Fuel Cell Market Size 2025-2029

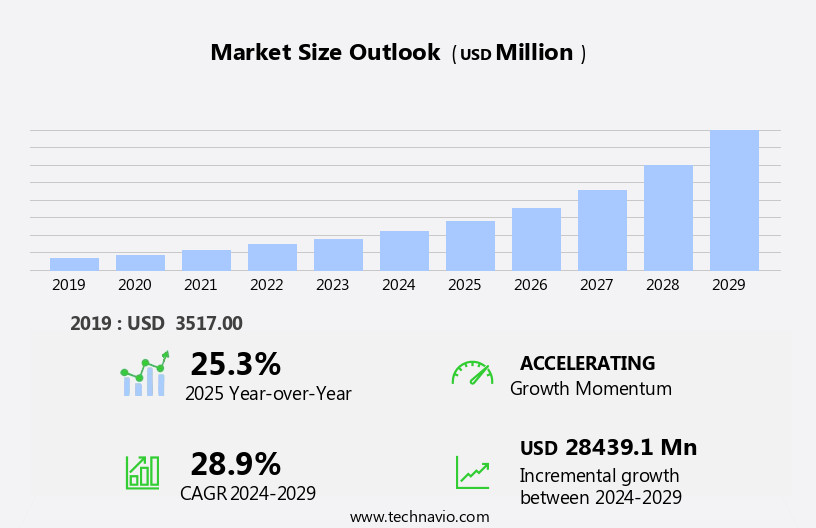

The fuel cell market size is forecast to increase by USD 28.44 billion at a CAGR of 28.9% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for efficient and clean energy sources. This trend is driven by the rising awareness of environmental concerns and the need to reduce greenhouse gas emissions. Additionally, increasing research and development activities are leading to advancements in fuel cell technology, making them more cost-effective and efficient. However, the high cost of fuel cells remains a challenge for market growth. Despite this, the market is expected to continue expanding as governments and businesses invest in renewable energy solutions and hydrogen infrastructure development. The market analysis report provides a comprehensive overview of these trends and challenges, offering valuable insights for stakeholders in the fuel cell industry.

What will be the Size of the Market During the Forecast Period?

- Fuel cells have emerged as a promising clean energy technology, offering significant benefits for various industries, particularly in the transportation sector with the rise of fuel cell electric vehicles (FCEVs). The International Energy Agency (IEA) has highlighted the potential of FCEVs in reducing carbon emissions and environmental impact, aligning with global efforts to transition towards sustainable energy solutions. They operate through a process called proton exchange membrane fuel cells (PEMFCs), converting chemical energy from hydrogen into electricity through an electrochemical reaction. This process generates only water as a byproduct, making it an attractive alternative to traditional combustion engines.

- Fuel cell manufacturers are increasingly focusing on improving the efficiency and durability of their products to cater to diverse applications, including FCEVs and Stationary Fuel Cell Systems (SOFCS) for data centers and backup power. The regulatory framework surrounding fuel cells is evolving, with initiatives such as the ENE-Farm program and collaborations between companies driving innovation and market growth. The integration of PEMFCs and DMFCs (Direct Methanol Fuel Cells) in various applications is expected to further expand the market scope.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- PEMFC

- PAFC

- SOFC

- Others

- Application

- Transport

- Stationary

- Portable

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Product Insights

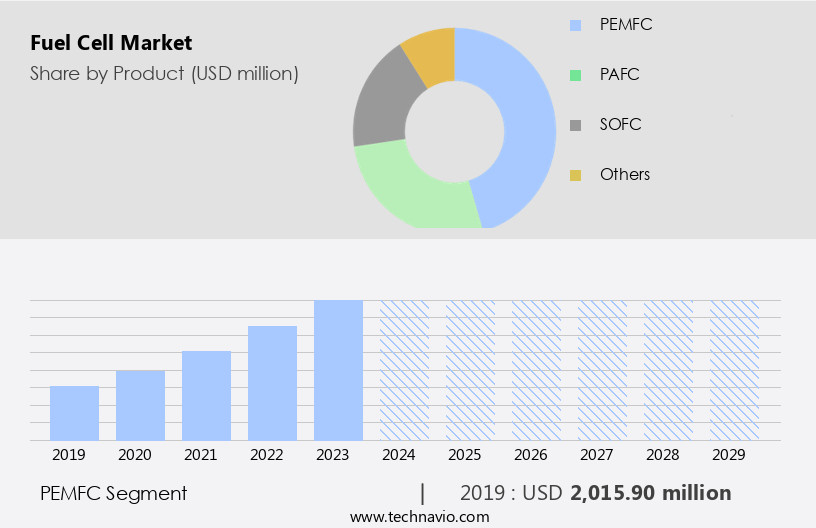

- The PEMFC segment is estimated to witness significant growth during the forecast period.

Proton Exchange Membrane Fuel Cells (PEMFCs) are a type of hydrogen fuel cell that utilizes a water-based, acidic polymer electrolyte. Operating at lower temperatures than other fuel cells, these cells are ideal for applications requiring power in a short timeframe, such as transportation and stationary power. PEMFCs, also known as polymer electrolyte membrane fuel cells, separate electrons from the protons of hydrogen fuel at the anode, with the electrons traveling through an external circuit to generate electricity. The protons pass through the membrane towards the cathode. Pioneering companies have led the way in this innovative technology.

PEMFCs offer numerous advantages, including high efficiency, low emissions, and quick response time, making them a promising alternative to battery-electric vehicles. Startups are also entering the market, contributing to the growth and advancement of this technology.

Get a glance at the market report of share of various segments Request Free Sample

The PEMFC segment was valued at USD 2.02 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing consistent growth, driven primarily by the United States. This region accounts for a significant share of global fuel cell vehicle (FCEV) shipments. Government support, including federal and state incentives for clean energy technologies, plays a crucial role in market expansion. Major corporations are increasingly investing in fuel cells due to their performance advantages and incentives. Fuel cell technologies, including proton exchange membrane (PEM) and solid oxide fuel cells (SOFCs), are gaining traction. Companies are also integrating fuel cells into their operations for power generation and water management. The International Energy Agency (IEA) anticipates continued growth in the market, driven by advancements in technology and increasing demand for clean energy solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Fuel Cell Market?

Growing demand for efficient and clean energy sources is the key driver of the market.

- Fuel cells represent a promising clean energy technology, offering high efficiency and reliability for various applications, including transportation, residential use, data centers, and utilities. Fuel cells generate power through an electrochemical process, producing heat and electricity without combustion, resulting in minimal or zero greenhouse gas (GHG) emissions. The primary emissions consist of water and heat, making fuel cells an attractive alternative to traditional power sources. Fuel cell vehicles (FCEVs) are gaining traction in the transportation sector as they offer extended driving ranges and quick refueling times, comparable to conventional internal combustion engine vehicles. The EV campaign, spearheaded by organizations like the International Energy Agency (IEA), aims to promote the adoption of FCEVs and other fuel cell electric vehicles (FCEVs), such as proton exchange membrane fuel cells (PEMFCs) and alkaline fuel cells.

- In the residential sector, fuel cells can provide clean energy for heating and electricity, reducing the carbon footprint and environmental impact. Data centers, which consume vast amounts of electricity, can benefit significantly from fuel cells, particularly tri-gen systems that generate electricity, heat, and hydrogen on-site. Utilities are also exploring the potential of fuel cells to improve grid reliability and reduce GHG emissions. The regulatory framework and incentives, including contracts, subsidies, and tax breaks, are essential in fostering the growth of the market.

What are the market trends shaping the Fuel Cell Market?

Increasing research and development activities is the upcoming trend in the market.

- Fuel cells, a clean energy technology, have gained significant attention due to their potential to reduce greenhouse gas (GHG) emissions in various sectors, including transportation and utilities. The high upfront costs of fuel cell vehicles (FCEVs) and fuel cell systems (FCS) have been a barrier to their widespread adoption. However, extensive research and development initiatives by governments and manufacturers aim to lower costs and increase deployment. Governments in countries like the US, South Korea, Germany, Japan, and the UK are investing in fuel cell technology through programs like the US Department of Energy's National Energy Technology Laboratory and the European Fuel Cell and Hydrogen Joint Undertaking (FCH JU).

- These efforts include subsidies, tax breaks, and public awareness campaigns to promote the adoption of FCEVs and FCS in transportation, residential, data center, and utility applications. Fuel cell systems come in various types, including proton exchange membrane fuel cells (PEMFCs), solid oxide fuel cells (SOFCs), and direct methanol fuel cells (DMFCs). Companies are pioneering innovative solutions like tri-gen systems, which generate electricity, heat, and hydrogen, to support the transition to clean energy. Water management is a critical aspect of fuel cell systems, and advancements in this area are driving improvements in efficiency and cost.

What challenges does the Fuel Cell Market face during its growth?

The high cost of fuel cell is a key challenge affecting the market growth.

- Fuel cell technology, particularly fuel cell vehicles (FCEVs), is gaining traction in various sectors, including transportation, residential, data centers, and utilities. The International Energy Agency (IEA) reports that PEM fuel cells are the most common type used, while SOFCs, alkaline fuel cells, microbial fuel cells, and DMFCs also have applications. Water management is a crucial aspect of fuel cell systems, requiring efficient methods to produce hydrogen fuel and manage wastewater. The high cost of producing hydrogen fuel is a significant challenge, as electrolysis, the process used to produce hydrogen from water, is energy-intensive and costly.

- The expense extends to the construction and maintenance of hydrogen fueling stations. Despite these challenges, the market is expected to grow as technology advances and economies of scale are achieved. Subsidies, tax breaks, and public awareness campaigns are also driving the adoption of clean energy technologies, such as fuel cells, to reduce environmental impact and carbon footprint. The transportation sector, particularly heavy-duty vehicles, is a significant focus for hydrogen-powered fuel cell systems due to their potential to significantly reduce greenhouse gas (GHG) emissions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ballard Power Systems Inc. - The company provides advanced fuel cell solutions for various applications, including the Fcgen LCS MEA and FCveloCity 9SSL MEA models.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ballard Power Systems Inc.

- Bloom Energy Corp.

- Ceres Power Holdings plc

- Doosan Corp.

- FuelCell Energy Inc.

- Fuji Electric Co. Ltd.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Intelligent Energy Ltd.

- KYOCERA Corp.

- Mitsubishi Heavy Industries Ltd.

- Niterra Co. Ltd.

- Panasonic Holdings Corp.

- Plug Power Inc.

- PowerCell Sweden AB

- Proton Motor Fuel Cell GmbH

- SFC Energy AG

- Toshiba Corp.

- Watt Fuel Cell Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fuel cells have emerged as a promising solution to address the growing demand for clean and sustainable energy sources. These electrochemical devices convert chemical energy into electricity through a chemical reaction, emitting only water as a byproduct. The market is witnessing significant growth, driven by advancements in technology and increasing focus on reducing greenhouse gas (GHG) emissions. Fuel cell vehicles (FCVs) are gaining traction as an alternative to battery-electric vehicles (BEVs) in the transportation sector. Proton exchange membrane fuel cells (PEMFCs) are the most commonly used type in FCVs due to their high efficiency and fast response time.

However, alkaline fuel cells and microbial fuel cells are also gaining attention for their unique advantages in specific applications. The International Energy Agency (IEA) reports that the market, including stationary and transport applications, is expected to grow at a compound annual growth rate (CAGR) of over 10% between 2021 and 2026. The transportation sector is a significant contributor to this growth, with FCVs offering a potential solution to the carbon footprint of the industry. The residential sector is another area where they are gaining popularity. Companies are providing fuel cell solutions for on-site power generation, offering reduced environmental impact and energy independence.

Furthermore, fuel cells are also being used in data centers to provide uninterrupted power supply and reduce their carbon footprint. Utilities are investing to expand their clean energy offerings and meet regulatory frameworks aimed at reducing GHG emissions. Water management is a crucial aspect of fuel cell technology. The fuel cells require water to operate, and the excess water produced can be used for various applications, including cooling and irrigation. This closed-loop system offers a significant advantage over traditional power generation methods. Fuel cell manufacturers are continuously innovating to improve the efficiency and cost-effectiveness of fuel cells.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.9% |

|

Market Growth 2025-2029 |

USD 28.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.3 |

|

Key countries |

US, Japan, India, Germany, Canada, UK, South Korea, France, China, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch