Industrial Food Cutting Machines Market Size 2024-2028

The Industrial Food Cutting Machines Market size is estimated to grow by USD 85.8 million between 2023 and 2028 accelerating at a CAGR of 2.57%. The market experiences continuous expansion, driven by various influential factors. Notably, the increasing frequency of new product introductions significantly contributes to market growth. Additionally, the processing industry's consistent expansion plays a pivotal role in market development. Furthermore, substantial investments in advanced production facilities underscore the market's robustness and potential for future growth. Key players in this sector prioritize innovation and efficiency, ensuring the market remains dynamic and competitive. It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2018 to 2022.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Request Free Sample PDF

Market Dynamics and Customer Landscape

The growing demand for freshly cut fruits and pre-cooked food has led to advancements in food cutting equipment. Food and beverage firms are investing in automation and ultrasonic technology to enhance productivity and meet consumer demand for high-quality, processed meat products. The governmental backing for food processing technology further supports the market's expansion. The rise in fast-food delivery services and the popularity of quick service restaurants drive the demand for efficient food processing solutions. With gender-neutral activity in kitchen tasks and increased participation from parents, the market for industrial food cutting machines is set to grow. The need for precision, efficiency, and consistency in the food and beverage sector underscores the importance of advanced food processing technologies in the modern food industry. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Drivers

The steady growth of the food processing industry is notably driving the market growth. The growing requirement for food processing as part of the food supply chain globally has helped increase the demand for machines in recent years. Due to the growing popularity of prepared foods that require little preparation time, food companies are increasingly expanding their selection of processed foods.

Additionally, the rising support to the industry through government initiatives in emerging economies, such as India, is expected to further boost the adoption of these processing applications during the forecast period. As part of the Union Budget 2017-2018, the Government of India announced a dairy processing infra fund worth USD 1.2 billion. The government also announced the relaxation of FDI norms for this sector, allowing up to 100% FDI in food product e-commerce. Such reforms are expected to boost the business of these processing companies and subsequently aid the adoption in the coming years. Overall, the growth of the global industry is expected to aid the growth of the global market during the forecast period.

Significant Market Trends

The increasing marketing initiatives taken by companies are the primary market trend. Global companies are using a comprehensive marketing approach, employing various channels such as newspapers, magazines, social media, and TV advertisements, followed by online campaigns to promote their products. This creative strategy improves brand recognition and generates consumer interest, with social media being a crucial component.

Companies utilize social media, particularly Instagram, to showcase product uses and post engaging content to increase product reach and develop brand communities. Increasing marketing efforts are expected to drive the growth of the global market in the forecast period.

Major Market Challenges

An increase in tariffs on steel imports is a major market challenge. The main raw material used is stainless steel. In March 2018, the US imposed a 25% tariff on steel scrap imports to promote domestic production, causing uncertainty in the metals industry. This decision not only impacted China but also other steel-exporting countries such as Canada, Mexico, and Germany, resulting in global steel price fluctuations.

The US imported 35.4 million metric tons of steel in 2017, with China being the largest exporter. NAFTA countries, China, and the EU contributed over 30% of steel imports to the US. Additionally, China's efforts to improve air quality are expected to reduce steel production capacity by 14 million tons in Hebei, a significant steel-producing province. Overall, this uncertainty in the steel trade is likely to negatively affect manufacturing and vendor profit margins in the forecast period.

Key Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

MARELEC Food Technologies - The company offers industrial food cutting machines that cut fresh products into portions of a programmed fixed weight, thickness, or a combination of the two using high-tech scanning with a laser and cameras.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Brunner Anliker AG

- Buhler AG

- CHEERSONIC Ultrasonic Equipment Co. Ltd.

- DADAUX SAS

- Deville Technologies Inc.

- EMURA FOOD MACHINE Co. Ltd.

- FAM NV

- GEA Group AG

- holac Maschinenbau GmbH

- Illinois Tool Works Inc.

- Jaymech Food Machines Ltd.

- KRONEN GmbH

- Marel TREIF GmbH

- ProXES GmbH

- SONIC ITALIA Srl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segment in the Market?

The market share growth of the fruits and vegetables segment will be significant during the forecast period. Popular processed tropical fruits include melons, watermelon, jack, papaya, grapefruit, pineapple, and mixed fruits. Fresh vegetables processed for cooking include corn, broccoli, cauliflower, celery, cabbage, and asparagus. F&B sector companies also offer fruit and vegetable mixed salads and leafy vegetable salads. Processing of fruits and vegetables mainly involves mechanical changes such as cutting, peeling, and cutting. After these changes, the processed product is packaged for consumption. Thanks to growing consumer awareness of the health benefits of fresh, wholesome, additive-free, chilled, fresh-cut fruits and vegetables have gained popularity in recent years.

Get a glance at the market contribution of various segments Request Free Sample PDF

The fruits and vegetables segment was valued at USD 136.20 million in 2018 and continued to grow by 2022. The growing popularity of fresh and frozen fruits and vegetables is encouraging established companies to launch new fruit and vegetable-cutting machines. In February 2019, Hefferman launched the industrial food chopper FAM Tridis 180, specially designed for the processing of fresh vegetables, individual quick-frozen vegetables, and fruits. The FAM Tridis 180 is suitable for medium cutting and can be used to cut fruits and vegetables such as peach, mango, pear, onion, carrot, and beetroot. Overall, the fruits and vegetables (except potatoes) segment is expected to witness significant growth during the forecast period.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Request Free Sample PDF

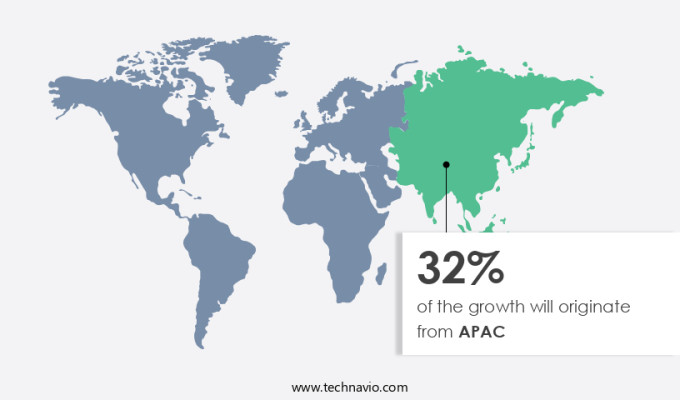

APAC is estimated to contribute 32% to the growth of the global market industry during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Another region offering significant growth opportunities to companies in Europe. The growing popularity of fresh and frozen fruits and vegetables is encouraging established companies to launch new fruit and vegetable-cutting machines. In February 2019, Hefferman launched the industrial food chopper FAM Tridis 180, specially designed for the processing of fresh vegetables, individual quick-frozen vegetables, and fruits. The FAM Tridis 180 is suitable for medium cutting and can be used to cut fruits and vegetables such as peach, mango, pear, onion, carrot, and beetroot. Overall, the fruits and vegetables (except potatoes) segment is expected to witness significant growth during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Fruits and vegetables

- Meat

- Potatoes

- Cheese

- Others

- Product Outlook

- Industrial food slicers

- Industrial food dicers

- Industrial food millers

- Industrial food shredders

- Region Outlook

- APAC

- China

- India

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- North America

- The U.S.

- Canada

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- APAC

You may also interested in below market reports:

- Food Processing Machinery Market: Food Processing Machinery Market Analysis APAC, Europe, North America, Middle East and Africa, South America - US, China, South Korea, Germany, UK - Size and Forecast

- Waterjet Cutting Machines Market: Waterjet Cutting Machines Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Germany, UK, Japan - Size and Forecast

- Plasma Cutting Machine Market: Plasma Cutting Machine Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, Japan, India - Size and Forecast

Market Analyst Overview

The market is experiencing significant growth due to the increasing demand for processed meat and poultry items and other convenience food products. The market caters to various processing facilities including potato processing factories, meat processing plants, fruits and vegetable processing plants, cheese processing plants, and confectionery products processing facilities.

Key applications of ultrasonic industrial food cutting machines in the food industry involve cutting bread, cakes, meats, and protein-rich meat products such as bacon, hot dogs, sausages, deli meats, beef, and veal. These machines ensure precise cutting into appropriate shapes, such as strips and cubes, catering to the needs of quick service restaurants, food chains, and fast-food centers. The automation in these machines, including automatic and semi-automatic technology, enhances efficiency and consistency in food processing. The market is particularly driven by the need for durability and extended shelf life of packaged foods. Automatic industrial food cutting equipment significantly aids in handling boneless chicken, beef, and fish and seafood processing plants. The adoption of ultrasound technology in food cutting ensures precision and maintains the integrity of the food items.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.57% |

|

Market growth 2024-2028 |

USD 85.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.48 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Brunner Anliker AG, Buhler AG, CHEERSONIC Ultrasonic Equipment Co. Ltd., DADAUX SAS, Deville Technologies Inc., EMURA FOOD MACHINE Co. Ltd., FAM NV, GEA Group AG, holac Maschinenbau GmbH, Illinois Tool Works Inc., Jaymech Food Machines Ltd., KRONEN GmbH, Marel TREIF GmbH, MARELEC Food Technologies, Proxes GmbH, SONIC ITALIA Srl, Sormac BV, Urschel Laboratories Inc., and Weber Maschinenbau GmbH |

|

Market dynamics |

Parent market analysis, Market forecasting, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch