Corrugated Packaging Software Market Size 2025-2029

The corrugated packaging software market size is forecast to increase by USD 17.31 billion, at a CAGR of 18.1% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing availability of packaged software solutions. This trend is attributed to the convenience and efficiency gains that software solutions offer in managing various aspects of corrugated packaging production. Additionally, the emergence of cloud-based software is further fueling market expansion, enabling remote access and real-time collaboration. However, the market also faces challenges related to customization and flexibility. As corrugated packaging businesses have unique requirements, off-the-shelf software may not always meet their specific needs.

- Consequently, there is a demand for software providers to offer customizable solutions that cater to the diverse needs of the industry. Navigating this challenge will be crucial for companies seeking to capitalize on market opportunities and maintain a competitive edge.

What will be the Size of the Corrugated Packaging Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The corrugated packaging market continues to evolve, driven by the dynamic needs of various industries and consumer preferences. Corrugated boxes, made from corrugated board, offer superior product protection with features such as bursting strength, edge crush test, and compression strength. These boxes find extensive applications in industrial, food, retail, e-commerce, and pharmaceutical sectors. The market's continuous unfolding is evident in the ongoing advancements in technology. Digital and offset printing, folding cartons, and API integration enable customized branding and product differentiation. Inventory management and warehouse optimization are enhanced through software solutions, ensuring shipping efficiency and cost optimization. Moreover, the market's evolution includes the adoption of sustainable practices, such as biodegradable packaging and recycled content.

The integration of data analytics, predictive analytics, and cloud computing facilitates real-time insights, improving workflow management and product quality. The corrugated packaging industry's ongoing development is further reflected in the integration of advanced technologies like artificial intelligence (AI) and paperboard grades with superior moisture resistance, tear resistance, and stacking strength. These innovations cater to the evolving needs of diverse sectors, ensuring consumer experience remains at the forefront.

How is this Corrugated Packaging Software Industry segmented?

The corrugated packaging software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- Type

- Packaged

- Standalone

- End-user

- Food and beverage

- Electronics

- Healthcare

- Personal care

- Others

- Sector

- SMEs

- Large enterprises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

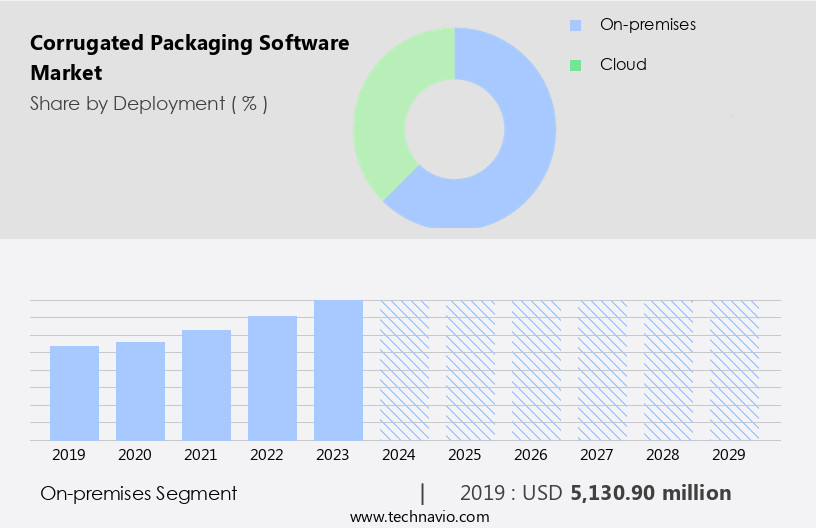

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

The market is driven by various factors, including pallet loading and warehouse optimization. Large-scale manufacturers require efficient solutions to manage their unique corrugated board designs for numerous customers, ensuring tear resistance, compression strength, and optimal box design for different industries such as pharmaceutical, beverage, and industrial packaging. On-premises software is a popular choice due to its enhanced security features, which is crucial as data privacy and security are paramount in the competitive market. With a perpetual license, on-premises software offers secure access and data sharing without the need for internet connectivity, allowing for customization and programming according to specific business needs.

Cost optimization through inventory management and workflow management is another significant trend. Digital and offset printing, along with flexo printing, enable high-quality brand identity and product protection. Data analytics and predictive analytics provide valuable insights into paperboard grades, stacking strength, and shipping efficiency, ensuring optimal performance and reducing waste. Sustainable packaging, including biodegradable and recycled content, is gaining traction, aligning with consumer preferences for eco-friendly solutions. Artificial intelligence and machine learning enhance packaging automation, improving overall efficiency and reducing human error. Moisture resistance, bursting strength, and edge crush tests ensure product protection during shipping. Software integration with shipping containers and API enables seamless workflows, while cloud computing offers flexibility and accessibility.

Ultimately, the market is focused on creating an exceptional consumer experience through innovative packaging solutions.

