China Dental Implants Market Size 2025-2029

The China dental implants market size is forecast to increase by USD 246.8 million at a CAGR of 7.5% between 2024 and 2029.

- The Dental Implants Market is experiencing significant growth driven by the increasing preference for implants over traditional dentures and the rising number of aging populations worldwide. Mini implants are gaining traction due to their smaller size and lower cost, expanding the market's reach to a larger patient base. Additionally, the adoption of computer-aided design and manufacturing (CAD/CAM) technology in the production of dental implants is streamlining the manufacturing process, improving accuracy, and reducing production time. Firstly, the increasing number of treatments related to cosmetic dentistry is driving demand for dental implants as a long-term solution for missing teeth. However, the high costs associated with dental implants remain a significant challenge for market growth, particularly in developing countries. To overcome this, players in the market are exploring cost-effective manufacturing methods and financing options for patients.

- Furthermore, advancements in biomaterials and biotechnology are expected to bring about innovations in dental implant design and functionality, creating new opportunities for market participants. The trend towards more efficient systems and better accessibility to oral care is also gaining momentum, ensuring the market's continued evolution. Companies seeking to capitalize on these trends should focus on cost reduction strategies, technological innovation, and expanding their product offerings to cater to a wider patient base.

What will be the size of the China Dental Implants Market during the forecast period?

- The dental implants market encompasses the production and distribution of dental implants, a type of dental prosthetic designed to replace missing teeth and restore oral function. This market caters to individuals experiencing tooth loss due to various reasons, including bone loss, oral disorders, dental ries, and injuries from accidents or sports. Advanced technologies, such as CAD/CAM machines, digital dentistry, and 3D printing, are revolutionizing the industry by enabling high-quality, customized implant designs and manufacturing processes. Dental implants offer several advantages over removable prosthetics, including improved chewing patterns, enhanced facial form, and the stimulation of natural bone growth. The market's growth is driven by an increasing global population aging and the rising prevalence of oral disorders.

- Additionally, advancements in dental intelligence and digital connectivity are enabling more precise implant placement and improved patient care. Soft tissue management and the use of natural bone in implant procedures further enhance the market's appeal. Overall, the dental implants market is poised for continued growth, offering significant opportunities for innovation and development.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Dental hospitals and clinics

- Dental laboratories

- Others

- Material

- Titanium implants

- Zirconia implants

- Product

- Tapered implants

- Parallel walled implants

- Price

- Premium implants

- Value implants

- Discounted implants

- Geography

- China

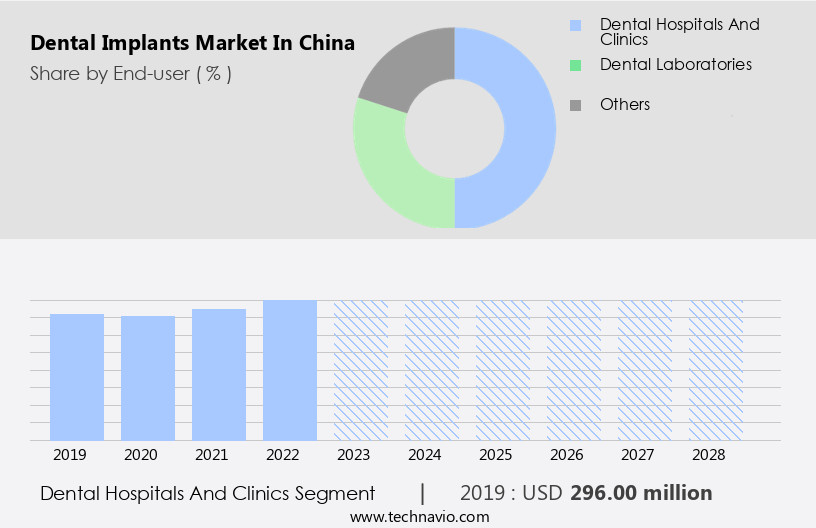

By End-user Insights

The dental hospitals and clinics segment is estimated to witness significant growth during the forecast period. The market is experiencing growth due to the rising number of dental hospitals and clinics, driven by the increasing demand for dental services. Oral health awareness and the need for regular check-ups are key factors fueling this trend. Dental implant procedures, which are primarily conducted in specialized dental facilities for orthodontic, aesthetic, and prosthetic treatments, contribute significantly to market growth. As more dental hospitals and clinics open to meet the demand for dental services, the number of dental implant procedures is expected to increase, thereby propelling market expansion in China during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The Dental hospitals and clinics segment was valued at USD 296.00 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of China Dental Implants Market?

- Mini implants gaining traction is the key driver of the market. Dental implants have emerged as a popular solution for tooth loss, addressing both oral function and facial form. According to the World Health Organization, tooth loss and resulting bone loss can lead to chewing patterns alterations, oral disorders, and even nerve damage. Dental ries for implant placement involve integrating biocompatible materials, such as gold alloys, stainless steel, titanium, zirconium, and antimicrobial coated implants, into the jawbone for permanent tooth replacement. Mini implants, a smaller alternative, are gaining traction due to their less invasive nature. They are often used to stabilize and retain removable dentures, particularly in cases of limited bone volume.

- Antimicrobial peptides and silver nanoparticles are increasingly incorporated into implant designs to combat oral bacteria, tooth decay, and periodontal diseases. Digital dentistry, including 3D printed implants and digital connectivity, is revolutionizing the industry, ensuring surgical precision and improved patient comfort. Dental clinics and offices are adopting these advancements, offering patients a more natural appearance, improved implant stability, and long-term dental health benefits. Despite these advancements, dental issues such as dental caries, periodontal disease, and dental injuries continue to affect the geriatric population. Regulatory scrutiny from government authorities and the need for patient comfort and dental aesthetics necessitate continuous innovation in implant technology and design.

What are the market trends shaping the China Dental Implants Market?

- Computer-aided design and manufacturing of dental implants is the upcoming trend in the market. Dental implants have emerged as a popular solution for tooth loss, addressing both oral function and facial form. The World Health Organization reports that tooth loss is a global health issue, affecting over 3.5 billion people worldwide. Dental implants offer a permanent solution with high implant success rates, providing excellent chewing function and aesthetic appeal. However, tooth decay and periodontal diseases caused by oral bacteria remain significant challenges. Advancements in dental technology have led to innovative solutions, such as antibacterial coated implants utilizing antimicrobial peptides and silver nanoparticles. These technologies aim to mitigate the risk of infection and improve implant durability.

-

Digital dentistry, including 3D printing and implant design using biocompatible materials, offers surgical precision and customized implant solutions. Dental clinics and dental offices have adopted digital connectivity, enabling seamless communication between dental professionals and improving patient care. Dental ons and solo practices benefit from these advancements, offering more efficient and effective dental solutions. The dental implant market encompasses various implant designs, including tapered implants, parallel walled implants, endosteal implants, subperiosteal implants, and transosteal implants. Materials such as gold alloys, stainless steel, titanium, zirconium, and smart arches are used in dental implant manufacturing. Despite these advancements, regulatory scrutiny from government authorities and the geriatric population's increasing need for dental care present challenges for the dental implant market.

What challenges does China Dental Implants Market face during the growth?

- High costs associated with dental implants is a key challenge affecting the market growth. Dental implants serve as a permanent solution for tooth loss, offering improved oral function and facial form. However, their high cost is a significant barrier for many. The materials used, such as titanium or zirconia, ensure bone integration and durability, but come with a premium price. Dental implant procedures involve surgical placement and post-implantation consultations, further increasing costs. Multiple tooth replacements necessitate additional dental implants, crowns, or artificial teeth, leading to higher expenses. Oral disorders like tooth decay and periodontal diseases, caused by oral bacteria, can lead to tooth loss. The World Health Organization reports that dental diseases are the most common non-communicable diseases worldwide.

-

Dental ries and related procedures are essential for oral health, but their cost can be prohibitive for some. Advanced technologies like dental 3D printers, digital dentistry implants, and antibacterial coated implants using antimicrobial peptides or silver nanoparticles offer potential cost savings and improved patient comfort. Dental clinics and dental offices offer various dental solutions, including dental care, bone grafting, and implant placement, to help restore natural appearance and dental health. Patients, especially in the geriatric population, may face regulatory scrutiny and government authorities' intervention when considering dental implants due to their cost. Dental issues like dental caries and periodontal disease can lead to missing teeth and require dental solutions. Despite these challenges, the market is expected to continue its growth due to the increasing demand for effective and long-lasting tooth replacement solutions, including metal implants and medical alloys.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasting partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AB Dental Devices Ltd.

- Cortex Dental Implants Industries Ltd.

- Denteng Shanghai Medical Devices Co. Ltd.

- Dentsply Sirona Inc.

- GC Corp.

- Guilin Woodpecker Medical Instrument Co. Ltd.

- Heraeus Holding GmbH

- Institut Straumann AG

- Neo Biotech

- Ningbo Runyes Medical Instrument Co. Ltd.

- Nobel Biocare Services AG

- Osstem

- Thommen Medical AG

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Dental implants have emerged as a popular solution for addressing tooth loss and related complications. This market encompasses a range of dental prosthetics designed to restore oral function and enhance facial form. Tooth loss, a prevalent issue worldwide, can stem from various causes such as bone loss, chewing patterns, and oral disorders. Bone loss, a significant concern in dental health, can lead to tooth loss and impact oral function. The World Health Organization reports that tooth loss is a global health issue, affecting millions of individuals. Dental ries, including implant placement, have become increasingly common to address tooth loss and its associated complications.

Dental intelligence and digital dentistry have significantly influenced the dental implants market. Innovations such as antibacterial coated implants and digital dentistry implants have shown promise in enhancing patient comfort and implant success. These advancements cater to the growing demand for biocompatible materials and surgical precision. Oral bacteria, a common cause of tooth decay and periodontal diseases, pose a significant challenge in dental health. Researchers continue to explore the use of antimicrobial peptides and silver nanoparticles to combat oral bacteria and improve implant durability. The dental implants market caters to various implant designs, including tapered implants, parallel walled implants, endosteal implants, subperiosteal implants, and transosteal implants.

These implants vary in their design and application, catering to the unique needs of individual patients. Solo practices and dental clinics have adopted digital connectivity and advanced dental technologies to enhance patient care and improve implant placement precision. Dental offices have also started offering cosmetic dentistry services, focusing on jaw stability, dental crowns, and implant stability to provide patients with a healthy smile and natural appearance. These include the presence of a large number of manufacturing companies, favorable reimbursement policies in countries like the UK and Germany, and the increasing adoption of CAD/CAM technology for implant design and manufacturing. The geriatric population represents a significant market for dental implants due to the high prevalence of tooth loss among older adults. Regulatory scrutiny and government authorities play a crucial role in ensuring the safety and efficacy of dental implants and related procedures. Technological advancements in dental 3D printing devices, such as CAD/CAM technologies and digital imaging, enable the production of customized dental implants, enhancing safety, effectiveness, and natural-looking teeth.

SmartArches dental implants and titanium implants have gained popularity due to their high implant success rates and aesthetic appeal. Zirconium implants offer an alternative to titanium, catering to patients with metal allergies or sensitivities. Medical tourism has emerged as a trend in the dental implants market, with patients traveling to countries with lower costs and advanced dental technologies. Tooth replacement remains a priority for individuals seeking to restore oral function and improve their quality of life. Bone integration and oral restoration are essential aspects of dental implant procedures, ensuring the long-term success and stability of the implants.

Patient comfort and dental hygiene play a crucial role in implant success and overall dental health. The dental implants market continues to evolve, driven by advancements in dental technology, patient demand, and regulatory requirements. The focus on biocompatible materials, surgical precision, and patient comfort is expected to shape the future of dental implants and oral health solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Market Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 246.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth analysis and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market report to meet your requirements Get in touch