Europe Industrial Gases Market Size 2025-2029

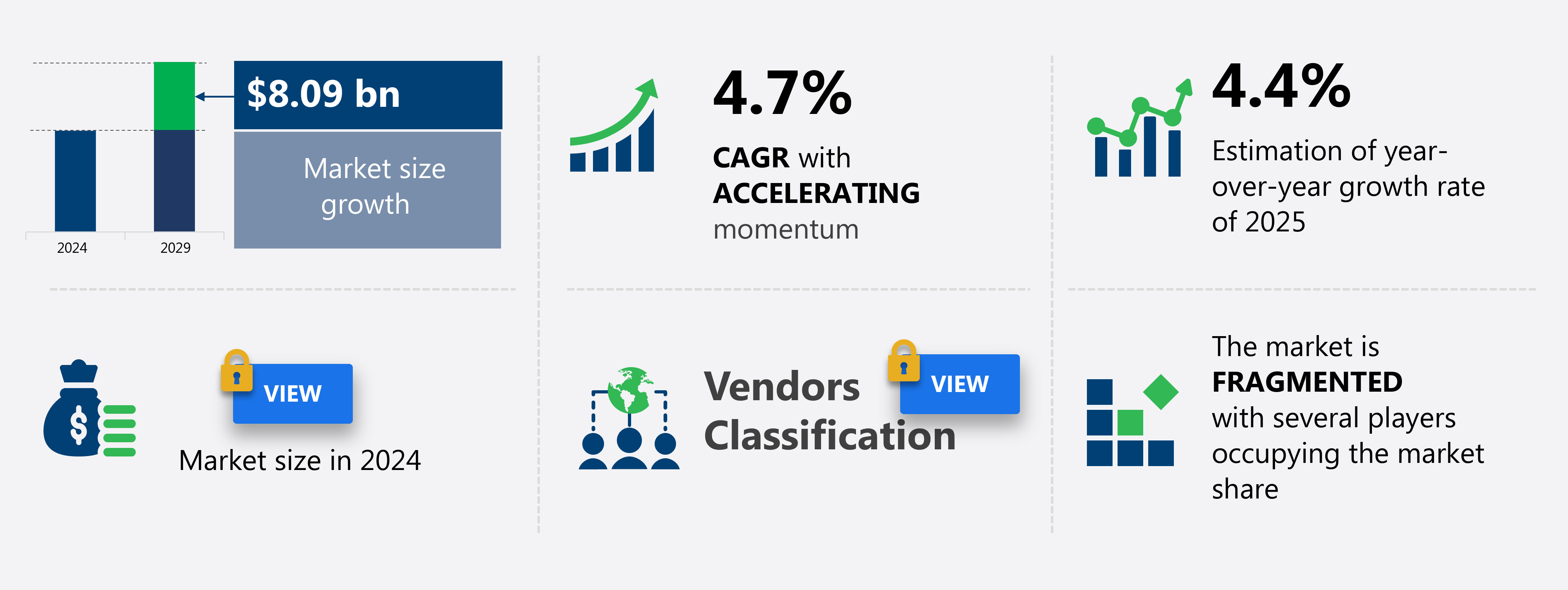

The Europe industrial gases market size is forecast to increase by USD 8.09 billion, at a CAGR of 4.7% between 2024 and 2029.

- The market exhibits significant growth due to the increased demand from various end-user industries. This market is driven by factors such as innovations in the storage, design, and packaging of industrial gases, which enhance their efficiency and safety. Carbon Dioxide (CO2) Market is a key segment within the market, witnessing considerable expansion. However, safety issues associated with the use of industrial gases remain a challenge, necessitating stringent regulations and technological advancements. Industrial Gas Phase Filtration Systems play a crucial role in ensuring the purity and safety of industrial gases, making them an essential component of this market. The market's growth trajectory is expected to continue, driven by these trends and challenges.

What will be the Size of the market During the Forecast Period?

- The market encompasses a diverse range of applications, primarily In the sectors of healthcare, manufacturing, metallurgy and glass, and chemicals and energy. Key gases include oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, argon, and others. In the healthcare sector, gases are utilized for therapeutic purposes and anesthesia. In manufacturing, they serve essential roles in various processes such as welding, metal fabrication, and glass production. In the chemicals and energy sector, industrial gases are used In the production of fertilizers, polymers, and other chemical compounds.

- Additionally, they find applications in food and beverages, including carbonation in beverages, refrigeration in dairy products, and the production of low-calorie alternatives like sugar alcohols and hydroxyl groups in organic compounds. Industrial gases are also integral to the production of consumer goods such as candies, chewing gums, ice creams, yogurts, fruit spreads, toothpaste, mouthwash, throat lozenges, and breath mints. The market is projected to grow steadily due to increasing demand from various end-use industries and technological advancements leading to more efficient production processes.

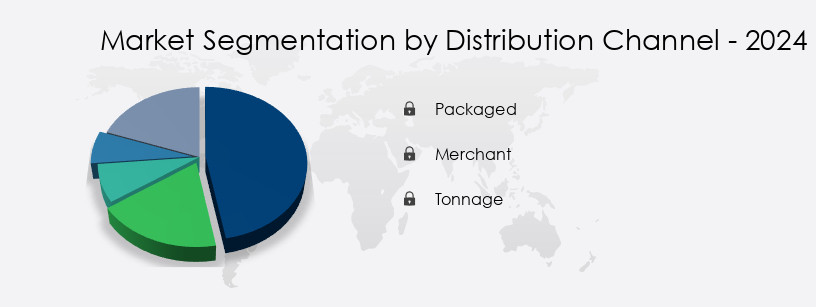

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Packaged

- Merchant

- Tonnage

- End-user

- Manufacturing

- Chemical processing

- Metallurgy

- Medical and healthcare

- Others

- Product

- Nitrogen

- Oxygen

- Carbon dioxide

- Hydrogen

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Distribution Channel Insights

- The packaged segment is estimated to witness significant growth during the forecast period.

Packaged industrial gases cater to the convenience and efficiency needs of small and medium-sized enterprises (SMEs) and end users with fluctuating demand. These solutions eliminate the requirement for large storage facilities, enabling businesses to effectively manage their gas requirements. The versatility of packaged gases makes them applicable to various industries, including healthcare, food and beverage, welding, and laboratories. The expanding base of SMEs, particularly in European sectors like manufacturing and healthcare, fuels the demand for cost-effective and manageable packaged industrial gas solutions. Packaged industrial gases contribute significantly to the production of flexible and rigid polyurethane coatings, foams, sealants, elastomers, adhesives, and insulating materials. They are also essential components in electronics, footwear, packaging, furniture, seating, headrests, armrests, ventilator headliners, protective components, exterior panels, housing electronics, and more.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Industrial Gases Market?

Increased demand for industrial gases from end-user industries is the key driver of the market.

- Industrial gases play a pivotal role in numerous applications across various industries, including metal and manufacturing. In metal production, gases such as oxygen, nitrogen, hydrogen, acetylene, and argon are extensively utilized for steel production and iron fabrication. The process industries, including oil and gas, petrochemicals, and chemicals, are significant revenue generators for the market. These industries employ specialty gases, medical gases, refrigerant gases, and fuel gases to optimize their production processes. Industrial gases are integral to the creation of final outputs In these industries. Moreover, In the food and beverage sector, industrial gases find applications In the production of organic compounds with hydroxyl groups, sugar alcohols, and carbohydrates.

- These low-calorie alternatives are used in table sugar substitutes, candies, chewing gums, ice creams, yogurts, fruit spreads, toothpaste, mouthwash, throat lozenges, breath mints, and other food products. Industrial gases also contribute to the manufacturing of flexible and rigid polyurethane coatings, foams, sealants, elastomers, adhesives, and product innovations based on Polyol-based products. These materials offer durability, hardness, light-weight, resistance to abrasion, and insulating properties, making them suitable for applications in electronics, footwear, packaging, furniture, seating, headrests, armrests, ventilator headliners, protective components, exterior panels, housing electronics, and various other industries.

What are the market trends shaping the Europe Industrial Gases Market?

Innovations in storage, design, and packaging of industrial gases is the upcoming trend In the market.

- Industrial gases, including nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others, play a crucial role in various industries such as manufacturing, energy, chemicals, healthcare, and food and beverages. In the Food and Beverages sector, these gases are utilized In the production of organic compounds with hydroxyl groups, sugar alcohols, and carbohydrates, which are essential ingredients in low-calorie food items like table sugar substitutes, candies, chewing gums, ice creams, yogurts, fruit spreads, toothpaste, mouthwash, throat lozenges, breath mints, and more. In the Industrial sector, these gases are employed In the production of flexible and rigid polyurethane coatings, foams, sealants, elastomers, adhesives, and product innovations like Polyol-based products.

