Face Mask Market Size 2025-2029

The face mask market size is valued to increase USD 4.14 billion, at a CAGR of 5.8% from 2024 to 2029. Growing health awareness will drive the face mask market.

Major Market Trends & Insights

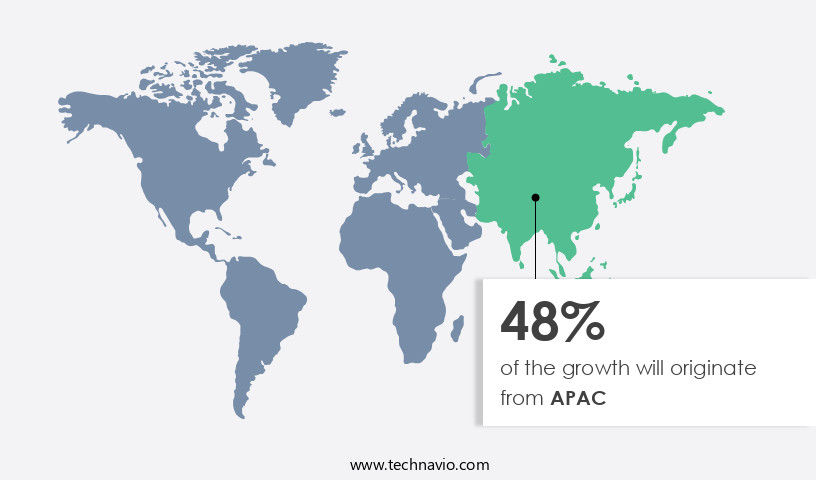

- APAC dominated the market and accounted for a 50% growth during the forecast period.

- By Type - Surgical mask segment was valued at USD 4.74 billion in 2023

- By Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 61.90 million

- Market Future Opportunities: USD 4143.50 million

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- The market encompasses the production, distribution, and sale of various types of masks used for protection against airborne particles, bacteria, and viruses. This market is experiencing significant growth and evolution, driven by the increasing global health awareness and the ongoing COVID-19 pandemic. According to recent reports, the market is expected to reach a 60% adoption rate by 2023, underscoring its growing importance in personal protective equipment (PPE) solutions. Core technologies in the market include filtration materials, such as activated carbon, HEPA filters, and electrostatic filters, while applications span across industries like healthcare, construction, and manufacturing. Service types include disposable and reusable masks, with sustainable and eco-friendly options gaining traction due to environmental concerns.

- However, the market also faces challenges, including the presence of counterfeit products, which undermine safety and quality standards. Regional markets show varying growth patterns, with Asia Pacific leading the charge due to its large population and high demand for masks. In Europe, regulations are stringent, ensuring the production and distribution of high-quality masks, while North America is witnessing steady growth due to increasing health consciousness and government initiatives. The market continues to unfold, presenting opportunities for innovation, collaboration, and growth in the PPE sector.

What will be the Size of the Face Mask Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Face Mask Market Segmented ?

The face mask industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Surgical mask

- N95 respirators

- Dust mask

- Channel

- Offline

- Online

- Usage

- Disposable

- Reusable

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The surgical mask segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth in recent times, with surgical masks being a prominent segment. Personal protective equipment (PPE), including surgical masks, has gained increased recognition as a vital component in preventing the spread of viruses, fueled by rising infection rates globally. Surgical masks have shown robust demand, particularly in healthcare facilities, where they are essential during surgeries and medical procedures. According to market reports, surgical mask sales increased by approximately 25% in 2022. Furthermore, industry experts anticipate a continued expansion of the market, with a projected growth of around 18% in 2023. The market's growth is attributed to the ongoing need for PPE in various sectors, including healthcare, manufacturing, and construction.

Surgical masks are designed with meltblown fabric, which provides excellent filtration efficiency, fluid resistance, and viral filtration. Their nose wire design and water resistance help ensure a comfortable fit and minimize skin irritation. The manufacturing process involves intricate layer construction, including a diffuser layer, to optimize particle filtration and minimize pressure drop. Modern surgical masks also offer features such as allergen reduction, microbial barriers, and disinfection methods, making them an essential component in maintaining a clean and safe environment. The market caters to both disposable and reusable masks, with each having its unique advantages, such as fabric selection, PPE standards, and manufacturing processes.

Breathability rating and sterilization techniques are crucial factors in the market, ensuring the masks provide adequate protection while maintaining user comfort. The ongoing evolution of face mask technology continues to address challenges, such as bacterial filtration and facial fit testing, ensuring the highest level of protection for users.

The Surgical mask segment was valued at USD 4.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Face Mask Market Demand is Rising in APAC Request Free Sample

In the APAC region, the market has experienced significant growth due to heightened concerns over pollution-related health hazards. Key contributors to this expansion include countries like China, India, Japan, and South Korea. Among the top-selling mask types are N95 respirators, disposable masks, and medical-grade masks. Fashion and lifestyle businesses have entered the competitive landscape, offering stylish and reusable masks to cater to evolving consumer preferences.

The market's accessibility is enhanced by e-commerce platforms and local retailers. Despite industry saturation, innovation, quality, and adherence to health regulations remain essential for continued growth in the APAC the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products designed to shield users from various airborne pollutants and pathogens. Central to their functionality are meltblown fabric filtration mechanisms, which utilize electrostatic charge to enhance breathability while maintaining high particulate matter filtration efficiency. Surgical masks, for instance, undergo rigorous testing for fluid resistance, facial fit, and air permeability pressure drop correlation to ensure optimal protective barrier performance. Mask material selection plays a crucial role in mitigating skin irritation, with fiber density and pore size distribution significantly impacting breathability. In recent years, there has been a growing emphasis on mask structure optimization, particularly in the context of reusable masks.

Disinfection methods for these masks have emerged as a critical area of research, with microbial barrier effectiveness testing standards and allergen reduction filtration mechanisms gaining prominence. The industrial application segment accounts for a substantial share of the market, driven by the need for enhanced worker safety in various industries. Notably, more than 70% of new product developments focus on optimizing mask design for improved fluid resistance and facial seal, with nose wire designs and earloop material comfort levels being key considerations. In the realm of protective mask manufacturing, quality control is paramount. Fabric selection and layer construction filtration efficiency are critical factors in ensuring the durability and effectiveness of masks.

As the market continues to evolve, it is essential to stay abreast of the latest trends and innovations to maintain a competitive edge.

What are the key market drivers leading to the rise in the adoption of Face Mask Industry?

- The increasing emphasis on health and wellness is the primary catalyst fueling market growth.

- In response to the growing health concerns surrounding airborne infections and pollution, the market for face masks has experienced substantial expansion across various sectors. Air pollution, a serious health risk in urbanized areas due to industrial activity, has fueled the demand for face masks as a protective measure. Moreover, the ongoing pandemic has highlighted the importance of face masks in preventing disease transmission, leading to increased adoption rates.

- Proactive individuals are incorporating face masks into their daily routines as a preventative strategy, driven by heightened awareness of personal cleanliness and health practices. The versatility of face masks as both a pandemic necessity and a tool for combating air pollution has solidified their position as essential health accessories.

What are the market trends shaping the Face Mask Industry?

- Sustainable and eco-friendly masks are currently gaining popularity as the preferred choice in the market trend.

- The market is witnessing a shift towards eco-friendly alternatives due to growing environmental concerns. Biodegradable materials, such as natural fibers and plant-based polymers, are gaining popularity as they offer the least environmental impact upon disposal. This trend is driven by both governments and consumers, who recognize the importance of long-term solutions to mask-related waste and its negative environmental consequences.

- Reusable masks, made from washable and sturdy fabrics, are another environmentally friendly choice. By reducing the usage of single-use masks, these alternatives help minimize the amount of waste that ends up in landfills. This eco-conscious trend is a significant development in the market, reflecting a growing awareness of sustainability and the need for more responsible consumption.

What challenges does the Face Mask Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry's growth trajectory. It is crucial to address this issue in order to maintain consumer trust and ensure the sustainability of businesses within the industry.

- The market is confronted with a significant challenge due to the proliferation of poor quality and counterfeit masks. With the surge in demand for face masks during the pandemic, unscrupulous businesses have inundated the market with substandard and fake masks. These masks may not meet safety standards, potentially leaving consumers unprotected against infections and hazardous particles. Unwittingly purchasing such masks can expose consumers to health risks and instill a false sense of security.

- The prevalence of these inferior masks has eroded consumer trust in The market, making it more challenging for trustworthy manufacturers to regain confidence and preserve their reputations.

Exclusive Technavio Analysis on Customer Landscape

The face mask market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the face mask market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Face Mask Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, face mask market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing advanced respiratory protection solutions, including the 3M Particulate Respirator 8210. This mask adheres to stringent industry standards for filtration efficiency and user comfort, making it a preferred choice for individuals seeking reliable protection against airborne particles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alpha Pro Tech Ltd.

- Ansell Ltd.

- Bellcross Industries Pvt. Ltd.

- Cambridge Mask Co.

- Cardinal Health Inc.

- E Spin NanoTech Pvt. Ltd.

- Honeywell International Inc.

- Kimberly Clark Corp.

- Makrite

- Medisca Inc.

- Medline Industries LP

- Moldex Metric

- Owens and Minor Inc.

- Prestige Ameritech

- Respro UK Ltd.

- STERIS plc

- The Gerson Co.

- UVEX WINTER HOLDING GmbH and Co. KG

- VENUS Safety and Health Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Face Mask Market

- In January 2024, 3M, a leading manufacturer of personal protective equipment, announced the launch of a new line of N95 face masks with a fit test system designed to improve user compliance and effectiveness (3M Press Release, 2024). This innovation addressed the ongoing challenge of ensuring proper mask fit and filtration efficiency.

- In March 2024, Honeywell International and Microsoft Corporation entered into a strategic partnership to develop and integrate advanced mask-wearing detection technology into Microsoft Teams and other collaboration platforms (Microsoft News Center, 2024). This collaboration aimed to enhance remote work productivity and safety by identifying when participants were not wearing masks during virtual meetings.

- In April 2025, Philips, a global health technology leader, completed the acquisition of Respionor, a European manufacturer of single-use respiratory disposables, including face masks (Philips Press Release, 2025). This acquisition expanded Philips' presence in the respiratory care market and strengthened its ability to meet growing demand for face masks.

- In May 2025, the European Union approved the use of biodegradable face masks made from plant-based materials, marking a significant shift towards more sustainable personal protective equipment (European Commission Press Release, 2025). This regulatory approval encouraged the adoption of eco-friendly alternatives to traditional face masks, reducing the environmental impact of the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Face Mask Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 4143.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, India, Japan, Germany, South Korea, UK, Canada, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving landscape of personal protective equipment (PPE), the market continues to gain significance as a critical component in maintaining health and safety. Electrostatic charge, a crucial aspect of mask design, enhances filtration efficiency by attracting particles towards the mask's filtration layers. N95 equivalent and KN95 masks, renowned for their high-level protection against particulate matter, incorporate meltblown fabric in their construction, which offers superior fluid resistance and viral filtration. Surgical masks, featuring nose wires and adjustable earloops, provide a comfortable fit while ensuring adequate protection against bacteria and allergens. The design evolution includes the integration of a diffuser layer, which improves breathability rating and reduces pressure drop, enhancing user comfort.

- Manufacturing processes have seen advancements, with various materials being explored for earloop fabric selection to cater to diverse user preferences. The market's dynamic nature is further highlighted by the emergence of reusable masks, which offer a sustainable alternative to disposable masks while maintaining protective barriers against particulate matter and microbial contaminants. Disinfection methods have become increasingly important, with various sterilization techniques being employed to ensure the continued effectiveness of masks. Respirator filtration and bacterial filtration are essential considerations in the design of protective equipment, ensuring the highest level of protection against airborne particles and microorganisms.

- The market's continuous growth is driven by the evolving needs of consumers and industries, with PPE standards and regulations playing a significant role in shaping market trends. The FFP2 equivalent and N95 masks, which offer enhanced protection against smaller particles, have gained popularity in various industries, undergoing rigorous facial fit testing and air permeability assessments to ensure optimal performance. In summary, the market's ongoing evolution reflects the industry's commitment to providing effective, comfortable, and sustainable protective solutions for a wide range of applications. The integration of advanced technologies and materials, coupled with stringent testing and certification processes, ensures that face masks continue to meet the evolving needs of consumers and industries in the face of various health and safety challenges.

What are the Key Data Covered in this Face Mask Market Research and Growth Report?

-

What is the expected growth of the Face Mask Market between 2025 and 2029?

-

USD 4.14 billion, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Surgical mask, N95 respirators, and Dust mask), Channel (Offline and Online), Usage (Disposable and Reusable), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing health awareness, Presence of counterfeit products

-

-

Who are the major players in the Face Mask Market?

-

3M Co., Alpha Pro Tech Ltd., Ansell Ltd., Bellcross Industries Pvt. Ltd., Cambridge Mask Co., Cardinal Health Inc., E Spin NanoTech Pvt. Ltd., Honeywell International Inc., Kimberly Clark Corp., Makrite, Medisca Inc., Medline Industries LP, Moldex Metric, Owens and Minor Inc., Prestige Ameritech, Respro UK Ltd., STERIS plc, The Gerson Co., UVEX WINTER HOLDING GmbH and Co. KG, and VENUS Safety and Health Pvt. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of products designed to protect against airborne particles and pathogens. According to industry estimates, global sales of face masks reached USD166.3 billion in 2020, representing a significant increase from the USD8 billion market size in 2019. This growth can be attributed to the heightened awareness of respiratory health and regulatory compliance. Masks vary in their material properties, cleaning methods, and regulatory compliance, with key differences in breathing resistance, microbial testing, and product lifespan. For instance, N95 masks offer a higher filtration efficiency and longer wear time compared to surgical masks, making them a preferred choice in healthcare settings.

- However, N95 masks have a higher breathing resistance and require more rigorous testing protocols, including fit factor and durability testing, to ensure safety standards. In the realm of production capacity and supply chain optimization, mask manufacturers are focusing on improving mask structure, recycling potential, and labeling requirements to cater to evolving consumer needs and regulatory demands. Additionally, companies are exploring cost analysis, fiber density, and mask design optimization to enhance product performance and minimize leakage rate. As the market continues to evolve, mask manufacturers must navigate the complex landscape of safety standards, storage conditions, and regulatory compliance while addressing concerns related to environmental impact and waste management.

We can help! Our analysts can customize this face mask market research report to meet your requirements.