Cold Storage Market Size 2025-2029

The cold storage market size is valued to increase USD 260.4 billion, at a CAGR of 19.3% from 2024 to 2029. Rising awareness about reducing wastage of food will drive the cold storage market.

Major Market Trends & Insights

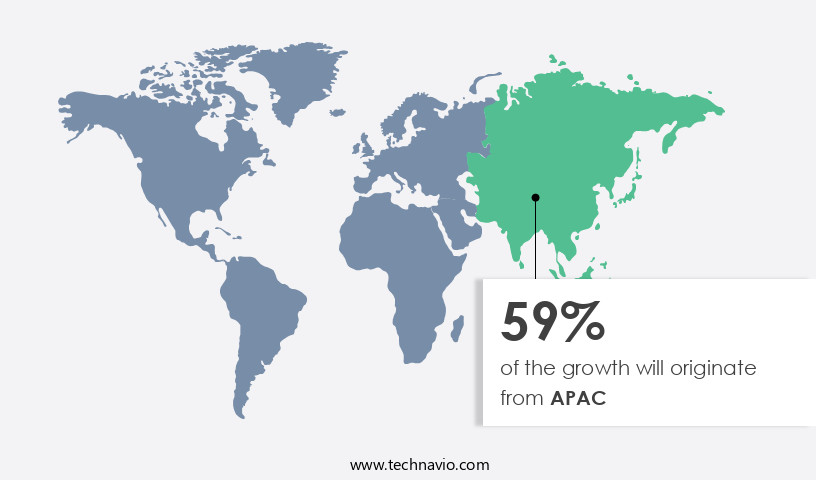

- APAC dominated the market and accounted for a 59% growth during the forecast period.

- By Application - Meat and seafood segment was valued at USD 23.80 billion in 2023

- By Type - Private and semi-private segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 475.03 billion

- Market Future Opportunities: USD 260.40 billion

- CAGR from 2024 to 2029 : 19.3%

Market Summary

- The market is a dynamic and continually evolving sector, characterized by advancements in core technologies and applications. With rising awareness about reducing food wastage and the increasing adoption of sustainable practices, the use of fuel cell based forklifts in refrigerated warehousing is gaining traction. According to recent reports, the market for fuel cell-powered material handling equipment is projected to reach a 25% market share by 2025. Seasonal demand for refrigerated products, particularly in regions with extreme climates, continues to drive growth in this sector. However, challenges such as high energy consumption and complex regulatory environments pose significant hurdles for market expansion.

- Despite these challenges, opportunities for innovation and efficiency improvements abound, making the market an intriguing and exciting space to watch.

What will be the Size of the Cold Storage Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cold Storage Market Segmented?

The cold storage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Meat and seafood

- Fruits and vegetables

- Bakery and confectionery

- Dairy and frozen products

- Others

- Type

- Private and semi-private

- Public

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The meat and seafood segment is estimated to witness significant growth during the forecast period.

The market, driven by the need for spoilage reduction and maintaining the quality of perishable goods, is a continuously evolving sector. In 2024, the meat and seafood segment led the market, accounting for a significant share, due to the temperature-sensitive nature of these products. Meat and seafood, rich in nutrition, require specific temperature conditions to preserve their quality. For instance, fresh seafood must be stored at 32°F (0°C), while frozen seafood needs to be kept at 0.40°F (-18°C) or lower. Cold storage solutions, integral to cold chain logistics, ensure these temperature requirements are met. They employ advanced refrigeration systems, humidity control, and temperature monitoring for optimal product shelf life.

The Meat and seafood segment was valued at USD 23.80 billion in 2019 and showed a gradual increase during the forecast period.

These facilities prioritize food safety regulations, implementing safety protocols, access control, and hygiene standards. Operational costs are managed through energy audits, remote monitoring, and preventive maintenance. Insulation materials, evaporator design, condenser efficiency, and compressor technology further enhance energy efficiency. These investments not only preserve product quality but also extend product shelf life, reducing waste and operational costs.

Regional Analysis

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cold Storage Market Demand is Rising in APAC Request Free Sample

The market exhibits a significant expansion, particularly in the Asia Pacific (APAC) region, which currently holds the largest market share. This growth can be attributed to the extensive presence of both food and healthcare product suppliers and consumers in APAC. In this dynamic market, the healthcare sector is experiencing notable growth due to the increasing geriatric population and rising healthcare expenditures in countries like Japan and China. The demand for temperature-controlled healthcare products, such as biopharmaceuticals, vaccines, and clinical trial materials, is on the rise in this region.

Simultaneously, the increasing preference for organic food products and certified organic dairy items, driven by health consciousness and rising disposable incomes, is propelling the adoption of cold storage solutions in countries such as China, Australia, and New Zealand. This trend underscores the market's evolving nature and its crucial role in maintaining the shelf life and desired quality of these products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector that ensures the preservation and efficient distribution of perishable goods, including food and pharmaceuticals. Effective cold chain logistics strategies are essential to minimize food spoilage and maintain product quality. Refrigeration system maintenance procedures play a pivotal role in optimizing energy efficiency in cold storage facilities, reducing operational costs. Humidity control is another crucial factor, as high humidity can significantly impact the quality and shelf life of perishable goods. Advanced temperature monitoring technologies, such as remote monitoring and automated systems, enable real-time tracking and proactive intervention in case of temperature deviations.

Optimizing warehouse layout for cold storage and implementing effective inventory management systems are best practices for maximizing storage capacity and minimizing wastage. Data analytics for cold chain optimization further enhances operational efficiency and facilitates predictive maintenance. In terms of facility design, implementing preventive maintenance, ensuring regulatory compliance, and implementing advanced alarm systems for cold storage facilities are essential for maintaining optimal conditions and reducing energy consumption. Cold storage solutions for frozen food, particularly those that minimize energy consumption and optimize storage capacity, are gaining significant attention. Technologies like automated systems and data analytics are transforming cold storage management, enabling more efficient and cost-effective operations.

A notable trend in the market is the adoption of advanced alarm systems and remote monitoring technologies, which account for over 50% of new installations. These systems enable early detection of temperature deviations and potential issues, significantly reducing the risk of product loss and ensuring optimal conditions for perishable goods. By focusing on these strategies and technologies, cold storage providers can optimize their operations, reduce energy consumption, and maintain regulatory compliance, ultimately driving growth in the market.

What are the key market drivers leading to the rise in the adoption of Cold Storage Industry?

- The increasing consciousness regarding the importance of minimizing food waste serves as the primary catalyst for market growth.

- Food wastage is a significant issue worldwide, with approximately 25% of the food produced annually being wasted. A primary contributor to this issue is the absence of adequate cold storage facilities. For instance, in China, around 15%-20% of fruits and vegetables are discarded due to inadequate cold storage. This problem is not unique to China; it's a global concern. In developing countries, the loss of perishable food products is more than 20%, primarily due to the lack of proper cold storage infrastructure.

- The absence of cold storage facilities results in perishable food items being exposed to varying temperatures throughout the supply chain, increasing the likelihood of spoilage and wastage. This issue is particularly pressing as more than 700 million people worldwide do not have access to enough food. The continuous evolution of the food industry necessitates innovative solutions to address this challenge and reduce food wastage.

What are the market trends shaping the Cold Storage Industry?

- In the realm of refrigerated warehousing, the utilization of fuel cell-based forklifts is emerging as the market trend. This advanced technology offers numerous benefits, including increased efficiency and reduced emissions.

- Fuel cell technology, which powers forklifts through an electrochemical reaction producing electricity, heat, and water, is gaining traction in various sectors. One such application is in forklifts, where it offers several advantages. Unlike battery-powered forklifts, fuel cell-based models can operate efficiently in low temperatures, such as those found in refrigerated warehouses. While a fully charged battery-powered forklift can function for approximately 7-9 hours, its performance significantly decreases in cold temperatures, reducing the total operational time by approximately 40%-60%.

- In contrast, fuel cell-based forklifts can perform optimally in temperatures as low as -30 degrees Celsius. This technological advancement not only enhances productivity but also reduces the reliance on fossil fuels, contributing to a more sustainable industrial landscape.

What challenges does the Cold Storage Industry face during its growth?

- The seasonal demand for refrigerated products poses a significant challenge to the industry's growth trajectory. This fluctuating market dynamic necessitates robust supply chain management and inventory planning strategies to ensure uninterrupted product availability and customer satisfaction.

- The seasonal fluctuations in the demand for refrigerated products, particularly those consumed during warmer seasons like ice creams, necessitate the use of cold chain solutions, such as cold storage facilities. However, the revenue of cold storage solution providers experiences variability due to the cyclical nature of this demand. For instance, the harvest season for fresh agricultural produce, typically occurring around October-November, results in a significant increase in the need for refrigerated storage. Conversely, during the winter or cold season, the demand for these products and storage solutions decreases.

- This seasonal pattern poses a challenge for companies in the cold storage industry. The refrigerated storage of perishable goods is a critical aspect of various sectors, including food and agriculture, pharmaceuticals, and logistics. The efficient management of cold chain solutions is crucial to ensure the preservation of product quality and longevity, as well as to maintain food safety and security.

Exclusive Technavio Analysis on Customer Landscape

The cold storage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cold storage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cold Storage Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, cold storage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Americold Realty Trust Inc. - This company specializes in cold storage solutions, providing temperature-controlled facilities and logistics networks for various industries, including agriculture, food production, and retail.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Americold Realty Trust Inc.

- Beijing Howcool Refrigeration Technology Co. Ltd.

- Burris Logistics Co.

- Changzhou Yuyan Refrigeration Equipment Co. Ltd.

- Coldman Logistics Pvt. Ltd.

- Commercial Cold Storage Group Ltd.

- Congebec Logistics Inc.

- Falcon Refrigeration Industry

- Holt Logistics Corp.

- Indicold Private Limited

- Interstate Cold Storage Inc.

- John Swire and Sons Ltd.

- Lineage Inc

- NewCold Cooperatief UA

- Nichirei Corp.

- Nor AM Cold Storage Inc.

- RSA Global DWC LLC

- snowman logistics ltd

- Stellar

- VersaCold Logistics Services

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cold Storage Market

- In January 2024, American Cold Storage, a leading cold storage solutions provider, announced the completion of a new 30 million cubic feet cold storage facility in Texas, expanding its US footprint and enhancing its capacity to serve the growing demand for temperature-controlled logistics solutions in the food and pharmaceutical industries (American Cold Storage press release).

- In March 2024, Lineage Logistics, a global leader in temperature-controlled logistics, entered into a strategic partnership with Danish dairy cooperative Arla Foods, to provide end-to-end cold chain solutions for Arla's North American operations, strengthening Lineage's position in the dairy sector (Lineage Logistics press release).

- In May 2024, Singapore-based Kuehne+Nagel International AG, a leading global logistics provider, acquired a majority stake in China's leading cold chain logistics provider, Sinotrans & Cainiao Logistics, marking a significant expansion into the Chinese market (Reuters).

- In April 2025, the European Union approved the Horizon Europe research and innovation program, which includes a 1.4 billion euro investment in the development of sustainable and digitally advanced cold chain infrastructure, aiming to reduce carbon emissions and improve the competitiveness of European businesses in the market (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cold Storage Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.3% |

|

Market growth 2025-2029 |

USD 260.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.3 |

|

Key countries |

US, China, India, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of cold storage, businesses are increasingly relying on advanced technologies to maintain the integrity of perishable goods and ensure compliance with food safety regulations. Cold storage solutions, encompassing refrigeration systems, humidity control, and temperature mapping, are at the forefront of this innovation. One significant trend in this market is the adoption of data logging and maintenance schedules to optimize operational costs and improve product shelf life. These tools enable real-time monitoring of storage conditions, facilitating preventive maintenance and early defect detection. Moreover, temperature monitoring and energy consumption analysis are essential components of cold chain logistics, ensuring the efficient and secure transportation of temperature-sensitive goods.

- Security systems, access control, and hygiene standards are also critical aspects of cold storage operations. Remote monitoring, alarm systems, and energy audits help maintain optimal conditions and minimize the risk of spoilage. Furthermore, insulation materials, evaporator design, and compressor technology contribute to energy efficiency and temperature consistency. Warehouse automation and preventive maintenance are gaining traction in the market, reducing labor costs and enhancing overall efficiency. Quality control measures, such as temperature mapping and refrigerant types, ensure the highest standards in frozen food storage. Automated defrosting and alarm systems further contribute to operational excellence and safety protocols.

- In conclusion, the market is characterized by continuous innovation and a focus on operational efficiency, energy savings, and regulatory compliance. By integrating advanced technologies and best practices, businesses can effectively manage their cold storage facilities and maintain the quality and safety of their perishable goods.

What are the Key Data Covered in this Cold Storage Market Research and Growth Report?

-

What is the expected growth of the Cold Storage Market between 2025 and 2029?

-

USD 260.4 billion, at a CAGR of 19.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Meat and seafood, Fruits and vegetables, Bakery and confectionery, Dairy and frozen products, and Others), Type (Private and semi-private and Public), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising awareness about reducing wastage of food, Seasonal demand for refrigerated products

-

-

Who are the major players in the Cold Storage Market?

-

Americold Realty Trust Inc., Beijing Howcool Refrigeration Technology Co. Ltd., Burris Logistics Co., Changzhou Yuyan Refrigeration Equipment Co. Ltd., Coldman Logistics Pvt. Ltd., Commercial Cold Storage Group Ltd., Congebec Logistics Inc., Falcon Refrigeration Industry, Holt Logistics Corp., Indicold Private Limited, Interstate Cold Storage Inc., John Swire and Sons Ltd., Lineage Inc, NewCold Cooperatief UA, Nichirei Corp., Nor AM Cold Storage Inc., RSA Global DWC LLC, snowman logistics ltd, Stellar, and VersaCold Logistics Services

-

Market Research Insights

- The market encompasses a range of storage solutions designed to maintain specific temperature conditions for extending the shelf life of perishable goods. Two key performance indicators (KPIs) in this sector are operational efficiency and cost reduction. According to industry data, the average cold storage facility operates at an efficiency level of 75%, leaving significant room for improvement. In contrast, leading facilities boast an efficiency rate of up to 95%, achieving substantial cost savings through optimized storage layouts, temperature fluctuations management, and refrigerant management. Storage solutions in the cold chain market prioritize quality assurance, performance indicators, and inventory tracking.

- Advanced technologies like humidity sensors, data analytics, and product traceability play a crucial role in maintaining cold chain integrity and minimizing defect rates. Demand forecasting and logistics planning are essential components of supply chain management, ensuring optimal distribution network efficiency and reducing waste. Sustainability initiatives, such as carbon footprint reduction and environmental impact mitigation, are increasingly becoming a focus in the market. Facility design and process optimization are ongoing priorities to meet the evolving needs of businesses and consumers.

We can help! Our analysts can customize this cold storage market research report to meet your requirements.