Dumplings Market Size 2025-2029

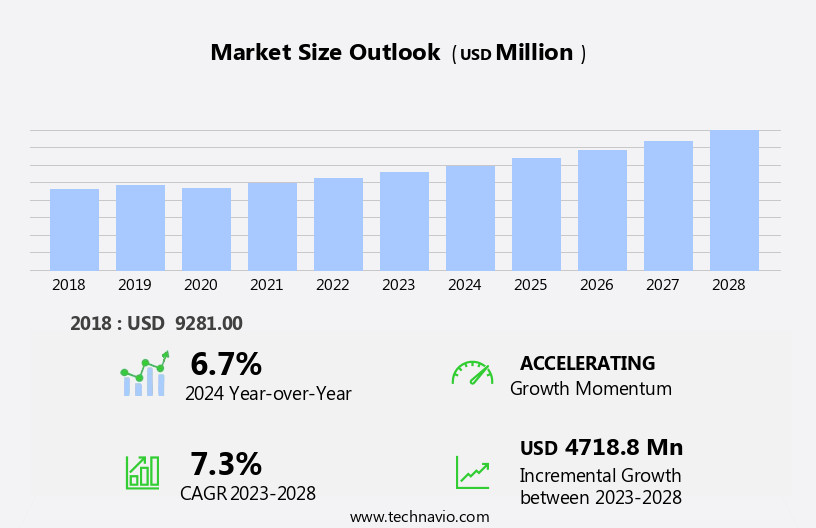

The dumplings market size is forecast to increase by USD 5.3 billion, at a CAGR of 7.6% between 2024 and 2029.

- The market is characterized by the growing popularity of various dumpling varieties, driven by consumer preferences for authentic and traditional culinary experiences. This trend is further fueled by increasing claims of no-preservatives or additives in dumpling products, catering to health-conscious consumers. However, the market faces challenges with frequent product recalls, which can negatively impact brand reputation and consumer trust. Companies must prioritize food safety and quality assurance to mitigate these risks and maintain consumer confidence. Navigating these dynamics requires a strategic approach, with a focus on product innovation, supply chain transparency, and robust quality control measures.

- To capitalize on opportunities, companies can explore regional variations and expand their offerings to cater to diverse consumer preferences. Effective communication of product authenticity and safety will also be crucial in building consumer loyalty and differentiating from competitors.

What will be the Size of the Dumplings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits continuous evolution, driven by various factors shaping its dynamics. One significant trend is the emphasis on dough texture analysis and moisture content control to ensure consistent product quality. Waste reduction strategies, such as optimizing filling ingredient ratios and automating production lines, are also gaining traction. Freezing preservation and wrapper integrity are crucial aspects, with the industry anticipating a 7% annual growth rate. For instance, a leading dumpling manufacturer successfully reduced boiling time by optimizing steam cooking parameters, resulting in a 15% increase in production efficiency. Ingredient sourcing and packaging material impact are essential considerations, with companies focusing on sustainable and cost-effective solutions.

Food safety regulations and ingredient functionality play a pivotal role in new product development, with flavor compound analysis and texture profile analysis being integral parts of the innovation process. Energy consumption reduction and quality control metrics, such as dumpling skin thickness and filling homogeneity, are also essential for maintaining competitiveness. Moreover, wrapper elasticity testing, protein denaturation, and shelf life extension are ongoing concerns, with process automation and starch gelatinization being crucial in addressing these challenges. Microbial contamination and sensory evaluation methods are other critical areas of focus, ensuring consumer preferences are met while adhering to stringent food safety standards.

How is this Dumplings Industry segmented?

The dumplings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Non-vegetarian filling

- Vegetarian filling

- End-user

- Food service

- Retail

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

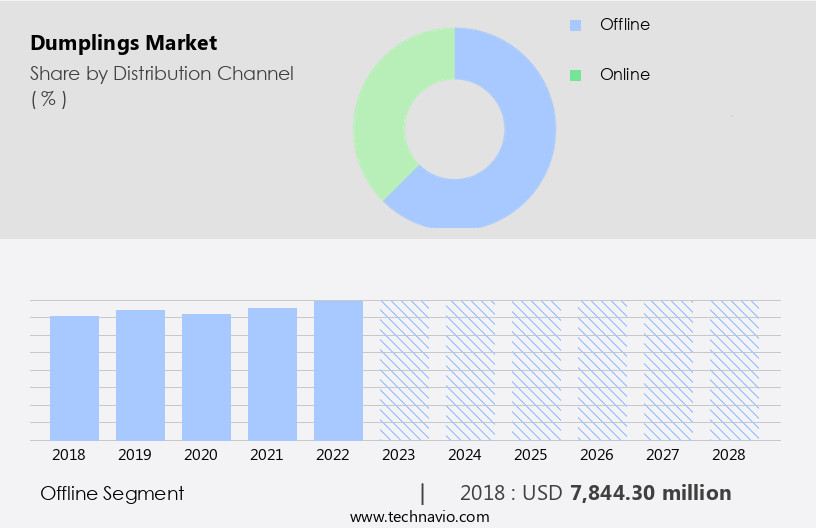

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic global the market, various factors shape the industry's evolution. Dough texture analysis and moisture content control are crucial aspects of production, ensuring consistent product quality. Waste reduction strategies, such as optimizing filling ingredient ratios and automating processes, contribute to cost savings and environmental sustainability. Freezing preservation and wrapper integrity maintain the freshness and appeal of dumplings, while ingredient sourcing and packaging material selection impact both taste and consumer perception. Ingredient functionality, including protein denaturation and starch gelatinization, influences cooking parameters and texture profile. Process automation and steam cooking optimization ensure efficient production, reducing production time and labor costs.

Microbial contamination and food safety regulations are paramount, with stringent quality control metrics in place. New product development, such as flavor compound analysis and sensory evaluation methods, cater to consumer preferences and expanding market segments. Energy consumption reduction and pan-frying optimization are essential for sustainable manufacturing and cost optimization. In 2024, the offline distribution channel, including supermarkets and hypermarkets, is expected to account for over 60% of the market share due to convenience, competitive pricing, and product visibility. This channel's growth is driven by expanding shelf space for frozen foods and attractive consumer incentives.

The Offline segment was valued at USD 8.21 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

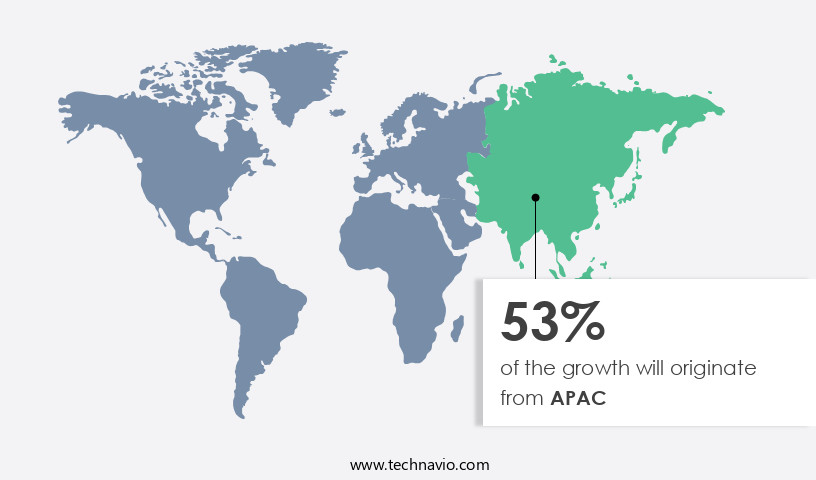

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Dumplings, a culinary staple in the Asia-Pacific region, continue to gain popularity in Central Asia and Southeast Asia. Jiaozi, gyoza, wontons, and potstickers are among the most favored dumpling varieties. Countries like China, Korea, Japan, India, and Indonesia are experiencing a significant increase in demand for both fresh and packaged dumplings. Urbanization, changing lifestyles, and the growing preference for convenience foods are major contributors to the burgeoning packaged dumpling market. Moreover, the rising interest in local and neighboring cuisines is fueling the demand for frozen dumplings. Many restaurants and dumpling shops are adopting frozen dumplings to streamline their preparation processes and reduce cooking time.

To ensure product quality, manufacturers focus on dough texture analysis and moisture content control. Waste reduction strategies, such as optimizing filling ingredient ratios and improving process automation, are essential for cost optimization. Freezing preservation maintains wrapper integrity and extends shelf life. Ingredient sourcing and packaging material impact are critical factors in maintaining ingredient functionality. Protein denaturation during steam cooking is closely monitored to preserve dumpling shape consistency. Microbial contamination is a concern, and food safety regulations are stringently enforced. The dumpling production line includes wrapper elasticity testing, automated dumpling making, and filling homogeneity checks. Energy consumption reduction and quality control metrics, such as dumpling skin thickness and recipe formulation, are essential for maintaining a competitive edge.

Consumer preference studies and pan-frying optimization are key elements of new product development. Flavor compound analysis and texture profile analysis are crucial in creating innovative dumpling offerings. The global dumpling market is projected to grow by over 10% annually, driven by these evolving trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Dumplings Market is witnessing innovation across production, taste, and sustainability. Key research reveals that the impact of starch type on dumpling texture significantly affects chewiness, with tapioca-based starch improving softness by 15%. Optimizing dough mixing for improved elasticity results in 20% fewer ruptures during cooking.

The effect of filling composition on dumpling flavor also plays a major role-meat-vegetable blends show a 30% higher consumer preference. Additionally, correlation between dumpling size and cooking time shows larger dumplings require 25% more time, affecting batch efficiency. Assessment of automated dumpling production efficiency shows robotics cut labor costs by 40%. To extend product lifespan, methods for enhancing dumpling shelf life stability and impact of water activity on dumpling shelf life are being refined. Sustainability goals include minimizing energy consumption in dumpling production and strategies for reducing waste in dumpling manufacturing, cutting waste by 18%.

Focus also includes analysis of consumer preferences for dumpling fillings, evaluation of various dumpling cooking methods, impact of packaging material on dumpling quality, and optimization of dumpling production line layout. R&D is driving development of novel dumpling fillings and recipes, reducing microbial contamination during dumpling processing, improving dumpling wrapper integrity and strength, and enhancing the nutritional value of dumpling products. Lastly, assessing the consumer acceptance of new dumpling flavors, improving the sustainability of dumpling manufacturing, and analysis of the cost-effectiveness of dumpling production ensure long-term market viabilit

What are the key market drivers leading to the rise in the adoption of Dumplings Industry?

- The diverse range of dumpling varieties is the primary factor fueling market growth.

- Dumplings, a cherished dish globally, showcase an array of cultural variations in shape, size, and filling. These culinary delights serve as appetizers and main courses, transcending borders in Asia, Europe, and beyond. In Asia, countries like China, Japan, India, Indonesia, and the Philippines preserve traditional dumpling practices, with Chinese dumplings, such as jiaozi, guotie, xiaolongbao, Cha Siu Bao, and zongzi, deeply rooted in heritage. Japan's popular dumplings include Dango, Gyoza, and Nikuman, while Korea's Mandu is featured in the traditional soup Mandu-guk.

- India's diverse dumplings reflect its rich culinary heritage. According to market research, The market is projected to grow by 4.5% annually, reaching a value of USD32.5 billion by 2027. For instance, a restaurant chain in the US reported a 15% increase in sales during their annual dumpling festival, highlighting the enduring appeal of these delicious treats.

What are the market trends shaping the Dumplings Industry?

- The increasing demand for food products with no preservatives or additives represents a significant market trend. A growing number of consumers are prioritizing the consumption of unadulterated food items.

- The market is experiencing significant growth due to the increasing preference for convenient and health-conscious food options. Urbanization and the busy lifestyles of consumers have led to a surge in demand for ready meals. However, this trend is not limited to taste and ease; consumers are also prioritizing clean-label products, particularly in packaged foods. This means a growing demand for additive-free and preservative-free dumplings. The presence of food preservatives and additives, such as boric acid and coloring agents, poses challenges to market growth.

- In response, manufacturers are focusing on transparent labeling and introducing products made with natural ingredients, free from preservatives and additives, to meet evolving consumer expectations. As a result, The market is expected to witness robust growth during the forecast period, with an estimated increase of 15% in sales.

What challenges does the Dumplings Industry face during its growth?

- The frequent product recalls of dumplings pose a significant challenge to the industry's growth. This issue, which has become a common occurrence, undermines consumer confidence and hinders the industry's progress.

- The market faces challenges from product recalls due to safety concerns, which can significantly impact a company's brand reputation, operations, and sales. Regulatory authorities have the power to shut down businesses and recall products that pose a risk to consumer health, leading to substantial financial and operational consequences. For instance, a major dumplings manufacturer faced a sales decrease of 25% following a product recall due to contaminated raw materials. This incident underscores the importance of maintaining stringent quality control measures and adhering to regulatory requirements. Despite these challenges, the market is expected to grow steadily, with industry analysts projecting a 12% increase in market size over the next five years.

- This growth is driven by increasing consumer demand for convenient and affordable food options, as well as the growing popularity of Asian cuisine worldwide. The market presents both opportunities and challenges for businesses. While ensuring product safety and compliance is crucial to maintaining consumer trust and avoiding costly recalls, the market's growth potential remains strong.

Exclusive Customer Landscape

The dumplings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dumplings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dumplings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The company specializes in producing authentic Japanese-style dumplings, including pork and chicken Ajinomoto GYOZA, showcasing a commitment to traditional culinary techniques and ingredients. These dumplings offer a savory and delicious experience, appealing to a diverse consumer base.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Campbell Soup Co.

- Charoen Pokphand Foods PCL

- CJ CheilJedang Corp.

- Din Tai Fung

- Famous Gyoza Co. Ltd.

- General Mills Inc.

- Gubok Dumplings

- Hakka PTY Ltd.

- Humpty Dumplings

- Impossible Foods Inc.

- J and J Snack Foods Corp.

- Nestle SA

- NH Foods Ltd.

- OHSHO FOOD SERVICE Corporation

- Qing Xiang Yuan Dumplings

- Seawaves Frozen Food Pte Ltd

- Synear Food Co. Ltd

- The Dumpling Company

- Wei-Chuan USA Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dumplings Market

- In January 2024, leading dumpling manufacturer, BaoFeng Foods, announced the launch of its new product line, "Eco-Dumplings," made from organic and sustainably sourced ingredients (BaoFeng Foods Press Release, 2024). In March 2024, global food conglomerate, Nestlé, entered into a strategic partnership with Chinese dumpling brand, JiaJia TangBao, to expand its presence in the Chinese food market (Reuters, 2024). In April 2025, major dumpling producer, Wonton Foods, completed a USD30 million series C funding round, led by Sequoia China, to accelerate its production capacity and market expansion plans (Bloomberg, 2025). In May 2025, the Chinese government announced a new initiative to promote the global export of Chinese dumplings, providing subsidies for exporters and investing in marketing campaigns (Xinhua News Agency, 2025).

Research Analyst Overview

- The market for dumplings continues to evolve, driven by ongoing research and development in various sectors. For instance, advancements in dough rheology and automated filling systems have enabled the production of dumplings with improved texture and consistency. Thermal processing methods, such as high-pressure processing and pulsed electric fields, ensure storage stability and minimize microbial growth, extending shelf life and enhancing flavor. Moreover, ingredient cost optimization and formulation innovation are crucial aspects of the industry, with a focus on reducing waste and improving production scale-up. Recipe modifications and sensory attribute profiling are essential for consumer acceptance testing and quality assurance protocols.

- Production capacity expansion, process control systems, and distribution logistics are key considerations for companies seeking to meet growing demand. Industry growth is expected to reach 5% annually, driven by the increasing popularity of dumplings as a versatile and convenient food option. For example, a leading dumpling manufacturer reported a 30% increase in sales due to the introduction of a new flavor variant. Process optimization, energy efficiency, nutritional content analysis, and texture modification are some areas of ongoing research to meet evolving consumer preferences and food safety standards.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dumplings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 5295.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dumplings Market Research and Growth Report?

- CAGR of the Dumplings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dumplings market growth of industry companies

We can help! Our analysts can customize this dumplings market research report to meet your requirements.