone services. They organize edutainment camps and nature treks to attract a diverse range of consumers. For instance, Camp Cheerio in the US offers a Senior Adult Camp program, which provides active adults over 55 years old with a chance to enjoy camping.

- With a focus on easy setup and essential supplies like carrying bags and first-aid kits, camping furniture manufacturers ensure a convenient and enjoyable experience for their customers.

What challenges does the Camping Furniture Industry face during its growth?

- Adversely affecting industry growth is the unfavorable weather conditions, which poses a significant challenge.

- The market is influenced by weather conditions, as unfavorable weather can negatively impact camping activities. Extreme heat, cold, and humidity can lead to unpleasant camping experiences, potentially deterring participation. In many countries, camping is restricted during certain seasons due to adverse weather conditions. For instance, heavy rainfall and hurricanes during the rainy season in the US, typically lasting from July to September, and heavy snowfall during the winter months, from November to January, significantly discourage camping. Campers rely on portable furniture, such as camp stools and chairs, sleeping pads, cookware sets, and camp lights, to enhance their camping experience.

- These items should be flame retardant, UV resistant, and have adequate weight capacity to ensure safety and comfort. Moreover, storage cases with sufficient storage space are essential to keep camping gear organized and easily accessible. Camping furniture plays a crucial role in creating an immersive and harmonious camping environment, emphasizing convenience and functionality. Recent research indicates that the market for camping furniture is growing, as more people seek outdoor adventures and the desire for a connection with nature continues to increase. Camping furniture manufacturers prioritize the development of robust and durable products to cater to the needs of this expanding market.

Exclusive Customer Landscape

The camping furniture market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the camping furniture market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, camping furniture market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Big Agnes, Inc. - Camping enthusiasts seek premium comfort with our axis chair, simmer lounger, and simmer chair offerings. Engineered for durability and original design, these furniture pieces enhance outdoor experiences, elevating camping trips. Innovative features ensure user satisfaction, optimizing relaxation and enjoyment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Big Agnes, Inc.

- Camp Chef

- Coleman Company, Inc. (Newell Brands)

- Decathlon S.A.

- Dometic Group AB

- Helinox (DAC, Inc.)

- Johnson Outdoors Inc.

- KingCamp Outdoor

- Mountcraft

- Nemo Equipment, Inc.

- Oase Outdoors ApS

- Outdoor Revolution

- Ozark Trail (Walmart Inc.)

- Robens (Oase Outdoors ApS)

- Snow Peak, Inc.

- The North Face (VF Corporation)

- Therm-a-Rest (Cascade Designs, Inc.)

- Vango (AMG Group Ltd.)

- Vaude Sport GmbH & Co. KG

- Zempire Camping Equipment

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Camping Furniture Market

- In January 2024, leading camping furniture manufacturer, Coleman, introduced its innovative line of solar-powered camping chairs at the Outdoor Retailer Winter Market, attracting significant attention due to the growing demand for eco-friendly and off-grid camping solutions (Coleman Press Release).

- In March 2024, REI Co-op, a prominent outdoor retailer, announced a strategic partnership with Helinox, a camping furniture specialist, to expand their product offerings and cater to the increasing number of campers seeking lightweight and portable camping gear (REI Co-op Press Release).

- In May 2024, The North Face, a renowned outdoor brand, secured a strategic investment of USD25 million from Qingdao Tsingyi Group, a leading Chinese furniture manufacturer, to expand its camping furniture production capacity and enter the Chinese market (Bloomberg).

- In January 2025, the European Union approved the new REACH regulations for camping furniture, enforcing stricter safety and environmental standards, which are expected to boost the market's growth by encouraging manufacturers to innovate and comply with the new regulations (European Chemicals Agency).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing popularity of outdoor activities and the demand for comfort and convenience in the wilderness. Sales forecasts indicate a steady expansion of the market, with outdoor clothing and travel accessories being key categories. Safety features, such as solar panels for charging devices and LED lighting for illumination, are becoming essential for campers. User reviews and retail partnerships play a crucial role in shaping consumer preferences, while distribution networks ensure accessibility to a wide audience. Technological trends, including Bluetooth speakers and portable power stations, enhance the camping experience. Economic factors, industry standards, and customer service are important considerations for brands seeking a competitive advantage.

- Product development, price competitiveness, and brand building are essential elements of the product lifecycle. Design thinking, safety regulations, campfire accessories, outdoor games, camp kitchen, and protective gear are all areas of innovation, offering growth potential and value proposition for investors. Environmental impact, brand loyalty, camping gear storage, marketing strategies, and waste management are critical aspects of the industry that require continuous attention.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Camping Furniture Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 2412.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Camping Furniture Market Research and Growth Report?

- CAGR of the Camping Furniture industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the camping furniture market growth of industry companies

We can help! Our analysts can customize this camping furniture market research report to meet your requirements.