China Cold Chain Market Size 2024-2028

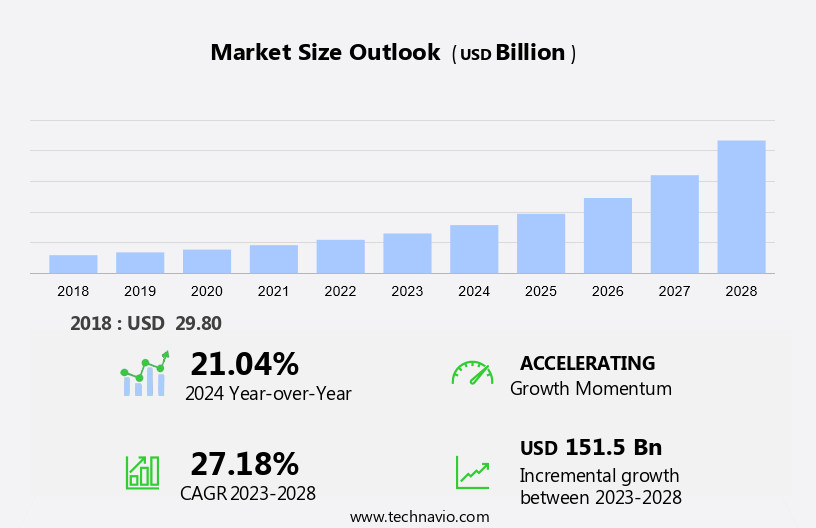

The China cold chain market size is forecast to increase by USD 151.5 billion at a CAGR of 27.18% between 2023 and 2028.

- Market growth is driven by factors such as the rising demand for frozen and perishable goods in China, growing initiatives to advance cold chains in China, and an increasing number of trade corridors. This development significantly influences market trends, particularly within the temperature-controlled logistics sector. With the surging need for pharmaceuticals, food, and healthcare products, there is an urgent requirement for proficient storage, transportation, and refrigeration solutions, such as temperature-controlled pharmaceutical packaging.

- As the demand for these items escalates, the supply chain must adapt to ensure timely and efficient delivery, underscoring the importance of logistics and supply chain management in meeting user expectations. The Chinese market is witnessing significant growth with advances in refrigerated warehousing and automation in cold chain logistics. Cold chain operations are increasingly vital for pharmaceuticals, vaccines, and fresh food distribution. Innovations in last-mile delivery and temperature-controlled packaging are improving efficiency. Additionally, sustainability in cold chain operations is becoming a priority, driving improvements across the sector to meet rising e-commerce demand and ensure product integrity.

What will be the size of the China Cold Chain Market during the forecast period?

- The market is a significant sector, focusing on the transportation and storage of fresh produce and temperature-sensitive goods. The Chinese Government enforces stringent regulations to ensure food safety standards are met. RFID technology, data analytics, and AI are integral to optimizing cold chain logistics. The packaging segment plays a crucial role, with reefer containers and temperature-controlled storage systems, including refrigerated warehouses, walk-in coolers, freezers, and refrigerated containers, being essential. Temperature sensors, data loggers, and real-time tracking systems are crucial software solutions for monitoring and maintaining the required temperatures In the chilled and deep frozen segments. E-commerce and online grocery platforms have fuelled the demand for frozen bakery items, frozen meat products, and fruits & vegetables.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Refrigerated warehouse

- Refrigerated transportation

- Application

- Meat fish and seafood sector

- Dairy and frozen desserts sector

- Fruits and vegetables sector

- Healthcare sector

- Bakery and confectionery sector

- Product Type

- Chilled

- Frozen

- Geography

- China

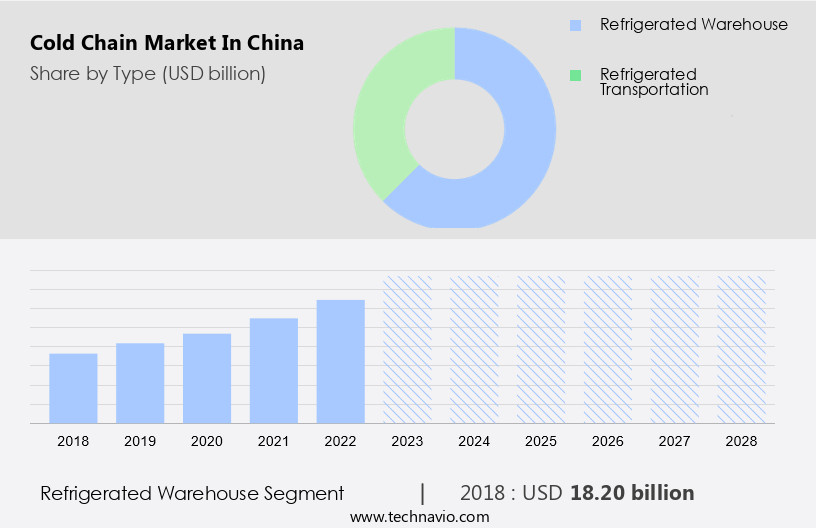

By Type Insights

- The refrigerated warehouse segment is estimated to witness significant growth during the forecast period. The market witnesses significant growth due to the increasing demand for eggs, aquatic products, and fresh agricultural products from the expanding middle and upper-middle class population. With rising disposable income and changing consumption patterns, Chinese residents are prioritizing the consumption of fresh food, including medicine and perishable goods. The solutions have become essential to ensure food safety and maintain the quality of these products. E-commerce players, such as JD, and logistics giants, including United Parcel Service, are investing heavily in cold chain infrastructure to meet the needs of the seafood, quick-frozen food, Fruit & vegetable market, and seafood market.

