Data Loss Prevention Market Size 2025-2029

The data loss prevention (DLP) market size is forecast to increase by USD 8.38 billion at a CAGR of 33.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of cloud services for data storage and the implementation of IT analytics for preventing data loss. The shift towards cloud computing has led to an exponential increase in data being stored and transmitted outside of traditional corporate networks, making data security a top priority for organizations. DLP solutions have become essential in mitigating the risks associated with data loss, particularly in industries that handle sensitive information. The integration of AI technologies is enhancing DLP solutions by enabling real-time threat detection, predictive analytics, and automated responses to potential data breaches. However, the deployment of DLP solutions is not without challenges. One of the main obstacles is the complexity of implementing and managing these solutions across diverse and distributed IT environments, compounded by the need to effectively incorporate AI into existing security infrastructures.

- Additionally, the ever-evolving threat landscape and the need to keep up with new data security regulations add to the challenges. Behavioral analytics and machine learning technologies enhance DLP capabilities by identifying anomalous behavior and potential threats. Despite these hurdles, the market presents significant opportunities for companies seeking to capitalize on the growing demand for data security solutions. Organizations can gain a competitive edge by investing in advanced DLP technologies that offer real-time threat detection, user behavior analytics, and automated response capabilities. By staying abreast of the latest trends and addressing the challenges effectively, companies can navigate the dynamic market landscape and protect their valuable data assets.

What will be the Size of the Data Loss Prevention (DLP) Market during the forecast period?

- The market in the United States continues to experience significant growth due to increasing concerns over data security breaches and the need to protect sensitive information. DLP solutions encompass a range of technologies, including security analytics, data sanitization, automation, data masking techniques, data obfuscation, data security assessments, anomaly detection, user behavior analytics, managed DLP services, and various deployment models. Key market drivers include the growing adoption of cloud-based DLP, the rise of insider threats, and the implementation of stringent data security frameworks. Additionally, advanced DLP capabilities such as data anonymization, data leakage detection, threat hunting, and DLP reporting tools are gaining traction.

- DLP awareness and training are also essential components of effective data security strategies, as is the integration of DLP solutions with other security technologies. Despite these advancements, data security operations remain complex, requiring ongoing vigilance and innovation to stay ahead of evolving threats. The market is expected to continue expanding, driven by the increasing importance of data security and the continuous development of new DLP solutions and capabilities.

How is this Data Loss Prevention (DLP) Industry segmented?

The data loss prevention (DLP) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud-based

- On-premises

- Technology

- Datacenter/Storage-based DLP

- Endpoint DLP

- Network DLP

- Customer Type

- Large enterprises

- SMEs

- End-user

- BFSI

- Healthcare

- Retail and e-commerce

- IT and telecom

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

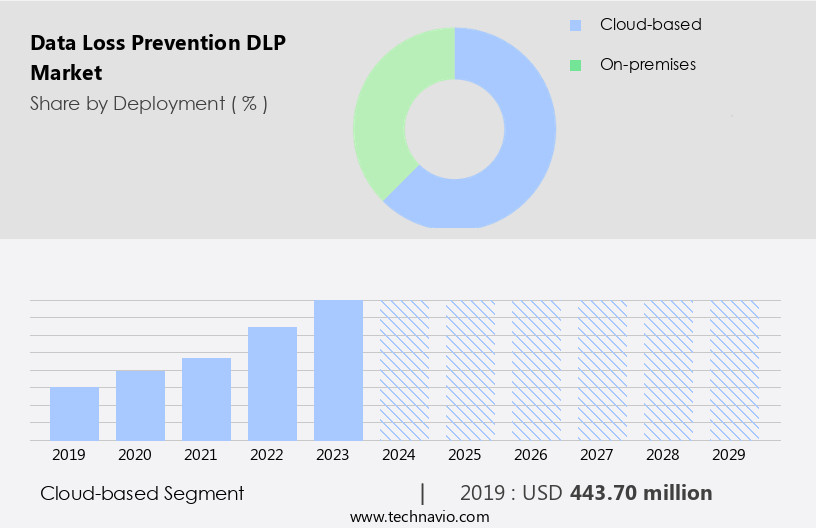

By Deployment Insights

The cloud-based segment is estimated to witness significant growth during the forecast period. Data Loss Prevention (DLP) is a critical aspect of data security for businesses, particularly those adopting cloud storage. Cloud-based DLP solutions ensure the protection of sensitive data by encrypting it before it is transferred to the cloud and only allowing access to authorized applications. These solutions integrate with cloud storage providers to scan servers for sensitive data, identify it, and encrypt it before sharing in the cloud. Additionally, they scan and audit previously stored data in the cloud, providing an extra layer of security. DLP solutions employ various techniques such as data masking, tokenization, and redaction to protect data sensitivity.

Compliance with regulatory frameworks like PCI DSS and adherence to data privacy policies are essential, and DLP tools facilitate this. DLP platforms provide data visibility, enabling organizations to monitor data usage, detect data leaks, and prevent data breaches. DLP services offer consulting and management to help businesses implement and optimize their DLP strategies. Other benefits include data encryption, data archiving, and threat intelligence to safeguard data in the cloud.

Get a glance at the market report of share of various segments Request Free Sample

The Cloud-based segment was valued at USD 443.70 billion in 2019 and showed a gradual increase during the forecast period.

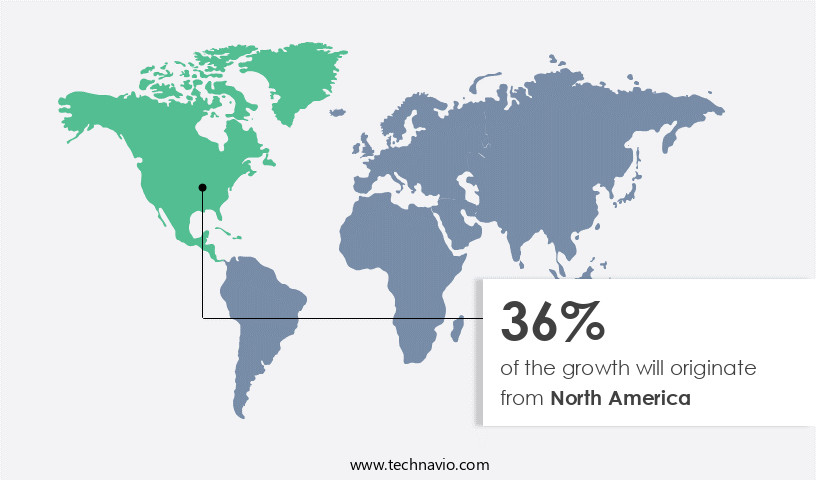

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing notable growth due to expanding presence of European DLP providers in the region. With a focus on increasing customer base, these companies are targeting the US and Canadian markets. However, the penetration of DLP solutions among Small and Medium-Sized Businesses (SMBs) remains low. DLP Implementation is critical for Data Breach Prevention and Data Leakage. Behavioral Analytics and Machine Learning are increasingly being used for advanced threat detection. DLP Reporting, Email Security, and DLP Auditing are essential for maintaining Data Privacy Policy and ensuring Data Compliance.

The market encompasses various sectors, including Financial Services, Public Sector, and Healthcare. Cloud Computing, Hybrid Cloud, and the Internet of Things are emerging areas of focus. DLP Services, DLP Consulting, and DLP Management are integral to the market ecosystem. Data Risk Assessment, Threat Intelligence, Vulnerability Management, and Incident Response are crucial for maintaining Data Security. The DLP market in North America is growing due to increased focus on regulatory compliance, mobile security, and data sensitivity. The market caters to various sectors and technologies, with a growing emphasis on advanced threat detection and data privacy policy.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Data Loss Prevention (DLP) Industry?

- Growing use of cloud for data storage is the key driver of the market. Enterprises are transitioning to cloud data storage due to its productivity benefits and the cost-effective operational expenditure (OPEX) model. The increasing adoption of Internet of Things (IoT) technology is driving the growth of cloud data storage, as more devices generate and require storage for vast amounts of data. By moving to the cloud, enterprises shift from a capital expenditure (CAPEX) model, which involves investing in physical assets that depreciate, to an OPEX model, where they pay for usage.

- This transfer of infrastructure management responsibilities to third-party providers significantly reduces the organizations' IT budgets. The cloud's flexibility and scalability enable businesses to store and access data efficiently, making it an essential component of modern enterprise operations.

What are the market trends shaping the Data Loss Prevention (DLP) Industry?

- The use of IT analytics for preventing data loss is the upcoming market trend. Data Loss Prevention (DLP) solutions have evolved to incorporate IT analytics, enhancing an enterprise's ability to protect sensitive information from both insiders and external threats. IT analytics, integrated with DLP, enables the creation of reports to identify and assess risks over time. This business intelligence and ad-hoc reporting tool empowers employees to access the DLP console and run reports, ensuring a unified approach to data protection. Advanced analytics are crucial in determining potential threats and delivering customized solutions that align with business processes and risk tolerance.

- Some companies are integrating IT analytics into their DLP offerings to provide more effective solutions for enterprises. By combining IT analytics and DLP, organizations can better safeguard their data from unauthorized access, use, or disclosure.

What challenges does the Data Loss Prevention (DLP) Industry face during its growth?

- Issues with the deployment of the DLP solution are a key challenge affecting the industry's growth. To safeguard an enterprise's sensitive data from potential loss, the deployment of Data Loss Prevention (DLP) solutions is essential, complementing other security mechanisms. However, inefficient deployment can diminish the system's effectiveness. Enterprises encounter challenges in implementing effective DLP solutions. One such challenge is the restriction of DLP solutions by access rights. In large organizations, management makes critical decisions regarding data confidentiality levels, user access, and DLP threshold settings.

- Despite strong security policies, the DLP solution may not address the issue if not granted the necessary access or permissions. Therefore, it's crucial for enterprises to address these challenges to ensure their DLP solutions function optimally and protect their data effectively.

Exclusive Customer Landscape

The data loss prevention (DLP) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data loss prevention (DLP) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, data loss prevention (DLP) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Broadcom Inc. - The company offers data loss prevention solutions such as Symantec Endpoint Data Loss Prevention.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Digital Guardian Inc.

- Forcepoint LLC

- Fortra LLC

- GTB Technologies Inc.

- International Business Machines Corp.

- McAfee LLC

- Microsoft Corp.

- Palo Alto Networks Inc.

- Proofpoint

- Singapore Telecommunications Ltd.

- Somansa Technologies Inc.

- Sophos Ltd.

- Spirion LLC

- Trend Micro Inc.

- Zecurion Inc.

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Data loss prevention (DLP) is an essential aspect of modern data security, as organizations increasingly rely on digital data to operate and grow. DLP solutions help safeguard sensitive information from unauthorized access, use, disclosure, or loss. This market encompasses a range of technologies and services designed to mitigate data risk and ensure regulatory compliance. The DLP landscape is shaped by several key drivers. Regulatory compliance requirements, such as the European Union's General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), mandate organizations to implement strong data security measures. Additionally, the increasing adoption of cloud computing, hybrid cloud environments, and the Internet of Things (IoT) expand the attack surface and create new challenges for data security teams.

DLP solutions provide various functionalities to address these challenges. DLP monitoring enables continuous surveillance of data traffic, both on-premises and in the cloud. Data masking and tokenization protect sensitive data by obscuring or replacing it with non-sensitive information. Data encryption ensures data confidentiality, while data redaction and data destruction help manage data retention and disposal. Behavioral analytics and machine learning algorithms play a crucial role in DLP platforms by identifying anomalous behavior and potential threats. DLP reporting and incident response capabilities help organizations respond effectively to data breaches and leaks. DLP consulting and services offer expert guidance on DLP implementation, policy development, and ongoing management.

The DLP market caters to various industries, with significant demand in financial services due to the high value and sensitivity of financial data. Other sectors, such as public sector organizations and healthcare providers, also face unique data security challenges and regulatory requirements. The market for DLP tools and platforms is competitive and diverse, with offerings from both established security companies and emerging players. DLP appliances and software solutions cater to organizations of all sizes and complexities. Cloud security and web security solutions extend DLP capabilities to protect data in cloud environments and on the web. Vulnerability management and threat intelligence are integral components of DLP platforms, helping organizations stay informed about emerging threats and vulnerabilities and prioritize their response efforts.

Endpoint security and network security solutions complement DLP solutions by securing the access points to data and the networks on which data travels. The Data Loss Prevention market is a dynamic and evolving landscape, driven by regulatory requirements, technological advancements, and the ever-expanding digital data environment. DLP solutions offer organizations a comprehensive approach to data security, helping them protect sensitive information, maintain regulatory compliance, and minimize data risk.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33.1% |

|

Market growth 2025-2029 |

USD 8.37 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

26.2 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, France, Brazil, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Data Loss Prevention (DLP) Market Research and Growth Report?

- CAGR of the Data Loss Prevention (DLP) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the data loss prevention (DLP) market growth and forecasting

We can help! Our analysts can customize this data loss prevention (DLP) market research report to meet your requirements.