The On-premises segment was valued at USD 5.13 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the corrugated packaging market, China, Japan, and India are significant revenue generators due to the rising container shipments from these countries, fueling the demand for corrugated boxes. The proliferation of e-commerce businesses in these regions is also driving new corrugated box manufacturers to enter the market. China, in particular, is a leading contributor due to the global popularity of Chinese goods, resulting in a surge in demand for corrugated boxes. However, the adoption of cloud-based corrugated packaging software in this region is currently limited, primarily due to insufficient infrastructure. Corrugated packaging solutions are increasingly adopted for various applications, including pharmaceutical, beverage, industrial, and retail sectors.

Factors such as compression strength, tear resistance, and stacking strength are crucial considerations in the design and production of corrugated boxes. Sustainability is a growing trend, with an emphasis on recycled content, sustainable packaging, and biodegradable options. Innovations in printing technologies, such as digital, offset, flexo, and gravure printing, enable customized branding and product protection. Tamper-evident seals and predictive analytics enhance product safety and supply chain efficiency. Cost optimization and workflow management are essential for streamlining operations and reducing waste. Corrugated board, available in various paperboard grades, is the primary raw material for producing corrugated boxes.

The flute profile, which affects the box's strength and stacking ability, is a critical design consideration. Bursting strength, edge crush tests, and vibration tests ensure the boxes can withstand shipping conditions. The integration of software solutions for inventory management, API integration, and packaging automation streamlines operations and improves shipping efficiency. Artificial intelligence and machine learning enable predictive analytics for demand forecasting and optimizing production. The consumer experience is a key focus, with an emphasis on product protection, ease of use, and brand identity. Corrugated packaging solutions cater to diverse industries, including food, cosmetics, pharmaceuticals, and e-commerce.

Moisture resistance, tear resistance, and tamper-evident seals are essential for food packaging. Cosmetic packaging requires high-quality graphics and durability. Pharmaceutical packaging must meet strict regulations for safety and security. E-commerce packaging must be cost-effective, efficient, and protective. In conclusion, the corrugated packaging market is dynamic, with various trends and innovations shaping its growth. The increasing demand for e-commerce and exports, the emphasis on sustainability, and the adoption of advanced technologies are key drivers. Corrugated packaging software solutions enable optimized production, improved efficiency, and enhanced product protection.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Corrugated Packaging Software Industry?

- The availability of packaged software solutions serves as the primary market driver, significantly influencing its growth and demand.

- Corrugated packaging software is a crucial tool for manufacturers, enabling efficient management of corrugated boards and the production of corrugated boxes. The software can be integrated into Enterprise Resource Planning (ERP) systems, expanding its functionality to include inventory management, planning, billing, and shipment. This integration offers cost savings compared to standalone corrugated packaging software. The market growth is driven by several factors. Predictive analytics and artificial intelligence (AI) technologies are increasingly being adopted to optimize production processes, improve quality, and enhance sustainability through features like moisture resistance and edge crush tests. Sustainability is a significant concern for brands, and the use of recycled content in corrugated packaging is becoming more prevalent.

- In the cosmetic industry, where brand identity is paramount, corrugated packaging software ensures consistent and high-quality printing. Drop tests and other quality control measures are essential for ensuring the durability and reliability of shipping containers. Corrugated packaging software facilitates these tests and helps maintain the required standards. With the growing emphasis on automation and the increasing complexity of packaging processes, the demand for corrugated packaging software is expected to continue growing.

What are the market trends shaping the Corrugated Packaging Software Industry?

- Cloud-based software is increasingly becoming the market trend due to its availability. This technological advancement offers professionals and businesses the convenience and flexibility to access software applications over the internet, making it a mandatory choice for staying competitive.

- In the realm of industrial packaging, businesses are increasingly turning to corrugated packaging software to optimize their operations and enhance product protection. This software plays a pivotal role in designing boxes with precise dimensions and bursting strength, ensuring the safe transportation of various goods. Two primary deployment models exist: on-premises and cloud-based. In on-premises deployment, the high upfront costs for software licensing and implementation, coupled with ongoing maintenance expenses, can be substantial. Conversely, cloud-based deployment offers a more cost-effective solution, as the software provider assumes responsibility for implementation, maintenance, updates, and backups. Moreover, cloud-based software utilizes a pay-per-use pricing model, allowing businesses to pay based on their usage rather than making a large upfront investment.

- In terms of integration, cloud-based software often includes APIs for seamless connection with other systems, improving the overall consumer experience in industries such as food packaging, retail, and e-commerce. The shift towards cloud-based solutions is a strategic move for businesses aiming to reduce costs, streamline processes, and prioritize product protection.

What challenges does the Corrugated Packaging Software Industry face during its growth?

- The customization and flexibility issues pose a significant challenge to the industry's growth, as companies strive to meet the unique needs of their clients while maintaining efficiency and scalability.

- The market is driven by the need for automation and efficiency in the production of corrugated packaging, including pallet loading, warehouse optimization, and inventory management. Customization and flexibility are crucial factors in this market, as businesses require software that can adapt to their unique packaging needs and design challenges. However, some software solutions may not offer sufficient customization or flexibility, which can hinder their ability to meet evolving business requirements. Factors limiting adaptability and flexibility include the use of outdated printing technologies, such as offset printing, and the inability to support various flute profiles and compression strengths.

- The pharmaceutical packaging sector, in particular, demands high levels of customization and regulatory compliance, making it a significant market for advanced corrugated packaging software. Digital printing technology has emerged as a game-changer in the corrugated packaging industry, enabling on-demand production of customized packaging designs and reducing inventory costs. As businesses continue to seek ways to improve shipping efficiency and reduce waste, the demand for advanced corrugated packaging software is expected to grow.

Exclusive Customer Landscape

The corrugated packaging software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the corrugated packaging software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, corrugated packaging software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abaca Systems Ltd. - The implementation of advanced corrugated packaging software, such as the Packing 3000 business management system, significantly enhances operational efficiency and minimizes errors within the packaging industry. This technology streamlines business processes, ensuring accurate order fulfillment, optimizing production, and reducing material waste. By automating manual tasks and providing real-time data analysis, companies can make informed decisions, ultimately improving overall productivity and profitability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abaca Systems Ltd.

- Advantive

- AICOMP Consulting GmbH

- Amtech Software LLC

- Arden Software Ltd.

- Dexciss Technology Pvt. Ltd.

- Eastern Software Systems Pvt. Ltd.

- Electronics For Imaging Inc.

- Epicor Software Corp.

- Erpisto

- Esko Graphics BV

- Finsys ERP

- Onesys Ltd.

- Oracle Corp.

- Prestige Atlantic Asia Sdn Bhd

- RITC Pvt. Ltd.

- Sistrade Software Consulting SA

- theurer.com GmbH

- Volume Software

- WITRON Logistik Informatik GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Corrugated Packaging Software Market

- In February 2023, Sealed Air, a leading global provider of food safety and security solutions, announced the launch of its new Corpulex Corrugated Packaging Software, designed to optimize corrugated packaging production and improve supply chain efficiency (Sealed Air Press Release, 2023). This innovative software solution enables real-time data analytics, streamlined workflows, and enhanced collaboration between various stakeholders.

- In May 2024, Ball Corporation, a leading supplier of aluminum packaging for beverages, announced a strategic partnership with Esko, a global provider of software and hardware solutions for the packaging industry. This collaboration aims to integrate Esko's ArtiosCAD and Automation Engine software into Ball's packaging design and production processes, enhancing efficiency and reducing time-to-market for new product launches (Ball Corporation Press Release, 2024).

- In August 2024, Schneider Electric, a global energy management and automation company, acquired AVEVA, a leading provider of industrial software, including solutions for the corrugated packaging industry. This acquisition strengthens Schneider Electric's position in the industrial software market and provides AVEVA's customers with access to Schneider Electric's extensive energy management and automation solutions (Schneider Electric Press Release, 2024).

- In November 2025, Tetra Pak, a leading food processing and packaging solutions company, announced the deployment of its new Tetra Pak IQ Corrugated Packaging Execution System in its manufacturing facilities. This system, which utilizes real-time data analytics and automation, aims to improve production efficiency, reduce waste, and enhance product quality (Tetra Pak Press Release, 2025).

Research Analyst Overview

- The corrugated packaging market is a dynamic and evolving sector within the larger packaging industry. Publications dedicated to this field provide valuable insights into current packaging trends, including the increasing adoption of circular economy packaging solutions and e-commerce fulfillment strategies. In the realm of corrugated board manufacturing, innovation continues to drive progress, with advancements in logistics optimization and supply chain management. Packaging industry events serve as platforms for showcasing new packaging design software and reuse initiatives, pushing the boundaries of sustainable packaging materials and design. Packaging compliance remains a critical concern, with industry associations advocating for adherence to packaging standards and regulations.

- Packaging sustainability reporting and cost modeling are essential tools for businesses seeking to minimize waste reduction and shipping regulations. Meanwhile, packaging testing laboratories ensure the quality and safety of products, contributing to the overall success of the industry. Circular economy packaging, e-commerce fulfillment, and sustainable packaging materials are shaping the future of the corrugated packaging market. As the industry adapts to these trends, it remains committed to innovation, compliance, and sustainability.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Corrugated Packaging Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.1% |

|

Market growth 2025-2029 |

USD 17310 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.9 |

|

Key countries |

US, China, Japan, Canada, India, Germany, South Korea, UK, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Corrugated Packaging Software Market Research and Growth Report?

- CAGR of the Corrugated Packaging Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the corrugated packaging software market growth of industry companies

We can help! Our analysts can customize this corrugated packaging software market research report to meet your requirements.