- The Chinese government is also investing in the market to improve food safety and support the biotech industry's growth. Biotech firms specializing in genomics and rare genetic diseases require temperature-controlled facilities to store medical information and samples. The solutions are crucial for the preservation and transportation of these valuable resources. The market is expected to continue its growth trajectory as the country's economy develops and consumer habits evolve. Western rivals are also entering the market, increasing competition and driving innovation in these solutions.

Get a glance at the market share of various segments Request Free Sample

The refrigerated warehouse segment was valued at USD 18.20 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of China Cold Chain Market?

- Increased demand for frozen and perishable food in China is the key driver of the market. The market has experienced significant growth due to several factors. According to official figures from the National Bureau of Statistics (NBS), China's gross domestic product (GDP) expanded by 8.1% in 2021 compared to the previous year. This economic growth, coupled with an increase in disposable income, has led to a growth in demand for frozen food and perishable products. Key players in China's market include Sinotrans, SF Express, and Beijing Ershang Group.

- These leading companies have capitalized on the rising demand, expanding their operations and investing in advanced technology to improve logistics and storage capabilities. Small players In the market are also entering the scene, contributing to a competitive landscape. The increasing consumption of meat and dairy products in China has further fueled the growth of the market, as these perishable items require temperature-controlled storage and transportation to maintaIn their quality.

What are the market trends shaping the China Cold Chain Market?

- Introduction of blockchain technology in cold chain is the upcoming trend In the market. In China, the market is experiencing significant growth, with official figures indicating a steady expansion in response to the country's increasing gross domestic product (GDP) and rising consumer demand for perishable goods. Key players, such as Sinotrans, SF Express, and Beijing Ershang Group, are spearheading this development by implementing blockchain technology In their cold supply chains.

- This innovation enables the maintenance of identical, cryptographically protected transaction records across multiple computer systems, eliminating the need for a central authority and reducing delays. The involvement of leading players, as well as smaller entities, in this technological shift is expected to create a cost-efficient and effective market.

What challenges does China Cold Chain Market face during the growth?

- Operational barriers due to increase in cold chain cost is a key challenge affecting market growth. The market is a significant sector, given the importance of cold storage facilities in preserving temperature-sensitive goods, particularly In the pharmaceutical industry. According to official figures, China's gross domestic product (GDP) growth rate has been steadily increasing, making it an attractive market for leading players such as Sinotrans, SF Express, and Beijing Ershang Group. However, the rising real estate costs in China, with land prices projected to increase by over 5% during the forecast period, pose a challenge for small players in the market.

- This additional expense will put pressure on their profit margins, potentially hindering their growth. Furthermore, fluctuations in fuel prices and operating costs are additional factors that may impact the market's expansion in China. Despite these challenges, the market is expected to continue its growth trajectory, driven by the increasing demand for temperature-controlled logistics solutions.

Exclusive China Cold Chain Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Americold Realty Trust Inc.

- AP Moller Maersk AS

- Arcticold Food Ltd.

- Beijing Shounong Food Group Co. Ltd.

- British Standards Institution

- CJ Logistics Corp.

- Deutsche Post AG

- FedEx Corp.

- Global Cold Chain Alliance

- JD.com Inc.

- Jin Jiang International Holdings Co. Ltd.

- John Swire and Sons Ltd.

- Kerry Logistics Network Ltd.

- Kuehne Nagel Management AG

- Nichirei Corp.

- SF Express Co. Ltd.

- Shandong Gaishi International Logistics Group

- Shanghai Speed International Logistics Co. Ltd.

- Shanghai Tengyi Boshi International Freight Forwarding Co. Ltd.

- Sinotrans Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector In the country's logistics industry. This market caters to the preservation and transportation of temperature-sensitive goods, primarily food and pharmaceuticals. The market's growth is driven by the increasing demand for perishable goods, particularly In the food industry. China's vast population and growing middle class have led to an increase in consumption of temperature-sensitive products. The Chinese government's initiatives to improve the infrastructure and promote the development of the agriculture sector have also contributed to the market's growth. The market is segmented into various categories, including refrigerated warehouses, cold transport, and cold storage equipment. The market is expected to grow at a steady pace due to the increasing demand for temperature-controlled logistics services. The Chinese market for the technologies is expected to witness significant growth due to the increasing demand for temperature-sensitive goods and the government's initiatives to improve the infrastructure.

The market is highly competitive, with several domestic and international players operating In the market. The key players in the market include suppliers of cold storage equipment, refrigerated transport providers, and logistics companies. The market's growth is also driven by the increasing adoption of advanced technologies such as automated storage and retrieval systems, temperature-controlled containers, and real-time monitoring systems. These technologies help improve the efficiency and effectiveness of logistics services, making them an essential component of the supply chain for temperature-sensitive goods. Thus, the market is a growing sector In the country's logistics industry, driven by the increasing demand for temperature-sensitive goods and the government's initiatives to improve the infrastructure. The market is highly competitive, with several domestic and international players operating in the market, and is expected to grow at a steady pace due to the increasing adoption of advanced technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.18% |

|

Market growth 2024-2028 |

USD 151.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

21.04 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch