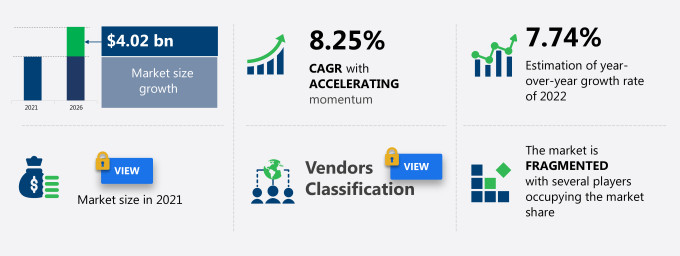

The hair shampoo market share in APAC is expected to increase by USD 4.02 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 8.25%.

This hair shampoo market in APAC research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers hair shampoo market segmentation in APAC by distribution channel (offline and online) and type (non-medicated and medicated). The hair shampoo market in APAC report also offers information on several market vendors, including Amway Corp., Himalaya Global Holdings Ltd., Johnson and Johnson Inc., Kao Corp., LOreal SA, Patanjali Ayurved Ltd., Shiseido Co. Ltd., The Avon Co., The Procter and Gamble Co., and Unilever PLC among others.

What will the Hair Shampoo Market Size in APAC be During the Forecast Period?

Download the Free Report Sample to Unlock the Hair Shampoo Market Size in APAC for the Forecast Period and Other Important Statistics

Hair Shampoo Market in APAC: Key Drivers, Trends, and Challenges

The innovation and portfolio extension leading to product premiumization is notably driving the hair shampoo market growth in APAC, although factors such as availability of counterfeit products may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the hair shampoo industry in APAC. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Hair Shampoo Market Driver in APAC

One of the key factors driving growth in the hair shampoo market in APAC is the innovation and portfolio extension leading to product premiumization. With the growing competition and customer demand for innovative products, vendors have actively started focusing on bettering their R&D operations in the region. Additionally, they have been focusing on differentiating themselves from pharmaceutical companies. To that end, their investments in innovating ingredients and technologies are rising. Customers usually look for hair shampoo products that can address concerns pertaining to multiple hair-related issues in minimal time. To meet these customer needs, vendors regularly innovate their product ranges and expand their product lines. In addition, the growing purchasing power and increasing disposable incomes have helped increase customer spending on hair care products, especially on premium hair care products. Apart from these, vendors are launching new products, which will drive market growth during the forecast period.

Key Hair Shampoo Market Trend in APAC

The growing demand for natural and organic hair shampoo is a hair shampoo market trend in APAC that is expected to have a positive impact in the coming years. Awareness about hair and skin-related problems caused by synthetic hair shampoo has pushed up the demand for natural and organic hair shampoos. The regular use of synthetic hair shampoo can cause hair and skin-related issues such as skin irritation, skin allergies, nerve damages, chemical burns and blisters on the scalp, hair breakage, and some forms of cancer. Organic hair shampoo is made of natural and organic ingredients such as plant extracts, and other natural ingredients. Organic hair shampoo is free from harmful ingredients such as petrochemicals, sulfates, and ammonia. These organic hair shampoos adhere to the high standards of purity set by various governing bodies of different countries. Therefore, the growing popularity of natural and organic hair shampoos is expected to increase the demand, which will propel the growth of the hair shampoo market in APAC during the forecast period.

Key Hair Shampoo Market Challenge in APAC

The availability of counterfeit products will be a major challenge for the hair shampoo market in APAC during the forecast period. Growing market prospects for hair products such as shampoo and the surging demand for these products drive the growth of the market for counterfeit hair shampoos in APAC. Counterfeits are made from low-quality raw materials and can cause hair damage. The use of such counterfeit hair care products can damage the hair permanently. The growing penetration of e-commerce across the region is propelling the sales of counterfeit products. Customers find it challenging to distinguish genuine products from counterfeit products, as they look similar. Counterfeit products are in high demand because of their low price. The growing adoption of counterfeit products will adversely affect the sales and pricing strategies of genuine regional vendors. Advertisements and promotional campaigns by genuine vendors help attract customers and ensure their loyalty toward their brands and prevent users from shifting to counterfeit products. However, such promotional activities come at huge costs and further reduce the profit margins of vendors.

This hair shampoo market in APAC analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the hair shampoo market in APAC as a part of the global personal products market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the hair shampoo market in APAC during the forecast period.

Who are the Major Hair Shampoo Market Vendors in APAC?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Amway Corp.

- Himalaya Global Holdings Ltd.

- Johnson and Johnson Inc.

- Kao Corp.

- LOreal SA

- Patanjali Ayurved Ltd.

- Shiseido Co. Ltd.

- The Avon Co.

- The Procter and Gamble Co.

- Unilever PLC

This statistical study of the hair shampoo market in APAC encompasses successful business strategies deployed by the key vendors. The hair shampoo market in APAC is fragmented and the vendors are deploying growth strategies such as continuous R&D and innovations to compete in the market.

Product Insights and News

-

Amway Corp. - Amway Corp. is a privately held company that is headquartered in the US. It is a global company that generated a revenue of $8500 million and had around 15000 employees. Its revenue from the hair shampoo market in APAC contributes to its overall revenues, along with its other offerings, but is not a key revenue stream for the company.

-

Amway Corp. - The company offers hair shampoo products SATINIQUE Hairfall Control Shampoo.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The hair shampoo market in APAC forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Hair Shampoo Market in APAC Value Chain Analysis

Our report provides extensive information on the value chain analysis for the hair shampoo market in APAC, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the personal products market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Distribution Channel Segments in the Hair Shampoo Market in APAC?

To gain further insights on the market contribution of various segments Request for a FREE sample

The hair shampoo market share growth in APAC by the offline segment will be significant during the forecast period. This distribution channel includes specialty stores; hypermarkets, supermarkets, convenience stores, and clubhouse stores; and others (department stores, salons and spas, and drugstores). An increase in the number of stores and business expansions by retailers has fueled the demand for this equipment. Vendors are focusing on the online-to-offline (O2O) business strategy to enhance sales through offline distribution channels while promoting their digital experience. The O2O channel provides various benefits to buyers, including in-store pickup of the goods purchased online, the purchase of goods online while being at the physical store, and returning products purchased online to the designated physical stores. Such strategies will help vendors increase their market share and expand their consumer base.

This report provides an accurate prediction of the contribution of all the segments to the growth of the hair shampoo market size in APAC and actionable market insights on post COVID-19 impact on each segment.

You may be interested in:

Hair Care market - The market share is expected to increase by USD 17.12 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 3.78%.

Hair Shampoo market - The market share is expected to grow at a modest CAGR of almost 2% during the forecast period.

Zero-waste Shampoo market - The market share is expected to increase by USD 57 million from 2021 to 2026, at a CAGR of 5.63%.

|

Hair Shampoo Market Scope in APAC |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.25% |

|

Market growth 2022-2026 |

$ 4.02 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

7.74 |

|

Regional analysis |

APAC |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Amway Corp., Himalaya Global Holdings Ltd., Johnson and Johnson Inc., Kao Corp., LOreal SA, Patanjali Ayurved Ltd., Shiseido Co. Ltd., The Avon Co., The Procter and Gamble Co., and Unilever PLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Hair Shampoo Market in APAC Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive hair shampoo market growth in APAC during the next five years

- Precise estimation of the hair shampoo market size in APAC and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the hair shampoo industry in APAC

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of hair shampoo market vendors in APAC

We can help! Our analysts can customize this report to meet your requirements. Get in touch