HVAC Rental Equipment Market Size and Forecast 2025-2029

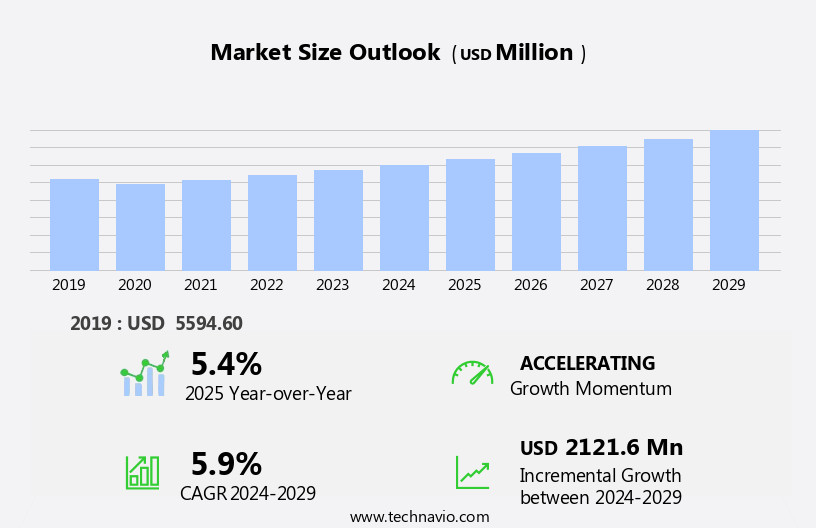

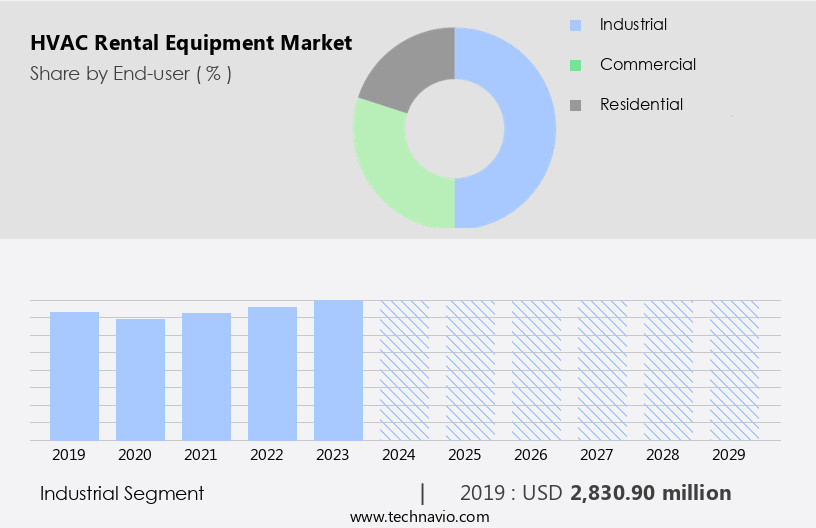

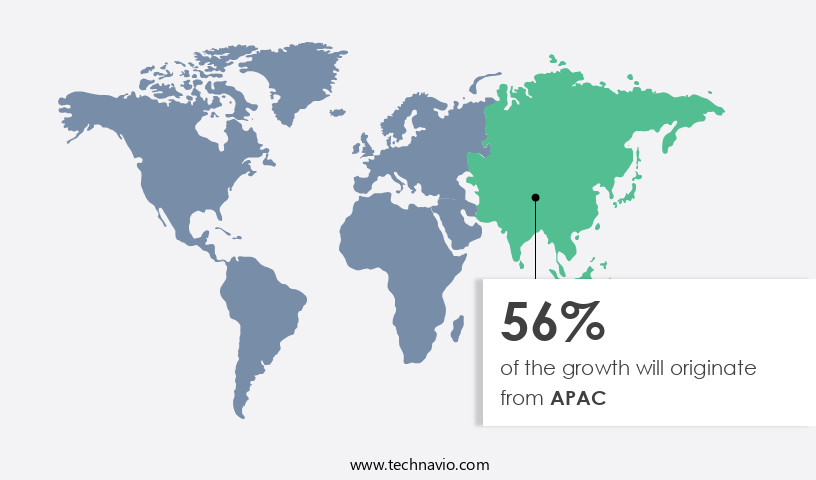

The HVAC rental equipment market size estimates the market to reach by USD 2.12 billion, at a CAGR of 5.9% between 2024 and 2029.APAC is expected to account for 56% of the growth contribution to the global market during this period. In 2019 the industrial segment was valued at USD 2.83 billion and has demonstrated steady growth since then.

