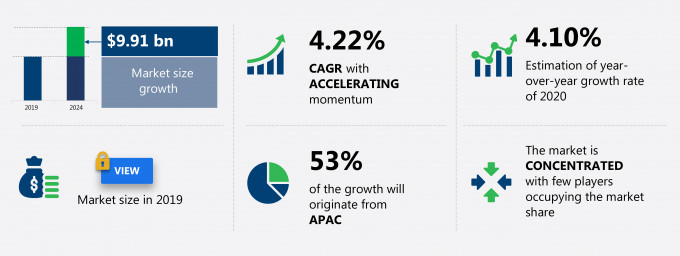

The industrial gearbox market share is expected to increase by USD 9.91 billion from 2019 to 2024, and the market’s growth momentum will accelerate at a CAGR of 4.22%.

The market research report provides valuable insights into the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers market segmentation by product (standard gearbox and precision gearbox), end-user (power generation, oil and gas, general machinery, and others), and geography (APAC, Europe, North America, South America, and MEA).

The industrial gearbox market report offers information on several market vendors, including ABB Ltd., Bonfiglioli Riduttori SpA, China High Speed Transmission Equipment Group Co. Ltd., Elecon Engineering Co. Ltd., Rexnord C

ABB Ltd. - The company is publicly held and headquartered in Switzerland. It is a global company generating USD 28,945 million in revenues and has around 105,000 employees. Its revenue from the global submarine power cable market is a key component of its overall revenues.

What will the Industrial Gearbox Market Size be During the Forecast Period?

Get the Industrial Gearbox Market Size Forecast by Download Report Sample

Parent Market Analysis

Technavio categorizes the global market as a part of the global industrial machinery market. Our research report extensively covers external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the industrial gearbox market during the forecast period.

Industrial Gearbox Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post-COVID-19 era. The adoption of industrial automation is notably driving the market growth, although factors such as challenges in the mining and steel industry may impede the market growth. Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The adoption of industrial automation is notably driving market growth. The growth in technology over the past few decades is driving advances in automation, prompting the adoption of robots and industrial automation. The use of automation across all industrial sectors globally is increasing. The rate of adoption of automation is especially high in the manufacturing sector, which is expected to become a driving force for the market during the forecast period. Robots and automation equipment are most often used in high-speed, repetitive tasks in manufacturing and other industries. The need to manufacture robots that have a higher level of sophistication and scope of application has led to research work on the development of high-precision gearboxes. The growing mechanization of manual jobs in industries is expected to result in the simultaneous growth in demand for industrial gearboxes during the forecast period.

Key Market Trend

The decline in the cost of gearboxes used in wind power generation is the key trend driving the market growth. The growth in wind power generation capacity over the past few decades has been augmented by the decline in the cost of the components used in wind turbines, including the cost of gearboxes. The cost of wind turbine gearboxes has declined considerably over the years due to enhancements in designs, optimization in raw material sourcing and supply chain, entry of new players into the market, leading to enhanced competition, and larger economies of scale due to increased demand for gearboxes. It is expected that the average global prices of wind turbine gearboxes will decline by around 5% during the period 2021-2025. These declining costs will fuel the demand for industrial gearboxes in the wind energy sector. The lower cost of gearboxes will also bring about a reduction in replacement costs, and the number of units sold will increase considerably, allowing vendors to compensate for the decline in manufacturing costs.

Key Market Challenge

The major challenge impeding market growth is the challenges in the mining and steel industry. Industrial gearboxes are used in various mining and metal manufacturing machinery, including pulverizers, ball mills, kiln drives, rolling mills, winders/rewinders, and Z mills. Multi-shaft parallel epicyclic gearboxes are commonly used in these applications. Therefore, the recession in the global mining industry is expected to have a negative impact on the market during the forecast period. China, the world's largest consumer of raw commodities, also registered a slowdown, which in turn, resulted in a decline in infrastructure construction and manufacturing activities. The construction and infrastructure sectors extensively make use of metals and minerals and account for almost half of global consumption. Many of the large mining companies reported a net loss from their operations because of the downturn. The downturn in the global commodities market, which has led to reduced investments in mining, as well as the consolidation moves in the steel industry, are expected to pose considerable challenges for the market during the forecast period.

This market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2020-2024.

Industrial Gearbox Market Value Chain Analysis

Our In-house experts produce extensive information on the value chain and parent market of the market, which vendors can leverage to gain a competitive advantage during the forecast period. The Value Chain information provides an end-to-end understanding of product insight and profit and also optimization and evaluation of business strategies. The players across the value chain include selective data and analysis from entire research findings as per the scope of the report.

Which are the Key Regions for Industrial Gearbox Market?

Get a glance at the market share of various regions Request PDF sample now!

53% of the market’s growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for the industrial gearbox in APAC.

The region is home to some of the largest oil and gas-consuming and chemical and industrial manufacturing countries. This will facilitate market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the outbreak of COVID-19 hindered the growth of the market. This is attributed to the imposition of periodic lockdowns in the region to curb the spread of the disease. Owing to the lockdowns imposed, numerous manufacturing units were temporarily closed. This restricted the demand for industrial gearboxes in 2020. However, as the regional governments announced the lifting of lockdown restrictions, economic activities were propelled in the region from Q3 2020. Numerous industries such as steel manufacturing and oil and gas have resumed their manufacturing activities. Thus, the rising end-user segments such as the industrial and agriculture sectors will boost the demand for industrial gearboxes in the region during the forecast period.

What are the Revenue-generating Product Segments in the Industrial Gearbox Market?

To gain insights on the market contribution of various segments Request for a FREE sample

The market share growth by the standard gearbox segment will be significant during the forecast period. The share of the standard industrial gearbox segment is expected to witness a contraction during the forecast period due to the lower growth rate than the precision industrial gearbox segment. Standard gearboxes are usually manufactured by large companies, which can easily take advantage of higher scales of the economy due to their substantial production output.

This report provides an accurate prediction of the contribution of all the segments to the growth of the market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Industrial Gearbox Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2019 |

|

Forecast period |

2020-2024 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.22% |

|

Market growth 2020-2024 |

$ 9.91 billion |

|

Market structure |

Concentrated |

|

YoY growth (%) |

4.10 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 53% |

|

Key consumer countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ABB Ltd., Bonfiglioli Riduttori SpA, China High Speed Transmission Equipment Group Co. Ltd., Elecon Engineering Co. Ltd., Rexnord Corp., SEW-EURODRIVE, Siemens AG, Sumitomo Heavy Industries Ltd., THE TIMKEN Co., and Triveni Engineering & Industries Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will drive market growth during the next five years

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behaviour

- The growth of the industrial gearbox industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch