Fortified Wine Market Size 2024-2028

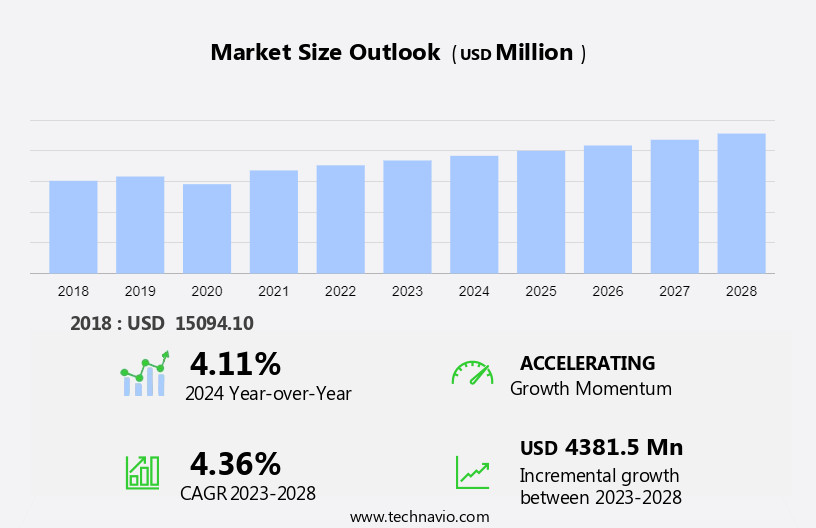

The fortified wine market size is forecast to increase by USD 4.38 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing consumption rate of fortified wines and the rising popularity of natural ingredients in mixology and cocktail culture. This trend is particularly evident in the popularity of dessert wines and aperitifs, which are often used as base ingredients in cocktails. However, the market faces challenges, including the negative perception associated with fortified wines and the impact of lockdowns and social distancing measures on traditional sales channels. Fortified wines, including sherry, port, vermouth, and dessert wines, offer consumers a premium experience, innovation in flavors, and social recognition.

- Fortified wine is considered a healthier choice compared to other alcoholic drinks due to its reduced alcohol consumption and level of antioxidants. Online wine auctions and sales platforms have emerged as key growth areas, offering consumers convenience and access to a wide range of fortified wines. As consumers continue to explore new ways to enjoy these unique and flavorful wines, the market is expected to continue its expansion.

What will be the Size of the Market During the Forecast Period?

- The alcoholic drinks industry continues to evolve, with fortified wines gaining significant attention due to their unique characteristics and various health benefits. Amid economic uncertainty, the working population is seeking more sustainable and session-able choices in alcohol, prompting investment in R&D by companies focused on improving the quality of wine, enhancing production facilities, and optimizing distribution centers, while craft brands continue to thrive, especially in pubs where consumers increasingly prioritize both taste and sustainability. Social media promotions and the influence of mixologists have contributed to the growing popularity of fortified wines. These beverages are increasingly being used as mixers in cocktails, expanding their consumer base beyond traditional markets. Brand recognition plays a crucial role in the market.

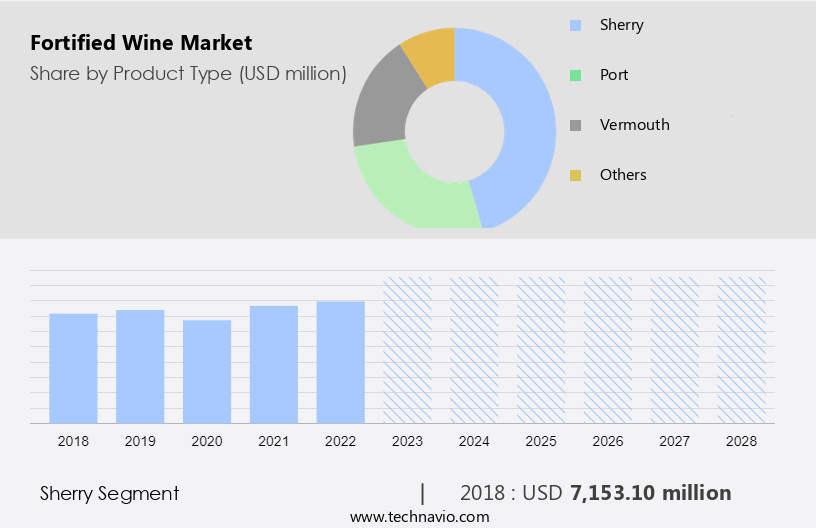

- Furthermore, alcohol Taxation and Regulations Increased taxation on alcoholic beverages, including fortified wines, may impact market growth. However, the implementation of strict regulations by authorities like the FSSAI ensures the production and sale of safe and authentic fortified wines, maintaining consumer trust. Segment Analysis The sherry segment holds a significant share of the market, with popular varieties like Amontillado, Fino, and Oloroso driving growth. The vermouth segment is also gaining popularity, particularly in the cocktail industry, due to its versatility and unique taste profile. Distribution Channels Fortified wines are available in various distribution channels, including liquor stores and single-spirit bars.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Sherry

- Port

- Vermouth

- Others

- Distribution Channel

- Off-trade

- On-trade

- Body Type

- Light bodied

- Medium bodied

- Full bodied

- Sweetness Level

- Dry

- Semi Sweet

- Sweet

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- US

- APAC

- South America

- Middle East and Africa

- Europe

By Product Type Insights

The sherry segment is estimated to witness significant growth during the forecast period. Fortified wines, including sherry, hold a distinguished place in the global market for alcoholic drinks due to their unique production methods and various health benefits. The sherry segment, in particular, is experiencing growth driven by its intricate production process and the premiumization trend. The solera system, a traditional method of aging sherry wines, sets it apart from other wines by blending young wines with older ones in a cascading manner. This results in a complex and desirable flavor profile that appeals to discerning consumers. For instance, a bottle of Amontillado Sherry may contain a small proportion of very old wine combined with a larger proportion of younger wine, creating a unique and sought-after taste.

Furthermore, the health benefits associated with fortified wines, such as potential heart health advantages, further add to their allure. However, increased taxation and regulations from organizations like the Food Safety and Standards Authority of India (FSSAI) may pose challenges to market growth. Despite these obstacles, innovation in flavors and social recognition continue to drive consumer interest in fortified wines.

Get a glance at the share of various segments. Request Free Sample

The sherry segment was valued at USD 7.15 billion in 2018 and showed a gradual increase during the forecast period.

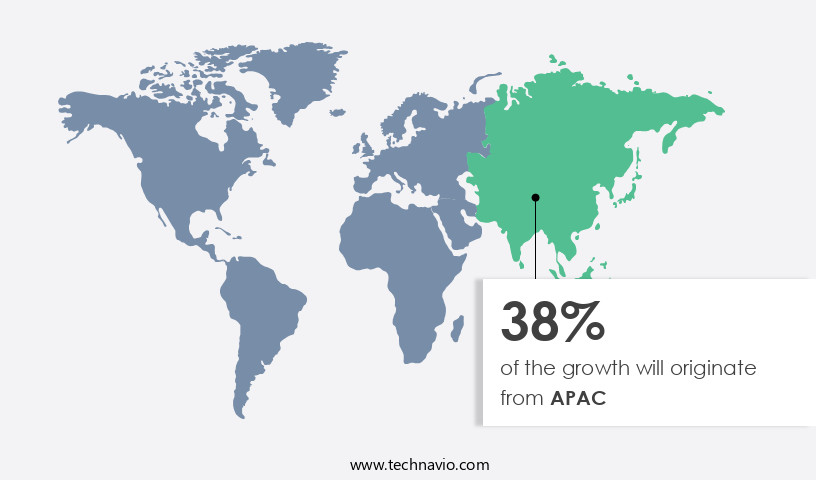

Regional Insights

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Europe holds a prominent position in the global wine market, recognized for its deep-rooted wine-making traditions and diverse regions. With a history spanning centuries, countries such as France, Italy, and Spain have honed their winemaking skills, resulting in exceptional wines that boast unparalleled taste and character. Notably, French wines like Bordeaux and Burgundy have gained global acclaim for their distinctive flavors. Europe's extensive wine regions enable the production of a vast array of grape varietals, catering to diverse consumer preferences. In the modern market landscape, fortified wines, including Sherry, Port, and Vermouth, have gained traction. Single-spirit bars have increasingly showcased these fortified wines, contributing to their growing popularity.

Furthermore, brands have capitalized on this trend through strategic marketing efforts and social media promotions. Europe's rich wine heritage, coupled with innovative marketing strategies, continues to strengthen brand recognition and drive growth in the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising consumption rate of wine consumption is the key driver of the market. The consumption of fortified wine in the market has experienced notable growth in recent times. This trend can be linked to several factors, including altering consumer tastes, escalating disposable incomes, and the expansion of wine tourism. One significant factor contributing to this increase in consumption is the evolution of consumer preferences towards healthier and premium alcoholic beverages. Moreover, the diverse range of flavors and types offered by fortified wine caters to the varying taste preferences of consumers. Mixologists have been incorporating fortified wines, such as those aged in Amontillado Sherry casks, into their creations, adding a unique twist to classic cocktails.

Brands have gained popularity for their innovative approaches to fortified wine production. The antioxidant properties of fortified wine, coupled with its rich flavors, make it an attractive option for health-conscious consumers seeking a premium alcoholic beverage experience. The market is expected to continue its growth trajectory, driven by these factors and the increasing popularity of fortified wine among consumers.

Market Trends

The growing popularity of online wine auctions and sales platforms is the upcoming trend in the market. The market is experiencing a significant shift towards online wine auctions and sales platforms in the current economic climate. These digital marketplaces have gained prominence among wine connoisseurs and collectors due to their accessibility and convenience. One of the primary reasons for the rising preference for online platforms is the flexibility they offer. Buyers can effortlessly explore an extensive collection of fortified wines from their preferred locations, eliminating the need to visit physical auction houses or retail stores. This convenience is especially valuable for time-strapped individuals who cannot attend live auctions or travel to wine shops.

Furthermore, the increasing trend towards sustainable, organic production in the fortified wine industry is also driving demand for low-alcohol and session-able choices on these platforms. Consumers are increasingly seeking out wines produced using eco-friendly and sustainable methods, as well as those with lower alcohol content, making online sales platforms an ideal destination for these preferences. Additionally, the availability of extensive product information, customer reviews, and competitive pricing on these platforms further enhances their appeal. Overall, the future of the market looks promising, with online sales platforms poised to play a pivotal role in catering to the evolving preferences and needs of consumers.

Market Challenge

Negative perception associated with fortified wines is a key challenge affecting the market growth. Fortified wines, such as madeira, dessert wines, and aperitifs, have faced a negative reputation among consumers due to their historical association with abandoned or confiscated bottles. This perception is largely based on the belief that these wines have been fortified due to inferior quality or production issues. However, the fortification process itself is a unique and intriguing aspect of winemaking, which is gaining popularity in the mixology and cocktail culture scenes. With the rise of social distancing measures and lockdowns, consumers have been exploring new ways to enjoy their favorite beverages at home. Fortified wines offer an excellent solution for those seeking a complex and flavorful drinking experience.

Furthermore, their versatility in mixology makes them a staple ingredient for creating innovative and delicious cocktails. Despite the negative perception, the use of natural ingredients in the production of fortified wines ensures a high-quality and authentic taste. As consumers become more educated about the benefits and unique characteristics of these wines, the market is poised for growth. The trend towards healthier lifestyles and lower alcohol content may also contribute to the increasing popularity of fortified wines as a dessert wine alternative. In conclusion, the market presents a unique and exciting opportunity for both producers and consumers. By embracing the historical significance and unique production process, as well as the growing popularity in mixology and cocktail culture, fortified wines can shed their negative reputation and become a sought-after beverage choice for discerning consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bacardi Ltd: The company offers fortified wine such as Bacardi Lemon.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anchor Brewers and Distillers LLC

- Bacardi Ltd.

- Campari Group

- Contratto srl

- DOWS Port

- E. and J. Gallo Winery

- Emilio Lustau S.A.

- Fonseca Port Wine

- Fratelli Gancia and C. SpA

- Mazurans Vineyards Ltd.

- Precept Wine

- Ramos Pinto

- Rhys and Rylee LLC

- SOGEVINUS FINE WINES SA

- Sogrape SGPS SA

- Symington Family Estates Vinhos S.A.

- Taylors Port

- The Great Wine Co.

- Vinbros and Co.

- Vinimark Trading Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fortified wines, a category of alcoholic drinks known for their distinctive flavors and health benefits, have been gaining popularity among consumers worldwide. The premiumization trend in the alcoholic drinks market has led to innovation in flavors and product offerings, making fortified wines an attractive choice for social recognition. Various health benefits associated with fortified wines, including antioxidants and natural ingredients, have contributed to their growing appeal. However, increased taxation and regulatory bodies like FSSAI have imposed challenges on the market. The vermouth segment and dessert wine categories have seen significant growth due to consumer preferences for product innovations.

Furthermore, liquor stores and internet retailing have emerged as key distribution channels, while production facilities and distribution centers have become essential components of the supply chain. Seasonal variations and grapes are crucial factors influencing the production of fortified wines. The sherry and port segments have gained traction due to their unique flavors and brand recognition. Mixologists and cocktail culture have further fueled the demand for fortified wines in bars and restaurants. The cannabis industry's emergence has led to new opportunities for fortified wine producers, with some experimenting with cannabis-infused products. The working population's shifting preferences towards premium drinks, low-alcohol choices have also impacted the market dynamics. Sustainable and organic production methods have become essential for fortified wine producers seeking to cater to evolving consumer demands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market Growth 2024-2028 |

USD 4.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 38% |

|

Key countries |

US, France, Italy, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anchor Brewers and Distillers LLC, Bacardi Ltd., Campari Group, Contratto srl, DOWS Port, E. and J. Gallo Winery, Emilio Lustau S.A., Fonseca Port Wine, Fratelli Gancia and C. SpA, Mazurans Vineyards Ltd., Precept Wine, Ramos Pinto, Rhys and Rylee LLC, SOGEVINUS FINE WINES SA, Sogrape SGPS SA, Symington Family Estates Vinhos S.A., Taylors Port, The Great Wine Co., Vinbros and Co., and Vinimark Trading Pty Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch