Foam Insulation Market Size 2024-2028

The foam insulation market size is forecast to increase by USD 20.27 billion at a CAGR of 10.87% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for energy-efficient solutions in various industries. Polyurethane foam, a key type of foam insulation, is gaining popularity in sectors such as HVAC, construction, and packaging, thanks to its excellent insulating properties. Innovations in this field, including the development of flexible foams and vacuum insulation panels, are driving market growth. However, the market is also influenced by external factors such as the fluctuation in crude oil prices and the availability of alternatives like aerogel and polystyrene foam. Specialty chemicals, including polyethylene and polypropylene, play a crucial role In the production of foam insulation. Spectroscopy is used to analyze the composition and properties of these materials, ensuring they meet industry standards. The foam insulation is widely used in refrigeration and greenhouse applications to maintain optimal temperatures and reduce energy consumption. Key players In the market are focusing on research and development to improve the performance and sustainability of their products.

What will be the Size of the Foam Insulation Market During the Forecast Period?

- The market encompasses a range of thermal insulation solutions, including rigid, spray, and flexible foams derived from polyurethane, polyolefin, and other materials. These insulations offer superior heat transfer properties, reducing energy consumption and greenhouse gas emissions in various applications. However, challenges such as allergens, dust, mold, and condensation remain concerns. The market's growth is driven by increasing demand for energy efficiency and sustainability in industries like reefer trailers and trucks. Building codes continue to evolve, pushing for higher thermal performance standards. The market also witnesses ongoing research and development efforts in bio-based and recyclable insulation materials to address environmental concerns.

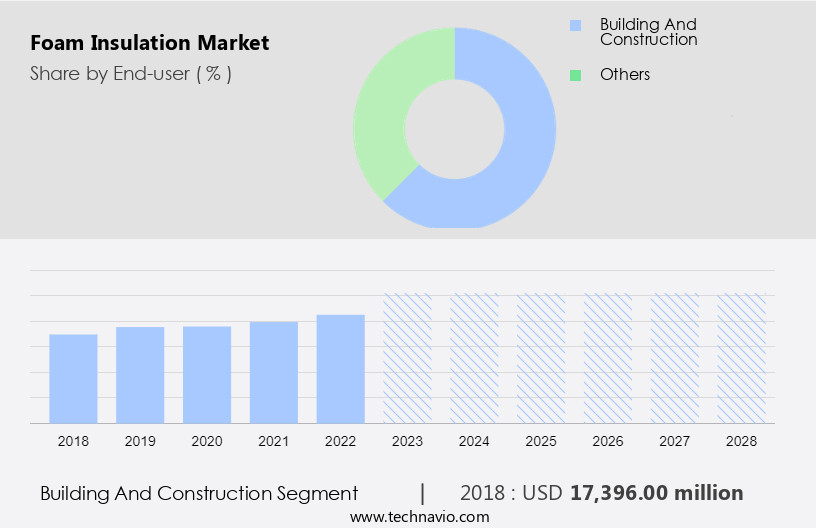

How is this Foam Insulation Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Building and construction

- Others

- Type

- Polystyrene foam

- Polyurethane and polyisocyanurate foam

- Phenolic foam

- Polyolefin foam

- Elastomeric foam

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The building and construction segment is estimated to witness significant growth during the forecast period.

The market is driven by the construction industry's demand for energy efficiency and sustainability. Foam insulations, including rigid, spray, flexible, polyolefin, polyurethane, polystyrene, elastomeric, phenolic, and other types, offer excellent thermal insulation properties, reducing heat transfer and energy consumption. They also minimize greenhouse gas emissions and improve indoor air quality by preventing allergens, dust, mold, and condensation. With the increasing focus on green buildings and sustainable construction practices, the market for foam insulation is expected to grow significantly during the forecast period. The construction industry's expansion in developing countries, such as China and India, due to urbanization and infrastructure development, will further fuel the demand for foam insulation.

The HVAC industry and industrial sectors, including manufacturing, are also significant consumers of foam insulation for thermal insulation solutions and retrofitting activities. Key players offer a range of foam insulation types and specialized equipment to meet various industry requirements. Building codes and fire safety regulations also mandate the use of insulation materials with high thermal performance and energy efficiency. The market is expected to continue growing, driven by the increasing demand for energy-efficient and sustainable insulation materials.

Get a glance at the Industry report of share of various segments Request Free Sample

The building and construction segment was valued at USD 17.4 billion in 2018 and showed a gradual increase during the forecast period.

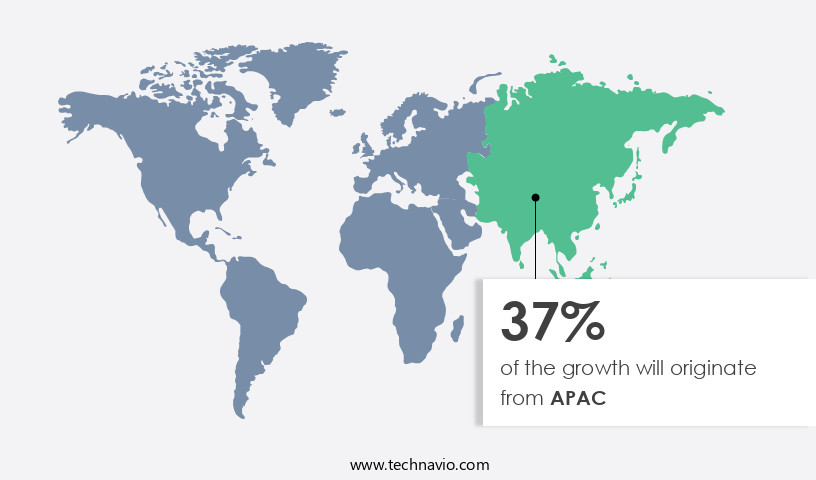

Regional Analysis

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market experienced significant growth in 2023, with APAC being the largest regional segment. Factors contributing to this expansion include population growth and urbanization in major countries like China, India, Malaysia, and Indonesia. The region's GDP growth, particularly in India and China, is driving demand for consumer appliances, such as refrigerators, coolers, and washing machines. These appliances require foam insulation for packaging, leading to increased demand. Furthermore, investments In the construction industry and other sectors in developing countries are expected to boost demand for foam insulation. Energy efficiency and sustainability are key considerations in insulation materials, making foam insulation an attractive option due to its thermal performance.

Building codes and green building certifications also promote the use of energy-efficient materials, further fueling market growth. Foam insulation materials include rigid foam, spray foam, flexible foam, polyolefin foam, polyurethane foam, polystyrene foam, elastomeric foam, phenolic foam, and others. These materials offer varying thermal performance and are used in residential, commercial, and industrial construction, as well as In the HVAC industry and retrofitting activities. Insulation materials are essential for reducing heat transfer, minimizing greenhouse gas emissions, and improving energy consumption efficiency. They also help prevent allergens, dust, mold, and condensation. Specialized equipment and fire safety regulations ensure the safe application and use of foam insulation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Foam Insulation Industry?

Increasing demand for foam insulation is the key driver of the market.

- The market experiences significant growth due to its essential role in reducing heat transfer in various industries. In the automotive sector, foam insulation is utilized for manufacturing automotive parts, including side skirts, wiper cowls, roll pans, and bumpers. The increasing demand for polyisocyanurate and phenolic foams in insulating automotive components and parts drives market expansion. Notably, the development of polystyrene and polyurethane foams has fueled market growth, as these foams are commonly used for interior components such as seats, headrests, armrests, roof liners, dashboards, and instrument panels. Energy consumption and greenhouse gas emissions reduction are crucial factors driving the adoption of foam insulation in buildings and industrial sectors.

- Foam insulations, including loose fill, rigid, spray, elastomeric, polyolefin, polyurethane, polystyrene, phenolic, and other types, offer excellent thermal insulation performance. Building codes increasingly mandate the use of energy-efficient insulation materials, and the HVAC industry, retrofitting activities, and industrial sectors are significant consumers. Moreover, the growing emphasis on sustainability, green buildings, and sustainable construction practices has led to the increased use of bio-based and recyclable materials in insulation. The market comprises various thermal insulation solutions, such as aerogels, vacuum insulation panels, and phase change materials, in addition to rigid foam insulation from companies like BASF. Indoor air quality, specialized equipment, and fire safety regulations are other essential considerations In the market.

What are the market trends shaping the Foam Insulation Industry?

Innovation in polyurethane foams is the upcoming market trend.

- The market encompasses various types of foam insulations, including rigid, spray, flexible, polyolefin, polyurethane, polystyrene, elastomeric, phenolic, and others. These insulations offer excellent thermal insulation properties by reducing heat transfer and minimizing energy consumption. However, they also provide additional benefits such as reducing greenhouse gas emissions, improving indoor air quality, and complying with fire safety regulations. Polyurethane foams, formed by reacting a polyol with a diisocyanate or a polymeric isocyanate, are gaining popularity due to their superior thermal performance. Innovations in this field include the development of photo-cross-linkable polyurethane foams. These new forms of foam insulation contain photo-responsive groups like coumarin, which dimerize upon UV light irradiation and can be cleaved again with light of a different wavelength.

- This property makes them suitable for various applications, such as reefer trailers, trucks, and industrial sectors. The market dynamics are driven by factors like energy efficiency, sustainability, and building codes. The HVAC industry, residential, commercial, and industrial construction sectors, and retrofitting activities are significant contributors to the market growth. Additionally, the increasing focus on green buildings, sustainable construction practices, and energy-efficient materials is expected to further boost the demand for foam insulation solutions. Bio-based materials and recyclable materials are becoming increasingly important In the foam insulation industry due to their environmental benefits. Aerogels, vacuum insulation panels, and phase change materials are some of the emerging insulation technologies that offer superior thermal performance.

What challenges does the Foam Insulation Industry face during its growth?

Fluctuation in crude oil prices is a key challenge affecting the industry growth.

- The market is driven by the need for effective thermal insulation to reduce heat transfer and enhance energy efficiency in various sectors, including residential, commercial, and industrial construction, as well as the HVAC industry. However, the use of foam insulations, such as rigid foam, spray foam, flexible foam, polyolefin foam, polyurethane foam, polystyrene foam, elastomeric foam, phenolic foam, and specialized insulation materials like aerogels, vacuum insulation panels, and phase change materials, comes with challenges. Raw materials, primarily petrochemical-based substances, account for a substantial portion of the production costs In the foam insulation industry. Fluctuations in raw material prices can create uncertainty in production costs for manufacturers, making it challenging to plan budgets, forecast profitability, and make strategic decisions regarding pricing and investments.

- When raw material prices rise, manufacturers may struggle to pass on the increased costs to customers due to competitive pressures or existing contractual agreements, potentially impacting their profit margins and financial viability. Moreover, foam insulation materials can pose challenges related to indoor air quality, with potential allergens, dust, and mold concerns. Adherence to fire safety regulations and building thermal insulation requirements is crucial in various applications. The shift towards green buildings and sustainable construction practices, as well as the adoption of energy-efficient materials and green building certifications, also influences market dynamics. In summary, the market faces challenges related to raw material costs, indoor air quality concerns, and regulatory compliance, while opportunities exist In the form of energy efficiency, sustainability, and the growing demand for thermal insulation solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alaska PUF Industries

- Alpers Insulation

- Armacell International SA

- Asahi Kasei Corp.

- BASF SE

- Berkshire Hathaway Inc.

- Compagnie de Saint Gobain

- Covestro AG

- DuPont de Nemours Inc.

- Elastochem Specialty Chemicals Inc.

- Green Insulation Technologies

- Huntsman International LLC

- Isothane Ltd.

- Kingspan Group Plc

- Owens Corning

- Paulsen Insulation Co. LLC

- Profoam Corp.

- Puff Inc.

- Ravago

- Southern Foam Insulation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of insulation materials, including rigid foam, spray foam, flexible foam, polyolefin foam, polyurethane foam, polystyrene foam, phenolic foam, elastomeric foam, and others. These insulation types offer various benefits in terms of thermal performance and energy efficiency, making them essential components in various industries and construction sectors. Heat transfer is a significant concern in many applications, and foam insulation plays a crucial role in mitigating it. By reducing heat transfer between indoor and outdoor environments, these insulation materials help maintain comfortable temperatures and reduce energy consumption. This is particularly important In the transportation sector, where reefer trailers and trucks rely on insulation to maintain the temperature of perishable goods.

However, foam insulation's benefits extend beyond thermal insulation. It also helps address environmental concerns, such as greenhouse gas emissions and indoor air quality. They can contribute to the reduction of greenhouse gas emissions by improving energy efficiency and reducing the need for energy-intensive heating and cooling systems. Aerogels, vacuum insulation panels, and phase change materials are emerging alternatives to traditional foam insulation. Additionally, some types are free of allergens, dust, and mold, making them suitable for applications where indoor air quality is a concern. Condensation is another issue that foam insulation addresses. By preventing the transfer of heat, they help prevent condensation, which can lead to moisture damage and other issues.

Furthermore, this is particularly important in building construction, where proper insulation is essential for maintaining a healthy and energy-efficient structure. The market is diverse and caters to various industries and construction sectors, including residential, commercial, and industrial. In residential construction, it is used to improve energy efficiency and reduce heating and cooling costs. In commercial construction, it is used to meet building codes and maintain comfortable indoor temperatures. In industrial construction, it is used to insulate industrial processes and equipment, ensuring energy efficiency and safety. The HVAC industry also relies on foam insulation to improve energy efficiency and reduce energy consumption.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 20.27 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

China, US, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.