Food Emulsifiers Market Size 2022-2026

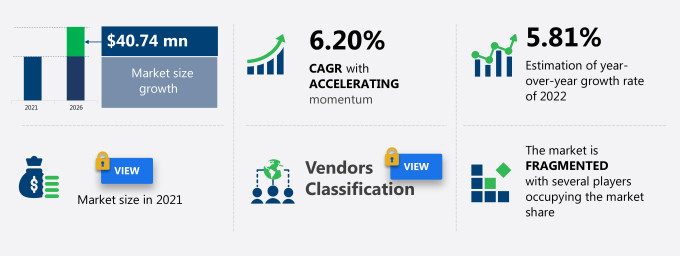

The food emulsifiers market share in India is expected to increase by USD 40.74 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 6.20%.

The increasing demand from the bakery and confectionery sectors is a major factor driving the growth of the food emulsifier market in India. Additionally, the rising demand for emulsifiers in emerging economies is contributing significantly to this market's expansion. Shifting urban lifestyles have led to a higher demand for processed foods, where emulsifiers play a crucial role as essential ingredients in many products.

What will the Food Emulsifiers Market Size in India be During the Forecast Period?

Download the Free Report Sample

The stearoyl lactylates market is growing rapidly as demand for natural emulsifying agents continues to rise in response to the consumer shift towards clean-label products. This trend is driven by changing dietary patterns, with a focus on healthier, more natural ingredients in processed foods. As consumers prioritize quality, products with natural ingredients like plant-based lecithin and plant-based substances are gaining traction, especially in the premiumization of foods. In the bakery sector, stearoyl lactylates are highly valued for their ability to improve texture enhancement and mouthfeel, contributing to better sensory appeal and product stability. These emulsifiers are used in a variety of applications such as sauces, frozen foods, and packaged dairy to extend shelf-life and ensure compatibility with various processing conditions. The increasing use of polyhydric emulsifiers and starch-based emulsifiers also supports the rise in emulsifier demand, especially for veganism and fat reduction.

As urbanization continues and disposable incomes rise, there is an increase in the consumption of packaged foods like cereals, bread, and frozen items. The shift towards healthier options, including monoglycerides and sorbitan derivatives, is evident in the growing popularity of encapsulation and dissolution-precipitation processes that enhance product stability and product structure. Additionally, the demand for working women's convenience foods, like ready-made packaged dairy, is contributing to this trend. With the increased focus on product stability and clean-label claims, emulsifier innovations are playing a critical role in developing food products that meet the evolving needs of consumers seeking natural and healthier alternatives.

Food Emulsifiers Market Dynamic

The growing demand from the bakery and confectionery industries is notably driving the food emulsifiers market growth in India, although factors such as the rise in the demand for enzymes as a substitute for emulsifiers may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the food emulsifiers industry in India. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Food Emulsifiers Market Driver in India

The growing demand from the bakery and confectionery industries is one of the key drivers supporting the food emulsifier market growth in India. There are many varieties of emulsifiers available in the market. Thus, the growth of the bakery and confectionery market is interdependent on the growth of the food emulsifiers market in India. Meanwhile, chocolate and sugar confectionery products both use emulsifiers. They act as functional additives that provide benefits during the processing and storage of chocolates and sugar confectioneries. For example, emulsifiers break down the fat into small fat globules in food such as caramel and toffee that contain dispersed fat phases. They also provide lubrication that makes the processing of food easier. Thus, the growing demand for food emulsifiers from the bakery and confectionery industries is expected to positively impact the market during the forecast period.

Key Food Emulsifiers Market Trends in India

Growing demand for emulsifiers from emerging economies is one of the key trends contributing to the food emulsifiers market growth in India. Changing urban lifestyles have given rise to the demand for processed food. Emulsifiers are essential ingredients in most processed food. They are heavily demanded by the manufacturers of such food. Furthermore, the multi-functional capacity of emulsifiers to bind water and oil and improve processing rate and shelf lives leads to high-quality food products. Manufacturers of various bakery and confectionery products and convenience/RTE food regularly utilize food emulsifiers. Developing economies such as Brazil, Argentina, and India are expected to become the key markets for food emulsifiers during the forecast period. Therefore, the growing demand for emulsifiers from emerging economies will further enhance the growth of the market during the forecast period.

Key Food Emulsifiers Market Challenge in India

The rise in the demand for enzymes as a substitute for emulsifiers is one of the factors hindering the food emulsifiers market growth in India. Although the time taken by different enzymes to work with ingredients vary from that of emulsifiers, certain enzymes perform a swifter action. This indicates that enzymes can be a good alternative to food emulsifiers. Also, enzymes are more cost-effective. There are different enzymes available in the market. They are often used during the handling, mixing, and fermentation stages of dough. Thus, enzymes help in the better processing of food in baking. The rise in the demand for enzymes as a substitute for emulsifiers is expected to negatively impact the market during the forecast period.

This food emulsifiers market in India analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch

Parent Market Analysis

Technavio categorizes the food emulsifiers market in India as a part of the global commodity chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the food emulsifiers market in India during the forecast period.

Who are the Major Food Emulsifiers Market Vendors in India?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- AAK AB

- Archer Daniels Midland Co.

- BASF SE

- Cargill Inc.

- Corbion NV

- DuPont de Nemours Inc.

- Gujarat Ambuja Exports Ltd.

- Ingredion Inc.

- Kerry Group Plc

- Puratos Group NV

This statistical study of the food emulsifiers market in India encompasses successful business strategies deployed by the key vendors. The food emulsifiers & natural food additives, the market in India is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- AAK AB - The company offers food emulsifiers products such as Lecithin.

- Archer Daniels Midland Co. - The company offers food emulsifiers products such as ADM PurelyForm Emulsifier.

- BASF SE - The company offers food emulsifiers products such as Lamemul K 2000 K and Lamemul K 2001 S.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.The food emulsifiers market in India forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Food Emulsifiers Market in India Value Chain Analysis

Our In-house experts produce extensive information on the value chain, and parent market of Food Emulsifier which vendors can leverage to gain a competitive advantage during the forecast period. The Value Chain information provides an end-end understanding of product insight and profit also optimization and evaluation of business strategies. The players across the value chain include selective data and analysis from entire research findings as per the scope of the Report.

The value chain of the commodity chemicals market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Support activities

- Innovations

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

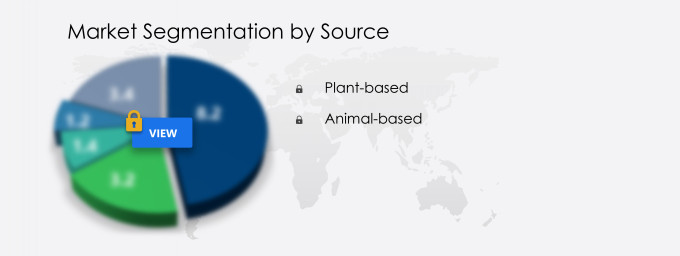

What are the Revenue-generating Source Segments in the Food Emulsifiers Market In India?

To gain further insights on the market contribution of various segments Request for a FREE sample

The food emulsifiers market share growth in India by the plant-based segment will be significant during the forecast period. Plant-based emulsifiers are defined as a group of natural emulsifiers. There are many vegan or plant-based emulsifiers that are used in preparing recipes, such as wheat, soy, pea protein-based, or any type of healthy unsaturated vegetable oil. Some of the best-known plant-based emulsifiers are agar-agar, guar gum, convenience food, and others. All these plant-based emulsifiers are high in demand which in turn will drive market growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the food emulsifiers market in India size and actionable market insights on post COVID-19 impact on each segment.

Market Research Overview

The emulsifier market is evolving rapidly, driven by consumer trends in healthy eating and conscious consumerism. As demand for clean label ingredients grows, food manufacturers are increasingly focused on sustainable production and sourcing natural additives to meet the rising demand for plant-based and vegetarian products. Industry research and science are key drivers of innovation, with new functional ingredients being developed to enhance food quality and preservation.The need for safety regulations and labeling compliance is critical, particularly as consumers demand transparency regarding ingredients and processing technology. Industry insights reveal a strong push for health and wellness trends, influencing product development in areas like processed fish, where emulsifier applications help with stabilization and preservation of freshness and texture.

Phospholipids and other functional ingredients are at the forefront of formulation, improving product volume and extending shelf life. Manufacturers are also focusing on the regulatory landscape, which is shaping ingredient trends and product formulations. With growing attention on safety and science research, companies are aligning their operations with industry trends to offer innovative, high-quality products that meet the needs of today's health-conscious consumers.

|

Food Emulsifiers Market In India Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.20% |

|

Market growth 2022-2026 |

USD 40.74 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.81 |

|

Regional analysis |

India |

|

Performing market contribution |

India at 100% |

|

Key consumer countries |

India and Rest of APAC |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AAK AB, Archer Daniels Midland Co., BASF SE, Cargill Inc., Corbion NV, DuPont de Nemours Inc., Gujarat Ambuja Exports Ltd., Ingredion Inc., Kerry Group Plc, and Puratos Group NV |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Food Emulsifiers Market in India Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive food emulsifiers market growth in India during the next five years

- Precise estimation of the food emulsifiers market size in India and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the food emulsifiers industry in India across India

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of food emulsifiers market vendors in India

We can help! Our analysts can customize this report to meet your requirements. Get in touch