HVAC Market Size 2025-2029

The HVAC market size is valued to increase by USD 90.5 billion, at a CAGR of 7% from 2024 to 2029. Growing construction sector will drive the HVAC market.

Major Market Trends & Insights

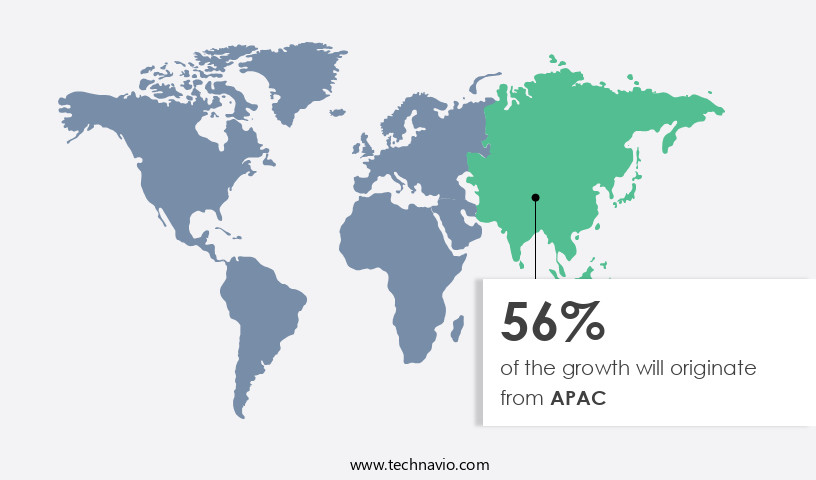

- APAC dominated the market and accounted for a 56% growth during the forecast period.

- By Type - HVAC equipment segment was valued at USD 118.50 billion in 2023

- By End-user - Non-residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 84.23 billion

- Market Future Opportunities: USD 90.50 billion

- CAGR from 2024 to 2029 : 7%

Market Summary

- The market, a critical component of infrastructure for commercial and residential buildings, experienced significant expansion in recent years. With the construction sector's robust growth, the demand for HVAC systems has escalated, driven by the increasing adoption of building automation systems. These advanced technologies enable energy efficiency, improved indoor air quality, and enhanced comfort, making them indispensable in modern architecture. However, challenges persist. HVAC equipment failures, often due to poor maintenance or aging infrastructure, can lead to significant operational disruptions and financial losses. To mitigate these issues, manufacturers and service providers are investing in innovative solutions, such as predictive maintenance technologies and smart HVAC systems.

- These advancements not only address equipment failures proactively but also contribute to energy savings and overall system optimization. According to a recent study, the market was valued at over USD 200 billion in 2020. This figure underscores the market's importance and potential for continued growth. As the industry evolves, it will remain focused on delivering energy efficiency, reliability, and connectivity to meet the ever-changing needs of businesses and consumers.

What will be the Size of the HVAC Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the HVAC Market Segmented?

The HVAC industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- HVAC equipment

- HVAC services

- End-user

- Non-residential

- Residential

- Heating Equipment

- Heat pumps

- Furnaces

- Unitary heaters

- Boilers

- Ventilation Equipment

- Air handling units

- Air filters

- Dehumidifiers

- Ventilation fans

- Humidifiers

- Air purifiers

- Cooling Equipment

- Unitary air conditioners

- VRF systems

- Chillers

- Room air conditioners

- Coolers

- Cooling towers

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The HVAC equipment segment is estimated to witness significant growth during the forecast period.

The market is experiencing robust growth due to the expanding population, surging construction expenditures, and rising sales of commercial and residential buildings. This trend is particularly noticeable in the adoption of advanced HVAC technologies such as zoned systems, thermal insulation, fan power optimization, direct digital controls, humidity control, and smart HVAC technology. Manufacturers are prioritizing energy efficiency and sustainability, with innovations like heat pump technology, variable refrigerant flow, and building automation systems gaining traction. Key sub-segments of the market include air conditioning, heating, and ventilation. In the air conditioning sector, there is a growing demand for heat pumps, room ACs, and unitary ACs.

The HVAC equipment segment was valued at USD 118.50 billion in 2019 and showed a gradual increase during the forecast period.

To meet stringent energy efficiency and green technology regulations, manufacturers are developing eco-friendly solutions that minimize chlorofluorocarbon (CFC) and hydrofluorocarbon (HFC) emissions. The growth is attributed to factors such as the increasing focus on energy efficiency metrics, building energy codes, and the integration of heat transfer principles, refrigeration cycles, and thermal comfort into HVAC system design. Additionally, advancements in air handling units, HVAC controls, refrigerant efficiency, energy modeling software, air filtration systems, chilled water systems, boiler system maintenance, cooling tower efficiency, ventilation optimization, and heating system design are driving market expansion.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How HVAC Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region dominates The market, driven by population growth, climatic conditions, urbanization, and demographic shifts. According to World Bank data, the population in China and India, two major markets, increased from 1.40 billion and 1.36 billion, respectively, in 2017 to 1.42 billion and 1.39 billion in 2023. The expanding commercial construction sector in these countries, particularly in China and India, is a significant growth driver.

Regulations and efficiency norms, such as India's Energy Conservation Building Code and China's Energy Efficiency Standards for Buildings, will further fuel market growth in APAC during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for energy efficiency improvements in building systems. Variable refrigerant flow (VRF) systems, with their advanced design and ability to optimize energy consumption, are leading the charge in this regard. Integration of building automation systems with HVAC is also becoming a norm, enabling better control and management of thermal comfort and air quality. Air filtration systems are a crucial component of modern HVAC systems, and selecting the right one is essential for maintaining optimal indoor air quality. Heat pump technology advancements have led to increased efficiency, making them a popular choice for cooling and heating applications. HVAC system optimization strategies, such as efficient cooling tower operation techniques and refrigerant charge optimization, are key to reducing energy consumption and costs. Improved ventilation methods, including demand-controlled ventilation system design and airflow balancing techniques, are essential for ensuring building energy code compliance. Advanced HVAC controls integration strategies, such as fault detection diagnostic tools and high-efficiency air handling unit selection, are also gaining popularity. Duct system design best practices and energy modeling software applications are crucial for ensuring optimal system performance and energy savings. Maintaining HVAC systems is crucial for ensuring their longevity and efficiency. Regular maintenance, including cleaning and filter replacement, is essential for preventing faults and reducing energy consumption. Building owners and operators must stay informed about the latest HVAC trends and technologies to ensure their systems remain efficient and effective.

What are the key market drivers leading to the rise in the adoption of HVAC Industry?

- The construction sector's robust growth serves as the primary catalyst for market expansion.

- The market experiences continuous evolution, significantly influenced by the construction sector's expansion. With the increasing number of commercial and residential buildings worldwide, the demand for HVAC equipment and services has surged. The construction industry's growth is noteworthy, particularly in APAC, which is anticipated to expand at the fastest rate during the forecast period. The primary catalysts for this growth are the ongoing infrastructure and real estate developments in the region.

- As of 2020, the APAC construction industry accounted for approximately 57% of the global construction output, highlighting its significant impact on the market's trajectory. The construction industry's expansion underscores the importance of energy-efficient HVAC systems, further fueling market growth.

What are the market trends shaping the HVAC Industry?

- Building automation systems are increasingly being incorporated into structures, representing a significant market trend.

- Building Automation Systems (BAS), incorporating advanced computing and digital communication tools, have gained significant traction in managing and optimizing HVAC systems and other building facilities. The proliferation of construction projects and building retrofits has driven the installation of these integrated BAS solutions. The evolution of BAS technology is attributed to advancements in sensor technology, the availability of cost-effective and swift communication systems, and enhanced user interfaces.

- Manufacturers are embracing open protocols, such as the Internet protocol, to deliver superior control solutions. BAS is increasingly adopted as a standard technology to facilitate seamless interaction and operability among HVAC, lighting, fire, and security control units within a building.

What challenges does the HVAC Industry face during its growth?

- The growth of the HVAC industry is significantly impacted by the challenges posed by equipment failures. This issue, which is of great concern to industry professionals, necessitates continuous efforts to improve system reliability and maintenance practices.

- The market encompasses a wide array of heating and cooling systems utilized in both residential and non-residential sectors. Over the years, these systems have undergone significant advancements, incorporating an expanded range of software-based, electrical, and mechanical components. With the rise in complexity, the potential for component failure has also increased. Neglecting these issues can adversely impact HVAC unit performance and escalate energy costs.

- For instance, clogged and worn-out filters compel the system to exert additional effort, ultimately shortening the unit's lifespan and heightening energy consumption.

Exclusive Technavio Analysis on Customer Landscape

The HVAC market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the HVAC market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of HVAC Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, HVAC market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABM Industries Inc. - The company specializes in providing tailored HVAC services, encompassing heating, air conditioning, and ventilation systems for commercial structures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABM Industries Inc.

- Air Comfort

- Alexander Mechanical Inc.

- Blue Star Ltd.

- Carrier Global Corp.

- Daikin Industries Ltd.

- EMCOR Group Inc.

- Emerson Electric Co.

- ENGIE SA

- Ferguson plc

- Fujitsu Ltd.

- Ingersoll Rand Inc.

- J and J Air Conditioning

- Johnson Controls International Plc

- Lennox International Inc.

- LG Corp.

- Nortek

- Samsung Electronics Co. Ltd.

- Service Logic

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HVAC Market

- In January 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new line of energy-efficient air conditioners, the AquaEdge 19DV centrifugal chiller, at the AHR Expo (Source: Carrier Global Corporation Press Release). This innovative product line is designed to reduce energy consumption by up to 20% compared to previous models.

- In March 2024, Johnson Controls and Honeywell International, two major HVAC players, announced a strategic partnership to integrate their building automation systems, creating a more comprehensive offering for customers (Source: Johnson Controls Press Release). This collaboration aims to improve energy efficiency and reduce operational costs for commercial and industrial clients.

- In May 2024, LG Electronics, a South Korean tech giant, completed the acquisition of Webeloit, a German smart home automation company, to expand its HVAC offerings and strengthen its presence in the European market (Source: LG Electronics Press Release). The acquisition is expected to generate annual synergies of approximately USD 100 million.

- In February 2025, the U.S. Department of Energy (DOE) issued a final rule to update the energy conservation standards for residential and commercial air conditioners and heat pumps, aiming to reduce energy consumption and greenhouse gas emissions (Source: U.S. Department of Energy Press Release). The new standards are projected to save consumers approximately USD 30 billion in energy costs over the next 30 years.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 90.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, US, Japan, Germany, UK, France, India, Spain, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and shifting consumer demands. Zoned HVAC systems, which allow for temperature control in specific areas of a building, have gained popularity due to their energy efficiency and improved thermal comfort. Thermal insulation, fan power optimization, and direct digital controls are among the technologies contributing to these systems' success. Smart HVAC technology, including air handling units and heat pump technology, is revolutionizing building automation. Variable refrigerant flow and demand-controlled ventilation systems are also on the rise, optimizing energy usage and improving indoor air quality. Building envelope improvements, such as insulation and air tightness, are essential for energy efficiency and reducing heating and cooling loads.

- According to recent market research, The market is projected to grow by over 5% annually. For instance, a large commercial building in New York City implemented a comprehensive HVAC upgrade, resulting in a 25% reduction in energy consumption and significant cost savings. Energy efficiency metrics, such as refrigerant efficiency and airflow measurement, are crucial in designing and commissioning HVAC systems. Building energy codes, adhering to heat transfer principles and refrigeration cycles, are driving the industry towards more sustainable solutions. Air filtration systems, chilled water systems, and boiler system maintenance are also essential components of modern HVAC systems.

- Despite advancements, challenges remain, including duct leakage testing, humidity control, and ventilation optimization. Pneumatic controls and duct design are being replaced with digital alternatives, ensuring better performance and reduced maintenance costs. HVAC controls and building automation systems are increasingly integrated, offering improved energy management and thermal comfort. In conclusion, the market is a dynamic and ever-evolving industry, with ongoing advancements in technology and consumer demands shaping its future. The integration of smart HVAC technology, energy efficiency measures, and building automation systems is transforming the industry, offering significant cost savings and improved thermal comfort.

What are the Key Data Covered in this HVAC Market Research and Growth Report?

-

What is the expected growth of the HVAC Market between 2025 and 2029?

-

USD 90.5 billion, at a CAGR of 7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (HVAC equipment and HVAC services), End-user (Non-residential and Residential), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Heating Equipment (Heat pumps, Furnaces, Unitary heaters, and Boilers), Ventilation Equipment (Air handling units, Air filters, Dehumidifiers, Ventilation fans, Humidifiers, and Air purifiers), and Cooling Equipment (Unitary air conditioners, VRF systems, Chillers, Room air conditioners, Coolers, and Cooling towers)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing construction sector, Failure issues with HVAC equipment

-

-

Who are the major players in the HVAC Market?

-

ABM Industries Inc., Air Comfort, Alexander Mechanical Inc., Blue Star Ltd., Carrier Global Corp., Daikin Industries Ltd., EMCOR Group Inc., Emerson Electric Co., ENGIE SA, Ferguson plc, Fujitsu Ltd., Ingersoll Rand Inc., J and J Air Conditioning, Johnson Controls International Plc, Lennox International Inc., LG Corp., Nortek, Samsung Electronics Co. Ltd., Service Logic, and Siemens AG

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, encompassing various components such as thermal storage systems, control strategies, HVAC inspection, and more. For instance, the adoption of advanced control strategies has led to a significant reduction in energy consumption, with some buildings reporting savings up to 20%. Furthermore, industry experts anticipate a continuous growth of approximately 5% annually, driven by the increasing demand for energy-efficient solutions and the ongoing modernization of existing buildings. This trend is evident in the widespread implementation of technologies like VAV systems, building management systems, and cooling load calculation tools, which optimize energy usage and improve overall system performance.

- Additionally, the integration of sensor technology and automation in HVAC systems has enabled real-time monitoring and diagnostics, ensuring efficient equipment selection and air distribution.

We can help! Our analysts can customize this HVAC market research report to meet your requirements.