Condom Market Size 2025-2029

The condom market size is forecast to increase by USD 7.38 billion, at a CAGR of 11.3% between 2024 and 2029. High growth of e-commerce platforms will drive the condom market.

Major Market Trends & Insights

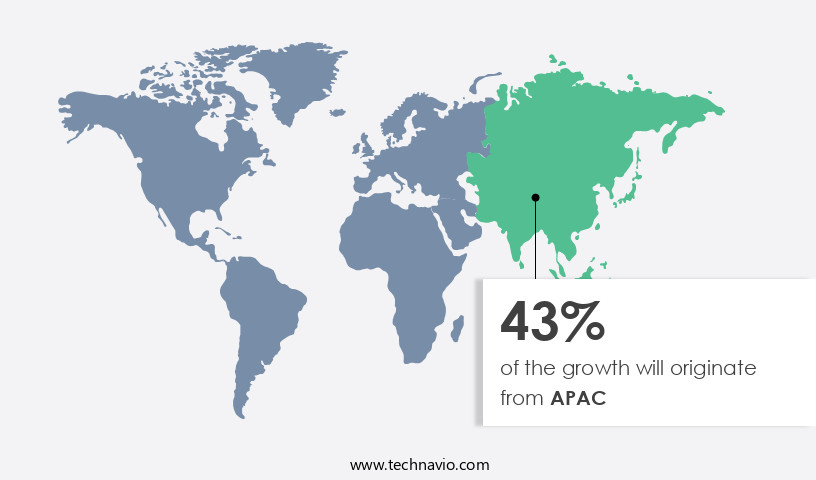

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 5.76 billion in 2023

- By Material - Latex segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 161.78 billion

- Market Future Opportunities: USD USD 7.38 billion

- CAGR : 11.3%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and continually evolving industry, driven by the increasing global focus on sexual and reproductive health. One of the primary factors fueling market growth is the rise of e-commerce platforms, which offer consumers greater convenience and accessibility. Another significant trend is product premiumization, as manufacturers invest in innovation and portfolio extension to cater to diverse consumer preferences. However, the market also faces challenges, such as the potential side effects of prolonged condom use and increasing competition from alternative methods of contraception.

- Looking forward, the next few years are expected to bring further developments, including advancements in condom technology and regulatory changes shaping the competitive landscape. Related markets such as the Feminine Hygiene and Family Planning markets also offer valuable insights and opportunities for market participants.

What will be the Size of the Condom Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Condom Market Segmented and what are the key trends of market segmentation?

The condom industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Material

- Latex

- Non latex

- Product

- Male condoms

- Female condoms

- Performance Features

- Flavored

- Textured

- Ultra-Thin

- Lubricated

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market is a significant sector within the sexual wellness industry, encompassing various distribution channels that play a vital role in making these essential products accessible to consumers. Mass merchandisers, including specialty stores, hypermarkets, supermarkets, and department stores, account for a substantial market share. This segment's growth is driven by the increasing consumer awareness of condoms and other contraceptive methods, fueled by the rising concern about sexually transmitted diseases (STDs). Moreover, the availability of a diverse range of brands and types of condoms in these stores further boosts market expansion. Lubricant viscosity and condom material biocompatibility are crucial factors in condom production.

Manufacturers prioritize ensuring their products meet the highest standards of safety and effectiveness. Condom tactile sensitivity and spermicide efficacy testing are essential aspects of the manufacturing process, as they significantly impact user satisfaction. Condoms serve as a popular pregnancy prevention method, with lubricated and non-lubricated options available. Condom types vary, including those with reservoir tips, rolled packaging, and electronic testing capabilities, catering to diverse consumer preferences. Condoms are subjected to rigorous testing for barrier contraceptive effectiveness, tensile strength, and viral barrier properties. Latex allergy testing is also essential, given the prevalence of latex condoms. Polyisoprene and polyurethane condom materials offer alternatives for individuals with latex sensitivities.

Condoms have a shelf life, which varies depending on the material and storage conditions. Proper quality control testing, including color variations and material elasticity, is essential to ensure product consistency and safety. The condom manufacturing process involves stringent production standards, with an emphasis on maintaining sterility and minimizing breakage rates. Thin condom designs cater to users seeking a more natural feel. Condom user satisfaction is a critical factor in market success, with ongoing research focusing on improving product design and effectiveness. The single-use nature of condoms necessitates proper disposal methods to minimize environmental impact. According to recent studies, The market is projected to expand by 15% in the upcoming years.

This growth can be attributed to the increasing awareness of sexual health and the rising prevalence of STDs. Furthermore, the market is expected to witness a 12% increase in demand for non-spermicidal condoms due to growing consumer preferences for natural and chemical-free options. These trends underscore the evolving nature of the market and its ongoing significance in addressing sexual health concerns.

The Offline segment was valued at USD 5.76 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Condom Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, fueled by increasing consumer awareness, a wide product range, and the consumption of premium offerings. Key contributing countries include China, Japan, South Korea, Thailand, Malaysia, and India. China, with its large consumer base and high spending on sexual wellness products, remains the market leader. As of 2024, China and India, as the world's most populous countries, collectively account for approximately 35% of the global population, driving substantial demand.

Additionally, rising disposable income, a burgeoning e-commerce sector, and population growth further boost market expansion. However, specific market size figures and growth rates are not mentioned in the provided text.

Market Dynamics

The condom market is fundamentally driven by a rigorous approach to safety, user satisfaction, and material science. Condom manufacturing process quality control is paramount, with every batch undergoing electronic condom burst pressure testing to ensure it can withstand a specific volume and pressure, with the global standard being that condoms must hold an average of 18 liters of air before bursting.

The choice of material is also a key factor, as natural rubber latex condom allergy testing is critical due to latex protein content causing allergic reactions in up to 6% of the population, leading to a rise in demand for alternatives like polyisoprene condom material properties.

Studies show that these materials can have a tensile strength that is 20% higher than traditional latex. User experience is a vital dynamic, with lubricant viscosity impact on condom performance being a key consideration, as studies suggest optimal lubrication can reduce the friction coefficient by over 40%, enhancing both comfort and condom tactile sensitivity.

This focus on detail, from condom shelf life extension techniques to adherence to condom safety standards and regulatory compliance, underscores the market's commitment to delivering reliable and safe products.

What are the key market drivers leading to the rise in the adoption of Condom Industry?

- The significant expansion of e-commerce platforms serves as the primary catalyst for market growth.

- The online market for condoms has experienced notable expansion in recent years, propelling the growth of the global condom industry. Online sales channels provide enhanced visibility to a broad range of product offerings from various companies. The advantages of online retailing, including expanded customer reach and decreased inventory management expenses, have fueled this growth. Despite accounting for a smaller share of the market, the online segment is projected to exhibit more rapid growth compared to the offline segment over the forecast period. The growth of the online the market can be attributed to several factors. First, the widespread availability of the internet and the increasing use of mobile internet devices have expanded consumer access to a diverse array of condom options.

- Second, growing awareness about sexual and reproductive health has led to a rise in demand for condoms, driving sales through both online and offline channels. The online market's convenience, accessibility, and competitive pricing have further contributed to its popularity. In summary, the online the market's growth is a response to evolving consumer preferences and technological advancements. As the market continues to evolve, it is essential for businesses to adapt and capitalize on these trends to remain competitive.

What are the market trends shaping the Condom Industry?

- Product innovation and portfolio extension are driving forces behind the upcoming market trend of product premiumization.

- The market experiences ongoing evolution, fueled by increasing consumer demand from various sectors. Companies respond by investing in research and development, introducing innovative products with diverse flavors, sizes, textures, and materials. These premium offerings command higher prices than standard condoms. Market growth is further propelled by substantial investments in advertising, particularly in the premium segment. Companies continually innovate and expand their product lines to cater to evolving customer preferences.

- The market's dynamic nature underscores the importance of staying informed about the latest trends and developments.

What challenges does the Condom Industry face during its growth?

- The use of condoms presents a significant challenge to the industry's growth due to potential side effects. This issue, which is of great concern to consumers, necessitates ongoing research and innovation to improve product efficacy and minimize any adverse reactions.

- The market faces challenges due to health concerns and shifting consumer preferences. According to research, approximately 13% of the global population uses condoms as a primary method of birth control (Source: Guttmacher Institute). However, the presence of allergens and toxic chemicals in condoms, such as latex, hormone-disrupting agents, and lubricants, can lead to various health issues. For instance, latex condoms may cause allergic reactions, including rashes, hives, and, in severe cases, anaphylaxis. Non-latex condoms, like those made of polyisoprene, lambskin, and nitrile, may contain chemicals that can cause skin infections and irritation.

- These health concerns pose a significant challenge to market growth, as consumers increasingly seek safer alternatives. The market's evolution is driven by innovations in materials and manufacturing processes, aiming to address these health concerns while maintaining effectiveness and affordability.

Exclusive Customer Landscape

The condom market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the condom market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Condom Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, condom market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Reckitt Benckiser Group Plc - The company caters to various consumer preferences through its diverse range of condom brands, including Kamyra, MyOne Perfect Fit Condoms, ceylor, GLYDE, Amor, Worlds Best, Chaps, and Adore. Each brand offers unique features and benefits, reflecting the company's commitment to catering to individual needs in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Reckitt Benckiser Group Plc

- Church & Dwight Co. Inc.

- Ansell Limited

- Karex Berhad

- Okamoto Industries Inc.

- Sagami Rubber Industries Co. Ltd.

- Trojan (Church & Dwight)

- Durex (Reckitt Benckiser)

- Lifestyles Healthcare Pte Ltd

- Caution Wear Corp.

- Glyde Health

- LELO

- Lovability

- My.Size Condoms

- Billy Boy (Mapalé)

- Pasante Healthcare Ltd.

- Sir Richard's Condom Company

- Unique Condoms

- Cupid Limited

- Veru Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Condom Market

- In January 2024, Durex, a leading condom manufacturer, introduced a new line of ultra-thin condoms called "Barely There," which gained significant market attention due to its innovative design and enhanced sensation (Durex Press Release, 2024). In March 2024, Trojan, another major player, announced a strategic partnership with a leading e-commerce platform to expand its online sales channels, aiming to capture a larger market share (Trojan Press Release, 2024).

- In April 2025, Ansell, a global leader in protective solutions, completed the acquisition of Lifestyles Condoms, a well-known brand in the market, further strengthening its presence in this sector (Ansell Press Release, 2025). In May 2025, the European Union approved a new regulation mandating the use of biodegradable condoms by 2030, creating a significant opportunity for manufacturers to invest in eco-friendly alternatives (European Parliament Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Condom Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 7378.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous innovation and advancements in technology and material science. This market caters to the demand for effective pregnancy prevention methods and sexually transmitted disease (STD) prevention. One crucial aspect of condom development is ensuring material biocompatibility and lubricant viscosity testing for optimal user experience. Condom manufacturers prioritize material selection, with options including latex, polyisoprene, and polyurethane, each offering distinct advantages in terms of tactile sensitivity, elasticity, and latex protein content. Spermicide efficacy testing plays a vital role in enhancing condom performance. Non-spermicidal and reservoir tip condoms are popular choices, with the latter featuring a reservoir tip to collect semen and improve spermicide distribution.

- Condom safety standards mandate rigorous testing for tensile strength, barrier contraceptive method efficacy, and viral barrier properties. Quality control testing, electronic condom testing, and latex allergy testing are essential to maintain consumer trust and ensure product safety. Condom storage conditions and shelf life are critical factors influencing market activity. Condom size variations cater to diverse user needs, with thin condom designs offering enhanced comfort and user satisfaction. STD prevention effectiveness is a significant market driver, with nonoxynol-9 spermicide and electronic condom testing contributing to improved protection against various sexually transmitted infections. Rolled condom packaging, single-use condoms, and condom disposal methods are essential considerations for manufacturers and consumers alike.

- The condom manufacturing process is subject to ongoing improvements, with a focus on sustainability, cost-effectiveness, and efficiency. In summary, the market is a vibrant and continuously evolving industry, with a strong focus on innovation, user experience, and safety. Condom manufacturers prioritize material selection, testing, and production processes to cater to the diverse needs of consumers and ensure effective pregnancy prevention and STD protection.

What are the Key Data Covered in this Condom Market Research and Growth Report?

-

What is the expected growth of the Condom Market between 2025 and 2029?

-

USD 7.38 billion, at a CAGR of 11.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Material (Latex and Non latex), Product (Male condoms and Female condoms), Geography (APAC, Europe, North America, Middle East and Africa, and South America), and Performance Features (Flavored, Textured, Ultra-Thin, and Lubricated)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

High growth of e-commerce platforms, Side effects of using condoms

-

-

Who are the major players in the Condom Market?

-

Key Companies Reckitt Benckiser Group Plc, Church & Dwight Co. Inc., Ansell Limited, Karex Berhad, Okamoto Industries Inc., Sagami Rubber Industries Co. Ltd., Trojan (Church & Dwight), Durex (Reckitt Benckiser), Lifestyles Healthcare Pte Ltd, Caution Wear Corp., Glyde Health, LELO, Lovability, My.Size Condoms, Billy Boy (Mapalé), Pasante Healthcare Ltd., Sir Richard's Condom Company, Unique Condoms, Cupid Limited, and Veru Inc.

-

Market Research Insights

- The condom market's evolution is driven by a strong focus on technical precision and user-centric design. Rigorous quality assurance protocols ensure a consistent product, with condom burst pressure testing standardizing durability. For example, a condom is required to withstand a test pressure of 18 liters of air.

- A key dynamic is the emphasis on material science. While a majority of the market is still dominated by latex, non-latex materials are gaining traction as they address the needs of the approximately 6% of the population with latex sensitivity. The viral transmission prevention and bacterial barrier function of both materials are rigorously studied, with specific material elasticity testing ensuring effectiveness.

- The market also sees innovation in user experience, with a focus on condom user preferences and the impact of condom shape variations to improve condom user compliance, which is the single most critical factor in a condom's effectiveness

We can help! Our analysts can customize this condom market research report to meet your requirements.