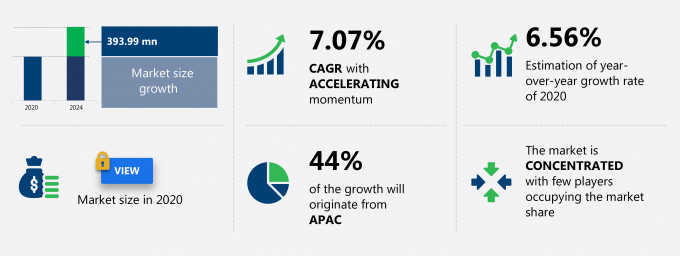

The cryogenic tanks market share is expected to increase by USD 393.99 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 7.07%.

This cryogenic tanks market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers cryogenic tanks market segmentation by product (LNG, nitrogen, and others) and geography (APAC, Europe, North America, and South America). The cryogenic tanks market report also offers information on several market vendors, including Air Products and Chemicals Inc., Air Water Inc., Chart Industries Inc., Cryofab Inc., FIBA Technologies Inc., INOX India Pvt. Ltd., L Air Liquide SA, Linde AG, VRV Srl, and Wessington Cryogenics among others.

What will the Cryogenic Tanks Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Cryogenic Tanks Market Size for the Forecast Period and Other Important Statistics

Cryogenic Tanks Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increased demand for nitrogen from food processing industry is notably driving the cryogenic tanks market growth, although factors such as supply chain disruptions due to covid-19 may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the cryogenic tanks industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Cryogenic Tanks Market Driver

The growing brewery industry in APAC is the major driver influencing the cryogenic tanks market growth. LN is used in beer processing as it helps to displace the oxygen, thereby increasing the shelf life. In addition, it helps in enhancing the taste of the beer. The factors that are creating new patterns of consumption in APAC are the following: Key growth factors of beer consumption in APACChanges in spending habitsRapid economicRising wagesThese factors are expected to increase the demand for beer in APAC. The alcoholic beverage market in APAC, especially beer, has experienced growth across the region. Thus, the use of liquid nitrogen in beer processing is likely to increase with the increase in beer production, which is expected to drive the market for cryogenic tanks during the forecast period.

Key Cryogenic Tanks Market Trend

Technological advances enhance the scope of cryogenics is the major trend influencing the cryogenic tanks market growth. Cryogenic technology has improved at a rapid rate in recent years. Intense research on cryogenics worldwide has led to technological advances that have broadened the scope of cryogenics in all major end-users, such as medical, industrial, energy, and food processing. In recent years, technologies such as hydrofracturing have boosted oil and gas production to new heights. However, the environmental impact of this process has laid down concerns regarding the future of this technology. Researchers in the US have discovered a breakthrough technology; wherein water can be replaced with cryogenic fluids such as LN or liquid CO . This technology can reduce water consumption in many processes, resulting in reduced groundwater pumping and the elimination of flowback disposal that leads to induced seismicity. In addition, it reduces formation damage that occurs due to capillary trapping. Technavio expects that this technology would be a major breakthrough in the oil and gas industry in replacing hydrofracturing techniques.In another breakthrough, Indian scientists at ISRO have developed an indigenous cryogenic engine that will aid in carrying heavier payloads. This would increase the scope of cryogenics in space applications. Increased demand for remote sensing data and communication platforms is expected to drive the demand for cryogenic equipment in space applications.

Key Cryogenic Tanks Market Challenge

Supply chain disruptions due to COVID-19 are the major hindrance to the cryogenic tanks market growth. Although the demand for medical oxygen has been increasing since the advent of the COVID-19 pandemic, the demand for non-medical oxygen and LNG decreased in 2020 due to transportation restrictions and stringent lockdowns. These factors declined the demand for cryogenic tanks from the food and beverage, construction, and other associated industries. Major industries such as food & beverage, construction, cosmetics were significantly affected by the pandemic. However, from Q1 of 2021, economic activities resumed across the regions. The increasing demand for food & beverage products, resumption of construction projects, and increasing demand for logistics and transportation of health-oriented products are expected to boost the growth of the cryogenic market during the forecast period. Vendors in the industry are focusing on expanding their manufacturing facilities and their business operations across the globe. These factors are expected to increase the growth of the cryogenic market during the forecast period.

This cryogenic tanks market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2020-2024.

Parent Market Analysis

Technavio categorizes global cryogenic tanks market as a part of the global industrial machinery market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the cryogenic tanks market during the forecast period.

Who are the Major Cryogenic Tanks Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Air Products and Chemicals Inc.

- Air Water Inc.

- Chart Industries Inc.

- Cryofab Inc.

- FIBA Technologies Inc.

- INOX India Pvt. Ltd.

- L Air Liquide SA

- Linde AG

- VRV Srl

- Wessington Cryogenics

This statistical study of the cryogenic tanks market encompasses successful business strategies deployed by the key vendors. The cryogenic tanks market is concentrated and the vendors are deploying growth strategies such as organic and inorganic strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The cryogenic tanks market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Cryogenic Tanks Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the cryogenic tanks market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global industrial machinery market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Cryogenic Tanks Market?

For more insights on the market share of various regions Request for a FREE sample now!

44% of the market’s growth will originate from APAC during the forecast period. China is the key market for cryogenic tanks market in APAC. Market growth in this region will be faster than the growth of the market in regions.

Availability of low-cost labor and resources will facilitate the cryogenic tanks market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The increasing demand for oxygen in the region due to the second wave of the COVID-19 pandemic in 2021 is expected to have a positive impact on the cryogenic market in APAC. The government's increasing efforts for adequate oxygen supply in the region boost the demand for cryogenic tanks in the market. For instance, as of March 2021, the government of India lifted restrictions on the transportation of liquid medical oxygen. The cryogenic tanks licensed for transport of nitrogen/argon are now permitted to transport liquid medical oxygen without amending the license for change of service. This was due to the severity of the second wave of the COVID-19 pandemic in India, which increased death tolls at the time. Leading companies working in the gas distribution sector are importing cryogenic tanks to meet the demand from the healthcare sector. For instance, as of April 2021, Adani Group, a Gujrat-based conglomerate company, secured 12 cryogenic tanks from Dubai and Thailand to transport liquid oxygen. Such initiatives are expected to increase the growth of the cryogenic tanks market in the region during the forecast period.

What are the Revenue-generating Product Segments in the Cryogenic Tanks Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The cryogenic tanks market share growth by the LNG segment will be significant during the forecast period. The recent plunge in global crude prices is expected to have a significant effect on the market, followed by the LNG tanker market over the forecast period. The primary aim of the LNG tanker market, which directs the course of the market, is related to the transportation of natural gas in a liquefied form. The market is, therefore, reliant on the broader demand-supply dynamics of the global natural gas market

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the cryogenic tanks market size and actionable market insights on post COVID-19 impact on each segment.

|

Cryogenic Tanks Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2019 |

|

Forecast period |

2020-2024 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.07% |

|

Market growth 2020-2024 |

USD 393.99 million |

|

Market structure |

Concentrated |

|

YoY growth (%) |

6.56 |

|

Regional analysis |

APAC, Europe, North America, and South America |

|

Performing market contribution |

APAC at 44% |

|

Key consumer countries |

US, China, Germany, and Canada |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Air Products and Chemicals Inc., Air Water Inc., Chart Industries Inc., Cryofab Inc., FIBA Technologies Inc., INOX India Pvt. Ltd., L Air Liquide SA, Linde AG, VRV Srl, and Wessington Cryogenics |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Cryogenic Tanks Market Report?

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will drive cryogenic tanks market growth during the next five years

- Precise estimation of the cryogenic tanks market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the cryogenic tanks industry across APAC, Europe, North America, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of cryogenic tanks market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch