Connected Logistics Market Size 2024-2028

The connected logistics market size is forecast to increase by USD 138.66 billion at a CAGR of 34.28% between 2023 and 2028. Market growth hinges on various factors, including the efficient management of temperature-sensitive goods, the rising demand for enhanced connectivity, and the increasing emphasis on bolstering visibility and control within supply chain systems. Effective temperature management is crucial for preserving the integrity of perishable products during storage and transit, driving the demand for advanced cold chain solutions. Moreover, the need to enhance connectivity across supply chain networks facilitates seamless communication and data exchange between stakeholders, optimizing operations and enabling real-time decision-making. Additionally, heightened emphasis on visibility and control empowers businesses to track inventory movements, monitor performance metrics, and mitigate risks effectively. By addressing these critical factors, businesses can enhance operational efficiency, minimize losses, and capitalize on emerging opportunities, thereby fostering the growth and resilience of the market. It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2018 to 2022.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamic

In the realm of connected logistics, supply chain partners leverage cutting-edge technologies like Internet of Things (IoT) sensors and cloud platforms to streamline logistical operations and enhance value-added logistics services. Through intelligent transportation solutions and autonomous logistics trucks, companies optimize shipping processes while ensuring security and safety. With cloud-based technology and Bluetooth connectivity, interoperability between systems is facilitated, enabling efficient order processing and financial transactions. This interconnected network of connected logistics hardware and IoT sensors revolutionizes warehousing and shipping, ushering in a new era of seamless online shopping experiences and accessible supply chain management. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Effective management of temperature-sensitive products is a major driving factor for the market. The market is set to benefit greatly from the efficient handling of temperature-sensitive products, such as food and vaccines. Inadequate supply chain systems, particularly in developing countries, contribute to significant product wastage. Insufficient temperature management and failure to adhere to regulatory guidelines in storage networks are major factors behind the wastage of temperature-sensitive items. This wastage impacts healthcare services by creating shortages of vital drugs and rendering vaccines ineffective.

Furthermore, organizations are investing in technologies like IoT-powered smart refrigerators, analytics, and cloud computing solutions to tackle these challenges. Connected logistics systems, specifically designed for perishable products, effectively manage temperature-sensitive items under varying climatic conditions. The implementation of technology, such as medical refrigerator systems, ensures the safe storage of vaccines in remote and developing regions. The ability to manage temperature-sensitive products offered by connected logistics is expected to drive the growth of the global market in the forecast period.

Significant Market Trends

Increasing adoption of IoT in SCM systems is the primary trend in the market growth. One of the significant trends in the market is the growing adoption of IoT in supply chain management (SCM) systems. IoT enables real-time tracking of shipments through smart connected devices, which has gained popularity in industries like manufacturing, healthcare, and transportation. Sensors and devices installed in storage facilities and containers capture and transmit real-time data to SCM teams, providing crucial information on product conditions and delivery status. To preserve perishable goods and vaccines within the required temperature ranges, IoT technology helps detect and control technical faults in cold chain storage systems, preventing damage to stored products. IoT also facilitates the tracking of refrigerated containers, known as reefers, on cargo ships.

Moreover, the worldwide proliferation of smart connected devices is expected to reach 47 billion by 2026, posing challenges in managing and maintaining data. IoT solutions aid logistics firms in capturing and analyzing large volumes of data generated by connected devices using statistical transportation mode techniques. Technologies such as RFID, sensors, barcodes, and GPS play a vital role in efficiently monitoring and managing physical assets in transportation and logistics. For example, RFID enables easier tracking of goods in the supply chain and facilitates inventory management. Companies like Tech Mahindra and HCL Technologies have developed IoT solutions to assist cold storage management teams in monitoring the movement of containers and carriers. These IoT advancements enhance business efficiency and value. Hence, such factors are driving the market during the forecast period.

Major Market Challenge

Technical glitches are challenging the market growth. The glitches can disrupt business operations and hinder the seamless functioning of connected logistics systems. Human intervention in supply chain systems can also impede the effectiveness of digital logger solutions, which should ideally be automated for continuous monitoring.

Moreover, some organizations still rely on manual processes, which can lead to delays in sending real-time temperature logs crucial for tracking and monitoring devices. This manual approach decreases the efficiency of the supply chain process and may result in the loss of clients for companies like Microsoft Corp and Oracle Corp. The prevalence of various technical glitches poses a significant threat to the growth of the market during the forecast period.

Exclusive Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Accenture Plc: The company offers connected logistics such as one connected supply chain.

- Amazon.com Inc: The company offers connected logistics such as the AWS supply chain.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- AT and T Inc.

- Cisco Systems Inc.

- HCL Technologies Ltd.

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- Intel Corp.

- International Business Machines Corp.

- Microsoft Corp.

- Nokia Corp.

- Oracle Corp.

- ORBCOMM Inc.

- PTC Inc.

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- SAP SE

- Siemens AG

- Tata Consultancy Services Ltd.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Product

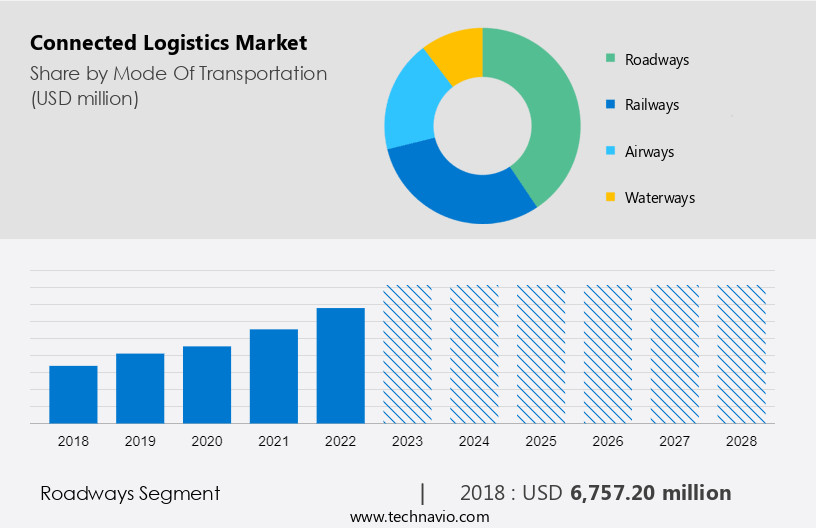

The roadways segment will account for a major share of the market's growth during the forecast period. Connected logistics plays a vital role in improving the efficiency of transportation operations by enabling more effective routing, optimal asset utilization, and enhanced customer service. The advantages of these logistics are the accurate fuel cost estimates and route options, contributing to the growth of connected logistics in the roadways segment. By reducing service failures and delays, connected logistics significantly improve the road transportation sector within the market.

Get a glance at the market contribution of various segments Request Free PDF Sample

The roadways segment was valued at USD 6.76 billion in 2018. Connected logistics aid in route planning by providing valuable information on weather conditions, traffic congestion, and potential obstacles. Cold storage, an essential element of the global supply chain, benefits from connected logistics through real-time temperature monitoring, which helps transportation managers and regulatory organizations prevent issues like product expiration. The advantages of connected logistics, such as accurate fuel cost estimates and route options, contribute to the growth of connected logistics in the roadways segment. By reducing service failures and delays, connected logistics significantly improve the road transportation sector within the market. Hence, such factors are fuelling the growth of this segment during the forecast period.

By Type

Based on type, the market has been segmented into software services, IT services, and hardware services. The software services segment will account for the largest share of this segment. The following are the primary contributing factors to the growing preference for cloud-based software services: Cloud-based solutions can be implemented more quickly than on-premise software solutions. Cloud-based IT architecture facilitates the deployment of cutting-edge IT solutions like predictive analytics, IoT-enabled applications, and M2M applications. Service-oriented architecture is favored by supply chain service providers due to its faster IT deployment and higher return on investment (ROI). On-premise software services are still preferred over cloud-based software services by businesses that have substantial IT budgets and resources and require value-added features. During the forecast period, it is anticipated that these factors will drive the segment's expansion. Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.

For more insights on the market share of various regions Request Free PDF Sample now!

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The region demonstrates a strong emphasis on connected logistics services, primarily driven by the widespread adoption of technology in supply chain and distribution management. The presence of robust information and communication technology infrastructure, along with excellent connectivity to global locations, contributes to the region's significant market share. Leading services providers like DHL, GENCO, and Lineage Services create growth opportunities for vendors operating in the market. These factors contribute to the projected strong growth of the market in North America during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Mode Of Transportation Outlook

- Roadways

- Railways

- Airways

- Waterways

- Type Outlook

- Software services

- IT services

- Hardware services

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Project Logistics Market: Project Logistics Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, India, Germany - Size and Forecast

- Connected Rail Solutions Market: Connected Rail Solutions Market Analysis Europe, APAC, North America, Middle East and Africa, South America - US, China, Japan, UK, Germany - Size and Forecast

- Finished Vehicles Logistics Market: Finished Vehicles Logistics Market Analysis APAC, North America, Europe, Middle East and Africa, South America - China, US, Japan, India, Germany - Size and Forecast

Market Analyst Overview:

The market is undergoing a transformative shift, leveraging fleet telematics, cellular IoT connectivity, and RFID tags for seamless operations. Real-time location and route management coupled with analytics solutions optimize efficiency while ensuring transportation visibility. From last-mile delivery to long-distance retail goods delivery, tracking tools and asset tracking management streamline processes. Enhanced disaster preparedness and worker safety measures are facilitated by linked devices and communication devices, supported by cloud integration for real-time tracking. Warehouse management software and fleet management software aid in inventory tracking and workload planning, catering to diverse industries like retail, aerospace and defense, and automotive. With end-to-end delivery tracking and accuracy, connected logistics propel supply chains forward, ensuring operational effectiveness and resilience against supply chain disruptions.

Additionally, in the realm of connected logistics, real-time position tracking and tracking devices play pivotal roles in enhancing asset tracking and management. Providers offer comprehensive managed services and consulting to optimize transportation modes efficiency and ensure optimal carrying capacity utilization. Governments' initiatives, such as national logistics policy, streamline operations, especially in sectors like railway where frictional resistance is a concern. Industries spanning retail and e-commerce, energy, and electronics and semiconductors benefit from interconnected communication systems and improved logistic operational effectiveness. In the evolving landscape of connected logistics, loT sensors play a pivotal role in enhancing security and safety concerns. Through robust communication systems and linked logistics systems, companies ensure accessibility and streamline operations. Intelligent transportation systems further optimize efficiency while fostering seamless coordination among various components. This integrated approach transforms traditional logistics into dynamic, interconnected networks, facilitating smoother supply chain management and enabling real-time monitoring of assets and shipments.

Further, smart devices and Internet connectivity empower logistic providers to offer real-time tracking logistics solutions, mitigating supply chain disruption risks. Enhanced labour management and efficient handling of raw materials and trade are facilitated through electronic data and app-based interfaces. E-commerce platforms bolster receiving and inventory storage, catering to diverse fixed assets like aircraft and transport vehicles. Advanced inventory tools and automated scanning techniques optimize inbound and outbound items management, minimizing fuel consumption and fostering government programs like rail freight initiatives, benefitting the automotive industry with real-time infographics for informed decision-making.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.28% |

|

Market growth 2024-2028 |

USD 138.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

25.64 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, Germany, UK, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture Plc, Amazon.com Inc., AT and T Inc., Cisco Systems Inc., HCL Technologies Ltd., Huawei Technologies Co. Ltd., Infosys Ltd., Intel Corp., International Business Machines Corp., Microsoft Corp., Nokia Corp., Oracle Corp., ORBCOMM Inc., PTC Inc., Qualcomm Inc., Samsung Electronics Co. Ltd., SAP SE, Siemens AG, Tata Consultancy Services Ltd., and Thales Group |

|

Market dynamics |

Parent market analysis, market growth analysis, market research and growth, market growth and forecasting, Market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028

- Precise estimation of the size of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market industry across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough market report analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market forecast analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.