Electromagnetic Compatibility Test Equipment Market Size 2025-2029

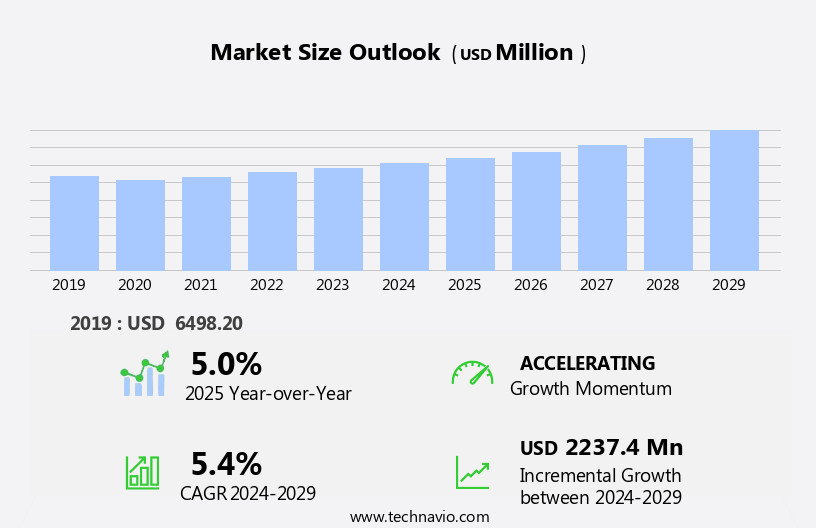

The electromagnetic compatibility (EMC) test equipment market size is forecast to increase by USD 2.24 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth due to the augmented production of smartphones and the emergence of automotive wireless technologies. The global electromagnetic compatibility (EMC) test equipment market is experiencing steady growth, driven by increasing demand for consumer electronics and advancements in technology. Key factors include the rising production of smartphones, which fuels the need for reliable EMC testing to ensure device performance, and the growing adoption of electric vehicles, requiring rigorous testing to meet electromagnetic standards. Furthermore, the necessity for price-sensitive and multiple technology solutions poses a challenge for market participants. Manufacturers must balance affordability with functionality to cater to various customer segments and applications.

- This dynamic market landscape requires strategic planning and innovation to capitalize on opportunities and navigate challenges effectively. Companies focusing on developing cost-effective, versatile EMC testing solutions that cater to the evolving needs of the smartphone and automotive industries are likely to thrive in this competitive landscape.

What will be the Size of the Electromagnetic Compatibility (EMC) Test Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The electromagnetic compatibility (EMC) market encompasses a diverse range of products and services, all aimed at ensuring the harmonious coexistence of electronic devices in various sectors. EMC standards, such as those set by the FCC and CISPR, continue to evolve, driving the demand for EMC testing equipment and services. EMC testing equipment, including spectrum analyzers, network analyzers, and power meters, plays a crucial role in measuring and analyzing electromagnetic emissions and immunity. EMC training and consulting services are essential for staying abreast of the latest EMC regulations and best practices. Surge protection and grounding techniques are integral components of EMC solutions, ensuring the resilience of electronic systems against transient voltage surges and electromagnetic interference (EMI).

EMC design and engineering services help prevent EMI and RFI emissions, while EMC testing services provide critical pre-compliance testing and certification. Anechoic chambers and shielding effectiveness testing are essential for assessing the electromagnetic performance of devices, particularly in the automotive, industrial, medical, and telecommunications sectors. EMC software and modeling tools facilitate efficient EMC design and optimization, while ESD protection ensures the reliability of sensitive electronic components. The ongoing development of EMC standards and the increasing complexity of electronic systems continue to fuel the dynamism of this market. EMC testing, design, and consulting services remain in high demand, as organizations seek to ensure regulatory compliance and maintain the performance and reliability of their electronic systems.

How is this Electromagnetic Compatibility (EMC) Test Equipment Industry segmented?

The electromagnetic compatibility (EMC) test equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer electronics

- Telecommunications

- Aerospace and defense

- Automotive

- Others

- Product

- EMI test receiver

- Signal generator

- Broadband amplifiers

- Spectrum analyzer

- Others

- Application

- Third-party laboratories

- In-house laboratories

- Governments

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The consumer electronics segment is estimated to witness significant growth during the forecast period.

The Electromagnetic Compatibility (EMC) market experiences significant growth due to the increasing production of consumer electronic devices, driven by rising disposable income and decreasing costs. Mobile devices, particularly smartphones and tablets, dominate this trend, as they offer mobility and multi-functionality through the use of mixed-signal ICs. The shorter replacement cycles of these devices, fueled by technological advances and consumer preferences, stimulate increased production. Additionally, the shift from desktop PCs to laptops contributes to market expansion. In this context, EMC testing equipment plays a crucial role in ensuring the proper functioning of these devices in various environments. EMC testing encompasses various techniques, including immunity testing, conducted and radiated emissions testing, and susceptibility testing, to evaluate a device's ability to operate in electromagnetically challenging conditions.

Spectrum analyzers, ESD protectors, near-field and far-field probes, power meters, EMC filters, and grounding techniques are essential EMC testing tools. EMC simulation, shielding effectiveness, transient voltage suppression, and surge protection are integral to EMC design and engineering. EMC regulatory compliance is a critical factor in the market, with FCC regulations and CE marking setting the standards for EMC testing and certification. Automotive EMC, medical EMC, and industrial EMC also contribute to the market's growth. EMC consulting, training, and testing services further support the industry. EMC solutions include RFI shielding, EMI shielding, and EMI/RFI suppression, which help minimize electromagnetic interference and ensure optimal device performance.

EMC software, audits, PCB layout, and modeling are essential components of EMC design and engineering. In conclusion, the Electromagnetic Compatibility market is driven by the increasing production of consumer electronic devices and the need for EMC testing and certification to meet regulatory requirements and ensure optimal device performance. EMC testing equipment, techniques, and solutions continue to evolve to address the challenges posed by the growing complexity of electronic devices.

The Consumer electronics segment was valued at USD 2.3 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the increasing demand from various industries for ensuring EMC compliance in their products. EMC testing is crucial to ensure the proper functioning of electronic devices in the presence of electromagnetic interference (EMI) and electromagnetic compatibility (EMC) issues. Spectrum analyzers, ESD protectors, near-field probes, conducted emissions, EMC filters, far-field probes, power meters, grounding techniques, EMC simulation, shielding effectiveness, transient voltage suppression, and EMC regulatory compliance are essential components of EMC testing. These tools help measure and analyze the electromagnetic emissions and susceptibility of devices, enabling manufacturers to identify and resolve EMC issues.

APAC is the leading region in the global EMC test equipment market, with countries like China, Japan, South Korea, and India contributing significantly to the revenue growth. The presence of these countries as major electronics producers and the increasing demand from end-user industries have been driving the market's expansion. China, being the world's largest consumer, producer, and exporter of consumer electronics, is a significant contributor to the demand for EMC test equipment in the region. EMC testing is essential in various industries, including automotive, medical, industrial, and consumer electronics. FCC regulations and CISPR standards mandate EMC compliance for electronic devices sold in the US and Europe, respectively.

EMC testing services, software, consulting, and engineering are integral parts of the EMC testing market, providing solutions for EMC design, testing, and compliance. RFI shielding, EMI shielding, EMI/RFI suppression, surge protection, and voltage probes are critical EMC hardware components used to mitigate electromagnetic interference and ensure proper device functionality. EMC testing equipment, including network analyzers, signal generators, and test chambers, enable manufacturers to conduct pre-compliance testing, immunity testing, and susceptibility testing to ensure EMC compliance. In conclusion, the EMC test equipment market is experiencing substantial growth due to the increasing demand for EMC compliance in various industries and regions.

APAC is the leading region, with China being a significant contributor, due to its dominance in global electronics production. EMC testing is essential for various industries, including automotive, medical, industrial, and consumer electronics, and is mandated by regulations such as FCC and CISPR. EMC testing services, software, consulting, and engineering provide solutions for EMC design, testing, and compliance. EMC testing equipment, including network analyzers, signal generators, and test chambers, enable manufacturers to conduct comprehensive EMC testing.

