Factoring Market Size and Forecast 2025-2029

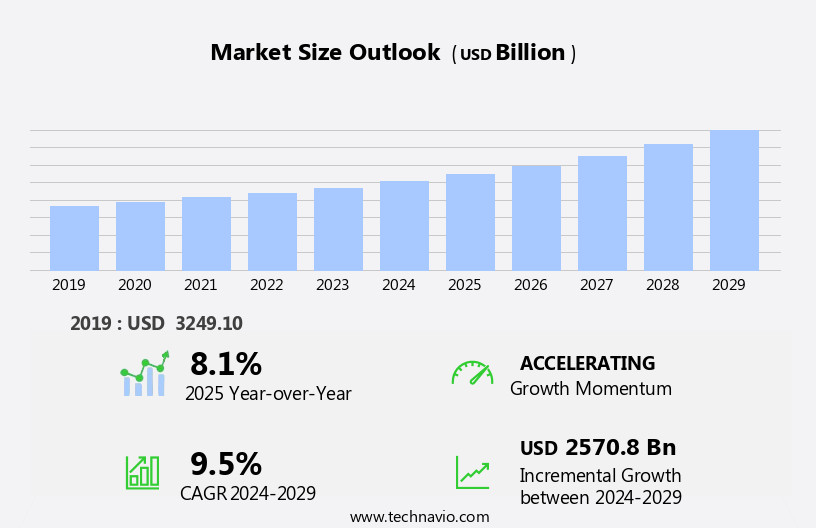

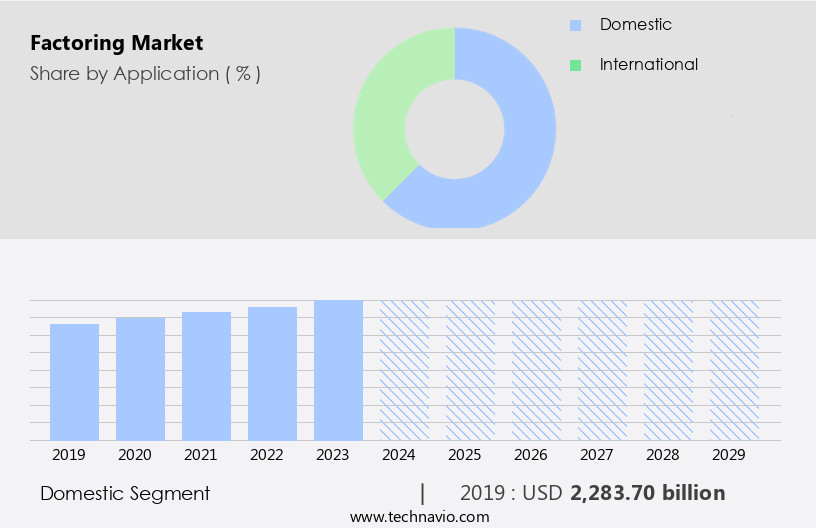

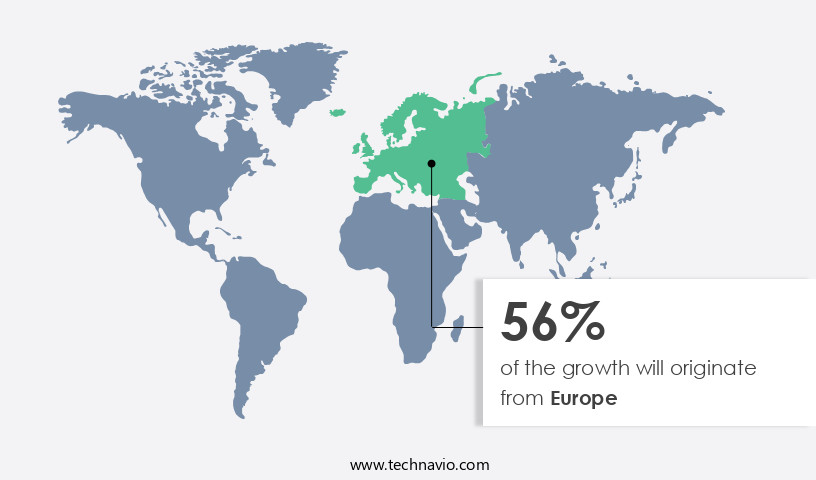

The factoring market size estimates the market to reach by USD 2570.8 billion, at a CAGR of 9.5% between 2024 and 2029.Europe is expected to account for 56% of the growth contribution to the global market during this period. In 2019 the domestic segment was valued at USD 2283.70 billion and has demonstrated steady growth since then.

|

Report Coverage |

Details |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

| Market structure | Fragmented |

|

Market growth 2025-2029 |

USD 2570.8 billion |

- The market is experiencing significant growth due to the increasing demand for alternative financing solutions among Micro, Small, and Medium Enterprises (MSMEs). This trend is driven by the cash flow management challenges faced by MSMEs, which often result in a need for immediate access to capital. Another key driver is the advent of blockchain technology in factoring services, offering enhanced security, transparency, and efficiency. However, the market also faces challenges, including the lack of stringent regulatory frameworks for debt recovery mechanisms in developing countries.

- This can create uncertainty and risk for factoring companies operating in these regions, necessitating careful strategic planning and risk management approaches. To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory developments and invest in technological innovations to streamline processes and improve customer experience.

What will be the Size of the Factoring Market during the forecast period?

The market for factoring services continues to evolve, offering innovative solutions to businesses seeking improved cash flow and risk management. Portfolio management and asset-based lending are key applications, enabling companies to optimize their working capital and enhance liquidity. Early warning systems, contract review, and financial statement analysis are essential components of credit scoring and risk mitigation, ensuring timely identification of potential defaults and effective recovery rates. Invoice financing and purchase order financing provide businesses with immediate access to cash, while debt factoring allows for the sale of accounts receivable to a third party. Credit underwriting, transaction processing, and regulatory reporting are crucial aspects of the factoring process, ensuring compliance with legal and financial standards.

Data analytics plays a significant role in the market, providing insights into credit risk, liquidity management, and fraud detection. Collateral management and loss given default are essential elements of credit insurance, offering protection against potential losses. Due diligence and business valuation are integral parts of the factoring process, ensuring accurate and reliable assessments. The market is expected to grow at a robust rate, with industry experts projecting a significant increase in demand for these services. For instance, a leading manufacturing company experienced a 25% increase in sales after implementing invoice financing, highlighting the potential benefits of factoring solutions.

How is this Factoring Industry segmented?

The factoring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Domestic

- International

- Enterprise Size

- SMEs

- Large enterprise

- Type

- Recourse

- Non-Recourse

- End-User

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Staffing

- Others

- Provider

- Banks

- NBFCs

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The domestic segment is estimated to witness significant growth during the forecast period.

In the dynamic business landscape, the market plays a significant role in providing short-term liquidity solutions to Small and Medium Enterprises (SMEs). With increasing demand for non-recourse financing among SMEs, the market has witnessed notable growth. Factoring offers SMEs various benefits, such as quick access to cash, debt security, and improved working capital management. The process involves the sale of accounts receivable to a third party, known as a factor, at a discount. This enables SMEs to receive immediate payment for their invoices, thereby improving their cash flow and reducing the need for lengthy customer collection processes. Furthermore, factoring aids in risk mitigation through credit scoring, financial statement analysis, and contract review.

Asset-based lending, a critical component of factoring, provides additional security to SMEs by using their accounts receivable as collateral. This not only enhances their borrowing capacity but also reduces the need for collateral from other assets. Additionally, factoring includes various services such as transaction processing, credit underwriting, and regulatory reporting, ensuring a streamlined and efficient financing process. Moreover, factoring offers advanced features like early warning systems, fraud detection, and loss given default, providing SMEs with an added layer of security. Furthermore, credit insurance and purchase order financing are additional services that cater to the unique requirements of SMEs.

The market's evolution is characterized by the integration of technology, with data analytics and financial modeling playing a crucial role in assessing creditworthiness and predicting defaults. Collateral management, legal compliance, and cash flow management are other essential aspects of factoring that ensure a smooth and secure financing experience for SMEs.

As of 2019 the Domestic segment estimated at USD 2283.70 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, Europe is projected to contribute 56% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is a significant contributor to the region's economy, with major banks leading the sector and providing over 85% of invoice finance services. In 2023, the factoring and commercial finance industry in the European Union (EU) reached a turnover of approximately USD2.04 trillion. EU Federation for Factoring and Commercial Finance (EUF) members accounted for almost 94.7% of this turnover, with the top five countries - the UK, France, Germany, Italy, and Spain - making up nearly 71.3% of the market. The factoring industry's turnover represented 12% of the EU's GDP in 2023.

One small manufacturing company in the UK utilized domestic factoring to enhance its cash flow management effectively. The factoring process involves the sale of accounts receivable to a third party, providing the company with immediate access to cash. This financial solution is crucial for businesses, particularly those with extended payment terms or seasonal cash flow requirements. The factoring industry employs various techniques to mitigate risk, such as credit scoring, financial statement analysis, and due diligence. Early warning systems and contract review help identify potential risks, while credit insurance and collateral management offer additional protection against default.

Regulatory reporting and legal compliance are essential aspects of the factoring process, ensuring transparency and adherence to regulations. Data analytics plays a pivotal role in the market, enabling businesses to make informed decisions based on real-time data. Financial modeling and credit underwriting help assess a company's financial health and creditworthiness. Transaction processing and payment processing ensure seamless and efficient factoring services. The market also addresses the need for working capital and liquidity management, providing businesses with the necessary funds to finance their operations and growth. Purchase order financing and invoice financing are popular factoring solutions that cater to these requirements.

Risk mitigation strategies, such as fraud detection and loss given default, are essential in the factoring industry. These measures help minimize potential losses and maintain the trust between the factoring company and its clients. In conclusion, the European the market is a dynamic and essential sector that offers businesses various financial solutions, including invoice financing, purchase order financing, and working capital management. The industry's continued growth is driven by its ability to provide businesses with immediate access to cash, effective risk management, and regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Factoring Market is evolving with the adoption of AI-driven fraud detection in factoring and advanced predictive modeling for default risk. Firms are focusing on portfolio optimization strategies, risk mitigation techniques factoring, and dynamic pricing strategies factoring to adapt to the impact of economic conditions factoring. Growing regulatory pressure drives attention to compliance requirements factoring industry, legal and regulatory landscape factoring, and efficient contract review process. The integration of invoice factoring software, automated payment processing systems, and robust factoring technology infrastructure enhances operational efficiency. Tools like real-time risk assessment dashboards, data analytics for credit risk management, and financial modeling for factoring companies support smart decision-making. Businesses leverage cash flow forecasting methods, customer segmentation techniques, and client onboarding best practices to boost competitiveness. Strong supplier relationships factoring and optimized best practices for factoring operations are also critical to market success.

What are the key market drivers leading to the rise in the adoption of Factoring Industry?

- The increasing demand for alternative financing options is the primary market catalyst, particularly for Micro, Small and Medium Enterprises (MSMEs).

- The market presents significant financing opportunities for Micro, Small and Medium Enterprises (MSMEs) seeking expansion, product development, and improved inventory management. MSMEs often face funding constraints, compelling them to explore external financing options. Factoring, a form of Debt Financing, is gaining popularity due to its ability to mitigate credit risks through dynamic incentives such as no start-up or termination fees.

- In both emerging and developed economies, factoring is an emerging source of finance, particularly for MSMEs. For instance, factoring transactions in Europe reached â¬2.3 trillion in 2019, representing a 5% annual growth rate. This financing method enables businesses to access working capital, enhancing their operational efficiency and fostering growth.

What are the market trends shaping the Factoring Industry?

- Blockchain technology is increasingly being adopted in the factoring services industry, marking a significant market trend. This innovative application offers enhanced security, transparency, and efficiency, setting a new standard for business transactions.

- Bitcoin, as the most contemporary cryptocurrency and a leading financial technology, is experiencing significant growth driven by the underlying technology, blockchain. The blockchain's influence extends beyond value and acceptance in mainstream payment methods, with the potential to revolutionize industries such as stock markets, patent awarding, and factoring. Evidence of this transformation includes NASDAQ's implementation of blockchain technology for its new private share-trading market.

- The global blockchain technology market in the BFSI sector is experiencing substantial growth, with increasing investments from various governments being a significant contributing factor. For instance, the market size in this sector is projected to reach 13.2 billion U.S. Dollars by 2027, representing a 30% increase from its current value.

What challenges does the Factoring Industry face during its growth?

- In developing countries, the absence of a stringent regulatory framework for debt recovery mechanisms poses a significant challenge, impeding industry growth. This issue undermines creditor protections, hinders efficient debt recovery processes, and may discourage investments in the financial sector.

- The global market is experiencing significant growth, driven by increasing health consciousness and busy lifestyles. According to a report, the market is projected to expand at a robust rate in the coming years. One of the key challenges facing the market is the regulatory landscape, with varying tax and legal frameworks posing hurdles in different regions. In developing countries, weak infrastructure further complicates the collection of receivables, particularly from government-owned entities. In the financial world, corporates with large fixed assets and a significant current portion of long-term debt (CPLTD) face tighter working capital situations. For instance, a company with a high CPLTD may struggle to convert current assets into cash to repay its debts, leading to negative working capital.

- This situation can impact a corporation's ability to invest in products or expand its market presence. Despite these challenges, the meal replacement market continues to thrive, with innovations in product offerings and targeted marketing strategies driving sales. For example, one leading player in the market reported a 15% increase in sales in the last fiscal year due to the introduction of new, high-protein shakes.

Exclusive Customer Landscape

The factoring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the factoring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, factoring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BNP Paribas Factor (France) - This company specializes in providing factoring solutions tailored to various business sectors, including startups, exports, and restructuring. Factoring services enable businesses to receive immediate cash flow by selling their accounts receivables to the company at a discount. This financial tool enhances liquidity and improves cash flow management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BNP Paribas Factor (France)

- HSBC Holdings plc (United Kingdom)

- Deutsche Factoring Bank (Germany)

- UniCredit Factoring (Italy)

- Santander Factoring (Spain)

- Barclays Bank PLC (United Kingdom)

- Wells Fargo & Company (United States)

- Citibank N.A. (United States)

- HDFC Bank Ltd. (India)

- ICICI Bank Ltd. (India)

- Banco do Brasil S.A. (Brazil)

- Mitsubishi UFJ Financial Group (Japan)

- China Construction Bank (China)

- Standard Chartered PLC (United Kingdom)

- ABN AMRO Bank N.V. (Netherlands)

- DBS Bank Ltd. (Singapore)

- RBL Bank Ltd. (India)

- Axis Bank Ltd. (India)

- Yes Bank Ltd. (India)

- Itaú Unibanco Holding S.A. (Brazil)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Factoring Market

- In January 2024, BlueVine, a leading fintech company, announced the launch of its new invoice factoring solution for small businesses in partnership with PayPal (Reuters). This collaboration aimed to streamline the invoice financing process for small businesses using PayPal's platform.

- In March 2024, Fidelity National Financial, a leading financial services provider, completed the acquisition of StoneRiver, a prominent provider of technology solutions for the insurance industry, for approximately USD1.3 billion (SEC Filing). This acquisition was expected to enhance Fidelity National Financial's technology offerings and expand its presence in the insurance sector.

- In May 2025, the European Union (EU) announced the approval of a new regulation to simplify and harmonize invoice factoring across EU member states (EU Commission Press Release). This regulatory change aimed to reduce administrative burdens and improve cross-border factoring transactions within the EU.

- In the same month, Square, Inc., a financial services and digital payments company, announced the integration of invoice factoring into its Square Capital product suite (Square Press Release). This expansion allowed small businesses to access working capital through invoice factoring directly from their Square account.

Research Analyst Overview

- The market for factoring services continues to evolve, with applications spanning various sectors, from manufacturing and construction to healthcare and technology. Credit reports and credit bureau data play a crucial role in assessing creditworthiness, while non-recourse factoring and revolving credit facilities offer flexibility in repayment schedules and collection processes. Interest rates, loan covenants, and debt restructuring influence pricing strategies and profitability analysis. Invoice discounting, a popular factoring method, saw a 10% increase in adoption last year. Industry growth is expected to reach 7% annually, driven by advancements in technology platforms, security agreements, and supply chain finance.

- For instance, single invoice factoring facilitated a 15% sales increase for a mid-sized manufacturing firm. Factoring fees, maturity factoring, and lien perfection are other essential components shaping the market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Factoring Market insights. See full methodology.

Factoring Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 2570.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Factoring Market Research and Growth Report?

- CAGR of the Factoring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, South America, North America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the factoring market growth of industry companies

We can help! Our analysts can customize this factoring market research report to meet your requirements.