Cognac Market Size 2023-2027

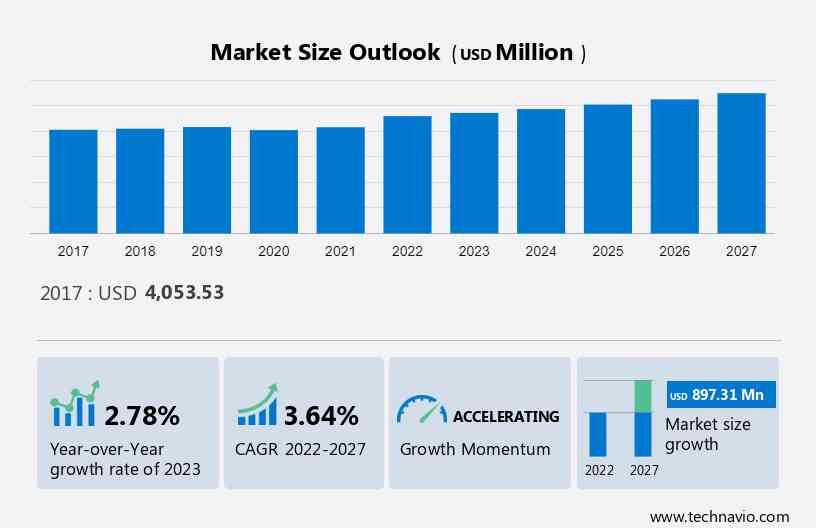

The cognac market size is projected to increase by USD 897.31 million at a CAGR of 3.64% between 2022 and 2027.

- The future of cognac looks promising, driven by the increasing appreciation for its health benefits, the rise of online platforms for distribution, and growing popularity in China. The market is also benefiting from the trend toward premiumization and the growing interest in luxury spirits such as cognac and luxury whiskey. Rising disposable incomes in emerging markets, especially in Asia, and the expanding reach of e-commerce platforms are making cognac more accessible, enhancing its position among premium spirits.

What will be the Size of the Cognac Market During the Forecast Period?

To get additional information about the cognac market report, Request Free Sample

Cognac Market Segmentation

The cognac market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2017 to 2027.

- Distribution Channel

- Off trade

- On trade

- Product

- VS

- VSOP

- XO

- Type

- Value

- Premium

- High-end Premium

- Super Premium

- Geography

- North America

- US

- APAC

- China

- Singapore

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Product

VS cognacs consist of Eaux-de-vie aged for a minimum of two years. These are also known as 3 stars or luxury. Some top-rated brands of VS cognac are Hennessey VS, Martell VS, and Courvoisier VS. These have a strong and sometimes very hard woody taste with spice and vanilla flavors that are reminiscent of young wood. The VS cognac does not have that delicate flavor and so is generally consumed with ice or water. The VS cognac, which is usually used in cocktails and mixed drinks, is not very recommended. This segment accounts for the largest share of the global market due to the low price. As they are aged for a less duration compared with VSOP and XO, their price is lower than that of the other two varieties. Therefore, all such factors will drive the growth of the VS segment in the market during the forecast period.

VSOP stands for very superior old pale or very special old pale, based on the brand. This is made from Eaux-de-vie, which is a clear, colorless fruit brandy that is distilled from wine. VSOP is extracted from the grapes grown in the cognac region in France. They have the finest quality. It has a light feel and a fresh citrus taste. It gives a citrus flavor immediately after consumption and a woody flavor after some time. For starters, VSOP cognac is a fine choice because it is mild and it's not overpowering. They are often eaten neat and chilled after meals. The emergence of online distribution platforms, increasing disposable income, and the growing demand for premiumization will increase the demand for VSOP, which will drive the growth of the VSPO segment in the market during the forecast period.

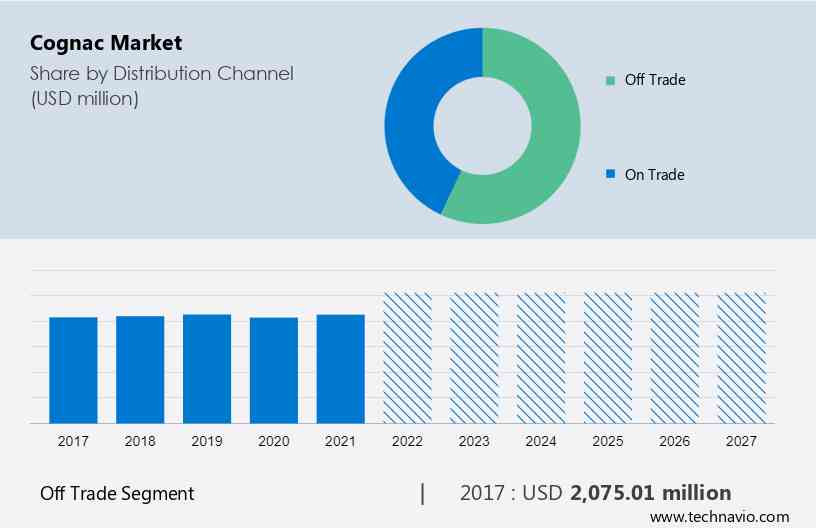

By Distributional Channel

The market share growth by the off trade segment will be significant during the forecast period. The off-trade market includes all the retail outlets like hypermarkets, supermarkets, convenience stores, mini markets, kiosks, wines, and spirits shops, among others. In 2022, The majority of the market share is held by the off-trade or off-premise, and distribution channels in terms of revenue and convenience stores account for more than any other segment.

For a detailed summary of the market segments. Request Sample Report

The off trade segment was valued at USD 2.07 billion in 2017. Consumers prefer to purchase their drinks from different liquor shops because of the lower prices offered to them compared with all other on-trade distributional channels. Moreover, people fond of collecting and tasting numerous brands prefer to buy from off-trade channels. Therefore, all such factors will spur the growth of the off-trade segment in the market during the forecast period.

On trade or on-premise distribution channels allow customers to consume their drinks at the place of purchase. Places such as restaurants, bars, pubs, and hotels are included in this segment. Due to relatively strong prices, the growth of this segment has slowed down as opposed to that of Off Trade channels. The rising number of new restaurants as well as people who eat outside their homes is another factor that underpins this segment's estimated growth. Specific dishes and recipes sold in fine-dine restaurants are frequently opted for by consumers preferring these products. Along with that, the demand for various cocktails and alcoholic beverages is adding to the growth of the channel.

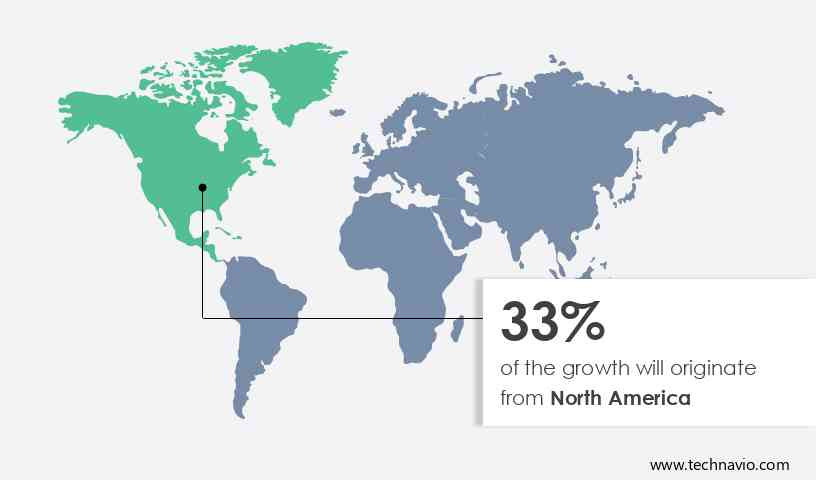

By Region

Get a glance at the market share of various regions. View PDF Sample

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America is known to be the largest market in terms of volume. Market growth in North America is led by the US, where the demand for preimmunized cognac is increasing. The growth in the demand for cognac in the US can be attributed to the changing demographics of customers from baby boomers to millennials, increasing health awareness, consciousness towards the benefits of low alcohol content consumption, and ease of ordering through online distribution channels. Young millennials have been increasingly demanding cognac-based cocktails. In Asia, this is still in consumption when eating and this trend has been observed among North American consumers recently. Millennials prefer drinking cognac before and during meals as it has a good taste and it also goes well with food.

Market Dynamics

- The market is characterized by its rich history and craftsmanship, with a focus on premium alcoholic liquors. This is typically made from white grapes and distilled in copper pot stills, resulting in a unique and refined taste. Brands offer high-quality, including the exclusive double toasted variety. This is often enjoyed in the context of the cocktail culture, adding a touch of sophistication to social gatherings in restaurants and bars. The market is influenced by factors such as spirits volume consumption and the increasing popularity of alcoholic drinks such as craft beverages. The market has shown resilience and innovation, exemplified by products like double toasted cognac.

- The rising awareness of the health benefits of cognac is driving growth in the market. Cognac contains certain medical benefits, including better cardiac health, and reduced the risk of type 2 diabetes or bad cholesterol, and improved cardiac health, which will enhance the growth of the market during the forecast period. Modernization is increasing the acceptance of cognac in all social gatherings, such as parties. This is supported by premium alcoholic liquors, craft beverages, spirits volume consumption, cocktail culture, socialization, and the presence of cognac in restaurants and bars. A few health benefits, such as a reduction of the risk of blood clots, and increasing antioxidant levels which can reduce the risk of clogged arteries, cancer, and vision loss will be created by adequate consumption of cognac. The fermented fruit mash cognac helps the body to absorb other antioxidants. The consumption is increasing as a healthy addition to the diet when added in appropriate quantities. Therefore, rising awareness of all the health benefits of cognac consumption will boost the growth of the market during the forecast period. Despite challenges, the market continues to thrive, with key players contributing to sustainable growth.

- Our researchers analyzed the data with 2022 as the base year, along with the key trends, and challenges. A holistic analysis of drivers, trends, and challenges will help stakeholders in the value chain refine their marketing strategies to gain a competitive advantage.

Major Cognac Market Trends

- The growth in personal consumption of alcoholic beverages is a key trend in the market. Alcoholic beverages hold a special place in social get-togethers are unalterable and are consumed across the world. Millennials are opening up to cognac drinking habits, and experimenting with new tastes and flavors. Also, there has been an increase in overall alcohol consumption due to the growing population of legal drinking age and a pattern shift in the consumption of alcohol with urbanization and industrialization.

- Moreover, the increasing disposable income and aspirational mindset of the middle class are propelling the concept of premiumization, driving the market. The consumption is growing due to increasing consumer awareness and knowledge of cognac. Therefore, the growth in the personal consumption of alcoholic beverages will positively impact the growth of the market during the forecast period.

Significant Cognac Market Challenge

- The growing competition from other alcoholic beverages is a major challenge faced by the market. The increased competition of other alcoholic beverages, such as vodka, rum, and whiskey. is expected to be one of the challenges to the growth of the market during the forecast period. The increasing demand for mezcal, vodka, rum, tequila, and others negatively impacts the sales.

- Moreover, in APAC, China is the largest market for alcoholic beverages, but the market is facing intense competition from the local alcoholic beverage Baijiu. Moreover, to keep and increase the customer base in a very competitive global market, the manufacturers should concentrate their efforts on new marketing strategies and product development. Therefore, the growing competition from other alcoholic beverages will hamper the growth of the market during the forecast period.

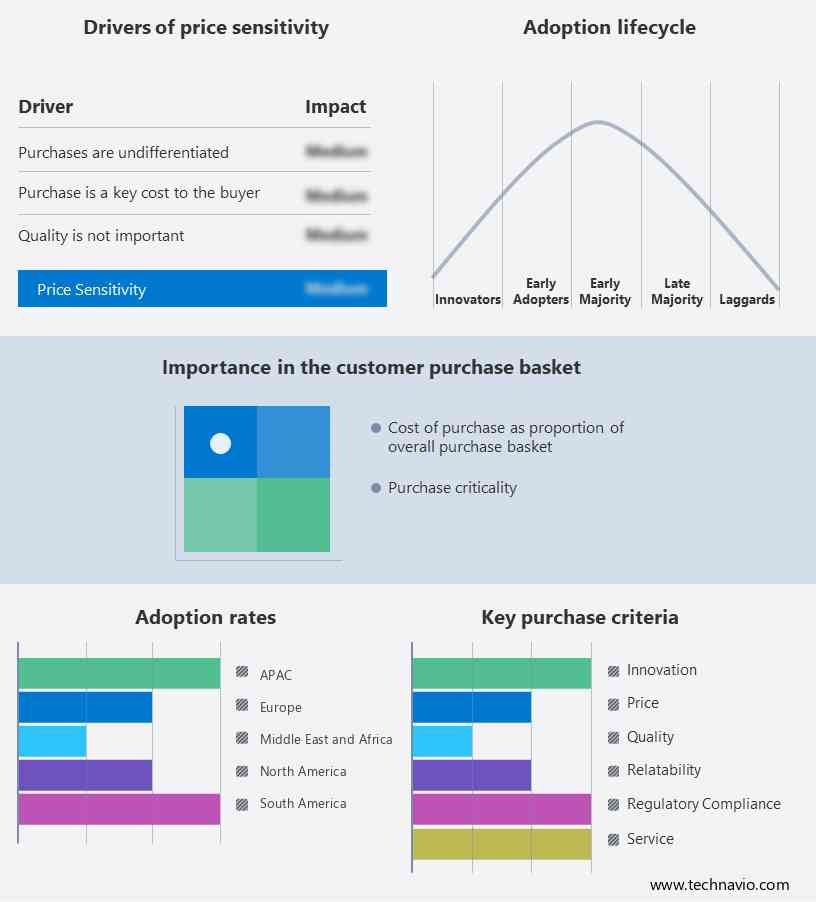

Customer Landscape

The cognac market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cognac market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Key Cognac Market Companies

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Key Offering- Bacardi Ltd. - The company offers cognac under its brand Dusse.

- Key Offering- Branded Spirits Ltd. - The company offers cognac under its brand Majeste XO and VSOP.

- Key Offering- CAMUS LA GRANDE MARQUE SAS - The company offers cognacs such as Cognac CAMUS Dark and Stormy, and Cognac CAMUS XO Borderies Single Estate.

The market forecasting report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Bacardi Ltd.

- Branded Spirits Ltd.

- CAMUS LA GRANDE MARQUE SAS

- Cognac Meukow

- Delord Freres SA

- KELT International SARL

- Louis Royer SA

- LVMH Moet Hennessy Louis Vuitton SE

- Maison Delamain

- MAISON FERRAND

- Pernod Ricard SA

- Remy Cointreau SA

- Suntory Holdings Ltd.

- Thomas HINE and Co.

- Zino Davidoff SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Hennessy introduced a new premium cognac product aimed at the luxury market. The new release features a blend of rare aged eaux-de-vie, targeting high-net-worth individuals looking for exclusive and sophisticated options in the growing luxury spirits market.

-

In November 2024, Rémy Martin entered into a collaboration with a renowned mixologist to create a line of limited-edition cognac-based cocktails. This initiative aims to reach a younger demographic interested in experimenting with premium spirits in innovative ways, expanding cognac’s appeal beyond traditional consumption.

-

In October 2024, Courvoisier launched an online campaign targeting international markets, highlighting the craftsmanship and heritage behind its cognac production process. The campaign is designed to educate consumers on the unique qualities of cognac and drive brand awareness in emerging markets, especially in Asia.

-

In September 2024, Pernod Ricard announced the acquisition of a boutique cognac brand, aiming to expand its portfolio and enhance its presence in the premium and super-premium segments. The acquisition is part of the company's strategy to capitalize on the growing global demand for high-end and artisanal spirits.

Market Analyst Overview

The cognac market is known for its diverse range of products, including the renowned Double Toasted cognac under the Larsen brand. Cognac is a distilled spirit often made from a fruit juice base, offering a unique taste profile. Despite challenges faced during the pandemic, the market has seen a steady rise in sales of liquor, especially premium spirits. This growth is attributed to the rising popularity of super-premium and luxury drinks among consumers, particularly in the spirits industry and brewing industries. Brands like Bacardi India and Good Man Premium Brandy have capitalized on this trend, offering high-quality products that cater to evolving consumer preferences. The market also sees significant engagement from pubs and bars, where cognac is enjoyed for its distinctive flavor and perceived health-imparting properties such as being anti-inflammatory, antidepressant, and having anti-aging potential.

The market has seen significant evolution, especially with the rise of super-premium spirits and the introduction of innovative products like the Double Toasted cognac Under Larsen brand. Despite challenges faced during the pandemic, the market has adapted, with a focus on online shopping platforms and engaging with alcohol oriented communities. Brands like Bardinet and Campari Group have introduced new offerings such as flavored coffee flavored brandy and Barista cocktails, catering to the evolving tastes of consumers, including Gen Z and the health-conscious who are turning to non-alcoholic beverages and RTD cocktail mixers. This market continues to innovate and expand, offering a wide range of choices for consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.64% |

|

Market growth 2023-2027 |

USD 897.31 million |

|

Market structure |

USD Fragmented |

|

YoY growth 2022-2023(%) |

2.78 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Singapore, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bacardi Ltd., Branded Spirits Ltd., CAMUS LA GRANDE MARQUE SAS, Cognac Meukow, Delord Freres SA, KELT International SARL, Louis Royer SA, LVMH Moet Hennessy Louis Vuitton SE, Maison Delamain, MAISON FERRAND, Pernod Ricard SA, Remy Cointreau SA, Suntory Holdings Ltd., Thomas HINE and Co., and Zino Davidoff SA |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

BUY NOW Full Report and Discover more

What are the Key Data Covered in this Cognac Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this cognac market research report to meet your requirements. Get in touch