Market Dynamics

The EMC Test Equipment Market is experiencing significant growth, driven by stringent regulatory requirements across industries. Key products like EMI receivers, RF power amplifiers, and specialized EMC antennas are fundamental for comprehensive EMC testing. Demand is particularly high for automotive EMC testing, ensuring vehicle electronics operate without interference. Essential equipment also includes ESD simulators and surge generators for immunity evaluations. The market is evolving with advanced EMC test software that enables automated EMC testing and facilitates efficient pre-compliance testing. Major players in the global EMC test equipment market are investing in innovations, including those for wireless device EMC testing and IoT device EMC testing. The increasing complexity of electronic systems, especially with the advent of 5G EMC testing, necessitates robust EMC test solutions provided by dedicated EMC test labs.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electromagnetic Compatibility (EMC) Test Equipment Industry?

- The significant increase in the manufacture of advanced smartphones serves as the primary catalyst for the market's growth.

- The market is experiencing significant growth due to the expanding electronics industry and increasing demand for EMC testing in various sectors. The Asia Pacific region, including China, Japan, and Singapore, is a major contributor to this market, driven by the strong growth in the semiconductor and electronics industry and the export of medium-sized and low-priced EMC test equipment from this region. In the consumer electronics segment, the surge in sales of smartphones, particularly in countries like China, Hong Kong, Vietnam, Singapore, and Taiwan, is fueling the demand for EMC testing to ensure compliance with regulations and maintain the quality of electronic devices.

- EMC solutions, including RFI shielding, EMI shielding, EMI/RFI suppression, and immunity testing, are essential for EMC design and engineering to ensure harmonious functionality of electronic devices and adherence to regulations such as FCC and CE marking. EMC hardware and measurement techniques play a crucial role in the development and production process of electronic devices, emphasizing the importance of this market.

What are the market trends shaping the Electromagnetic Compatibility (EMC) Test Equipment Industry?

- The emergence of automotive wireless technologies is a significant market trend. This developing trend encompasses the integration of advanced wireless systems, such as Wi-Fi, Bluetooth, and cellular connectivity, into automobiles for enhanced functionality and improved user experience.

- Electromagnetic compatibility (EMC) is a critical aspect of modern technology, particularly in the automotive industry where wired and wireless serial communications are increasingly being used. Two communication technologies, MOST150 and Broad R-Reach Ethernet, are gaining popularity in vehicles, contributing to the demand for EMC test equipment. New entertainment systems in cars are also driving this demand, as they connect more devices using Wi-Fi and Bluetooth. In Europe, embedded cellular technology plays a significant role in eCall, which automatically sends alerts to emergency centers in case of accidents. Advanced features such as GPS systems and hotspots that convert 3G or 4G signals into Wi-Fi further emphasize the importance of EMC.

- EMC testing equipment is essential to ensure these technologies function correctly and do not interfere with each other. This includes surge protection devices, network analyzers, EMC software, and anechoic chambers. EMC training and audits are also crucial to maintain EMC standards in design and manufacturing processes, particularly in the layout of printed circuit boards (PCBs) and EMC modeling. ESD protection is another critical aspect of EMC, ensuring the proper functioning of electronic devices.

What challenges does the Electromagnetic Compatibility (EMC) Test Equipment Industry face during its growth?

- The price-sensitivity and requirement for multiple technology solutions in the industry pose a significant challenge to its growth, necessitating the adoption of professional and cost-effective strategies to address these demands.

- Electromagnetic Compatibility (EMC) testing plays a crucial role in ensuring the proper functioning of electronic devices in various industries, including medical, industrial, and consumer electronics. EMC testing involves measuring and managing electromagnetic interference (EMI) and assessing a device's susceptibility to external EMI. Pre-compliance testing is essential to identify potential issues before bringing a product to market, preventing costly recalls and delays. Signal generators are integral to EMC testing, as they produce electromagnetic signals to test a device's immunity. EMC compliance with CISPR standards is essential for manufacturers to ensure their products meet international regulations. EMC consulting services help companies navigate the complex testing process, ensuring they meet the necessary requirements.

- Voltage probes and current probes are essential tools for measuring EMI levels. Radiated emissions testing assesses a device's ability to withstand external electromagnetic fields, while susceptibility testing evaluates a device's sensitivity to internal electromagnetic disturbances. Test reports provide valuable documentation of a device's EMC performance, essential for regulatory compliance and customer confidence. EMC management systems help organizations streamline their testing processes, ensuring consistent and efficient compliance. Despite the importance of EMC testing, rising raw material costs and import duties have increased the production cost of EMC test equipment, making it a significant investment for price-sensitive end-users.

- However, investing in high-quality EMC test equipment is essential to ensure product reliability and regulatory compliance.

Exclusive Customer Landscape

The electromagnetic compatibility (emc) test equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electromagnetic compatibility (emc) test equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electromagnetic compatibility (emc) test equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMETEK Inc. - This company specializes in providing EMC (Electromagnetic Compatibility) testing equipment, encompassing Programmable AC and DC power sources, RF (Radio Frequency) probes and clamps, and RF system components and accessories. These solutions enable engineers to ensure electronic devices meet required compatibility standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMETEK Inc.

- Anritsu Corp.

- AR Inc.

- Bureau Veritas SA

- Com Power Corp.

- DEKRA SE

- ESCO Technologies Inc.

- Eurofins Scientific SE

- Fortive Corp.

- Frankonia Germany EMC Solutions GmbH

- GAUSS INSTRUMENTS International GmbH

- Good Will Instrument Co. Ltd.

- Intertek Group Plc

- Keysight Technologies Inc.

- Laird Connectivity

- NITTO KOGYO CORP.

- Parker Hannifin Corp.

- Rohde and Schwarz GmbH and Co. KG

- SGS SA

- TUV SUD AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electromagnetic Compatibility (EMC) Test Equipment Market

- In January 2024, Anritsu Corporation, a leading provider of test and measurement solutions, announced the launch of its new EMC test receiver, the MS2090A Series. This advanced receiver is designed to meet the latest automotive EMC standards and offers enhanced features for improved testing efficiency (Anritsu Corporation Press Release).

- In March 2024, Rohde & Schwarz and National Instruments entered into a strategic partnership to integrate Rohde & Schwarz's EMC test solutions with National Instruments' automated test systems. This collaboration aims to streamline EMC testing processes and reduce development time for automotive and industrial customers (Rohde & Schwarz Press Release).

- In May 2024, Keysight Technologies announced the acquisition of Ixia, a leading provider of network test, visibility, and security solutions. The acquisition strengthened Keysight's position in the EMC test market by expanding its offerings to include advanced network testing solutions (Keysight Technologies Press Release).

- In February 2025, the European Union released the new EMC Directive 2025/XXX, which includes stricter emission limits and immunity requirements for electronic devices. This directive is expected to drive demand for advanced EMC test equipment to ensure compliance (European Commission Press Release).

Research Analyst Overview

- The market encompasses a range of solutions designed to ensure product safety and compliance with EMC regulations in various industries. Product designers and engineers employ EMC testing to mitigate electromagnetic interference (EMI) and electromagnetic fields (EMF) in IoT devices, wireless communication systems, and aerospace applications. Antenna measurements, impedance measurement, and common-mode measurement are crucial components of EMC product design, while validation testing and accreditation of EMC laboratories are essential for ensuring reliability engineering and EMC compliance management. High-frequency measurement, time-domain reflectometry (TDR), and frequency-domain reflectometry (FDR) are key techniques used in EMC system design and test planning. In defense and aerospace sectors, EMC testing plays a vital role in signal integrity, power integrity, and wireless power transfer.

- EMC in defense applications also involves return loss and insertion loss measurements for effective EMC mitigation strategies. Wireless communication testing is another significant application area, necessitating low-frequency measurement to ensure proper functionality and minimize EMI. Overall, EMC test equipment is an indispensable tool for companies seeking to design, manufacture, and verify EMC-compliant products.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electromagnetic Compatibility (EMC) Test Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 2237.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, Germany, Canada, UK, India, Japan, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electromagnetic Compatibility (EMC) Test Equipment Market Research and Growth Report?

- CAGR of the Electromagnetic Compatibility (EMC) Test Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electromagnetic compatibility (emc) test equipment market growth of industry companies

We can help! Our analysts can customize this electromagnetic compatibility (emc) test equipment market research report to meet your requirements.