Handling And Lifting Equipment Market Size 2025-2029

The handling and lifting equipment market size is forecast to increase by USD 18.56 billion, at a CAGR of 4% between 2024 and 2029.

- The market is poised for significant growth, driven by the expansion of the construction sector and the increasing popularity of equipment rental businesses. These trends reflect the industry's ability to cater to the evolving needs of various industries, particularly construction, where the demand for efficient and flexible handling solutions continues to rise. However, market participants face challenges as well, with the fluctuating prices of raw materials posing a significant obstacle. This volatility can impact the cost structure of manufacturers and, in turn, their competitiveness in the market. To capitalize on opportunities and navigate challenges effectively, companies must remain agile and responsive to market dynamics.

- By focusing on innovation, cost optimization, and strategic partnerships, they can differentiate themselves and maintain a competitive edge. Additionally, investing in sustainable and energy-efficient solutions will enable businesses to cater to the growing demand for eco-friendly equipment and contribute to a more sustainable future for the industry.

What will be the Size of the Handling And Lifting Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the diverse demands of various sectors. ISO standards play a crucial role in ensuring safety and efficiency, with entities such as remote controls, hydraulic lifters, load binders, lifting magnets, logistics automation, telescopic handlers, and chain slings integrating seamlessly into material handling systems. Remote controls enable precise operation of machinery, enhancing productivity and reducing human error. Hydraulic lifters offer increased lifting capacity and versatility, while load binders secure loads effectively during transportation. Lifting magnets facilitate the handling of ferromagnetic materials, and logistics automation streamlines supply chain management. Telescopic handlers provide flexibility for lifting and transporting heavy loads at height, while mobile cranes offer mobility and versatility.

CE marking ensures compliance with European safety regulations, and operator training is essential for safe and effective use of all equipment. Continuous innovation in this market includes the development of RFID tracking for real-time inventory management, pneumatic lifters for lighter loads, and vacuum lifters for handling delicate items. The integration of these technologies and standards enhances safety, improves efficiency, and adapts to the evolving needs of industries. Material handling systems, including forklift attachments, conveyor systems, and overhead cranes, continue to adapt to the demands of various sectors, with a focus on load capacity, lifting height, and safety standards. The ongoing unfolding of market activities underscores the importance of staying informed and adhering to the latest industry trends and regulations.

How is this Handling And Lifting Equipment Industry segmented?

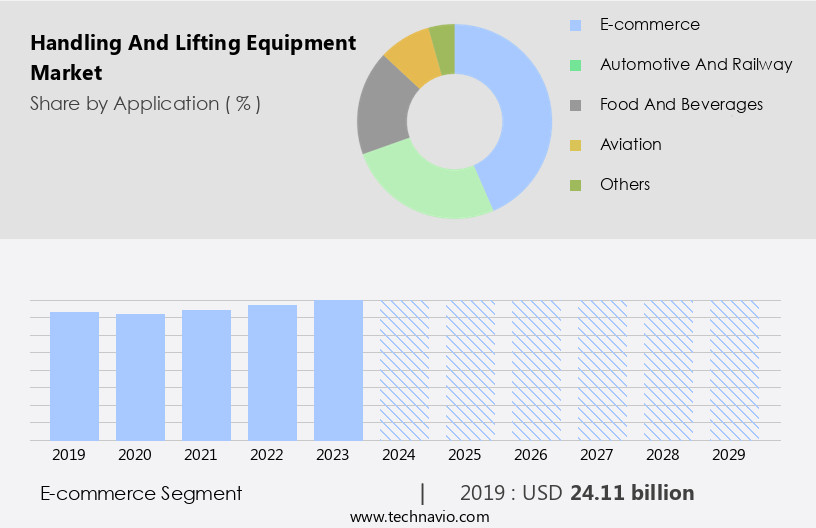

The handling and lifting equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- E-commerce

- Automotive and railway

- Food and beverages

- Aviation

- Others

- Product

- Cranes

- Forklifts

- Conveyor systems

- Hoists

- Source

- Electric lifting and handling equipment

- Hydraulic lifting equipment

- Internal combustion engine (ICE)-powered equipment

- Pneumatic lifting equipment

- Manual lifting equipment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The e-commerce segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of products, including pallet jacks, warehouse equipment, rigging hardware, eye bolts, electric chain hoists, RFID tracking, and supply chain management solutions. Cargo handling equipment, such as hand trucks, conveyor systems, pneumatic lifters, and reach stackers, are also integral to this market. Compliance with safety standards, including ASME and ISO, is paramount. Jib cranes, gantry cranes, vacuum lifters, air hoists, and manual chain hoists are essential for industrial safety in various industries. Lifting beams, webbing slings, load cells, and overhead cranes facilitate heavy-duty lifting tasks. Logistics automation through telescopic handlers, remote controls, hydraulic lifters, and load binders streamlines operations.

E-commerce companies are driving market growth by focusing on large order fulfillment rates and maximum efficiency using automated processes. The e-commerce segment's growth rate is anticipated to surpass that of the conventional retail sector. Rigging hardware, lifting slings, and material handling systems cater to the unique demands of e-commerce and 3PL warehousing service providers. Safety standards, such as OSHA compliance and CE marking, are essential for operator training and accident prevention. Forklift attachments ensure versatility in various applications. The market is continually evolving, with innovations in technology, such as RFID tracking and load capacity monitoring, enhancing efficiency and productivity.

The E-commerce segment was valued at USD 24.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth, driven by the expanding construction, e-commerce, mining, and other industries. China, as the largest market in APAC, contributes substantially to this growth. The increasing demand for efficient material handling solutions in various sectors is a primary growth factor. Moreover, the rising disposable income in the automotive and food and beverage industries is expected to further fuel market expansion. The industrial sector in APAC is undergoing a transformative phase, with key contributors being China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. The use of advanced technologies such as RFID tracking, supply chain management, and logistics automation is becoming increasingly prevalent in the market.

Compliance with safety standards, including OSHA and ISO, is essential for manufacturers and end-users. Equipment offerings include pallet jacks, warehouse equipment, rigging hardware, eye bolts, electric chain hoists, manual and hydraulic chain hoists, jib cranes, gantry cranes, vacuum lifters, air hoists, lifting beams, webbing slings, load cells, overhead cranes, reach stackers, telescopic handlers, and various types of cranes, such as mobile, overhead bridge, and gantry cranes. These solutions cater to diverse load capacities and lifting heights. Safety is a top priority in the market, with industrial safety and work safety being key concerns. Training operators and ensuring OSHA compliance are essential to prevent accidents.

Equipment offerings include forklift attachments, lifting slings, and various types of crane attachments. The market also adheres to safety standards such as CE marking and ASME and EN standards. The market is continuously evolving, with innovations in technology and safety features.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of machinery and tools designed to move, position, and secure various materials in industries such as construction, manufacturing, and logistics. Key players in this sector offer solutions including cranes, forklifts, hoists, scissor lifts, and telehandlers. These equipment types cater to different lifting capacities, heights, and applications. Factors driving market growth include increasing industrialization, urbanization, and automation. Safety features, energy efficiency, and ergonomics are crucial considerations in the design and development of modern handling and lifting equipment. Additionally, advancements in technology, such as electric and autonomous models, are transforming the market landscape. Overall, the market presents significant opportunities for innovation and growth.

What are the key market drivers leading to the rise in the adoption of Handling And Lifting Equipment Industry?

- The construction sector's expansion serves as the primary catalyst for market growth.

- The global construction industry is experiencing continuous growth, driven by the increasing demand for residential and commercial buildings, including office and retail complexes. Favorable interest rates in major markets, such as the US and China, are further fueling private construction activities. Additionally, governments are investing in social infrastructure projects in sectors like healthcare, education, power, transport, and communication. Construction projects necessitate the use of handling and lifting equipment, such as cranes and hoists, to facilitate the movement and positioning of heavy materials. As a result, the expansion of the global construction sector is driving the demand for this equipment.

- Handling and lifting equipment encompasses various types, including jib cranes, gantry cranes, vacuum lifters, air hoists, manual chain hoists, lifting beams, webbing slings, load cells, overhead cranes, and reach stackers. Industrial safety and occupational safety are paramount considerations in the use of these tools, ensuring the protection of workers and the efficient execution of projects.

What are the market trends shaping the Handling And Lifting Equipment Industry?

- Equipment rental business is experiencing significant growth, making it a noteworthy market trend.

- Handling and lifting equipment is a critical investment for businesses involved in logistics automation and construction projects. However, the high cost of ownership has led small- and medium-sized enterprises (SMEs) to consider equipment rental as a more cost-effective solution. Renting allows SMEs to access the latest, technologically advanced equipment, such as remote-controlled telescopic handlers, hydraulic lifters, load binders, lifting magnets, and mobile cranes, which are essential for efficient and safe operations. Renting also offers flexibility in servicing, selection, and exchange of equipment. Contractors can easily switch between various types of equipment to suit their project requirements. Moreover, the rental companies provide operator training, ensuring that the equipment is handled correctly, reducing downtime and increasing productivity.

- ISO standards and CE marking are essential certifications for handling and lifting equipment, ensuring safety and compliance with regulations. Equipment rental companies invest in these certifications, providing customers with peace of mind and confidence in the equipment's quality. Chain slings are another essential handling and lifting equipment that is widely used in various industries. They are available in different types, such as wire rope slings, round slings, and web slings, and are suitable for lifting different types of loads. In conclusion, the market is dynamic, with a focus on innovation and safety. Renting equipment offers flexibility, cost savings, and access to the latest technology.

- ISO standards and CE marking ensure safety and compliance with regulations, making it a wise investment for businesses.

What challenges does the Handling And Lifting Equipment Industry face during its growth?

- The volatility in the pricing of raw materials poses a significant challenge to the growth of the industry.

- Handling and lifting equipment, which includes material handling systems and lifting slings, plays a crucial role in various industries for moving and positioning heavy loads. The market for this equipment is influenced by several factors, including load capacity, lifting height, and safety standards. Raw materials, primarily steel, hardened steel, and aluminum, significantly impact the production cost of handling and lifting equipment. Fluctuations in the prices of these materials can be attributed to macroeconomic factors such as inflation, labor costs, and regulatory policy changes. For instance, the price of iron ore, a key raw material, is projected to decrease from USD100 per ton in 2024 to USD85-95 per ton in 2025 and further to USD80-90 per ton in 2026.

- Safety is a top priority in the market, with safety standards such as OSHA compliance being strictly adhered to. Equipment used in material handling includes overhead bridge cranes, forklift attachments, and wire rope slings, among others. Work safety and accident prevention are essential considerations in the design and implementation of these systems. In conclusion, the market is driven by factors such as load capacity, lifting height, and safety standards. The cost of production is influenced by the price of raw materials, which can fluctuate due to macroeconomic factors. Safety remains a top priority, with strict adherence to safety standards such as OSHA compliance.

Exclusive Customer Landscape

The handling and lifting equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the handling and lifting equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, handling and lifting equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Crane and Equipment Corp. - Specializing in lifting solutions, we provide clean room hoists and cranes engineered for contaminant-free environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Crane and Equipment Corp.

- Cargotec Corp.

- Columbus McKinnon Corp.

- Daifuku Co. Ltd.

- Escorts Ltd.

- Haulotte Group

- Hyster Yale Materials Handling Inc.

- KITO Corp.

- Komatsu Ltd.

- Konecranes

- Liebherr International AG

- Manitex International Inc.

- Sany Group

- Shandong Dahan Construction Machinery Co. Ltd.

- Sumitomo Heavy Industries Ltd.

- Terex Corp.

- The Manitowoc Co. Inc.

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Handling And Lifting Equipment Market

- In January 2024, Terex Corporation, a leading manufacturer of lifting and material handling solutions, announced the launch of its new Terex Rough Terrain Cranes series, featuring improved fuel efficiency and enhanced safety features (Terex Press Release).

- In March 2024, Konecranes and Dematic, two prominent players in the material handling equipment market, entered into a strategic partnership to offer integrated automation solutions, expanding their combined market reach (Konecranes Press Release).

- In April 2025, JLG Industries, Inc., a global manufacturer of access equipment, completed the acquisition of SkyTrak, a leading provider of wireless tracking and fleet management systems for aerial work platforms, bolstering JLG's digital capabilities (JLG Industries Press Release).

- In May 2025, the European Union passed the new Machinery Directive 2025/123, which sets stricter safety and environmental standards for handling and lifting equipment, effective from January 2026 (European Parliament Press Release).

Research Analyst Overview

- The market encompasses a diverse range of products, including wire ropes, hydraulic valves, pneumatic valves, power supplies, and control systems. Distribution networks play a crucial role in ensuring the seamless delivery of these components to end users. Lease agreements and rental services provide flexible solutions for businesses requiring short-term access to equipment. Material science advances continue to impact the market, with innovations in wire rope technology, limit switches, and stress analysis enhancing safety and efficiency. Component sourcing and supply chain optimization are key focus areas, with businesses prioritizing quality control and compliance consulting to ensure regulatory adherence.

- Load monitoring and control systems, including PLC programming, SCADA systems, and remote diagnostics, enable real-time equipment performance analysis and predictive maintenance. Training programs and safety interlocks are essential for ensuring operator competence and equipment reliability. The market also incorporates a range of ancillary equipment, such as hydraulic pumps, motors drives, and brake systems, which contribute to overall system functionality. Testing procedures and simulation software facilitate product development and performance evaluation. Market trends include the integration of data analytics and aftermarket services, enabling predictive maintenance and optimizing equipment performance. Emergency stop systems, crane rails, and welding techniques ensure safe and efficient handling and lifting operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Handling And Lifting Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 18.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, France, UK, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Handling And Lifting Equipment Market Research and Growth Report?

- CAGR of the Handling And Lifting Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the handling and lifting equipment market growth of industry companies

We can help! Our analysts can customize this handling and lifting equipment market research report to meet your requirements.