Caustic Soda Market Size 2025-2029

The caustic soda (NaOH) market size is forecast to increase by USD 10.53 billion, at a CAGR of 4.4% between 2024 and 2029.

- The market is experiencing significant growth due to increasing demand from various industries, including aluminum, textile, fuel additives, and specialty chemicals. in the aluminum industry, caustic soda is used extensively in the production of alumina, aluminum oxide, and aluminum smelting. in the textile industry, it is used as a bleach and a pH regulator in the manufacturing process. Moreover, caustic soda finds applications in the production of pulp and paper, chlorine, lime, anticoagulants, and catalysts. The demand is also driven by its usage in the manufacturing of plastics, rubber, titanium, mercury, solvents, and organic solvents. The market is further boosted by the increasing production capacity for caustic soda and the fluctuations in its prices. However, the market faces challenges such as stringent regulations and the availability of substitutes like potassium hydroxide. The market trends and analysis report provides an in-depth analysis of these factors and more, offering valuable insights for stakeholders in the industry.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a significant segment of the global chemicals industry. This essential commodity is widely used in various industries, including aluminum production, pulp and paper manufacturing, and the production of chlorine derivatives. Caustic soda is also a critical ingredient in the production of titanium dioxide, a pigment used in paints, plastics, and other applications. The market is driven by the demand for its primary uses, such as the production of alumina, chlorine, and hydroxide anions. Additionally, it finds applications in the manufacturing of aerosol compounds, silica, asbestos, and biopharma industries, including ACS and pharmaceutical grades.

- The growth of the industries utilizing caustic soda, such as the transport sector, soap and detergent production, and the pulp and paper industry, contributes to the market's expansion. Environmental concerns, particularly regarding water vapor emissions, are influencing the market's direction. The emergence of regulations and the shift towards more sustainable production methods may impact the market dynamics. The market is vast and diverse, with applications ranging from commodity chemicals to specialty chemicals, including bleached pulp, inorganics, and biopharma.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Organic chemicals

- Soaps/detergents/textiles

- Paper and pulp

- Aluminum

- Others

- Method

- Membrane cell process

- Diaphragm cell process

- Mercury cell process

- Grade Type

- Industrial grade

- Food grade

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Application Insights

- The organic chemicals segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by its extensive applications in various industries, particularly in the production of organic chemicals. In 2024, the organic chemicals segment led the market, with caustic soda being a crucial reactant in the manufacturing of organic acids, organic resins, and chemicals such as epoxy resins, propylene oxide, polycarbonates, ethylene amines, pigments, and dyes. Caustic soda is employed in the base-driven hydrolysis process of esters, alkyl halides, and amides. However, potassium hydroxide serves as a substitute due to its higher solubility in several organic solvents. It plays an essential role in the production of valuable organic chemicals, including titanium dioxide, aluminum, hydroxide anion, and chlorine derivatives.

It is also used in water treatment, soaps and detergents, pulp and paper, and pharmaceuticals. Despite environmental concerns, the demand continues to grow, driven by the transport sector, soap and detergent industry, and the need for water treatment and descaling agents. Impurities and pollutants in caustic soda can be mitigated through advanced technologies, ensuring sustainability in its production and use.

Get a glance at the Industry report of share of various segments Request Free Sample

The organic chemicals segment was valued at USD 10.86 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

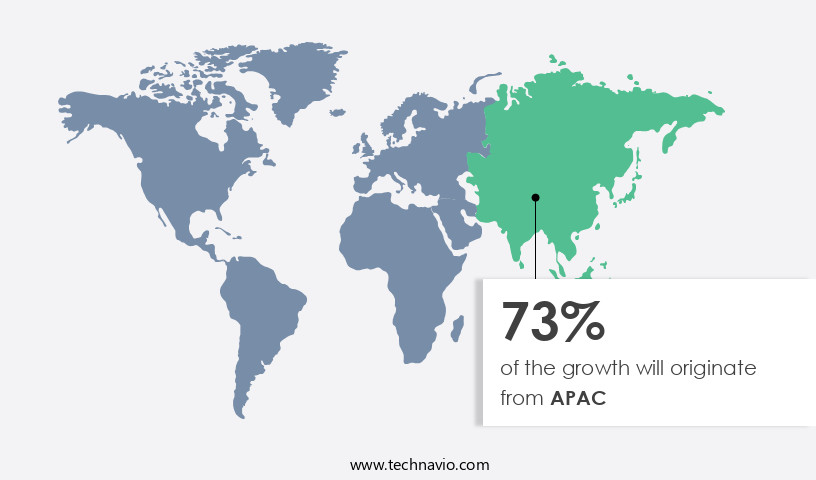

- APAC is estimated to contribute 73% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region dominates The market due to its significant production and consumption. Japan and South Korea exhibit high per capita consumption of caustic soda, driven by a strong chlor-alkali industry. Key contributors to the APAC market include China, India, Australia, South Korea, and Indonesia. The region's high production capacity and strong end-user industries, such as pulp and paper, aluminum, and water treatment, fuel market growth. Caustic soda is an essential ingredient in various applications, including the production of titanium dioxide, chlorine derivatives, and soaps and detergents. In industries like pharmaceuticals, it is used in the saponification process for producing drugs like aspirin, anticoagulants, and cholesterol-lowering agents. Caustic soda's ionic properties make it a crucial component in water treatment, metal processing, and the production of silica, asbestos, and hydroxide anions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Caustic Soda (NaOH) Industry?

Increasing demand from alumina industry is the key driver of the market.

- Caustic soda, or sodium hydroxide (NaOH), is a critical ingredient in various industries, including the production of titanium dioxide, aluminum, and chlorine derivatives. in the aluminum industry, caustic soda is used in the Bayer process to extract alumina from bauxite ore. Approximately 85-115 kilograms of caustic soda are required to produce one metric ton of alumina. in the chemical industry, it is used in the manufacture of aerosol compounds, silica, and asbestos. The hydroxide anion in caustic soda plays a significant role in various chemical reactions, such as the saponification process used in the production of soaps and detergents.

- Caustic soda is also an essential component in the pharmaceutical industry, used in the production of drugs like aspirin, anticoagulants, and cholesterol-lowering agents. In water treatment, it is used to neutralize acidic water and remove impurities and pollutants. Additionally, it is used in the production of pulp and paper, textiles, and various other industrial applications. Caustic soda is produced through the chlor-alkali process, which involves the electrolysis of brine. The process generates NaOH as a byproduct, along with chlorine. The demand for soaps and detergents, fuel additives, and other applications drives the growth of the market.

- However, environmental concerns and the need for sustainability are increasing the focus on reducing the use of NaOH and exploring alternative production methods. It is available in both solid and liquid forms and is used in various industries, including metals, water treatment, and soaps and detergents. The market is diverse, with applications ranging from industrial manufacturing to consumer products. Impurities and pollutants in NaOH can impact its quality and performance, making purity a critical factor in the market. Mercury cells and diaphragm cells are commonly used in the production of caustic soda, with mercury cells being more energy-intensive but producing a higher purity product.

What are the market trends shaping the Caustic Soda (NaOH) Industry?

Increasing production capacity for caustic soda is the upcoming market trend.

- The market is experiencing growth due to the escalating demand from various industries. Caustic soda is a critical ingredient in the production of titanium dioxide, aluminum, and chlorine. Its increasing use in water treatment, soaps and detergents, and pharmaceuticals is driving market expansion. in the pulp and paper industry, the consumption of NaOH in the saponification process of vegetable oils and production of anionic surfactants is significant. Additionally, the demand in the production of chlorine derivatives, such as hydroxide anion, is increasing. Emerging economies are witnessing a rise in the production capacity of NaOH to cater to the increasing demand from these industries.

- The high demand in the production of essential chemicals like silica, asbestos, and potassium oxide is also contributing to market growth. The market dynamics are influenced by factors such as sustainability concerns, impurities and pollutants, and the need for solid and liquid forms of caustic soda in various applications. NaOH is used in the production of mercury cells and diaphragm cells for chlorine production. Its application in the production of coral in the chemicals market is also noteworthy. Inorganics, biopharma, and specialty chemicals industries are significant consumers of NaOH, and the demand is expected to continue during the forecast period.

What challenges does the Caustic Soda (NaOH) Industry face during its growth?

Fluctuations in caustic soda prices is a key challenge affecting the industry growth.

- Caustic soda, also known as sodium hydroxide (NaOH), is a crucial commodity chemical widely used in various industries. Its primary applications include the production of titanium dioxide, aluminum, chlorine, and pulp and paper. in the chemicals market, caustic soda is essential for manufacturing aerosol compounds, silica, asbestos, hydroxide anions, and chlorine derivatives. in the pharmaceutical sector, caustic soda is used in the production of coral, drugs such as aspirin, anticoagulants, and blood clots treatments. Caustic soda plays a significant role in the production of soaps and detergents, fuel additives, and clothes. in the metals industry, it is used in water treatment and the saponification process with vegetable oils.

- The price volatility significantly impacts the global market. As a commodity, its production and consumption patterns are highly dependent on the demand from its end-user industries. Economic performance and price elasticity influence the market's growth. The price fluctuations bring uncertainty to the market and affect the profit margins of the value chain stakeholders. Caustic soda is used in various industries, including pulp and paper, alumina, inorganics, biopharma, and chlor-alkali production. Its ionic properties make it an essential ingredient in the production of anionic surfactants, essential for household cleaning, fuel additives, and clothes.

- The use of alternative technologies, such as mercury cells and diaphragm cells, has led to the production with higher purity levels, including ACS Grade and Pharmaceutical Grade. Emerging economies' growing demand, particularly in the production of chlorine derivatives, is expected to drive the market's growth. However, environmental concerns and the presence of impurities and pollutants remain challenges for the market. NaOH is a versatile chemical with numerous applications in various industries. Its demand is driven by the industries' growth, particularly in the transport sector and soap and detergent production. The market's growth is influenced by factors such as sustainability, technological advancements, and regulatory requirements.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Birla Chemicals - The company offers caustic soda such as caustic soda flakes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including

- Arkema

- BASF SE

- Braskem SA

- Covestro AG

- Formosa Plastics Corp.

- Genesis Energy LP

- Gujarat Alkalies and Chemicals Ltd.

- INEOS Group Holdings S.A.

- Kemira Oyj

- Nouryon Chemicals Holding B.V.

- Occidental Petroleum Corp.

- Olin Corp.

- Shin Etsu Chemical Co. Ltd.

- Solvay SA

- Superior Plus Corp.

- Tata Chemicals Ltd.

- The Dow Chemical Co.

- Tosoh Corp.

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Caustic soda, also known as sodium hydroxide (NaOH), is a critical commodity chemical widely used in various industries. Its unique properties, such as its strong alkaline nature and ability to form salts with various acids, make it an essential ingredient in numerous applications. The market is driven by the demand for various end-use industries. in the chemicals sector, NaOH is extensively used in the production of chlorine and its derivatives, which are integral to the manufacture of PVC, chlorinated paraffins, and other chlorinated compounds. Additionally, it is used in the production of pulp and paper, alumina, and inorganics.

in the biopharma industry, caustic soda is employed in the production of pharmaceutical-grade and ACS-grade sodium hydroxide. It is used in the synthesis of various drugs, including anticoagulants, aspirin, and cholesterol-lowering agents. in the metals industry, caustic soda is used in the production of titanium dioxide, a pigment used in paints and coatings, and in the refining of metals such as aluminum. The demand is also significant in the water treatment sector, where it is used to remove impurities and pollutants. in the manufacturing of soaps and detergents, NaOH undergoes the saponification process with vegetable oils to produce various anionic surfactants used in household cleaning products and fuel additives.

In addition, the market is influenced by several factors. Environmental concerns have led to increased regulations and stringent standards for the production and use of caustic soda. The emergence of sustainable production methods, such as mercury cells and diaphragm cells, has reduced the environmental impact of NaOH production. The growth of the transport sector and the demand for soap and detergent products have driven the market's expansion. However, the market is also subject to price volatility due to the production process's dependence on natural resources and energy costs. Despite its widespread use, the production of NaOH comes with challenges.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market Growth 2025-2029 |

USD 10.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

China, US, India, Japan, Canada, Germany, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.