Crop Production Software Market Size 2024-2028

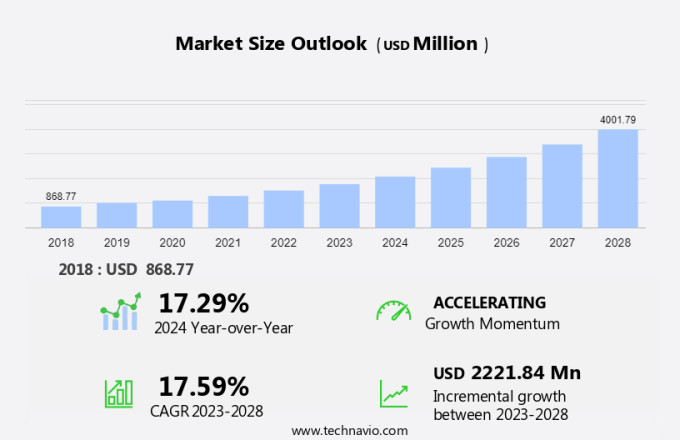

The crop production software market size is forecast to increase by USD 2.22 billion at a CAGR of 17.59% between 2023 and 2028.

- The agricultural market is experiencing substantial growth due to several notable trends and challenges. One notable trend is the increasing use of precision farming, which employs advanced technologies to optimize crop yields and reduce waste. Another significant development is the integration of artificial intelligence (AI) and machine learning (ML) into crop production software. This innovation enables predictive analytics and the automation of farming processes, leading to improved efficiency and productivity. However, the substantial upfront capital investments required by farmers pose a significant barrier to market expansion. Despite this obstacle, the potential benefits of these technologies are compelling, making the agricultural sector an intriguing and dynamic area to monitor.

What will the size of the market be during the forecast period?

- The agribusiness sector is witnessing significant advancements in crop production, driven by the global population's increasing demand for food and the challenges of urbanization, climate change, and the depletion of arable land. Sustainable agriculture solutions, such as precision farming, real-time data collection and analysis, predictive modeling, monitoring, and control, are becoming essential for optimizing food production.

- Companies are pioneering the use of Satellite IoT (SatIoT) and sensors, actuators, and devices to create greenhouses and monitor microclimates. Government investments in satellite imaging, in-field sensors, artificial intelligence, and machine learning are also playing a crucial role in developing regions. The integration of drones and Internet of Things (IoT) devices into crop production software is revolutionizing planting schedules and enhancing overall productivity in the agricultural sector.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Type

- Small

- Medium

- Large

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Deployment Insights

- The on-premises segment is estimated to witness significant growth during the forecast period.

Agribusinesses, farmers, ranchers, and growers worldwide are increasingly adopting crop production software to optimize food production in the face of global population growth, urbanization, climate change, and the need for sustainable agriculture. On-premises deployment of these solutions requires farmers to invest in hardware (servers, network equipment, security devices) and software, making it a significant upfront cost. However, the benefits include enhanced data security, real-time data collection and analysis, predictive modeling, monitoring, and control. Smart greenhouses utilize sensors, actuators, and devices to optimize microclimates, while Satellite IoT (SatIoT) and drones provide valuable data for precision farming.

Furthermore, in-field sensors, satellite imaging, and artificial intelligence enable advanced analytics and automation capabilities. Government investments in agriculture technology and cloud services facilitate the integration of mobile applications and data analysis tools. Despite the advantages, the high deployment costs may limit the adoption of on-premises crop production software, particularly in developing regions. However, the potential for increased efficiency, productivity, and profitability makes it an attractive option for agribusinesses and farmers alike.

Get a glance at the market report of share of various segments Request Free Sample

The on-premises segment was valued at USD 465.49 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the integration of advanced technologies in agriculture. High-speed imagery services are becoming increasingly crucial for farmers to monitor crop quality and resource use, leading to improved precision in agriculture. This, in turn, helps in reducing input costs and enhancing food security. Sustainability is a key focus area, with weather conditions, temperatures, and moisture levels being closely monitored through software to optimize crop production. Crop prices are also influenced by these factors, making real-time data analysis essential for farmers. Government initiatives, such as those by the National Institute of Food and Agriculture (NIFA), are promoting the adoption of precision agriculture techniques, further driving market growth. Despite varying weather conditions and temperatures, the software enables farmers to make informed decisions based on accurate data, ensuring optimal crop productivity and ensuring global export of agricultural products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Crop Production Software Market?

The growing popularity of precision farming is the key driver of the market.

- Agribusinesses worldwide are embracing crop production software to optimize farm output and enhance crop yield with minimal input utilization. Farmers, ranchers, and growers leverage these tools for managing fertilizer applications, monitoring crops, and overseeing farm tasks. Real-time data collection and analysis, facilitated by sensors, actuators, and devices, enable farmers to make informed decisions regarding microclimate, moisture, and crop health. Global population growth, urbanization, climate change, and dwindling arable land necessitate sustainable agriculture practices, such as precision farming. Advanced technologies like predictive modeling, monitoring, and control systems are integral to precision farming.

- Government investments in agriculture technology and satellite imaging, coupled with in-field sensors and artificial intelligence, are revolutionizing agriculture. Drones and IoT devices are increasingly used for planting schedules, inventory management, and pest management. Incorporating advanced analytics and automation capabilities into cloud services and mobile applications streamlines data analysis and enhances overall farm management efficiency.

What are the market trends shaping the Crop Production Software Market?

The incorporation of AI and ML into crop production software is the upcoming trend in the market.

- Agribusinesses worldwide are leveraging advanced technologies, including artificial intelligence (AI) and machine learning (ML), to enhance crop production software. This transformation is significantly impacting the global market, empowering farmers, ranchers, and growers to optimize food production for the burgeoning global population. The United Nations projects that urbanization and climate change will reduce arable land by 2050, necessitating sustainable agriculture and precision farming solutions. AI and ML enable these systems to collect, process, and analyze data in real-time, providing farmers with intelligent insights for resource usage, maximizing crop yield, and analyzing soil data. Predictive modeling, a key feature, anticipates pest infestations and crop disease outbreaks based on historical data, weather conditions, and pest lifecycles, enabling farmers to take preventative measures.

- Smart greenhouses, sensors, actuators, and devices monitor microclimates, while satellite IoT (SatIoT) and drones collect data for advanced analytics. Government investments in smart agriculture solutions, such as Avirtech, Astrocast, and Avirlink, support the integration of AI and ML, enhancing automation capabilities, cloud services, and mobile applications. In-field sensors and inventory management systems further streamline operations, while pest management benefits from real-time monitoring and control. In developing regions, these technologies can revolutionize agriculture, improving planting schedules, reducing waste, and increasing overall efficiency. The integration of AI and ML in crop production software is a game-changer, ensuring food security and sustainable agriculture for the future.

What challenges does the Crop Production Software Market face during the growth?

The need for high initial capital investments by end-users is a key challenge affecting the market growth.

- Agribusinesses worldwide are increasingly embracing advanced crop production techniques and software to enhance food production in response to the growing global population, urbanization, climate change, and the need for sustainable agriculture. However, the high costs associated with these solutions remain a significant barrier for farmers, ranchers, and growers, particularly in developing regions. The expenses encompass not only the purchase and implementation of smart farming tools but also the integration of these systems, data analytics tools, and training. The United Nations and various governments recognize the importance of precision farming, real-time data collection and analysis, predictive modeling, monitoring, and control in modern agriculture.

- Technologies such as smart greenhouses, sensors, actuators, and devices enable farmers to optimize microclimates and improve crop yields. Satellite IoT (SatIoT), Astrocast, Avirtech, and other companies offer various smart agriculture solutions to help farmers make informed decisions based on accurate data. However, the costs of these advanced technologies can be prohibitive for many farmers. Government investments in satellite imaging, in-field sensors, artificial intelligence, and machine learning can help offset some of these expenses. Additionally, the use of drones, IoT devices, and mobile applications for planting schedules, inventory management, pest management, and advanced analytics can provide automation capabilities and cloud services to streamline farming operations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerobotics Pty Ltd.

- AgriApp

- Agrivi d.o.o.

- BASF SE

- CNH Industrial NV

- Conservis

- Cropin Technology Solutions Pvt. Ltd.

- Croptracker

- CropX Technologies Ltd.

- DeHaat

- Farmonaut Technologies Pvt. Ltd.

- FRONTIER AGRICULTURE LTD.

- HELM AG

- Kynetec

- OneSoil

- Syngenta Crop Protection AG

- Topcon Corp.

- Traction Ag

- Trimble Inc.

- Farmers Edge Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant sector that relies on advanced technology to optimize farming operations and increase yields. crop production software plays a crucial role in this regard, providing farmers with real-time data and insights to make informed decisions. This software assists in various aspects of farming, including soil analysis, weather forecasting, crop monitoring, and inventory management. The market is growing at an impressive rate due to the increasing adoption of technology in agriculture. Farmers are recognizing the benefits of using software to manage their operations more efficiently and effectively. The market is driven by factors such as the need for higher crop yields, the availability of affordable technology, and government initiatives to promote technological advancements in agriculture.

Furthermore, the market caters to a wide range of farming activities, from small-scale operations to large commercial farms. It offers features such as satellite imagery, weather data, and precision farming tools to help farmers optimize their crop production. The market is also witnessing the emergence of cloud-based solutions, which offer greater flexibility and accessibility to farmers. In conclusion, the market is a dynamic and growing sector that is transforming agriculture by providing farmers with the tools they need to optimize their operations and increase yields. The market is driven by various factors, including the need for higher crop yields, the availability of affordable technology, and government initiatives. Farmers are increasingly recognizing the benefits of using software to manage their operations more efficiently and effectively.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.59% |

|

Market Growth 2024-2028 |

USD 2.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.29 |

|

Key countries |

US, China, Australia, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch