Freestanding Playground Equipment Market Size 2025-2029

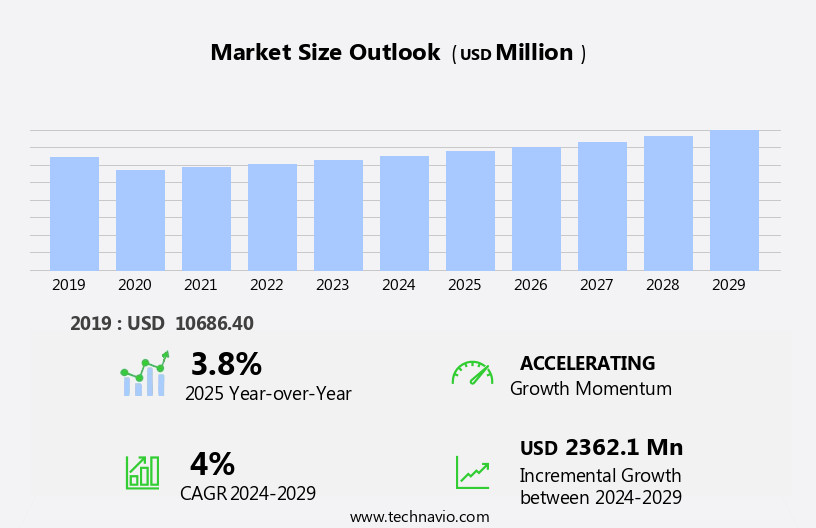

The freestanding playground equipment market size is forecast to increase by USD 2.36 billion at a CAGR of 4% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. The increasing urbanization rate in various regions is driving the demand for open spaces, leading to the installation of freestanding playground equipment in parks and public areas. Materials used in manufacturing include metal, stainless steel, plastic, and wood. Furthermore, the rise in the number of preschools and daycare centers is boosting market growth as these institutions prioritize providing safe and engaging play areas for children.

- Additionally, the growing adoption of online games and digital entertainment is encouraging parents to encourage their children to engage in outdoor activities, thereby increasing the demand for freestanding playground equipment. These trends are expected to continue shaping the market dynamics in the coming years.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a range of independent structures designed for children's recreational use in various settings, including schools, parks, daycare centers, playschools, and recreational areas. Equipment offerings span from traditional items like swings, slides, and seesaws to innovative designs such as climbers, balance beams, spinners, interactive panels, and rope courses. Materials used in manufacturing include metal, stainless steel, plastic, and wood.

- The market's growth is driven by increasing demand from working women and dual-income households for affordable, high-quality child products. Parents prioritize safety, durability, and accessibility In their purchasing decisions. Overall, the market continues to expand, catering to the diverse needs of children in various settings.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Slides

- Swings

- Climbers

- Others

- Application

- Parks and amusement parks

- Communities

- Schools

- Others

- Type

- Fixed/stationary equipment

- Portable equipment

- Material

- Metal

- Plastic

- Wood

- Composite

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

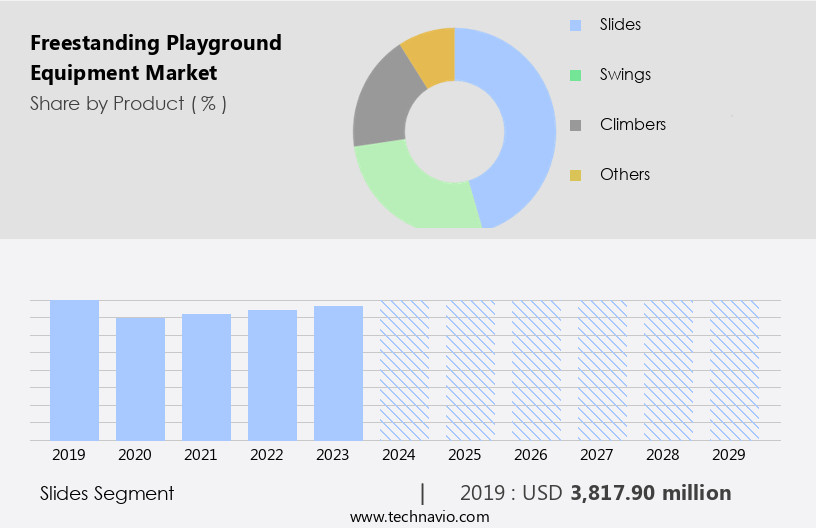

The slides segment is estimated to witness significant growth during the forecast period. Freestanding playground equipment, including climbers, slides, swings, and play structures, is a crucial component of public spaces, schools, communities, daycare centers, and recreational areas. Climbers, such as balance beams and spinners, promote physical activity and child development by enhancing balance, coordination, and spatial awareness. Slides, available in various types, including straight, wavy, tunnel, spiral, and parallel, are popular among children and offer essential physical benefits. These structures are typically made of materials like stainless steel, plastic, or wood and cater to children of all ages, from toddlers to school-aged children. The availability of inclusive playground equipment ensures community well-being and safety standards for all children.

Get a glance at the market report of share of various segments Request Free Sample

The slides segment was valued at USD 3.82 billion in 2019 and showed a gradual increase during the forecast period.

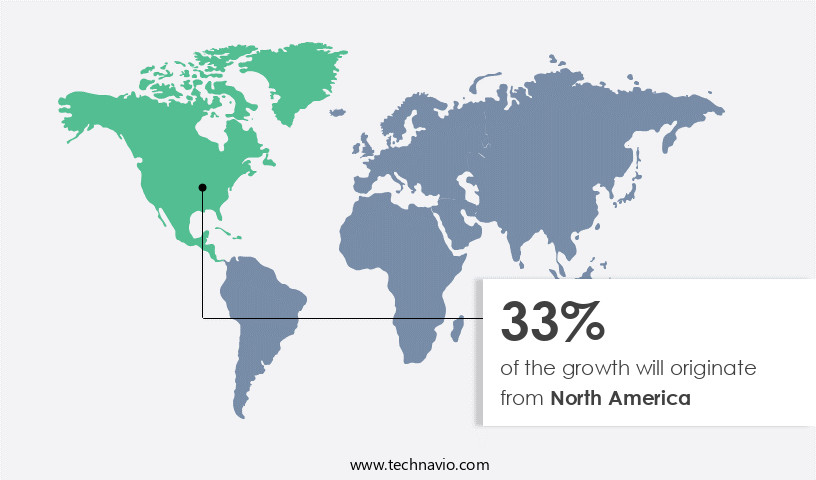

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American region dominates The market due to the presence of key players like Dynamo Industries and Playcraft Systems. In the US, Canada, and Mexico, the market is driven by factors such as increasing demand for inclusive playground equipment that caters to children of all abilities, and a growing focus on physical activity to combat childhood obesity. In Canada, specialty stores prioritize high-quality products and the premium segment to outperform the competition. Consumers are shifting towards scientific and educational playground equipment to foster early childhood development. Safety regulations are stringent in North America, ensuring the safety of children using these structures.

For more insights on the market size of various regions, Request Free Sample

Moreover, freestanding playground equipment includes various types such as climbers, balance beams, spinners, interactive panels, slides, swings, seesaws, spring riders, and rope courses, available in materials like metal, plastic, and wood. These products cater to children and toddlers in schools, communities, parks, daycare centers, recreational areas, and playschools. Caregivers, educators, urban planners, and parents are key stakeholders In the market, ensuring affordability and adherence to safety standards.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Freestanding Playground Equipment Industry?

- The growing urbanization rate is the key driver of the market. The global demand for freestanding playground equipment, including climbing structures, slides, swings, and other play structures, is experiencing significant growth due to the increasing urbanization rate and the rise of working women and dual-income households. In many developing countries, such as Brazil, China, and India, urbanization has led to an increase in demand for child products, including freestanding playground equipment. In 2023, North America had an urbanization rate of 83.3%, Europe had an urbanization rate of 75%, while the rate of urbanization was 36.3% in Asia, and 81.5% in South America. According to the World Bank Group, India, China, Indonesia, Nigeria, and the US are expected to account for the highest share of the global urban population by 2050.

- Parents, educators, urban planners, and caregivers recognize the importance of physical activity for children's health and development, particularly In the context of sedentary lifestyles and childhood obesity. Freestanding playground equipment, such as climbers, balance beams, spinners, interactive panels, seesaws, spring riders, rope courses, and swings, provide opportunities for children, toddlers, and even disabled children to engage in outdoor play and inclusive playground equipment. These products come in various materials, including metal, plastic, and wood, catering to different safety standards and budgets. Dynamo Industries, Kidstuff Playsystems, Park Supplies, and Play & Park Structures are among the leading commercial playground equipment providers.

What are the market trends shaping the Freestanding Playground Equipment Industry?

- Increase in number of preschools is the upcoming market trend. The market encompasses a range of products, including Climbing Equipments, Slides, Swings, and Play structures, designed for Schools, Communities, Daycare centers, Recreational areas, and other Public spaces. These products cater to Children of all ages, from Toddlers to School-going Children, and come in various materials such as Metal, Plastic, and Wood. The market dynamics are driven by the growing awareness of the importance of Physical activity in combating Sedentary lifestyles and Childhood obesity. Parents, Educators, Urban planners, and Caregivers recognize the role of Inclusive playground equipment in promoting Child development and Community well-being. Safety regulations are stringently enforced to ensure the Safety standards of these products.

- The Market offers a wide range of products, including Climbers, Balance beams, Spinners, Interactive panels, Slides, Swings, Seesaws, Spring riders, Rope courses, and more. Brands like Dynamo Industries, Kidstuff Playsystems, Park Supplies, and Play & Park Structures cater to the demand for Commercial playground equipment in Playschools and Preschools. Product affordability is a crucial factor for Dual-income households, making it essential for manufacturers to offer competitive pricing while maintaining Safety and Quality. The Market continues to evolve, with new innovations in Materials and Designs, such as Stainless steel and Interactive panels, catering to the changing needs of Children and the Community.

What challenges does the Freestanding Playground Equipment Industry face during its growth?

- Growing adoption of online games is a key challenge affecting the industry growth. The market faces challenges due to the increasing popularity of digital games among children. Traditional playground equipment, such as Climbing Equipments, Slides, Swings, and Play structures made of Metal, Plastic, or Wood, continue to be essential components of Schools, Communities, Parks, Daycare centers, and Recreational areas. However, the rise of interactive digital games, including Climbers, Balance beams, Spinners, Interactive panels, and Seesaws in digital form, is significantly impacting the market. Children, from Toddlers to school-going age, are increasingly drawn to the convenience and entertainment offered by digital games. Physical activity through outdoor play is being overshadowed by sedentary lifestyles, contributing to concerns regarding Childhood obesity.

- Parents, Educators, Urban planners, and Caregivers are advocating for the importance of outdoor play and inclusive playground equipment that caters to children with different abilities. Safety regulations and standards are stringently enforced to ensure the well-being of children using playground equipment. Commercial playground equipment manufacturers, such as Dynamo Industries, Kidstuff Playsystems, Park Supplies, and Play & Park Structures, offer a wide range of products, including Spring riders, Rope courses, and Swings, adhering to safety guidelines. Despite these challenges, the market for freestanding playground equipment remains vital due to its role in child development and community well-being. The affordability and availability of various product options cater to the needs of Dual-income households and Working women.

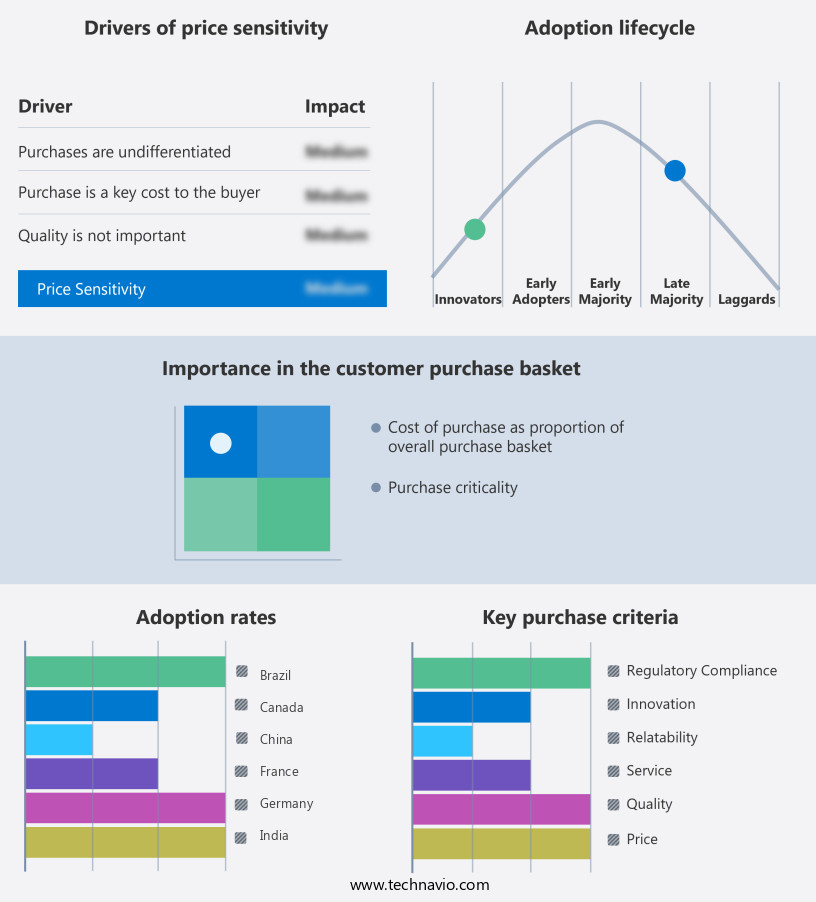

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BCI Burke Co. - The company offers freestanding playground equipment such as educational play, electronic play, swings, climbers, and slides.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BuildIndia

- Childforms

- Dynamo Industries Inc.

- E. Beckmann e.K.

- European Leisure Industries BV

- FUN PLAY SYSTEMS Pvt. Ltd.

- Funriders

- HAGS Aneby AB

- HENDERSON RECREATION EQUIPMENT Ltd.

- Kaiqi Group Co. Ltd.

- Kidstuff Playsystems

- KOMPAN AS

- Landscape Structures Inc.

- Playcraft Systems Inc.

- Playmart Inc.

- Pro Playgrounds

- Sportsplay Equipment Inc.

- Treadwall Fitness

- VINEX Enterprises Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products designed to promote physical activity and child development in various public spaces. These equipment categories include climbers, slides, swings, balance beams, spinners, interactive panels, and other play structures. The market caters to numerous sectors, including schools, communities, parks, children daycare services, recreational areas, and educational institutions. Freestanding playground equipment plays a vital role in addressing sedentary lifestyles and childhood obesity concerns. With increasing awareness of the importance of physical activity for children's health and wellness, there is a growing demand for these products in public spaces. Parents, educators, urban planners, and caregivers are among the key stakeholders driving the market's growth.

In addition, safety regulations and standards are essential considerations In the market. Manufacturers adhere to stringent safety guidelines to ensure the equipment is safe for children of various age groups, including toddlers and older children. Materials such as metal, plastic, and wood are commonly used In the production of these products, with safety features like surface contact materials and inclusive playground equipment designs ensuring accessibility for all children. The market for freestanding playground equipment is diverse and dynamic. It caters to various sectors, including commercial playground equipment for parks and playschools, as well as equipment for preschools and daycare centers.

Moreover, product affordability is a significant factor influencing market trends, with manufacturers catering to the needs of dual-income households and working women. The market is characterized by continuous innovation, with new product offerings such as seesaws, spring riders, rope courses, and interactive panels. Stainless steel and other durable materials are increasingly being used to ensure long-lasting equipment that can withstand heavy usage in public spaces. Urban planners and community leaders recognize the importance of investing in high-quality freestanding playground equipment to promote child development, community well-being, and physical activity. As such, the market is expected to continue growing, driven by increasing demand from various sectors and the ongoing need to address childhood obesity and sedentary lifestyles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 2.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, China, Germany, UK, Canada, France, Japan, India, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Freestanding Playground Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.