Esports Market Size 2025-2029

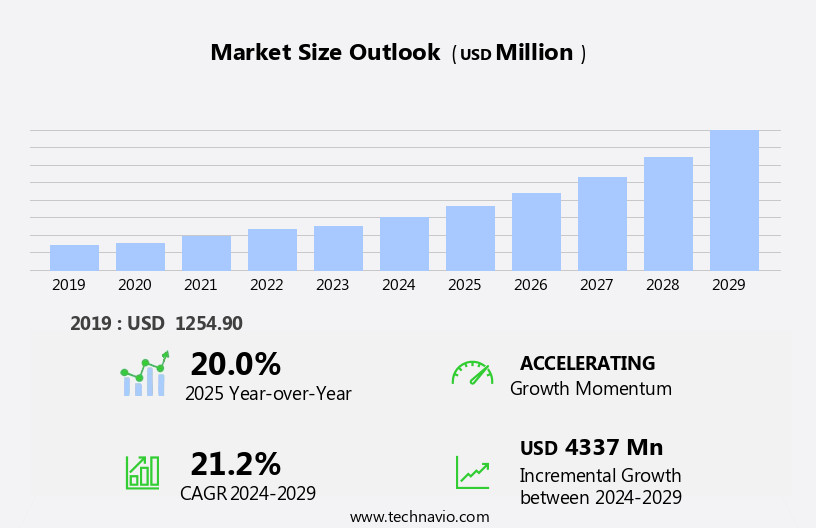

The esports market size is forecast to increase by USD 4.34 billion at a CAGR of 21.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing brand engagement and the surge in esports betting. Brands are recognizing the value of esports as a powerful marketing tool to reach the coveted millennial and Gen Z demographics. Sports events offer unique opportunities for brand activation and fan engagement, with sponsorships, product placements, and team collaborations becoming increasingly common. Additionally, the global esports betting market is projected to reach substantial growth, fueled by the rise in popularity of esports and the increasing legalization of online gambling. However, the market also faces challenges, including the escalating costs of game development and the need for standardized regulations to ensure ethical business practices.

- Game developers are under pressure to continuously release new titles and updates to maintain player engagement and stay competitive, driving up development costs. Regulations surrounding esports betting vary widely across jurisdictions, creating complexities for businesses operating in multiple markets. Companies seeking to capitalize on the market's opportunities must navigate these challenges effectively, focusing on innovation, cost management, and regulatory compliance.

What will be the Size of the Esports Market during the forecast period?

- The market continues to evolve, with dynamic interactions between various sectors shaping its growth and development. Esports demographics expand as new audiences discover the excitement of competitive gaming, leading to increased esports participation and engagement. Esports media outlets adapt to cater to this growing audience, providing comprehensive coverage of esports events, trends, and player profiles. Esports development is driven by innovative strategies and infrastructure, enabling the creation of immersive gaming experiences and advanced training facilities. Esports management teams leverage technology to optimize operations and enhance fan experiences, while esports ecosystems foster collaboration and growth across the industry.

- Esports trends emerge and evolve, with a focus on sustainability, accessibility, and ethical practices. Esports franchises and teams form strategic partnerships, while esports content and platforms monetize their offerings through various revenue streams, including advertising, sponsorships, merchandise sales, and analytics. Esports governance and regulations aim to ensure fair play and ethical conduct, while esports betting and disruption introduce new challenges and opportunities for innovation. Esports education and talent development programs foster the next generation of gaming professionals, ensuring the continued growth and vitality of the esports industry.

How is this Esports Industry segmented?

The esports industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Revenue Stream

- Sponsorships

- Media rights

- Publisher fees

- Advertising

- Merchandise and ticket sales

- Genre

- MOBA

- FPS

- RTS

- Others

- Device

- Smart phone and smart TV

- Gaming console

- Desktop / laptop / tablets

- Audience Type

- Players

- Spectators

- Casual Gamers

- Event Type

- Tournaments

- Exhibitions

- Online-Only

- LAN

- Platform

- PC-Specific

- Console-Specific

- Mobile-Specific

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Revenue Stream Insights

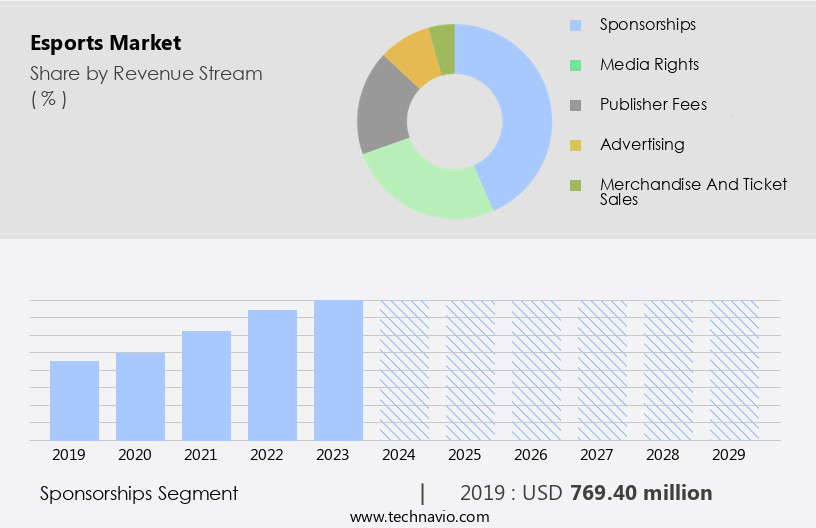

The sponsorships segment is estimated to witness significant growth during the forecast period.

Esports, a dynamic and evolving industry, encompasses various entities that fuel its growth and engagement. Training programs hone the skills of esports athletes, ensuring they remain at the top of their game. Regulations and ethics establish a fair and competitive environment, while broadcasting platforms deliver immersive experiences to a global audience. Esports strategies and marketing tactics attract sponsors, who invest in teams, franchises, and events to reach the highly engaged demographic. Esports infrastructure, including arenas and studios, provides the necessary resources for players and teams to thrive. Sustainability initiatives and betting regulations ensure the industry's long-term viability.

Esports communities foster a sense of belonging and passion among fans, driving participation and merchandise sales. Esports content and platforms offer endless opportunities for innovation, streaming, and monetization. Analytics and talent coaching help teams optimize performance and strategy. Esports disruption and advertising create new revenue streams, while governance and tournaments maintain a level playing field. The esports ecosystem continues to evolve, driven by the passion and dedication of players, teams, and fans alike.

The Sponsorships segment was valued at USD 769.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

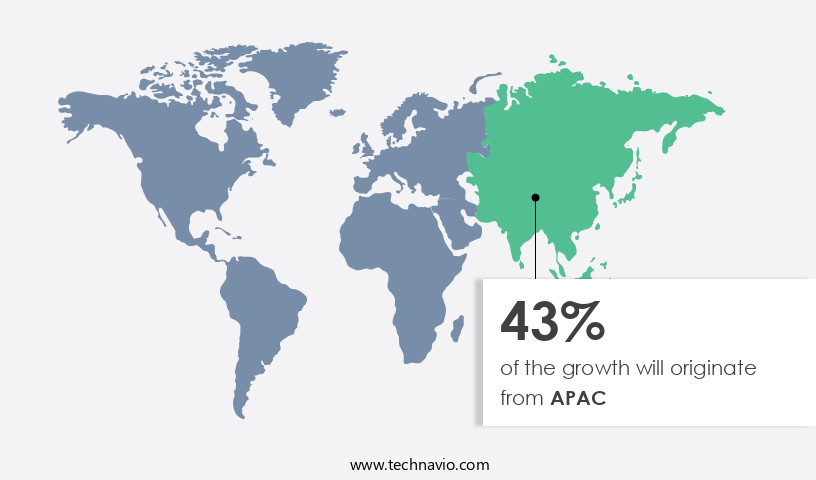

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing remarkable growth, outpacing other regions. This expansion can be attributed to several factors, including the entry of global brands into the market, the increasing adoption of online mobile gaming, and the burgeoning popularity of esports among millennials. The gaming industry's development is another significant contributor. Key markets in APAC include China, Japan, South Korea, and India. China, in particular, is a major player due to its large population with growing disposable income, enabling the purchase of advanced gaming consoles and increased spending on gaming equipment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Esports Market 2025-2029 grows with B2B esports solutions and digital esports platforms for organizers. Esports market trends 2025-2029 highlight esports tournaments with live streaming and esports sponsorship for brands. Cost-effective esports solutions for SMEs and esports platforms for small organizers drive demand, per global esports market size and forecast. Scalable esports providers and digital esports market insights support esports deployment for events. Esports for competitive gaming and esports adoption in education enhance engagement. Technology-driven esports benefits, esports for corporate events, and esports market analysis address esports market challenges and solutions. Global esports market competitive landscape and future of esports 2029 insights fuel esports market growth opportunities 2025.

What are the key market drivers leading to the rise in the adoption of Esports Industry?

- Esports serves as a primary catalyst for market growth by enhancing brand recognition. Esports events serve as valuable platforms for brands to showcase their products and services to a vast, engaged audience. Major corporations, including gaming console manufacturers, video game developers, and other businesses, have recognized the potential of esports for brand promotion. By sponsoring esports tournaments, these companies can reach millions of viewers and connect with dedicated esports players. The market benefits from these sponsorships, generating new revenue streams for esports events. Notable sponsors of esports events include HTC Corp., Twitch, Intel, Adidas AG, Vodafone Plc, and The Coca-Cola Co., among others. In July 2024, the Esports World Cup took place in Saudi Arabia, marking its inaugural event, featuring tournaments for various PC, console, and mobile titles, with over USD60 million in prizes.

- This significant investment in esports demonstrates the growing importance of the industry and the potential it holds for both esports and sponsoring brands. Esports governance ensures fair play and maintains the integrity of the competitions, further enhancing the appeal for sponsors and viewers alike.

What are the market trends shaping the Esports Industry?

- Esports betting is currently experiencing significant growth and is becoming a prominent trend in the market. This increasing interest in wagering on electronic sports competitions is a noteworthy development in the industry.

- The market is experiencing significant growth and transformation, bridging the gap between traditional sports and digital gaming events. Esports training and ethics have become crucial components of the industry, ensuring fair play and skill development. Regulations are being established to govern esports, creating a more structured and professional environment. Esports broadcasting has evolved, offering high-quality streams and immersive viewing experiences for audiences worldwide. Esports teams and communities have gained substantial followings, leading to increased marketing opportunities for brands. Strategies for the marketing have become essential for businesses looking to engage with the dedicated and passionate fan base. Esports infrastructure continues to improve, with advanced technology and infrastructure supporting the industry's growth.

- The future of esports holds immense potential, with continued innovation and expansion expected. The esports industry's global reach and accessibility through digital platforms have made betting on esports a popular trend. Esports betting platforms offer fans the opportunity to place wagers on their predictions from anywhere in the world, enhancing the overall fan experience.

What challenges does the Esports Industry face during its growth?

- The escalating costs of game development pose a significant challenge to the industry's growth trajectory. Game development costs continue to rise, putting pressure on companies to increase revenue and innovate in order to remain competitive. This trend, if unchecked, could hinder the industry's ability to expand and reach new audiences.

- The market demonstrates significant growth and innovation, driven by evolving consumer preferences and advancements in technology. Esports demographics span a wide range, with a growing number of fans from diverse backgrounds engaging with Esports content. Esports media platforms have emerged as key players in the ecosystem, providing access to Esports gaming, franchises, and content. Esports development costs have risen due to the demand for enhanced in-game experiences, with major titles reportedly costing over USD700 million in development and marketing. Game developers employ advanced software and tools, such as SpeedTree for realistic graphics, to create immersive gaming environments.

- The Esports industry's sustainability relies on continuous innovation and collaboration between developers, teams, and platforms. As Esports trends evolve, so too do the challenges and opportunities. Esports management requires a deep understanding of the industry's intricacies, from player contracts and sponsorships to marketing and fan engagement. The Esports ecosystem is a complex network of stakeholders, from game developers and publishers to teams, leagues, and media companies. Together, they contribute to the creation, distribution, and monetization of Esports content. Technology plays a crucial role in the Esports industry, from high-performance gaming computers and internet connections to virtual and augmented reality experiences.

- As technology continues to advance, Esports will continue to push the boundaries of what is possible in gaming and entertainment.

Exclusive Customer Landscape

The esports market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the esports market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, esports market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard Inc. - The company specializes in hosting and showcasing premier esports competitions online, featuring titles like Overwatch League and Call of Duty League.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard Inc.

- Amazon.com Inc.

- ANT Esports

- Electronic Arts Inc.

- Gfinity Plc

- Hi Rez Studios Inc.

- Kabam Games Inc.

- Modern Times Group MTG AB

- Nintendo Co. Ltd.

- Riot Games Inc.

- Rovio Entertainment Corp.

- Starladder Ltd.

- Take Two Interactive Software Inc.

- TaKeTV GmbH

- Tencent Holdings Ltd.

- Valve Corp.

- Wargaming Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Esports Market

- In February 2023, Riot Games, a leading developer and publisher in the esports industry, announced the launch of Valorant Champions Tour, a global circuit featuring over 30 events across six regions, with a total prize pool of USD10 million (Riot Games press release). This initiative signifies a significant expansion in the competitive scene for Valorant, attracting more players and viewers to the game.

- In May 2024, Amazon Prime Video and Twitch, Amazon's live streaming platform, entered into a strategic partnership to offer exclusive live streaming rights for select esports events. This collaboration marked a significant shift in the media landscape, providing fans with more accessible and convenient ways to watch their favorite esports content (Amazon press release).

- In October 2024, Tencent Holdings, the world's largest gaming company, completed its acquisition of Summit Esports, a leading esports organization. This acquisition represented a major consolidation in the industry, with Tencent strengthening its presence in the competitive scene and expanding its influence in the esports ecosystem (Reuters).

- In January 2025, the European Union announced the Esports Integrity Coalition (ESIC) Code of Conduct, a set of regulations aimed at maintaining fair play and integrity in esports events. This initiative marked a significant milestone in the maturation of the esports industry, with regulatory bodies stepping in to address concerns around cheating and match-fixing (ESIC press release).

Research Analyst Overview

In the dynamic world of esports, various sectors are experiencing significant growth and innovation. Professional gaming and team management require effective community engagement, utilizing esports data analytics to optimize performance. Virtual sports events, produced with advanced technology, offer sponsorship opportunities for brands seeking to reach a dedicated fanbase. The market analysis reveals revenue streams from brand partnerships, merchandise sales, streaming services, and advertising campaigns. Esports infrastructure development includes legal frameworks and ethical considerations, ensuring a sustainable competitive landscape. Online gaming leagues and tournaments foster talent development and intense competition, while branding guidelines maintain industry standards.

Technology advancements and broadcasting networks enhance gaming entertainment, attracting more fans and investors. Esports content marketing strategies leverage influencer partnerships and innovative storytelling, creating engaging experiences for viewers. Sustainability initiatives promote eco-conscious practices, aligning the industry with social responsibility. Amidst this evolving ecosystem, cyber sports continue to challenge traditional sports, offering unique opportunities for growth and innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Esports Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.2% |

|

Market growth 2025-2029 |

USD 4337 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

20.0 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Esports Market Research and Growth Report?

- CAGR of the Esports industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the esports market growth of industry companies

We can help! Our analysts can customize this esports market research report to meet your requirements.