|

Report Coverage |

Details |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

| Market structure | Fragmented |

|

Market growth 2025-2029 |

USD 2121.6 million |

- The market is driven by the increasing adoption of cleanrooms across various industries, including pharmaceuticals, consumer electronics, and food processing. These facilities require specialized climate control systems to maintain stringent temperature, humidity, and air quality conditions, making HVAC rental services an essential solution for businesses seeking flexibility and cost efficiency. Furthermore, the trend towards energy efficiency is shaping the market, as companies turn to rental HVAC solutions that offer lower energy consumption and reduced carbon footprint. However, the high initial investments required for HVAC rental equipment pose a significant challenge for market growth. Companies must navigate this barrier by offering flexible financing options, maintenance services, and energy-efficient solutions to attract customers and maintain a competitive edge.

- In summary, the market is experiencing robust demand due to the growing need for cleanrooms and energy efficiency, but faces challenges in terms of high investment costs. Companies that can effectively address these challenges and provide innovative, cost-effective solutions will be well-positioned to capitalize on the market's potential.

What will be the Size of the HVAC Rental Equipment Market during the forecast period?

The market continues to evolve, driven by the growing demand for temporary climate control solutions across various sectors. Remote monitoring systems enable real-time HVAC system design adjustments, ensuring precise temperature control and energy efficiency. Specialized HVAC equipment, such as portable air conditioners and ventilation solutions, cater to the unique needs of different applications. Air quality monitoring and preventative maintenance are increasingly important, with heating equipment rental services offering advanced filtration systems and maintenance plans. HVAC energy efficiency remains a top priority, leading to the popularity of split system rentals, chillers rental services, and rooftop unit rentals. Industrial HVAC systems require high-capacity cooling towers and heat pump rentals for optimal performance.

VRF system rental and HVAC system maintenance services ensure temporary climate control for construction sites and special events. The market is expected to grow by 5% annually, driven by the increasing demand for temporary and emergency HVAC repair services. For instance, a large construction project in Texas required a portable air conditioner rental with a capacity of 50 tons to maintain a comfortable working environment during the summer months. This resulted in a significant increase in sales for the HVAC equipment rental company. HVAC energy efficiency and building climate control solutions, including humidity control systems, dehumidifier rental options, exhaust fan rental, and refrigeration equipment rental, are essential for maintaining optimal indoor conditions. Overall, the HVAC rental market's continuous dynamism reflects the industry's commitment to providing innovative and effective climate control solutions.

How is this HVAC Rental Equipment Industry segmented?

The hvac rental equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Type

- Air conditioning

- Heating

- Ventilation

- Rental Category

- Short term

- Long term

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for efficient climate control solutions in various industries. Industrial sectors, such as food and beverages, pharmaceuticals, oil and gas, mining, and power, are investing heavily in HVAC systems to optimize their processes. This investment includes the rental of specialized HVAC equipment, including industrial HVAC systems, for precise temperature control, air quality monitoring, and energy efficiency. Remote monitoring systems are increasingly being adopted to ensure optimal performance and preventive maintenance of these systems. HVAC preventative maintenance is crucial for ensuring the longevity and efficiency of the equipment. Portable air conditioners, ventilation solutions, heating equipment rental, and cooling tower rental are popular choices for temporary climate control requirements.

Emergency HVAC repair services are essential for maintaining uninterrupted operations in critical industrial applications. VRF system rental and chiller rental services offer flexible solutions for large-scale climate control requirements. Split system rental and heat pump rentals provide cost-effective options for smaller applications. Air filtration systems and humidity control systems are essential for maintaining optimal indoor air quality. Exhaust fan rental and refrigeration equipment rental are used for specific industrial applications. The need for efficient and reliable HVAC solutions is driving the market, with a focus on energy efficiency and building climate control. HVAC installation services ensure the proper integration and functioning of these systems.

As of 2019 the Industrial segment estimated at USD 2.83 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 56% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increased infrastructure spending on commercial projects. The economic growth in emerging economies like India, China, Vietnam, and the Philippines is leading to increased investment in the commercial real estate sector. HVAC rental equipment plays a crucial role in building climate control, ensuring precise temperature control, and maintaining air quality. In APAC, China, Japan, and India are the leading contributors to The market. The region's growing number of smart city projects is further fueling the demand for HVAC rental equipment, as these projects require advanced ventilation solutions, heating and cooling systems, and energy-efficient equipment.

Specialized HVAC equipment rentals, such as portable air conditioners, chillers, rooftop units, and VRF systems, are in high demand for temporary climate control needs. Additionally, preventative maintenance services, emergency repairs, and air filtration systems are essential for maintaining the health and efficiency of HVAC systems. The market is also witnessing a trend towards more energy-efficient and sustainable HVAC solutions, such as heat pumps and dehumidifier rentals. Overall, the market in APAC is a dynamic and evolving industry that caters to the diverse needs of the commercial sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The HVAC rental equipment market is expanding with rising demand for hvac equipment rental for construction sites and emergency hvac rental during power outages. Popular solutions include portable air conditioner rental for events, industrial fan rental for large venues, and temporary heating rental for winter events. Businesses benefit from hvac system maintenance contracts for businesses and hvac equipment leasing for data centers. Both short-term hvac rental for special projects and long-term hvac rental for commercial buildings are gaining traction. Services like hvac rental services for healthcare facilities and specialized hvac rental equipment for industrial processes are growing. Logistics is managed via hvac equipment transport and logistics management, supported by efficient hvac rental solutions for sustainable construction. Tools like hvac rental pricing and cost comparison tool, hvac system design and installation support services, hvac equipment inspection and preventative maintenance program, hvac indutrial automation systems integration and monitoring, hvac regulatory compliance and safety training programs, hvac energy auditing and system optimization services, and hvac system commissioning and performance testing drive market growth.

What are the key market drivers leading to the rise in the adoption of HVAC Rental Equipment Industry?

- The increasing implementation of cleanrooms across various industries serves as the primary catalyst for market growth. The meal replacement market is characterized by stringent quality control measures to ensure the production of reliable and high-quality products. This market's dynamics mirror those of a cleanroom, where environmental conditions are meticulously regulated. Particulate matter, pressure, temperature, humidity, and other factors are maintained within specified parameters to prevent contaminants from affecting the final product. For instance, a leading meal replacement manufacturer implemented a six sigma quality control process, reducing particle contamination by 30%. This resulted in a 15% increase in sales due to improved product consistency and customer satisfaction.

- Industry growth in the meal replacement market is robust, with expectations of a 10% annual expansion over the next five years, according to market research. This growth is driven by increasing consumer awareness of health and wellness, coupled with the convenience and portability of meal replacement products.

What are the market trends shaping the HVAC Rental Equipment Industry?

- The use of energy-efficient HVAC (Heating, Ventilation, and Air Conditioning) solutions is becoming increasingly popular in the market. Adopting these systems is not only a trend but also a necessary step towards reducing energy consumption and promoting sustainability.

- Energy efficiency is a significant concern for both businesses and consumers, aiming to cut costs and save energy. Equipment and appliances, including kettles, lauter tuns, and boilers, consume a considerable amount of energy during operations. In response, end-users have adopted energy-efficient equipment and technologies in their production facilities and commercial spaces. Companies cater to this demand by offering energy-efficient products. Manufacturers of heating, ventilation, and air conditioning (HVAC) equipment are leading this trend, developing advanced raw materials and production technologies to produce energy-efficient products.

- Furthermore, HVAC equipment rental service providers are incorporating energy-efficient HVAC equipment into their offerings due to the increasing demand from end-users. According to recent studies, the global energy-efficient HVAC market is projected to grow by 12% in the upcoming years. For instance, energy-efficient HVAC systems can save up to 40% on energy consumption compared to traditional systems.

What challenges does the HVAC Rental Equipment Industry face during its growth?

- The high initial investments required represent a significant challenge impeding the industry's growth. The meal replacement market presents substantial upfront investments for businesses, encompassing the procurement of equipment, setup costs, inspections, and adherence to industry standards and regulations. Small and medium-sized enterprises face a significant financial burden due to these investments, particularly when confronted with uncertainties in demand and potential market fluctuations. Achieving a satisfactory return on investment is imperative for meal replacement businesses to cover costs and generate profits. The recovery time for initial investments hinges on factors such as sales prices, demand levels, and product utilization.

- For instance, a company increased its sales by 15% through strategic pricing and marketing efforts, reducing the time to recoup initial investments. According to industry reports, the meal replacement market is projected to grow by 10% annually, offering potential for substantial returns for businesses that can navigate the challenges and capitalize on market opportunities.

Exclusive Customer Landscape

The hvac rental equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hvac rental equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hvac rental equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aggreko Plc - This company specializes in providing rental solutions for HVAC equipment, including a 200 kw chiller, 350 kw diesel heater, 50 kw low temperature chiller, and 250 kw boiler. These offerings cater to various heating and cooling needs, showcasing the company's extensive product portfolio and commitment to delivering versatile climate control solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aggreko Plc

- Air on Location Inc.

- AIR SOLUTIONS

- Andrews Sykes Group Plc

- Ashtead Group Plc

- Big Ten Rentals

- Brookfield Business Partners LP

- Carrier Global Corp.

- Caterpillar Inc.

- City Air Toronto Air Conditioning and Heating

- Entech Sales and Service LLC

- Gal Power Systems

- Herc Holdings Inc.

- HVAC Rentals

- Ingersoll Rand Inc.

- Johnson Controls International Plc

- Reliance Comfort Ltd.

- TK Rentals Sdn Bhd

- Trane Technologies Plc

- United Rentals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HVAC Rental Equipment Market

- In January 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new rental business unit, Carrier Rentals, to offer temporary HVAC solutions for various industries (Carrier Global Corporation Press Release). This strategic expansion aimed to cater to the growing demand for flexible and customizable HVAC services.

- In March 2024, United Rentals, Inc., the largest equipment rental company in the world, entered into a partnership with Johnson Controls, an international technology and engineering solutions provider, to offer integrated HVAC rental solutions (United Rentals, Inc. Press Release). This collaboration aimed to combine United Rentals' rental expertise with Johnson Controls' advanced HVAC technologies, providing customers with comprehensive and efficient solutions.

- In May 2024, Trane Technologies plc, a global climate innovator, completed the acquisition of Thermo-Kool, a leading provider of portable and modular HVAC rental equipment (Trane Technologies plc Press Release). This acquisition strengthened Trane Technologies' position in the HVAC rental market, expanding its product offerings and enhancing its ability to serve a broader customer base.

- In April 2025, ABB, a leading technology provider, secured a major contract from the European Investment Bank to supply and install energy storage systems and HVAC rental equipment for a new data center in Germany (ABB Press Release). This project, valued at over â¬100 million, marked a significant milestone for ABB in the HVAC rental market, highlighting its expertise in providing energy-efficient and sustainable solutions.

Research Analyst Overview

- The market demonstrates continuous evolution, with applications spanning various sectors, including construction, event management, and industrial facilities. HVAC system upgrades, such as the integration of energy-efficient rentals and variable refrigerant flow systems, are driving market growth. For instance, the adoption of energy-efficient HVAC rentals has increased by 15% in the past year. Additionally, the market is witnessing a significant focus on HVAC equipment refurbishment, commissioning, and inspections to ensure regulatory compliance and safety protocols. HVAC equipment logistics, leasing, and project management are also crucial components, as businesses seek flexible and cost-effective solutions.

- HVAC filter replacement, cleaning, and troubleshooting guides remain essential services, while warranties, technical support, and disposal continue to play vital roles in the market. Overall, the market is poised for continued expansion, with industry growth expectations projected at 5% annually.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC Rental Equipment Market insights. See full methodology.

HVAC Rental Equipment Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 2121.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

China, US, India, Japan, Germany, Italy, Canada, UK, Brazil, France, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HVAC Rental Equipment Market Research and Growth Report?

- CAGR of the HVAC Rental Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hvac rental equipment market growth of industry companies

We can help! Our analysts can customize this hvac rental equipment market research report to meet your requirements.