Fly Ash Market Size 2025-2029

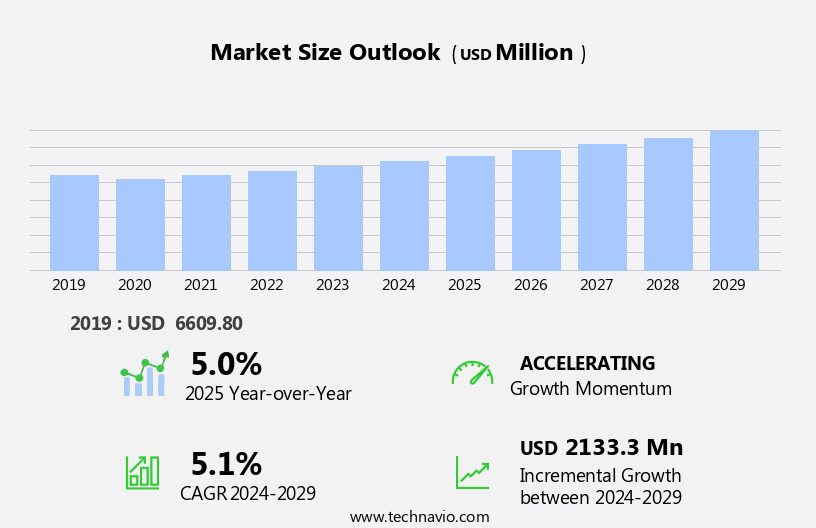

The fly ash market size is forecast to increase by USD 2.13 billion at a CAGR of 5.1% between 2024 and 2029.

- The market experiences significant growth, driven primarily by the increasing construction activities worldwide. The adoption of eco-friendly cement technology, which incorporates fly ash as a key component, is a primary catalyst fueling market expansion. However, the limitations in the use of fly ash pose challenges to market growth. Regulatory hurdles impact adoption due to varying standards and guidelines for fly ash utilization across regions. Additionally, supply chain inconsistencies, including the availability and quality of fly ash, can temper growth potential. Fly ash, a byproduct of coal combustion in thermal power plants has gained significant attention in recent years due to its potential as a sustainable and cost-effective alternative in various industries.

- Despite these challenges, companies can capitalize on the market opportunities by focusing on addressing these issues through strategic partnerships, technological advancements, and regulatory compliance. Effective navigation of these challenges will enable businesses to seize the potential of this growing market and maintain a competitive edge. Agriculture soil restoration is another emerging area where fly ash is being used to improve soil quality.

What will be the Size of the Fly Ash Market during the forecast period?

- Fly ash, a byproduct of coal-fired power plants, has emerged as a valuable resource in the US construction sector. This industrial waste material offers numerous benefits, including durability improvement, carbon sequestration, and waste management. Fly ash testing and analysis play a crucial role in ensuring compliance with industry standards, enhancing fly ash properties for various applications. In the realm of commercial construction, fly ash is increasingly used in ready-mix and precast concrete, contributing to the reduction of greenhouse gas emissions and energy consumption. Fly ash-based geopolymers have gained traction as innovative alternatives to traditional cementitious materials, offering improved performance and sustainability. Furthermore, fly ash can be utilized in the production of glass-ceramics and glass materials, expanding its application scope.

- Additionally, fly ash slurry is used for soil stabilization, while fly ash price competitiveness drives its adoption in lightweight and insulating concrete. Regulations and certifications govern fly ash handling, transportation, and disposal, ensuring safety and environmental compliance. As the market evolves, research and development efforts continue to uncover new applications and opportunities for this versatile material. In the US construction industry, fly ash is poised to play a significant role in the future, with continued innovation and demand driven by its unique properties and sustainable benefits.

How is this Fly Ash Industry segmented?

The fly ash industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Portland cement

- Agriculture

- Road construction

- Fire bricks

- Others

- Type

- Class F

- Class C

- End-user

- Construction

- Mining

- Water treatment

- Agriculture

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

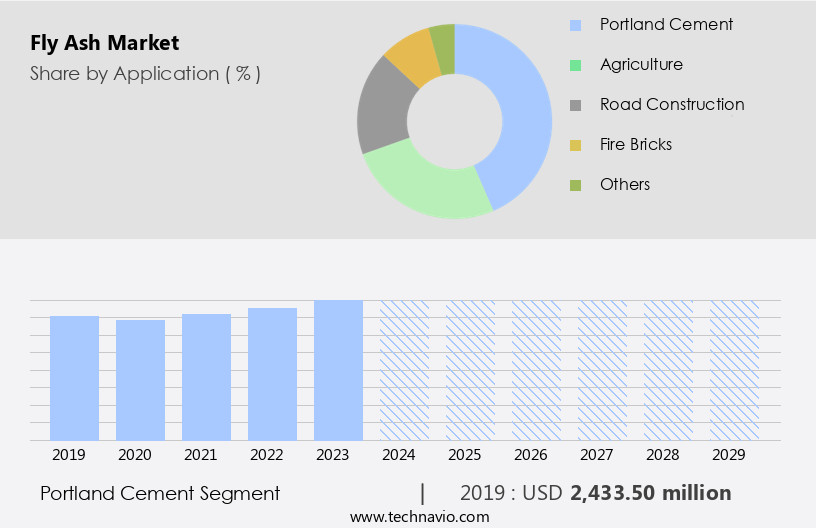

By Application Insights

The portland cement segment is estimated to witness significant growth during the forecast period. Fly ash, a byproduct of coal-fired power plants, offers significant benefits when used as an additive in portland cement concrete. Its incorporation enhances concrete's properties in both fresh and hardened states. In the plastic stage, fly ash improves workability, enabling better flowability and reducing the need for water. Hardened concrete gains strength and durability, with fly ash acting as a pozzolanic material, reacting with available lime and alkali to produce additional cementitious compounds. Fly ash's chemical composition and particle size distribution contribute to these advantages. It allows for cement replacement, reducing the overall cost of concrete production.

Moreover, fly ash's utilization in infrastructure projects, such as highways and bridges, contributes to the circular economy by repurposing industrial byproducts. Fly ash's applications extend beyond concrete production. It is used in geotechnical engineering for soil stabilization and in geopolymer concrete for sustainable construction. In the realm of industrial construction and civil engineering, fly ash's use results in emission reduction and improved durability. Fly ash's properties align with various construction material requirements. It enhances the workability of ready-mix and precast concrete, contributing to their production efficiency. Additionally, fly ash-based geopolymers offer lightweight and insulating concrete solutions. Fly ash's incorporation into concrete adheres to ASTM standards and classification, ensuring consistent quality control. In the initial stages, fly ash improves the workability of plastic concrete, enabling easier handling and better compaction.

Its use in brick manufacturing and as fill material further expands its applications. Fly ash's environmental benefits extend to carbon sequestration and waste management. Its use in concrete production reduces the need for virgin raw materials and minimizes the environmental impact of industrial activities. Adherence to environmental regulations is crucial in ensuring sustainable practices within the construction industry. Furthermore, the primary reason for fly ash's effectiveness lies in its chemical reaction with the lime and alkali present in concrete, resulting in the formation of additional cementitious compounds.

The Portland cement segment was valued at USD 2.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

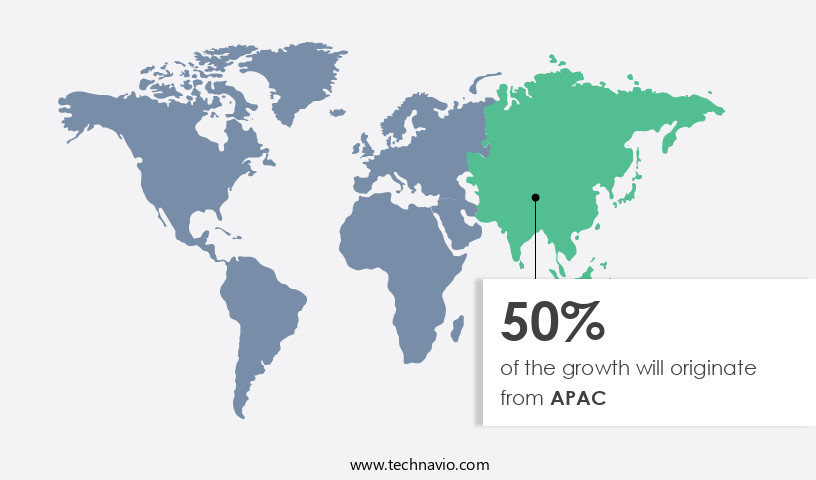

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. The increasing demand for fly ash in developing economies, such as India, Malaysia, and China, is driving this trend. Industrialization and urbanization in these countries have led to a surge in construction expenditure, fueling the need for residential and non-residential buildings. As a result, the use of fly ash in Portland cement and concrete applications is on the rise. Fly ash's chemical composition makes it an ideal substitute for cement in concrete production. Its use not only enhances the strength and durability of concrete but also contributes to environmental benefits, such as emission reduction and waste management. Fly ash also plays a crucial role in various industries, including glass, ceramics, metal refining, and road construction.

In addition, fly ash is utilized in various industries, including geotechnical engineering, brick manufacturing, and soil stabilization. The market is subject to stringent quality control measures and adheres to ASTM standards and fly ash classification. The particle size distribution of fly ash is crucial in concrete mix design, ensuring optimal workability enhancement and strength enhancement. Furthermore, fly ash is used in the production of geopolymer concrete, a sustainable construction material, and in the manufacturing of lightweight and insulating concrete. The circular economy concept has gained traction in the construction industry, leading to increased utilization of industrial byproducts like fly ash.

Infrastructure projects, including highways and bridges, are significant consumers of fly ash. Industrial construction and civil engineering also rely heavily on fly ash as a cost-effective and eco-friendly alternative to cement. Fly ash utilization in thermal power plants is another significant application. The use of fly ash in concrete production and other applications contributes to carbon sequestration, making it an essential component of sustainable construction. Overall, the market is dynamic and evolving, with ongoing research and development efforts focused on improving its properties and expanding its applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Fly Ash market drivers leading to the rise in the adoption of Industry?

- The surge in construction activities serves as the primary driver for market growth. The global construction industry is projected to expand by USD 12 trillion during the forecast period, with Asia Pacific (APAC) being a significant contributor due to the emergence of major economies such as India, China, Indonesia, and the Philippines. In this region, countries like Vietnam and Malaysia hold considerable potential. Singapore stands out for its high-quality infrastructure. The cost of building materials, which typically accounts for almost half of a building's total cost, can reach 80% for lower-income housing projects, depending on the country. The use of fly ash as a cement substitute in the construction industry presents a promising growth opportunity in APAC.

- This industrial byproduct, generated from thermal power plants, can be beneficiated and utilized in various applications, including geopolymer concrete, brick manufacturing, and fill material. Its adoption not only reduces the demand for virgin raw materials but also enhances the workability and durability of construction materials. As the construction industry transitions towards more sustainable practices, the market for fly ash is poised for growth.

What are the Fly Ash market trends shaping the Industry?

- Eco-friendly cement technology is the growing trend in the construction industry. This innovative approach prioritizes sustainability and reduces the environmental impact of cement production. The global construction industry's growing demand for bricks and cement is putting pressure on these sectors to find eco-friendly and cost-effective alternatives. According to recent research, the global construction output is projected to expand by over USD 15 trillion by 2030, with China, the US, and India leading the market growth. These countries are expected to account for more than 55% of the total increase. Construction materials, particularly cement and bricks, are the largest resource consumers in building and infrastructure projects. Fly ash, a byproduct of coal-fired power plants, is gaining popularity as a sustainable alternative to traditional construction materials.

- Its use in ready-mix concrete and precast concrete improves durability and reduces the carbon footprint of these industries. Additionally, fly ash-based geopolymers are emerging as a viable option for waste management and soil stabilization. Furthermore, fly ash can be used to produce lightweight concrete and insulating concrete, offering additional benefits. Carbon sequestration is another advantage of using fly ash in construction. The use of fly ash in concrete can help reduce the carbon emissions associated with the production of cement. As the construction industry continues to expand, the demand for eco-friendly and cost-effective materials is becoming increasingly important.

- Fly ash is poised to play a significant role in addressing these demands while minimizing the environmental impact.

How does Fly Ash market faces challenges face during its growth?

- The fly ash utilization limitations pose a significant challenge to the expansion and growth of the industry. Fly ash, a byproduct of coal-fired power plants, is increasingly utilized in industrial construction and civil engineering projects due to its ability to decrease water content in concrete mixtures without affecting workability. This results in a significant increase in the use of fly ash from 15-25% to 40-60% by mass. However, the use of high volumes of fly ash may lead to challenges such as extended setting time and slower strength development, particularly in cold weather conditions. The quality of fly ash is crucial, as poor-quality fly ash can increase permeability and potentially damage buildings and structures.

- Furthermore, concerns regarding fly ash's tendency to effloresce and freezing or thaw performance have hindered its widespread adoption among traditional builders. Adherence to ASTM standards and proper fly ash classification are essential to ensure emission reduction, cost reduction, and environmental regulations compliance. Fly ash's unique characteristics make it a valuable resource in the construction industry, but careful consideration and proper handling are necessary to maximize its benefits.

Exclusive Customer Landscape

The fly ash market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fly ash market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fly ash market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashtech India Pvt. Ltd. - The company specializes in supplying high-performance fly ash solutions, including Ashtech SUPERPOZZ and Ashtech DURACRETE.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashtech India Pvt. Ltd.

- Boral Ltd.

- CEMEX SAB de CV

- Charah Solutions Inc.

- CRH Plc

- Ecocem Ireland Ltd.

- HeidelbergCement AG

- Holcim Ltd.

- National Minerals Corp.

- NTPC Ltd.

- Salt River Materials Group

- Sephaku Holdings Ltd.

- Suyog Elements India Pvt. Ltd.

- The SEFA Group LLC

- Titan Cement Group

- Usb Chemicals

- Waste Management Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fly Ash Market

- In February 2024, Holcim, a leading global building solutions company, announced the commissioning of a new fly ash production line at its cement plant in Mexico. This expansion is expected to increase the company's fly ash production capacity by 20%, strengthening its position as a key player in the market (Holcim press release, 2024).

- In October 2025, LafargeHolcim, a leading building materials company, and Siemens Energy, a global technology powerhouse, signed a strategic partnership to develop and implement a carbon capture, utilization, and storage (CCUS) system at LafargeHolcim's fly ash production facilities. The collaboration aims to reduce the carbon footprint of the cement industry by utilizing fly ash as a substitute for limestone in cement production (LafargeHolcim press release, 2025).

- In January 2025, Cemex, a global cement company, secured a significant regulatory approval from the European Union for its new fly ash processing plant in Poland. The approval marks the completion of the permitting process and paves the way for the plant's construction, which is expected to commence in the second quarter of 2025 (Cemex press release, 2025).

- In March 2024, HeidelbergCement, a leading global building materials company, announced a â¬100 million investment in its fly ash recycling project in the Netherlands. The project aims to increase the company's fly ash recycling capacity by 50%, reducing the need for virgin raw materials and promoting sustainable construction practices (HeidelbergCement press release, 2024).

Research Analyst Overview

Fly ash, a byproduct of coal-fired power generation, has emerged as a valuable resource in various industries, particularly in construction. The ongoing dynamics and evolving patterns of the market reflect its growing significance in environmental sustainability and infrastructure development. Fly ash's chemical composition makes it an ideal substitute for traditional construction materials. Its environmental benefits include emission reduction and cost savings in cement replacement during concrete mix design. The particle size distribution of fly ash enables workability enhancement and strength enhancement in concrete production, making it a preferred choice for infrastructure projects. In the realm of highways and bridges, fly ash's use as a geotechnical engineering material has gained traction due to its durability improvement properties.

The Fly Ash Market is witnessing significant growth, driven by advancements in fly ash blending and fly ash stabilization techniques that enhance utility in construction and environmental applications. Efficient fly ash disposal and fly ash transportation systems ensure seamless operations and reduced environmental impact. Ongoing fly ash research and fly ash innovation are addressing industry challenges and propelling growth. The rising fly ash demand has spurred interest in fly ash substitutes and fly ash alternatives, complying with stringent fly ash regulations and adhering to fly ash standards. Obtaining fly ash certification through rigorous fly ash analysis underscores its quality and usability. Emphasis on fly ash sustainability supports eco-friendly practices, reinforcing its vital role in modern infrastructure development.

The material's properties also make it suitable for green building materials and sustainable construction projects, contributing to the circular economy. Fly ash beneficiation techniques have advanced significantly, ensuring consistent quality control in the production of fly ash for various applications. The material's use extends to industrial byproducts such as brick manufacturing and fill material, as well as commercial and residential construction. Geopolymer concrete, a relatively new development in the construction industry, is gaining popularity due to its environmental advantages and cost-effectiveness. Fly ash-based geopolymers offer superior strength and durability, making them a viable alternative to traditional concrete in industrial and civil engineering projects.

The use of fly ash in thermal power plants as a waste management solution has become increasingly important in light of environmental regulations. The material's potential applications in soil stabilization, carbon sequestration, lightweight concrete, and insulating concrete further expand its market reach. Fly ash's role in infrastructure projects is not limited to concrete production. Its use in precast concrete and ready-mix concrete has gained momentum due to its ability to enhance workability and improve durability. The material's properties also make it suitable for testing and analysis in various construction applications. ASTM standards and fly ash classification systems ensure consistent quality and uniformity in the production and use of fly ash.

The evolving patterns in the market reflect the ongoing efforts to optimize its use in various industries and applications, while adhering to environmental regulations and sustainability goals. In conclusion, the market is a dynamic and evolving industry, driven by the growing demand for sustainable construction materials and the need for waste management solutions. The material's versatility and environmental benefits make it a valuable resource in various industries, from infrastructure projects to commercial and residential construction. The ongoing research and development in fly ash utilization continue to expand its applications and contribute to the circular economy.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fly Ash Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 2.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, Japan, India, South Korea, Germany, Canada, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fly Ash Market Research and Growth Report?

- CAGR of the Fly Ash industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fly ash market growth of industry companies

We can help! Our analysts can customize this fly ash market research report to meet your requirements.