Carbon Fiber in the Automotive Composites Market Size 2024-2028

The carbon fiber in the automotive composites market size is estimated to grow by USD 173.1 million at a CAGR of 5.72% between 2023 and 2028. The market is experiencing significant growth due to the excellent properties exhibited by carbon fiber, including a high strength-to-weight ratio, superior corrosion resistance, and excellent thermal stability. These properties make carbon fiber an ideal material for automotive applications, particularly in the production of lightweight and fuel-efficient vehicles. Additionally, developments in the automotive industry, such as the increasing demand for electric and hybrid vehicles, are driving the adoption of carbon fiber composites to reduce vehicle weight and improve overall performance. However, the high costs associated with carbon fiber production and processing remain a major challenge for market growth. Despite this, ongoing research and advancements in manufacturing technologies are expected to drive down costs and increase the affordability of carbon fiber composites, making them a more viable option for mass-market automotive applications.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Segmentation

By Material

The Exterior components segment is estimated to witness significant growth during the forecast period. . Carbon fiber composites offer several advantages over traditional materials such as steel and aluminum, including improved fuel efficiency, emission control, and weather resistance. These benefits are driving the adoption of carbon fiber composites in the production of automotive parts, particularly in the exterior application segment. Exterior components, including door modules, fascia, mirror housing, wheel covers, claddings, wheel trims, bumpers, and rocker panels, are the largest application segment in the market. The rising demand for lightweight vehicles, in response to strict government rules on CO2 emissions and the increasing popularity of electric vehicles, is further fueling the market's growth.

Get a glance at the market contribution of various segments View the PDF Sample

The Exterior components segment was the largest segment and was valued at USD 160.40 million in 2018. Long fiber thermoplastic are widely used in automotive applications to produce light vehicles to reduce the overall weight of the material and prevent corrosion and chemical attack. The enhanced performance and diverse applications of LFTs will likely lead to significant growth in the segment in the market during the forecast period.

By Region

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC is the largest segment by region in terms of volume and value. The growing demand for lightweight, fuel-efficient vehicles and improving economic conditions in the APAC region have fueled the growth of the market.

In addition, the sudden expansion of automakers and increased investment in R&D by major suppliers has contributed to the production of high-performance carbon fibers in automotive composites. The competitive landscape and increased R&D spending by key suppliers will lead to improved quality and reduced prices, thereby driving growth in APAC during the forecast period.

Market Dynamics

The market plays a pivotal role in addressing emission control and fuel efficiency challenges in the automotive industry. Known for its exceptional strength to weight ratio and weather resistance, carbon fiber finds extensive Applications in thne automotive industry, including car bodies and automotive parts. By reducing vehicle weight, it contributes to lower CO2 emissions and enables the production of impact-resistant cars. The carbon fiber market is seeing significant growth due to its battery enclosures application in manufacturing, as well as its use in automotive components like bumper beam, fender, front end module, and hood, which benefit from carbon fiber's strength and lightweight properties. As a lightweight material, carbon fiber helps in improving fuel efficiency and battery weight in transportation vehicles. It's also widely utilized in various end-use industries like aerospace & defense, wind energy, and construction to enhance performance and durability. Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Excellent properties exhibited by carbon fiber is the key factor driving the growth of the market. This has several important properties, including high strength-to-weight ratio, corrosion and fire resistance, electrical conductivity, lubricity, inertness, and less toxicity. Carbon fiber is chemically stable and corrosion-resistant. Carbon fiber in epoxy or UV-resistant paint is chemically stable and remains resistant to corrosion.

In addition, they are heat stable and fire resistant. These properties enable its widespread use in the automotive, aerospace, and defense industries as well as other industrial applications. Due to all these properties, the demand in automotive composites is increasing, which is expected to drive the growth of the global market during the forecast period.

Significant Market Trends

Increasing demand for fuel-efficient vehicles is the primary trend in the market. Growing urban populations and industrialization are important factors driving the growth of the auto industry in countries such as India and China. The availability of alternative fuels, coupled with awareness of the positive impact of green and light vehicles, can directly contribute to the growth of the market.

In addition, fuel-efficient cars are environmentally friendly, have high driving ranges, can run on alternative fuels, and use advanced fuel technology. Hybrid electric cars, battery-powered cars, plug-in hybrids, and pneumatic electric cars are some of the fuel-efficient vehicles favored by consumers. These light vehicles make extensive use of composites, which directly increases the demand for the market during the forecast period.

Major Market Challenge

High costs associated with carbon fiber is a challenge that affects the growth of the market. Composites are more costly than their alternatives, such as metals, plastics, and polymer. Manufacturing and R&D costs associated with carbon fiber could reduce demand for carbon fiber in automotive composites and increase demand for alternative products.

Moreover, the production and R&D cost of carbon fiber composites is eight times higher than that of steel. PAN is one of the raw materials used in the production of carbon fiber composite materials; PAN is more costly than its alternatives. The high production costs associated with carbon fiber composites are primarily due to the high cost of raw materials. Thus, high costs associated with carbon fiber will impede the growth of the market during the forecast period.

Key Market Customer Landscape

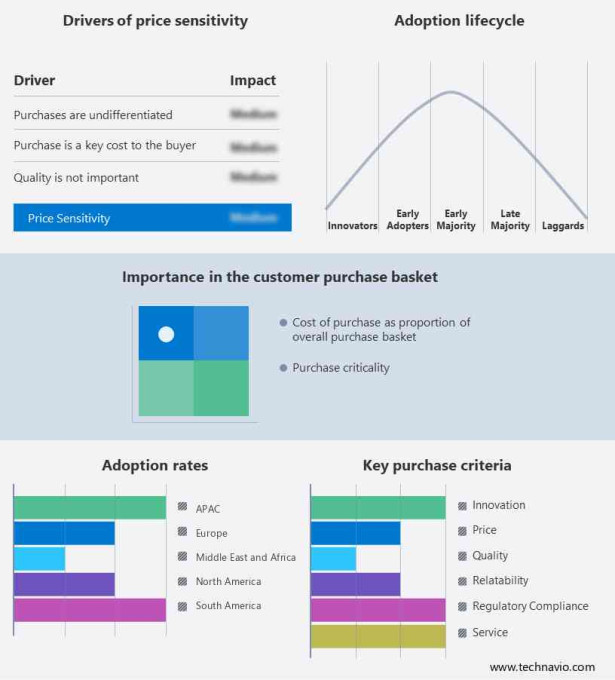

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- ACP Composites Inc.: The company offers carbon fiber products, including a range of fabric reinforcements and structural carbon fiber components such as tubes, panels, and laminates found across multiple industries, including aerospace, automotive, recreational, and medical.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- China Composites Group Corp. Ltd.

- DowAksa Ileri Kompozit Malzemeler San. Ltd. Sti.

- Formosa Plastics Corp.

- Hexcel Corp.

- HP Composites S.p.A.

- Hyosung Corp.

- Knauf Industries

- Kureha Corp.

- Mitsubishi Chemical Group Corp.

- Plasan Sasa Ltd.

- Revchem Composites Inc.

- SAERTEX GmbH and Co.KG

- Saudi Basic Industries Corp.

- SGL Carbon SE

- Shenzhen KIY Carbon Co. Ltd.

- Solvay SA

- Teijin Ltd.

- Toray Industries Inc.

- Muhr und Bender KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Material Outlook

- Long fiber thermoplastic

- Sheet moulding compound

- Prepreg

- Short fiber thermoplastic

- Others

- Application Outlook

- Exterior components

- Interior components

- Structural and powertrains

- Chassis systems

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market finds extensive applications in the automotive industry, particularly in addressing greenhouse gas emissions and enhancing fuel efficiency within the transportation industry. As one of the most sought-after lightweight materials, carbon fiber competes with aluminum and other metal products for use in various automotive components, including car bodies and battery enclosures for electric vehicles. Its flexibility and strength make it ideal for manufacturing body panels, hoods, and components for supercars. With strict government rules on emissions and safety driving demand, carbon fiber reinforced plastics (CFRPs) are increasingly replacing traditional materials in automotive applications, contributing to reduced carbon emission and air pollution.

Furthermore, it is revolutionizing the automotive industry with its diverse applications. It plays a crucial role in reducing greenhouse gas emission by enabling the production of lightweight vehicles. Used extensively in the car body, carbon fiber is also employed in the exterior application segment for components like bumper beams, fenders, front end modules, door panels, and hoods. Additionally, it's increasingly utilized in battery enclosures for electric vehicles, further enhancing their efficiency and performance. Manufacturers (OEMs) are embracing carbon fiber to meet consumer demand for sales of automobiles and avoid penalty payments associated with excessive carbon emissions. Its integration with thermoplastic resins offers superior durability and strength compared to traditional materials, making it a preferred choice in the automotive composites market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.72% |

|

Market growth 2024-2028 |

USD 173.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.33 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ACP Composites Inc., China Composites Group Corp. Ltd., DowAksa, Formosa Plastics Corp., Hexcel Corp., HP Composites S.p.A. , Hyosung Corp., Knauf Industries, Kureha Corp., Mitsubishi Chemical Group Corp., Muhr und Bender KG, Plasan Sasa Ltd., Revchem Composites Inc., SAERTEX GmbH and Co.KG, Saudi Basic Industries Corp., SGL Carbon SE, Shenzhen KIY Carbon Co. Ltd., Solvay SA, Teijin Ltd., and Toray Industries Inc. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.