Credit Card Payments Market Size 2025-2029

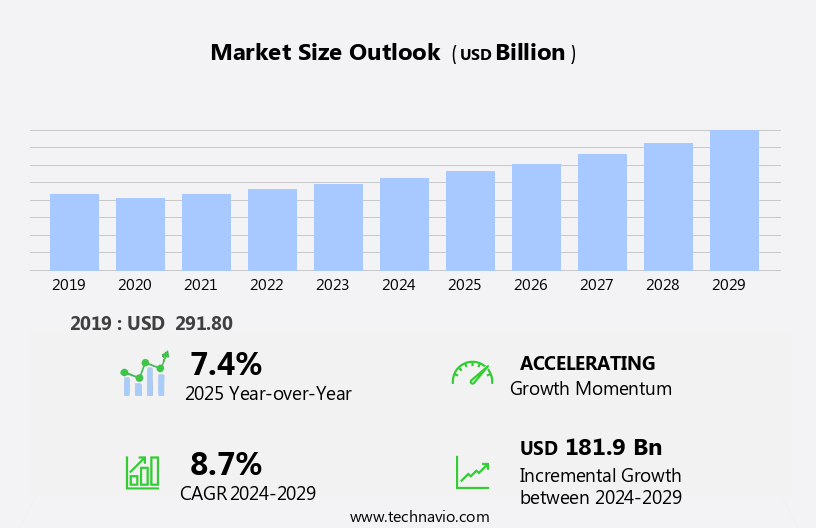

The credit card payments market size is forecast to increase by USD 181.9 billion, at a CAGR of 8.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prevalence of online transactions. The digital shift in consumer behavior, fueled by the convenience and accessibility of e-commerce platforms, is leading to a surge in credit card payments. Another key trend shaping the market is the adoption of mobile biometrics for payment processing. This advanced technology offers enhanced security and ease of use, making it an attractive option for both consumers and merchants. However, the market also faces challenges.

- In developing economies, a lack of awareness and infrastructure for online payments presents a significant obstacle. Bridging the digital divide and educating consumers about the benefits and security of online transactions will be crucial for market expansion in these regions. Effective strategies, such as partnerships with local financial institutions and targeted marketing campaigns, can help overcome this challenge and unlock new opportunities for growth.

What will be the Size of the Credit Card Payments Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Payment optimization through EMV chip technology and payment authorization systems enhances security and streamlines transactions. Cross-border payments and chargeback prevention are crucial for businesses expanding globally. Ecommerce payment solutions, BNPL solutions, and mobile payments cater to the digital age, offering flexibility and convenience. Payment experience is paramount, with user interface design and alternative payment methods enhancing customer satisfaction. Merchant account services and payment gateway integration enable seamless transaction processing. Payment analytics and loyalty programs help businesses understand customer behavior and boost retention. Interchange fees, chargeback management, and dispute resolution are essential components of credit card processing.

Data encryption and fraud detection ensure payment security. Multi-currency support and digital wallets cater to diverse customer needs. Customer support and subscription management are vital for maintaining positive relationships and managing recurring billing. Processing rates, settlement cycles, and PCI compliance are key considerations for businesses seeking efficient and cost-effective payment solutions. The ongoing integration of these elements shapes the dynamic and evolving credit card payments landscape.

How is this Credit Card Payments Industry segmented?

The credit card payments industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer or individual

- Commercial

- Product Type

- General purpose credit cards

- Specialty credit cards

- Others

- Application

- Food and groceries

- Health and pharmacy

- Restaurants and bars

- Consumer electronics

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

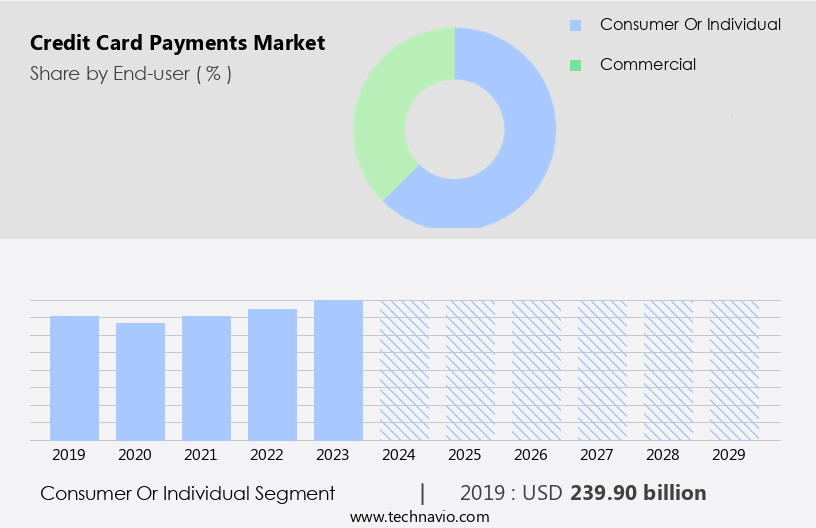

The consumer or individual segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and evolving landscape that caters to businesses and consumers alike. Recurring billing enables merchants to automatically charge customers for goods or services on a regular basis, streamlining the payment process for both parties. EMV chip technology enhances payment security, reducing the risk of fraud. Payment optimization techniques help businesses minimize transaction costs and improve authorization rates. Cross-border payments facilitate international business, while chargeback prevention measures protect merchants from revenue loss due to disputed transactions. Ecommerce payment solutions provide convenience for consumers and merchants, with payment gateway integration ensuring seamless transactions. Rewards programs and buy now, pay later (BNPL) solutions incentivize consumer spending.

Mobile payments and digital wallets offer flexibility and convenience. Merchants can accept various payment methods, including cryptocurrencies, and benefit from payment analytics and conversion rate optimization. Payment volume continues to grow, necessitating robust fraud detection systems and multi-currency support. Customer support is crucial for resolving disputes and addressing payment issues. Alternative payment methods cater to diverse consumer preferences. The payment experience is key to customer retention and acquisition, with user interface design playing a significant role. Payment security, PCI compliance, and dispute resolution are essential components of the market. Interchange fees, processing rates, and settlement cycles impact profitability. Contactless payments and payment flexibility cater to evolving consumer preferences.

Payment decline rates and acceptance rates influence merchant success. In this market, businesses must navigate the complexities of credit card processing, global payment processing, and international expansion. Payment security, customer retention, and customer segmentation are essential for long-term success.

The Consumer or individual segment was valued at USD 239.90 billion in 2019 and showed a gradual increase during the forecast period.

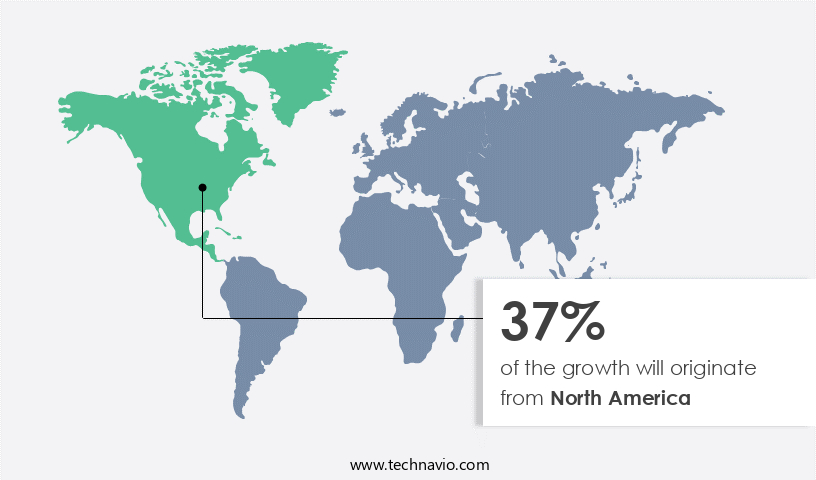

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is a pioneer in adopting advanced technologies and holds significant potential for the credit card payments industry. With a strong technological infrastructure, economies in this region are driving market growth. The increasing number of smartphone users in North America is a major factor fueling the market's expansion. Key players in the industry have a robust presence in the region, further boosting market growth. The demand for mobility, cloud solutions, and social app integration is leading to a co-dependent and intelligent economy in North America. Moreover, the young and socially active population in the region is on the rise, contributing positively to the market.

In terms of payment solutions, there is a growing preference for ecommerce, mobile payments, and BNPL options. Payment optimization, authorization, and fraud detection are essential aspects that businesses prioritize to enhance user experience and ensure security. Cross-border payments, multi-currency support, and chargeback management are crucial for businesses operating internationally. Merchant account services, payment gateway integration, and payment analytics are essential tools for businesses to manage transactions efficiently and make data-driven decisions. Contactless payments, PCI compliance, and dispute resolution are other essential elements that businesses focus on to provide a seamless payment experience. The credit card processing industry is continually evolving, with a focus on payment flexibility, security, and customer retention.

The market is also witnessing the emergence of alternative payment methods, such as digital wallets and cryptocurrencies. Overall, the market in North America is dynamic and innovative, with businesses constantly adapting to meet the evolving needs of their customers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Credit Card Payments Industry?

- The surge in online transactions is the primary catalyst fueling market growth, as an increasing number of consumers prefer the convenience and accessibility of digital platforms for their purchasing needs.

- In today's digital economy, online transactions are increasingly preferred for their ease, speed, and convenience. The financial and e-commerce sectors lead the adoption of this trend, with consumers using Internet-connected devices, particularly smartphones, to make purchases. However, this shift to digital transactions brings new challenges, including the risk of cyber-attacks. The demand for credit card payments has consequently surged, fueling market growth. Advanced threats targeting devices, people, and networks pose significant risks to industries such as finance and e-commerce. To mitigate these risks, merchant account services and payment gateway integration have become essential tools. Payment analytics and fraud detection systems help merchants monitor transactions and identify potential threats.

- Multi-currency support and digital wallets cater to the global market, while user interface design enhances the customer experience. Moreover, the emergence of cryptocurrency payments adds another layer of complexity and opportunity to the market. Payment conversion rates are a crucial metric for businesses, and loyalty programs help retain customers. Payment volume continues to increase, driven by the growing number of online transactions. As the market evolves, staying updated on the latest trends, such as payment analytics and user interface design, is essential for businesses to remain competitive.

What are the market trends shaping the Credit Card Payments Industry?

- The use of mobile biometrics for payments is an emerging market trend, gaining significant traction among consumers and businesses alike. This innovative technology, which includes fingerprint, facial recognition, and iris scanning, offers enhanced security and convenience for financial transactions.

- In today's digital economy, the market is witnessing significant advancements, driven by the increasing preference for convenient and secure payment solutions. The integration of customer support services, alternative payment methods, and advanced technologies is enhancing the payment experience for businesses and consumers alike. Point-of-Sale (POS) systems, subscription management, interchange fees, chargeback management, data encryption, dispute resolution, and other features are becoming essential components of payment processing. Biometric technologies, such as fingerprint recognition, voice recognition, and facial recognition, are gaining popularity for their ability to provide a more secure and immersive payment experience. These technologies are being integrated into various payment platforms, including mobile devices and POS systems, to prevent fraudulent activities and ensure authorized access to personal data.

- Moreover, the use of multimodal biometrics for individual identification and verification is becoming increasingly common. This technology not only enhances security but also streamlines the payment process, reducing the need for manual intervention and minimizing errors. Processing rates, settlement cycles, and customer acquisition costs are critical factors influencing the competitiveness of payment service providers. As the market continues to evolve, providers must stay abreast of the latest trends and technologies to offer innovative and cost-effective solutions to their clients. By focusing on security, convenience, and customer satisfaction, payment service providers can differentiate themselves and build long-term relationships with their customers.

What challenges does the Credit Card Payments Industry face during its growth?

- In developing economies, the lack of awareness and understanding of online payment systems poses a significant challenge to the growth of the industry. This issue hinders the adoption of digital payment solutions, limiting their potential to transform financial transactions and expand financial inclusion.

- The market expansion is driven by the increasing preference for contactless payments and the need for payment flexibility. However, international markets face challenges such as payment decline rates due to PCI compliance and customer segmentation. In developing economies, the lack of awareness about credit card processing and the limited availability of essential telecom infrastructure for mobile payments hinder market growth.

- Although internet penetration is high in certain countries, LTE technology adoption remains modest, impacting the reliability and continuity of mobile payment transactions. Ensuring payment security is crucial for customer retention and market growth. As the market evolves, businesses must adapt to the changing payment landscape and prioritize security measures to maintain customer trust.

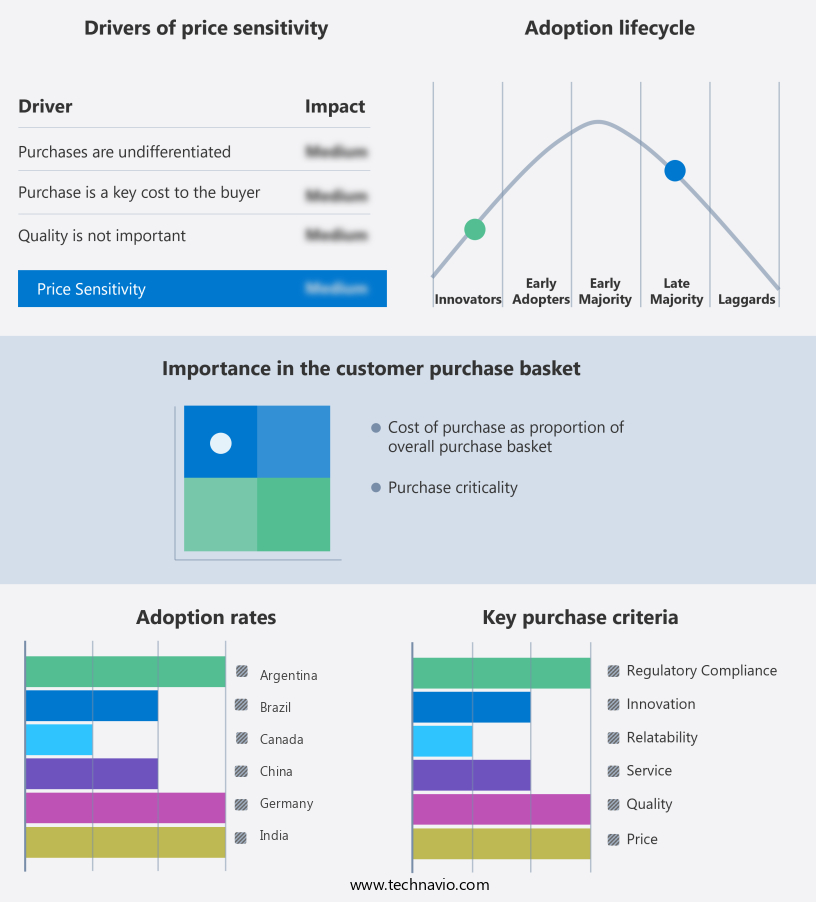

Exclusive Customer Landscape

The credit card payments market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the credit card payments market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, credit card payments market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Express Co. - This company provides a selection of credit card offerings, including the American Express Membership Rewards Credit Card and SmartEarn Credit Card. These cards cater to diverse spending habits and preferences, enabling users to earn rewards and optimize their financial management. The American Express Membership Rewards Credit Card offers flexible points that can be redeemed for various rewards, while the SmartEarn Credit Card provides cash back on select purchases. By offering a range of reward structures, this company empowers individuals to make informed choices and maximize their earnings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Express Co.

- Bajaj Finserv Ltd.

- Bank of America Corp.

- Bank of Montreal

- Barclays Bank Plc

- Capital One Financial Corp.

- Citigroup Inc.

- Credicard SA

- Credit One Bank N.A.

- HDFC Bank Ltd.

- JCB Co. Ltd.

- JPMorgan Chase and Co.

- Malayan Banking Berhad

- Mastercard Inc.

- Royal Bank of Canada

- SYNCHRONY FINANCIAL

- THE PNC FINANCIAL SERVICES GROUP INC.

- USAA

- Visa Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Credit Card Payments Market

- In March 2024, Mastercard announced the launch of its new contactless payment solution, Mastercard Click to Pay, designed to simplify online checkout processes for consumers. This innovation enables merchants to offer a unified checkout experience across multiple e-commerce platforms, reducing the need for customers to remember multiple usernames and passwords (Mastercard, 2024).

- In August 2024, Visa and Google formed a strategic partnership to expand Google Pay's acceptance as a payment method at brick-and-mortar retailers. This collaboration aims to increase the usage of contactless payments and digital wallets, with Google Pay expected to be available at over 70 million merchant locations worldwide by the end of 2025 (Visa, 2024).

- In January 2025, PayPal completed its acquisition of Paidy, a Japanese buy now, pay later (BNPL) fintech company. This deal strengthened PayPal's presence in the Asian market and expanded its BNPL offerings, positioning the company to capture a larger share of the growing e-commerce market in the region (PayPal, 2025).

- In May 2025, the European Central Bank (ECB) announced the successful completion of its Instant Payment Settlement (TIPS) system, enabling real-time credit card transactions across Europe. This initiative aims to improve payment efficiency and reduce transaction times, benefiting both consumers and merchants (ECB, 2025).

Research Analyst Overview

- In the dynamic payment market, mobile commerce is revolutionizing consumer behavior, driving a shift towards contactless transactions. Financial modeling and payment data analytics are essential tools for payment service providers to understand market trends and anticipate consumer needs. Artificial intelligence and machine learning are transforming risk management and network security, enhancing payment innovation and infrastructure. Payment adoption in the travel industry and online shopping continues to soar, with emerging technologies like biometric authentication and machine learning streamlining transactions. Payment innovation is also reshaping the hospitality industry, offering new opportunities for business intelligence and customer insights. Payment ecosystem players, including financial institutions and payment processors, must navigate regulatory compliance and data privacy regulations to ensure secure and reliable payment services.

- Card networks are investing in anti-money laundering measures and data breach prevention to maintain trust and confidence in the payment system. Fintech startups are disrupting the payment landscape with innovative solutions, creating investment opportunities in the sector. Payment service providers must stay abreast of emerging technologies and regulatory requirements to remain competitive and meet evolving consumer demands.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Credit Card Payments Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 181.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, Canada, China, Japan, India, South Korea, Germany, UK, Brazil, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Credit Card Payments Market Research and Growth Report?

- CAGR of the Credit Card Payments industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the credit card payments market growth of industry companies

We can help! Our analysts can customize this credit card payments market research report to meet your requirements.