Gummy Vitamin Market Size 2024-2028

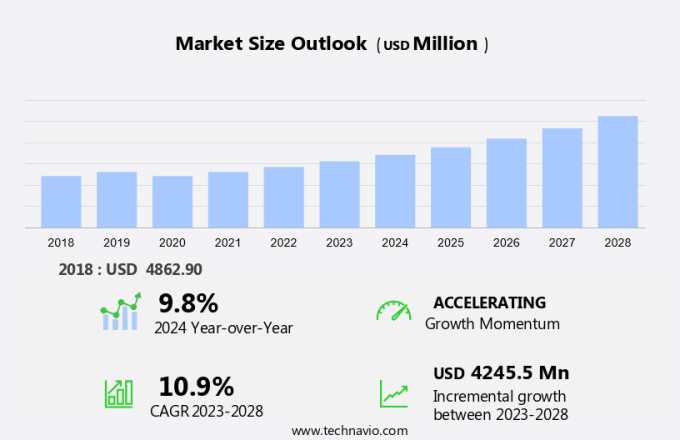

The gummy vitamin market size is forecast to increase by USD 4.25 billion at a CAGR of 10.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for convenient, on-the-go nutritional supplements. The popularity of gummy vitamins, which include vitamins, minerals, and nutraceutical products, is driven by their appeal to consumers, particularly children, who find them enjoyable to consume. However, the high cost of production poses a challenge for market growth. Health awareness and the consumption of processed foods have led to a rise in demand for nutritional supplements to fill nutritional gaps.

- In addition, immune health, omega-3 fatty acids, probiotics, and prebiotics are popular categories in the market. Consumers are turning to these supplements to support their overall health and wellness. The availability of gummy supplements for children is another trend driving market growth. Manufacturers are innovating by introducing new flavors, shapes, and functionalities to cater to the diverse needs and preferences of consumers. Despite the challenges, the market is expected to continue its growth trajectory in the coming years.

What will be the Size of the Market During the Forecast Period?

- The market for chewable vitamin supplements, specifically gummies, has witnessed significant growth in the United States. This trend can be attributed to several factors, including the convenience of the chewable form, health awareness, and the increasing prevalence of nutritional deficiencies. Chewable vitamins, including gummies, offer a solution for individuals who have difficulty swallowing pills. The chewy texture and tasty flavor make these supplements an attractive alternative to traditional vitamin formulas. Moreover, the natural sweetness of gummies can be enhanced with various flavors, catering to diverse consumer preferences.

- Furthermore, functional gummies, fortified with essential vitamins, minerals, and nutrients, are gaining popularity due to their ability to address specific health concerns. Immunity-boosting gummies, for instance, are in high demand, especially during flu season. Similarly, gummies formulated for skin health, hair health, sleep aid, and other health concerns are increasingly being sought after. The natural products segment of the market is also growing rapidly. Consumers are increasingly opting for vegan gummies and those made with natural active ingredients. These gummies cater to the demand for healthier and more sustainable options. The health benefits of gummy vitamins extend beyond addressing nutritional deficiencies.

- For instance, multivitamins and single-nutrient supplements can help maintain overall health and wellness. Specialty formulations, such as those designed for immune support or sleep aid, offer targeted solutions for specific health concerns. The long shelf life of gummy vitamins is another factor contributing to their popularity. These supplements can be stored for extended periods without losing their potency, making them a convenient choice for consumers. In conclusion, the market in the US is experiencing steady growth, driven by the convenience, taste, and health benefits of these supplements. Functional and natural gummy formulas cater to diverse consumer preferences and health concerns, making them an attractive alternative to traditional vitamin pills. The market is expected to continue growing, as consumers increasingly prioritize their health and seek out convenient and effective supplement solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Online

- Offline

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- South America

- Brazil

- Argentina

- Europe

- Germany

- Italy

- Spain

- Middle East and Africa

- APAC

By Distribution Channel Insights

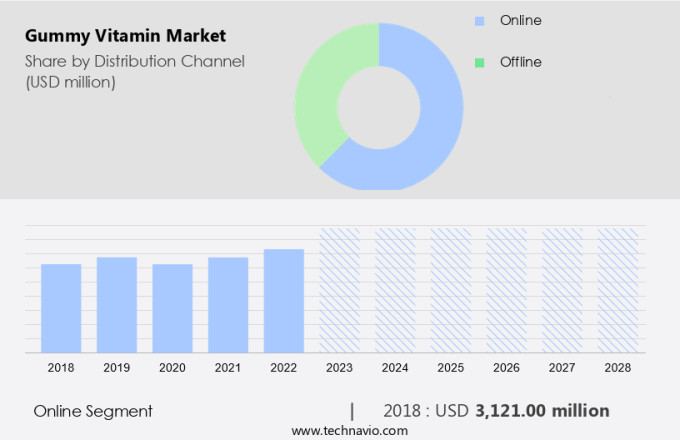

- The online segment is estimated to witness significant growth during the forecast period.

The market has experienced significant growth due to the popularity of chewable formulas among consumers. These vitamins offer a delicious, tasty alternative to traditional tablets and capsules, making them an appealing choice for individuals seeking to improve their health. Multivitamins and single-nutrient supplements are available in gummy form, catering to various health needs. Specialty formulations, such as those designed for immune support, skin health, hair health, and sleep aid, are also gaining traction in the market. E-retail is the preferred distribution channel for gummy vitamins, as it offers convenience and affordability. The increasing number of online retailers selling these products has made them easily accessible to consumers.

Moreover, the cost savings and time efficiency of purchasing gummy vitamins online are significant advantages, as many international and national brands sell their products through their websites. For instance, Amway is a notable company that offers gummy vitamins for sale online, enabling them to effectively promote their brand and reach a larger customer base. In summary, the market is thriving due to the chewy texture and tasty flavors of these supplements. Their availability in various health categories, such as multivitamins and specialty formulations, further broadens their appeal. E-retailing is the primary distribution channel for gummy vitamins, offering consumers a convenient and cost-effective shopping experience. Brands can effectively reach their audience and enhance their brand image by selling gummy vitamins online.

Get a glance at the market report of share of various segments Request Free Sample

The online segment was valued at USD 3.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the market, the Asia Pacific region held the largest market share in 2023. This dominance can be attributed to the health-conscious consumer behavior prevalent in the region. With a growing focus on personal wellness, consumers are increasingly turning to vitamin supplements, including gummies, to meet their daily nutritional needs. Furthermore, the rising healthcare expenditure in the region has encouraged consumers to prioritize their health and seek cost-effective solutions, such as vitamin gummies, to complement their regular healthcare expenses. Consequently, the demand for gummy vitamins has resulted in an influx of both international and local players in the APAC the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Gummy Vitamin Market?

High demand for on-the-go dietary supplement products is the key driver of the market.

- The demand for gummy and chewable vitamins continues to grow as consumers prioritize their health and well-being. Nutritional deficiencies and the need to boost immunity have made vitamins essential dietary supplements for many. With the rise in consumer awareness, particularly among millennials and the elderly, there is a preference for alternative forms of vitamins that offer flavor enhancements and ease of consumption.

- Similarly, synthetic vitamins have been a common choice due to their availability and affordability, but the trend is shifting towards natural vitamins for their health benefits. The market for gummy vitamins is expanding to cater to this demand, with manufacturers introducing various products to meet the diverse needs of consumers. The convenience of gummy vitamins, particularly for those who have difficulty swallowing pills, is an added advantage. Overall, the market is poised for significant growth as consumers continue to prioritize their health and seek out convenient and effective ways to meet their nutritional needs.

What are the market trends shaping the Gummy Vitamin Market?

The availability of gummy supplements for children is the upcoming trend in the market.

- Parents are increasingly concerned about their children's health and nutrition, particularly as many kids are picky eaters and may not consume sufficient vitamins and minerals through their diet. To address this issue, the market for gummy vitamin and nutraceutical products has gained popularity. These supplements come in various formats, including gummy bears, fruits, and flowers, which are appealing to children. The convenience and fun aspect of consuming these supplements make them an attractive option for parents.

- Additionally, companies are responding to the growing demand for natural and organic ingredients by producing gummy supplements made from organic sources. This trend is expected to continue as parents prioritize their children's health and well-being. With the rise of health awareness and the availability of a wide range of gummy vitamin and nutraceutical products, parents can ensure their children receive essential vitamins, minerals, omega-3 fatty acids, probiotics, and prebiotics in a tasty and convenient way.

What challenges does Gummy Vitamin Market face during the growth?

The high cost of production is a key challenge affecting the market growth.

- The market has experienced significant growth due to the increasing preference for plant-based and vegan lifestyles, leading to a higher demand for nutraceuticals in the form of functional and fortified gummies. While naturally sourced vitamins remain popular among consumers, their production comes with high costs and investment due to the limited availability of raw materials. Synthetic vitamins, on the other hand, are derived from low-cost raw materials such as petroleum extracts and coal tar derivatives, making them a more economical option for gummy supplement manufacturers.

- However, operational challenges in the procurement of raw materials for vitamins A and E have disrupted the efficient supply chain, making synthetic alternatives increasingly attractive. As a result, the market for gummy vitamins continues to expand, offering a wide range of flavors and natural product options for consumers seeking health benefits.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Bayer AG

- Catalent Inc.

- Church and Dwight Co. Inc.

- Ernest Jackson and Co Ltd

- GlaxoSmithKline Plc

- Herbaland Gummies

- Hero Nutritionals LLC

- Ion Labs Inc.

- Life Science Nutritionals Inc.

- Makers Nutrition LLC

- Mr. Gummy Vitamins LLC.

- Natures Bounty

- Nestle SA

- Nutra Solutions USA

- Pharmavite LLC

- Power Gummies

- Rainbow Light

- The Honest Co. Inc.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Chewable vitamins, also known as gummy vitamins, have gained significant popularity in recent years due to their delicious taste and convenient chewable format. These nutritional supplements offer various health benefits, making them an ideal solution for individuals dealing with nutritional deficiencies or those following specific dietary restrictions, such as vegan lifestyles. Gummy vitamins come in various flavors and textures, catering to diverse preferences. They can be fortified with essential vitamins, minerals, omega-3 fatty acids, probiotics, and prebiotics, among other active ingredients. The market is witnessing substantial growth due to increasing health awareness, a shift towards natural products, and the convenience they offer for individuals dealing with pill-swallowing issues.

Furthermore, functional gummies, such as immune support, skin health, hair health, sleep aid, and probiotic gummy vitamins, cater to various health concerns. Manufacturers are focusing on using natural ingredients, plant-based gelatin substitutes, and clean-label products to cater to health-conscious consumers. The market is also witnessing innovation with the introduction of specialty formulations and flavors, including psychedelic mushroom gummies containing psilocybin. E-commerce platforms and online retailers have made it easier for consumers to purchase gummy vitamin products, offering added convenience and taste. With a long shelf life, gummy vitamins provide a tasty and convenient alternative to traditional nutraceutical products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.9% |

|

Market growth 2024-2028 |

USD 4.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.8 |

|

Key countries |

US, China, India, Brazil, Australia, Canada, Spain, Argentina, Italy, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, South America, Europe, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch