Gastroscopes Market Size 2024-2028

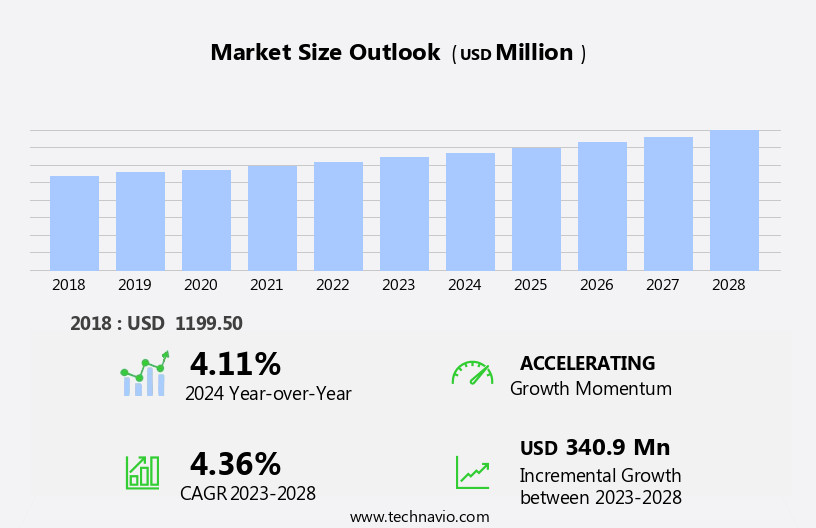

The gastroscopes market size is forecast to increase by USD 340.9 million, at a CAGR of 4.36% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing incidence of gastrointestinal disorders. This trend is driven by an aging population and unhealthy lifestyles leading to an increase in chronic conditions such as gastroesophageal reflux disease, peptic ulcers, and colitis. Another key driver is the integration of artificial intelligence in gastroscopes and endoscopy systems, enabling improved diagnostic accuracy and efficiency. However, the market faces challenges from stringent regulations for approval of gastrointestinal devices, which can delay product launches and increase costs.

- Companies must navigate these regulatory hurdles while also investing in research and development to stay competitive in this dynamic market. To capitalize on opportunities and overcome challenges, strategic business decisions and operational planning should focus on regulatory compliance, technological innovation, and patient-centric solutions.

What will be the Size of the Gastroscopes Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Endoscopic procedures, including therapeutic endoscopy, endoscopic mucosal resection, and balloon dilation, are increasingly utilizing high-definition video and optical coherence tomography for enhanced diagnostic accuracy. These techniques enable real-time visualization of mucosal structures, facilitating more precise interventions. Endoscope durability testing and cleaning protocols remain critical to ensuring patient safety and maintaining instrument functionality. Innovations in endoscope design materials, sterilization methods, and image processing algorithms contribute to improved endoscope durability and infection control. Flexible gastroscopes, incorporating advanced light source technology and narrow band imaging, offer superior image quality and improved patient comfort.

Therapeutic applications, such as endoscopic submucosal dissection, hemostasis devices, and polypectomy snares, are revolutionizing endoscopic procedures, reducing procedure complication rates and enhancing patient recovery time. Advancements in endoscopic imaging, endoscopic ultrasound, and endoscopic retrograde cholangiopancreatography continue to expand the diagnostic capabilities of gastroscopes. Flexible shaft technology and wireless endoscopy further enhance procedural versatility, enabling access to previously difficult-to-reach areas. The ongoing evolution of gastroscopes is shaped by continuous research and development efforts, ensuring that these essential medical devices remain at the forefront of diagnostic and therapeutic advancements.

How is this Gastroscopes Industry segmented?

The gastroscopes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospital

- ASCs

- Others

- Product

- Flexible

- Rigid

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

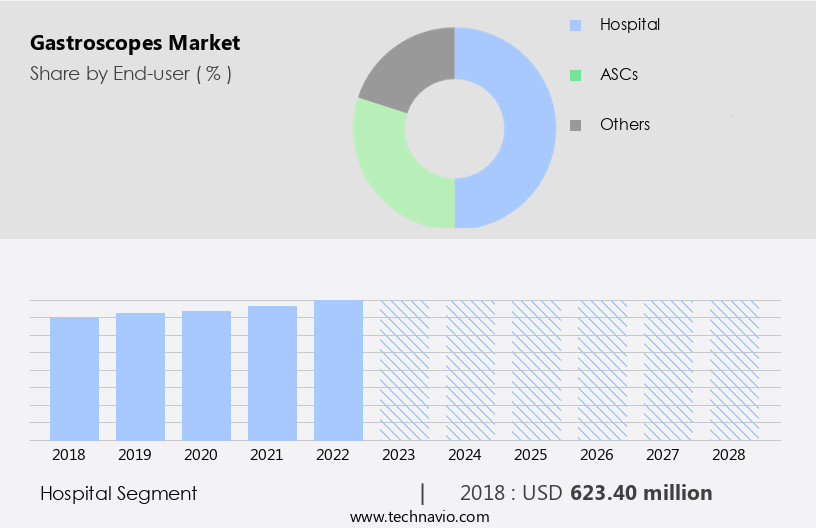

By End-user Insights

The hospital segment is estimated to witness significant growth during the forecast period.

Gastroscopes are integral tools in hospitals' gastroenterology departments for diagnosing and treating various gastrointestinal (GI) disorders. Advanced endoscopy units extensively utilize these instruments during upper GI endoscopy procedures, enabling healthcare professionals to examine the esophagus, stomach, and duodenum. These procedures play a crucial role in diagnosing conditions such as gastritis, peptic ulcers, gastroesophageal reflux disease (GERD), Barrett's esophagus, and gastrointestinal cancers. Moreover, gastroscopes facilitate biopsies and tissue sampling from suspicious GI tract areas. Pathological examinations of these samples contribute to accurate diagnoses. Image enhancement features, like narrow band imaging and chromoendoscopy techniques, improve diagnostic accuracy.

Image processing algorithms and high-definition video further enhance endoscopic imaging. Endoscope design materials, sterilization methods, and durability testing ensure patient safety and endoscope longevity. Endoscopic submucosal dissection, hemostasis devices, and argon plasma coagulation facilitate therapeutic procedures. Balloon dilation, stent placement, and wireless endoscopy expand the scope of endoscopic procedures. Endoscopic ultrasound and optical coherence tomography offer additional diagnostic capabilities. Infection control protocols and scope cleaning procedures maintain patient safety and minimize complications. Procedure complication rates remain a concern, with potential risks including bleeding, perforation, and infection. Polypectomy snare, biopsy forceps, and flexible shaft technology streamline endoscopic procedures.

Light source technology and gastroscope insertion techniques optimize visualization and accessibility. Therapeutic endoscopy, including endoscopic mucosal resection and endoscopic retrograde cholangiopancreatography, offers minimally invasive treatment options. Hospitals invest in these advanced endoscopy units to provide comprehensive GI care, ensuring timely and accurate diagnoses and effective treatments.

The Hospital segment was valued at USD 623.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

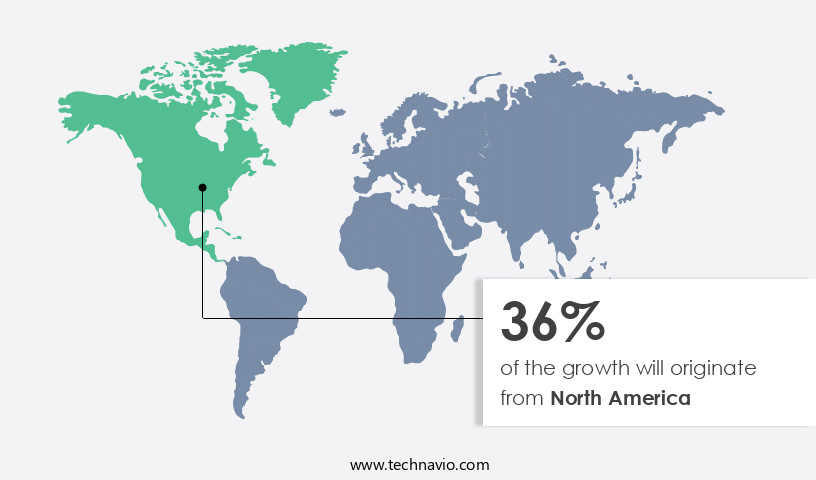

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the increasing prevalence of gastrointestinal disorders and the adoption of advanced medical technologies in North America, which holds the largest market share. The region's robust healthcare infrastructure and the rising incidence of conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, inflammatory bowel disease (IBD), and gastrointestinal cancers are driving market expansion. Innovations in gastroscope technology, such as image enhancement features, narrow band imaging, and chromoendoscopy techniques, are improving diagnostic accuracy and enabling early intervention. Procedure complication rates are being mitigated through stringent infection control protocols and patient recovery times are shortening.

Image processing algorithms and high-definition video are enhancing endoscopic imaging, while endoscopic ultrasound and optical coherence tomography offer additional diagnostic capabilities. Endoscope design materials and sterilization methods ensure durability and hygiene, while therapeutic endoscopy, endoscopic submucosal dissection, hemostasis devices, and argon plasma coagulation facilitate effective treatment. Flexible shaft technology and gastroscope insertion techniques enable easier access to hard-to-reach areas, and stent placement and wireless endoscopy offer minimally invasive solutions. Endoscopic retrograde cholangiopancreatography is a valuable diagnostic and therapeutic tool in the field of gastroenterology. Market trends include the development of more compact and portable gastroscopes, advancements in light source technology, and the integration of artificial intelligence and machine learning for image analysis.

These innovations are improving patient outcomes, reducing procedure times, and enhancing the overall endoscopic experience.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gastroscopes Industry?

- The rising prevalence of gastrointestinal disorders serves as the primary catalyst for market growth in this sector.

- The market has gained significant traction due to the increasing prevalence of gastrointestinal disorders among the aging population. Chronic conditions, such as diverticulosis, bowel diseases, gastrointestinal malignancies, and urinary and fecal-related problems, are on the rise. According to the American Cancer Society, approximately 133,000 new cases of colorectal and rectal cancers are diagnosed annually in the US. Advancements in gastroscopy technology have led to innovations like capsule endoscopy, image enhancement features, narrow band imaging, and chromoendoscopy techniques. These technologies enable healthcare professionals to diagnose and monitor gastrointestinal disorders more accurately and effectively. Procedure complication rates are minimized through stringent infection control protocols, ensuring patient safety.

- Patient recovery time is also reduced due to these advancements, making gastroscopy procedures more accessible and convenient. Image processing algorithms facilitate faster and more precise diagnosis, enhancing overall efficiency and improving patient outcomes. These factors are driving the growth of the market, providing opportunities for continued innovation and development.

What are the market trends shaping the Gastroscopes Industry?

- Artificial intelligence (AI) integration is becoming a significant trend in the gastroscopes and endoscopy systems market. This advanced technology enhances diagnostic accuracy and efficiency in gastrointestinal procedures.

- Artificial intelligence (AI) integration in gastroscopes and endoscopy systems is revolutionizing the field of gastroenterology. AI algorithms analyze real-time images captured by gastroscopes, identifying suspicious lesions or abnormalities that may go unnoticed. This technology aids in the early detection of gastrointestinal (GI) disorders, including early-stage cancers and precancerous lesions. Timely interventions based on AI-identified abnormalities can significantly improve patient prognosis. Endoscope design materials and sterilization methods are crucial considerations in the gastroscopy market. Advanced image sensor technology and endoscopic ultrasound enhance endoscopic imaging, providing clearer and more detailed visuals for accurate diagnostic assessments. Hemostasis devices are essential for controlling bleeding during endoscopic procedures, ensuring patient safety and reducing complications.

- Endoscopic submucosal dissection (ESD) is a minimally invasive procedure that uses high-definition imaging and fine instruments to remove lesions. AI can assist in ESD by providing real-time feedback to the endoscopist, improving precision and reducing the risk of complications. In conclusion, AI-powered gastroscopes and endoscopy systems offer numerous benefits, from enhanced diagnostic accuracy to improved patient outcomes. Continuous advancements in endoscope design materials, sterilization methods, image sensor technology, and hemostasis devices contribute to the growth and evolution of the market.

What challenges does the Gastroscopes Industry face during its growth?

- The stringent regulatory approvals process for gastrointestinal devices poses a significant challenge and significantly impacts the growth of the industry.

- The market encompasses high-technology devices used for diagnostic and therapeutic endoscopy procedures in the healthcare industry. These devices, classified as class III medical devices, undergo rigorous regulatory scrutiny due to their high risk nature. Regulatory authorities, such as the FDA, enforce stringent regulations and labeling requirements to ensure medical efficacy and patient safety. Endoscopes undergo extensive testing for durability and performance, including endoscope durability testing and high-definition video capabilities. Advanced technologies, such as endoscopic mucosal resection, therapeutic endoscopy, balloon dilation, and optical coherence tomography, enhance the diagnostic capabilities of these devices. However, the lengthy and complex regulatory approval process poses a significant challenge to market growth.

- The FDA's rigorous safety evaluations can take several years, and failure to comply with regulations can result in adverse consequences. Scope cleaning protocols are also crucial to maintaining the hygiene and functionality of gastroscopes. In conclusion, the market is driven by technological advancements and increasing demand for minimally invasive diagnostic and therapeutic procedures. However, the stringent regulatory environment necessitates a focus on compliance and adherence to safety standards to ensure market growth.

Exclusive Customer Landscape

The gastroscopes market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gastroscopes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gastroscopes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advin Health Care - The company specializes in advanced gastroscopes, including video Endoscope Gastroscopes, enhancing diagnostic accuracy and patient care in the medical field. These innovative devices enable healthcare professionals to examine the digestive tract with clarity and precision.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advin Health Care

- Arthrex Inc.

- B.Braun SE

- Boston Scientific Corp.

- Carl Zeiss AG

- Conmed Corp.

- dantschke Medizintechnik GmbH and Co. KG

- Endomed Systems GmbH

- FUJIFILM Corp.

- HOYA Corp.

- HUGER Medical Instrument Co. Ltd.

- Johnson and Johnson Services Inc.

- KARL STORZ SE and Co. KG

- Laborie

- Medtronic Plc

- Mitra Group

- Olympus Corp.

- Richard Wolf GmbH

- Smith and Nephew plc

- Stryker Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gastroscopes Market

- In January 2024, Medtronic, a leading medical technology company, announced the FDA approval of its new generation gastroscope, the Hydrodragdâ¢, featuring a water-filled balloon technology for improved patient comfort during endoscopic procedures (Medtronic Press Release, 2024).

- In March 2024, Fujifilm Corporation and Olympus Corporation, two major players in the market, formed a strategic partnership to co-develop and commercialize next-generation endoscopic technologies, aiming to enhance their product offerings and compete more effectively (Fujifilm Press Release, 2024).

- In May 2025, Boston Scientific Corporation completed the acquisition of EndoChoice, a leading provider of diagnostic and therapeutic solutions for gastrointestinal diseases, strengthening its presence in the gastroenterology market and expanding its product portfolio (Boston Scientific Press Release, 2025).

- In the same month, the European Commission approved the marketing authorization for Erbe Elektromedizin's new gastroscope, the Videocapsule Endoscopy System, enabling the company to expand its presence in the European the market and offer a non-invasive alternative to traditional endoscopic procedures (Erbe Elektromedizin Press Release, 2025).

Research Analyst Overview

- The market encompasses advanced technologies designed for diagnostic and therapeutic interventions in the gastrointestinal tract. Surgical precision and treatment efficacy are paramount in this field, with tissue ablation and endoscopic clipping playing crucial roles. Reprocessing guidelines ensure optimal reusability, while disease staging and cancer detection rely on image quality assessment and lesion detection. Endoscope calibration and visual inspection maintain equipment accuracy, and minimal invasiveness enhances patient comfort.

- Disposable components and advanced endoscopy techniques facilitate procedure duration reduction and bleeding control. Long-term outcomes are improved through image artifacts reduction, foreign body removal, and obstruction relief. Quality control measures and operator experience are essential for successful ulcer assessment and stricture dilation. Equipment maintenance and advanced visualization technologies further optimize gastroscopes' performance.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gastroscopes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 340.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Germany, Japan, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gastroscopes Market Research and Growth Report?

- CAGR of the Gastroscopes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gastroscopes market growth of industry companies

We can help! Our analysts can customize this gastroscopes market research report to meet your requirements.