Flexible Electronics Market Size 2024-2028

The flexible electronics market size is forecast to increase by USD 25.69 billion at a CAGR of 10.87% between 2023 and 2028.

- The market is experiencing significant growth, driven by key factors such as capacity expansion plans and the advent of conceptual flexible display products. However, the market faces challenges, including the lag in mass production of flexible OLED displays. Capacity expansion plans are a major growth driver, as companies invest in new facilities to meet increasing demand for flexible electronics. The development of conceptual flexible display products, such as foldable and rollable displays, represents a significant trend In the market. However, the mass production of these displays remains a challenge, as the technology is still in its infancy and requires significant investment and innovation to become cost-effective and efficient at scale.

- Overall, the market is poised for robust growth, but companies must navigate these challenges to succeed.

What will be the Size of the Flexible Electronics Market During the Forecast Period?

- The market encompasses a diverse range of technologies, including flexible displays, batteries, sensors, memories, photovoltaics, and circuits. These innovations offer significant advantages over traditional electronics, such as lightweight, flexibility, and improved durability. Key applications include consumer electronics, particularly In the form of foldable devices and bendable smartphones, as well as wearable electronics, such as AR glasses and headmounted displays (HMDs). In addition, flexible electronics are gaining traction In the medical and healthcare sector for use in smart textiles and flexible medical devices. The energy and power segment is also witnessing growth with the adoption of flexible lithium-ion technology and flexible printed batteries.

- Other emerging applications include flexible memories, flexible photovoltaics, and flexible circuits and PCB designs. The market is driven by the increasing demand for miniaturization, portability, and the integration of advanced technologies like 5G SA core and hinge mechanisms into flexible devices. Industries such as consumer electronics, military, and healthcare are expected to fuel the market's growth In the coming years.

How is this Flexible Electronics Industry segmented and which is the largest segment?

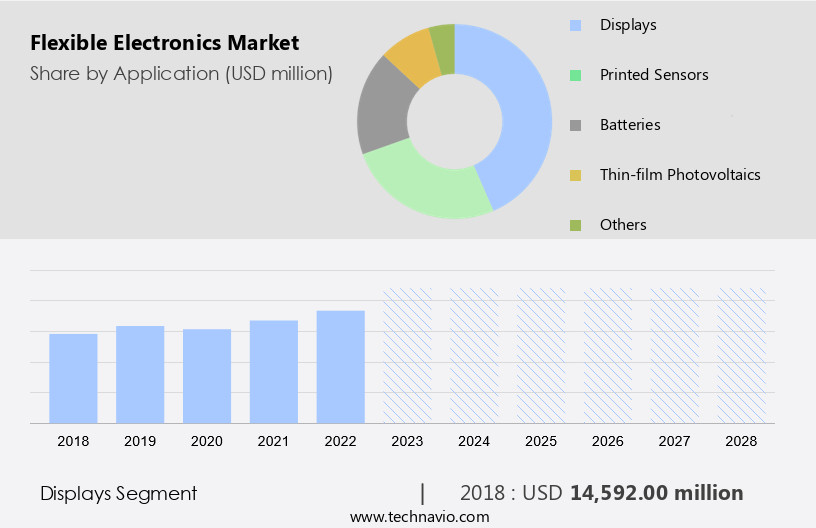

The flexible electronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Displays

- Printed sensors

- Batteries

- Thin-film photovoltaics

- Others

- End-user

- Consumer electronics

- Automotive

- Healthcare

- Military and defense

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

- The displays segment is estimated to witness significant growth during the forecast period.

Flexible electronics, a cutting-edge technology, encompasses various components such as displays, batteries, sensors, and circuits, all manufactured using flexible substrates. This innovation offers advantages like lightweight, durability, and flexibility, making it suitable for diverse applications. Market leaders are focusing on developing flexible displays for consumer goods, including smartphones, tablets, and wearables, enhancing their ruggedness and versatility. Additionally, flexible displays are expected to penetrate sectors like healthcare, robotics, agriculture, aerospace and defense, and monitoring, sensing, lighting, storage, and energy storage technology. The technology's potential applications extend to advanced display technology, lighting technology, health monitoring systems, smart cities, and connected infrastructure. In the future, flexible electronics may power foldable devices, hinge mechanisms, and multilayer flex circuits.

However, challenges like heat damage, lifted pads, damaged conductors, and shortcircuiting situations necessitate continuous research and development.

Get a glance at the Flexible Electronics Industry report of share of various segments Request Free Sample

The Displays segment was valued at USD 14.59 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is primarily driven by the dominance of APAC, which accounts for a significant share due to the region's concentration of display device and OLED panel manufacturers. APAC's established supply chain for display devices will continue to support its market leadership during the forecast period. Major electronic device manufacturers, including flat-panel TV, smartphone, tablet, and wearable device producers, are based in South Korea, Japan, Taiwan, and China, contributing to APAC's role as a major revenue generator In the global market. Flexible electronics applications span various industries, including consumer goods, healthcare, robotics, agriculture, aerospace and defense, monitoring, sensing, lighting, display, storage, and energy storage technology.

Key technologies include flexible printed batteries, thinfilm technologies, fOLED technology, AR glasses, headmounted displays (HMDs), bendable smartphones, smart textiles, flexible medical devices, wearable electronics, and flexible displays. Rigid flexible electronics, flexible printed circuits, and flexible PCB designs are essential components of these applications. The market encompasses consumer electronics, medical and healthcare, energy and power, smart electronics, wearable devices, advanced display technology, lighting technology, health monitoring systems, smart cities, connected infrastructure, data analytics, artificial intelligence, 5G SA core, foldable devices, hinge mechanisms, multilayer flex circuits, smartphones, PCs, TVs, tablets, wearables, and large-screen devices. Challenges in flexible electronics include heat damage, lifted pads, damaged conductors, and shortcircuiting situations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Flexible Electronics Industry?

Capacity expansion plans is the key driver of the market.

- The market is experiencing significant growth as major corporations, such as Samsung Electronics Co. Ltd. And LG Corp., invest in manufacturing capacity expansions and advanced technology developments. Flexible printed batteries using flexible lithium-ion technology, thinfilm technologies, fOLED technology, and AR glasses are driving the market forward. Flexible displays, wearable electronics, and smart textiles are also gaining popularity in consumer goods, healthcare, robotics, agriculture, aerospace and defense, monitoring, sensing, lighting, storage, and energy storage technology. Rigid flexible electronics, flexible printed circuits, and flex PCB designs are essential components of this market. Investments in next-generation manufacturing plants in countries like South Korea, Taiwan, China, and India are shortening the time-to-market for flexible electronics.

- These countries are becoming preferred destinations due to their advanced manufacturing capabilities and supportive business environments. The market encompasses various applications, including advanced display technology, lighting technology, health monitoring systems, smart cities, connected infrastructure, data analytics, artificial intelligence, 5G SA core, foldable devices, and hinge mechanisms. Manufacturing challenges, such as heat damage, lifted pads, damaged conductors, and shortcircuiting situations, are being addressed through reworking techniques and advanced manufacturing processes. Flexible electronics are being integrated into various industries, including consumer electronics, medical and healthcare, energy and power, smart electronics, and wearable devices. The market's growth is fueled by the increasing demand for flexible sensors, flexible memories, flexible photovoltaics, and multilayer flex circuits.

What are the market trends shaping the Flexible Electronics Industry?

Advent of conceptual flexible display products is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of flexible displays in various industries. Flexible printed batteries, utilizing flexible lithium-ion technology, are a key component of this market. Companies like Thinfilm Technologies are leading the way in developing these advanced technologies. Flexible organic light-emitting diodes (fOLED) technology is also gaining traction in applications such as AR glasses and headmounted displays (HMDs). Bendable smartphones and smart textiles are other areas where flexible electronics are making a mark. In healthcare, flexible medical devices and wearable electronics are revolutionizing patient care and monitoring. The use of flexible displays in consumer goods, robotics, agriculture, aerospace and defense, and energy and power sectors is also on the rise.

- Flexible substrates, energy storage technology, and sensors are crucial elements of this market. Flexible batteries, memories, photovoltaics, and circuits are essential components of flexible electronics. The market dynamics are driven by the increasing demand for advanced display technology, lighting technology, health monitoring systems, smart cities, and connected infrastructure. Data analytics, artificial intelligence, and 5G SA core are some of the emerging trends In the market. The development of foldable devices and hinge mechanisms is also gaining momentum. However, challenges such as heat damage, lifted pads, damaged conductors, and shortcircuiting situations need to be addressed to ensure the reliability and durability of flexible electronics.

- The market for flexible electronics is expected to grow significantly In the coming years, with applications spanning consumer electronics, medical and healthcare, and energy and power sectors. The market is poised for growth due to the combination of technological advancements and expanding applications.

What challenges does the Flexible Electronics Industry face during its growth?

Lag in mass production of flexible OLED displays is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for flexible displays, batteries, sensors, and photovoltaics in various industries. Flexible printed batteries using flexible lithium-ion technology, such as those developed by Thinfilm Technologies, are gaining popularity in consumer goods like bendable smartphones and wearable electronics. Flexible displays using fOLED technology are also being integrated into AR glasses, headmounted displays (HMDs), and large-screen devices. Rigid flexible electronics, including flexible printed circuits and flex PCB designs, are essential components In these applications. Flexible electronics are finding their way into healthcare with flexible medical devices, health monitoring systems, and smart textiles.

- The energy storage technology market, specifically flexible batteries and sensors, is expected to grow significantly in sectors like robotics, agriculture, aerospace and defense, and monitoring and sensing. Flexible substrates and energy storage technology are crucial for advanced display technology and lighting technology applications. Data analytics, artificial intelligence, and 5G SA core are driving the demand for flexible electronics in smart cities and connected infrastructure. However, challenges such as reworking damaged components, including heat-damaged, lifted pads, and damaged conductors, can lead to shortcircuiting situations in flexible electronics, affecting their commercialization. Despite these challenges, major companies are investing in mass production plants In the APAC market to achieve economies of scale and meet the growing demand for flexible electronics.

Exclusive Customer Landscape

The flexible electronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flexible electronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flexible electronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - Flexible electronics, including E-Paper, represent a significant segment of the global technology market. These innovative technologies offer advantages such as flexibility, lightweight, and durability, making them suitable for various applications, from consumer electronics to healthcare and automotive industries. The market is driven by factors like increasing demand for portable devices, growing adoption of wearable technology, and advancements in materials science and manufacturing processes. Despite challenges such as production costs and scalability, the market is expected to grow at a steady pace due to its vast potential and continuous technological advancements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AUO Corp.

- Blue Spark Technologies Inc.

- Buhler AG

- Corning Inc.

- Cymbet Corp.

- DuPont de Nemours Inc.

- E Ink Holdings Inc.

- Enfucell

- FlexEnable

- Imprint Energy

- Kateeva Inc.

- Koch Industries Inc.

- LG Corp.

- Microchip Technology Inc.

- Royole Corp.

- Samsung Electronics Co. Ltd.

- Shenzhen Radiant Technology Co. Ltd.

- The Lubrizol Corp.

- Visionox Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Flexible electronics, a burgeoning technology segment, represents a significant shift In the electronic industry. This technology enables the creation of flexible, lightweight, and versatile devices, opening up new applications across various sectors. Flexible electronics encompass a range of technologies, including flexible printed batteries, thin-film transistors, and organic light-emitting diodes (OLEDs). Flexible printed batteries, a critical component of flexible electronics, offer several advantages over traditional batteries. They are lightweight, flexible, and can be easily integrated into various devices. Flexible lithium-ion technology, a popular choice for these batteries, ensures high energy density and long cycle life. The market for flexible electronics is witnessing robust growth, driven by the increasing demand for flexible displays, smart textiles, and wearable electronics.

Flexible displays offer improved durability, enhanced flexibility, and reduced weight compared to their rigid counterparts. They find applications in various sectors, including consumer goods, healthcare, robotics, agriculture, aerospace and defense, and monitoring and sensing. Flexible displays are not limited to flat screens. They can also be used to create bendable smartphones, foldable devices, and head-mounted displays (HMDs) for augmented reality (AR) glasses. These devices offer unique user experiences and are gaining popularity, especially In the consumer electronics market. Smart textiles, another application of flexible electronics, combine functionality and fashion. They offer features such as temperature regulation, moisture management, and health monitoring.

These textiles find applications in various industries, including healthcare and military. Flexible electronics also find extensive use in healthcare, particularly In the development of flexible medical devices. These devices offer improved patient comfort, enhanced functionality, and reduced invasiveness. They include wearable health monitoring systems, smart insulin patches, and flexible stents. The aerospace and defense sector is another significant user of flexible electronics. These applications include flexible sensors for monitoring aircraft structures, flexible displays for avionics, and flexible antennas for communication systems. Flexible electronics offer advantages such as reduced weight, improved durability, and enhanced flexibility. Flexible electronics also find applications in energy and power, including flexible batteries and solar cells.

Flexible batteries offer advantages such as lightweight, flexible design, and improved safety. Flexible solar cells offer increased efficiency and flexibility, making them suitable for various applications, including portable devices and smart cities. The market for flexible electronics is expected to grow significantly due to the increasing demand for smart electronics, advanced display technology, and lighting technology. The integration of data analytics, artificial intelligence, and 5G SA core technologies is expected to further drive the growth of this market. Despite the numerous advantages of flexible electronics, there are challenges associated with their manufacturing and integration into various devices. These challenges include reworking flexible electronics, which can be complicated due to the risk of damaging the flexible components.

Damages such as heat damage, lifted pads, and damaged conductors can lead to shortcircuiting situations. In conclusion, flexible electronics represent a significant shift In the electronic industry, offering numerous advantages over traditional rigid electronics. They find applications in various sectors, including consumer goods, healthcare, robotics, agriculture, aerospace and defense, monitoring and sensing, lighting, energy storage, and smart cities. The market for flexible electronics is expected to grow significantly due to the increasing demand for smart electronics, advanced display technology, and lighting technology. However, challenges associated with their manufacturing and integration into various devices need to be addressed to fully realize the potential of this technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 25691.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

South Korea, US, Japan, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flexible Electronics Market Research and Growth Report?

- CAGR of the Flexible Electronics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flexible electronics market growth of industry companies

We can help! Our analysts can customize this flexible electronics market research report to meet your requirements.