- The demand for these gases is driven by their durability, hardness, light-weight, resistance to abrasion, and insulating properties, making them indispensable in various applications such as electronics, footwear, packaging, furniture, seating, headrests, armrests, ventilator headliners, protective components, exterior panels, housing electronics, and more. Despite their hazardous nature, industrial gases are transported through pipelines during most phases of chemical production, maintaining low pressure and short pipeline lengths. For long-distance travel, specialized cylinders are used to store gases in high-pressure conditions. These gases are also extensively used in the Chemicals and Energy sector, particularly In the production of Acetylene for Metallurgy and Glass.

What challenges does the Europe Industrial Gases Market face during the growth?

Safety issues associated with use of industrial gases is a key challenge affecting the market growth.

-

Industrial gases play a crucial role in various sectors, including manufacturing, energy, chemicals, healthcare, and food and beverages. These gases, such as nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others, are essential for producing organic compounds, hydroxyl groups, sugar alcohols, and carbohydrates used in food products like table sugar, candies, chewing gums, ice creams, yogurts, fruit spreads, toothpaste, mouthwash, throat lozenges, breath mints, and more. In the chemical industry, industrial gases are used in the production of flexible and rigid polyurethane coatings, foams, sealants, elastomers, adhesives, and product innovations like polyol-based products. However, handling industrial gases requires caution due to their potential health hazards.

- Exposure to these gases can lead to respiratory issues. Moreover, high-pressure cylinders and liquid tanks need skilled labor for handling. The scarcity of a skilled workforce affects the market growth. Stringent safety regulations govern various processes, including industrial gas manufacturing, product classification and labeling, registration, packaging, storage, transportation, displaying product information, and product disposal. Regulatory bodies monitor the use of industrial gases in manufacturing units due to their potential risks to human health and safety. Industrial gases are used in various industries, including electronics, footwear, packaging, furniture, seating, headrest, armrest, ventilator headliners, protective components, exterior panels, housing electronics, and more.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Air Liquide SA - The company offers industrial gases such as hydrogen, nitrogen, argon.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Products and Chemicals Inc.

- BASF

- BUSE KSW GmbH & Co. KG

- Cryogenmash

- Ellenbarrie Industrial Gases Ltd.

- Gasum Oy

- GAZ SYSTEMES SASU

- IJSFABRIEK STROMBEEK NV

- Iwatani Corp.

- Linde Plc

- Messer SE and Co. KGaA

- Mitsubishi Chemical Group Corp.

- PJSC Gazprom

- SOL Spa

- Taiyo Nippon Sanso Corp.

- Westfalen AG

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

It plays a crucial role in various industries, contributing significantly to manufacturing processes, energy production, and the production of chemicals. These gases, including nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others, serve diverse functions, from acting as shielding agents in welding to providing essential components in food and beverage production. Nitrogen, a colorless, odorless, and non-toxic gas, is widely used for its inert properties. It is employed as a protective gas in various applications, such as food preservation, purging, and as a carrier gas in chemical reactions. Oxygen, another essential industrial gas, is used extensively in various industries, including energy production, healthcare, and manufacturing.

In addition, it is a key component In the production of steel and other metals through the process of oxidation. Carbon dioxide, a gas produced during fermentation and other chemical processes, is used extensively In the food and beverage industry as a refrigerant and as a propellant In the production of carbonated beverages. Argon, an inert gas, is used as a shielding gas in welding and as a protective atmosphere In the production of metals and glass. Hydrogen, a highly reactive gas, is used as a reducing agent in various chemical reactions and as a fuel in energy production. These are used in a wide range of applications, from manufacturing and energy production to healthcare and food and beverage production.

In the manufacturing sector, these gases are used In the production of polymers, such as flexible and rigid polyurethane coatings, foams, sealants, elastomers, and adhesives. The use in the production of polyol-based products has led to innovations in durability, hardness, light-weight, and resistance to abrasion, making these materials ideal for use in insulating materials, electronics, footwear, packaging, furniture, seating, headrests, armrests, ventilator headliners, protective components, exterior panels, and housing electronics. The demand is driven by various factors, including the increasing use of these gases in manufacturing processes, the growing demand for lightweight and durable materials, and the increasing focus on energy efficiency and sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market Growth 2025-2029 |

USD 8.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

Germany, France, Italy, UK, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.