Insect Repellent Market Size 2025-2029

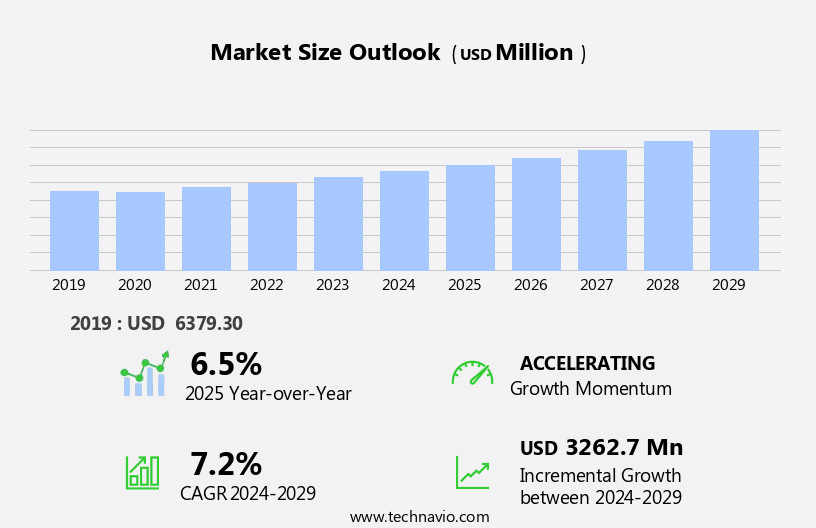

The insect repellent market size is forecast to increase by USD 3.26 billion, at a CAGR of 7.2% between 2024 and 2029.

- The market is driven by the increasing demand for organic and eco-friendly insect repellent products. Consumers are increasingly seeking natural alternatives to traditional DEET-containing repellents, leading to a surge in demand for insect repellent fabrics and plant-based repellents such as mothballs, marigold, lemongrass, essential oils, and lemon eucalyptus oil are gaining popularity. This trend is expected to continue as consumers become more health-conscious and environmentally aware. However, the market faces challenges from stringent regulations pertaining to the manufacturing of insect repellent products. Compliance with these regulations adds to the production costs and can limit the market size for some players.

- Additionally, the emergence of counterfeit products and the need for continuous innovation to keep up with evolving insect species pose significant challenges for market participants. Companies seeking to capitalize on market opportunities should focus on developing innovative, eco-friendly, and effective insect repellent solutions while navigating regulatory compliance and competition effectively.

Quick Stats of Insect Repellent Market

- Incremental Value (2025-2029): USD 3.26 bllion

- Forecast CAGR: 7.2%

- Historic Value (2019): USD 6379.30 million

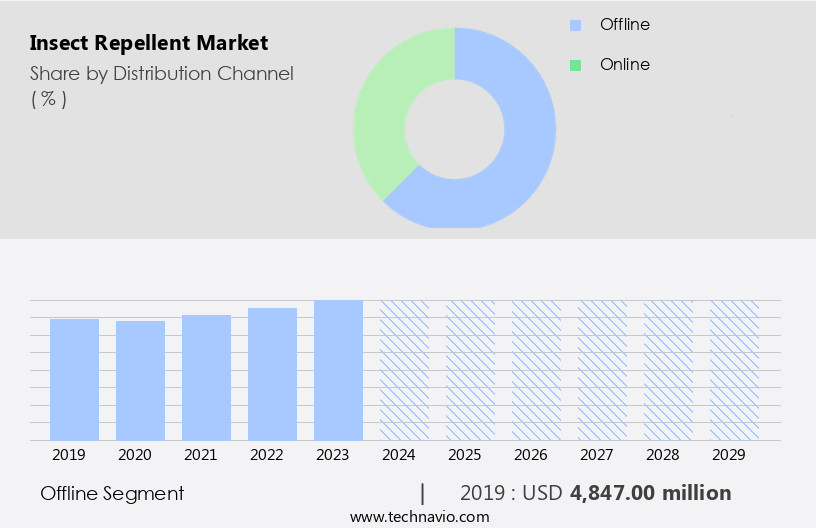

- Leading Market Segment in 2025: Offline

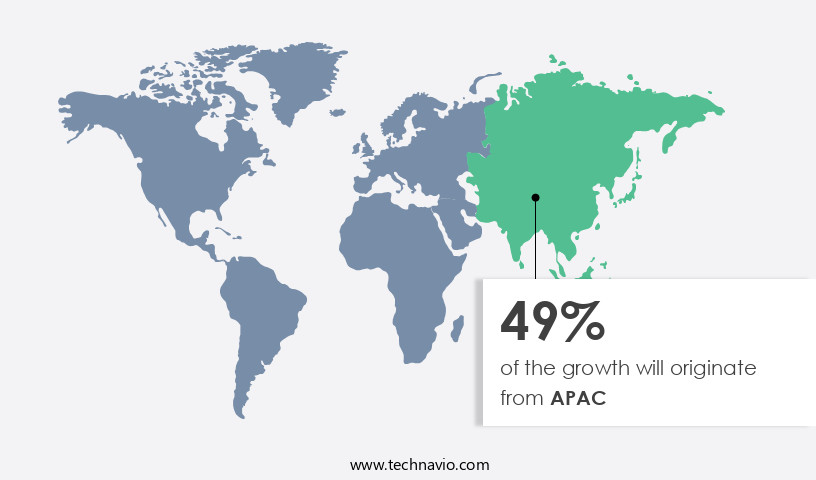

- Key Growth Region: APAC (fastest-growing market with a 49%)

What will be the Size of the Insect Repellent Market during the forecast period?

The market continues to evolve, driven by the persistent need for effective solutions to manage insects and prevent the spread of various diseases. Regulatory compliance plays a crucial role in ensuring the safety and efficacy of insect repellents. Skin sensitivity is a significant consideration, leading to the development of various forms, including lotions, wipes, patches, and bracelets. Active ingredients, such as peppermint oil, tea tree oil, and lemon eucalyptus oil, are subject to ongoing research and development to enhance their performance and reduce environmental impact. Insect management extends beyond human health, encompassing public health, wildlife protection, and pest control.

Prevention of diseases like Lyme, chikungunya, Zika, dengue fever, and yellow fever remains a key application area. Innovations include electric mosquito killers, mosquito traps, and ultrasonic repellents. Mosquito nets and insect repellent clothing offer additional protection in outdoor recreation and safety guidelines. Product testing and application method optimization continue to be essential aspects of the market. Insect repellents serve a vital role in maintaining environmental health by reducing the need for harsh chemicals and pesticides. However, the environmental impact of certain active ingredients remains a concern, necessitating continuous research and development. The market's dynamics are shaped by disease outbreaks, regulatory changes, and consumer preferences, ensuring a continuous unfolding of market activities.

How is this Insect Repellent Industry segmented?

The insect repellent industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Vaporizers

- Sprays

- Cream and oils

- Coils

- Others

- Type

- Mosquito repellent

- Bug repellent

- Product Type

- Synthetic

- Natural

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The offline distribution channel of the market caters to consumers through various retail outlets, ensuring easy access to a diverse range of products. Supermarkets, pharmacies, convenience stores, outdoor and camping stores, and department stores are significant retail channels for insect repellents. These outlets offer customers a wide selection of insect repellent coils, creams, oils, and sprays, allowing them to make informed decisions based on their requirements and preferences. Specialized shops focusing on travel, healthcare, and outdoor activities also contribute significantly to offline sales. Direct interaction with products is a key advantage of the offline distribution network, enabling customers to test and seek recommendations from store employees.

Regulatory compliance is a priority in the production and sale of insect repellents, ensuring safety for consumers. Active ingredients, such as DEET, picaridin, and essential oils like lemon eucalyptus and tea tree, are effective in preventing insect bites. Insect repellent wipes, patches, bracelets, and clothing offer alternative application methods. Mosquito traps and electric mosquito killers are additional insect management solutions. Public health and environmental health concerns influence the market, with a focus on minimizing environmental impact. Mosquito nets and ultrasonic repellents provide additional protection against insects. Insect repellents are essential for disease prevention, including Lyme disease, chikungunya, Zika virus, dengue fever, malaria, and yellow fever.

The Offline segment was valued at USD 4.85 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant growth in the Asia Pacific (APAC) region due to its large population, rising disposable income, and increasing awareness towards disease prevention. Households in APAC countries, such as India and China, frequently deal with common insects like flies, termites, bed bugs, ants, and cockroaches. In response, the market offers a variety of insect repellent forms, including sprays, vaporizers, chalks, and powders, to cater to the region's demand. Insect repellents are essential for public health, especially in preventing diseases like Lyme disease, chikungunya, and Zika virus. Active ingredients like peppermint oil, tea tree oil, lavender oil, and lemon eucalyptus oil are popular choices for their effectiveness against various insects.

Insect repellent lotions, patches, bracelets, candles, and clothing are widely used for personal protection during outdoor recreation. Environmental health and impact are crucial considerations in the market. Mosquito traps, electric mosquito killers, and ultrasonic repellents offer non-chemical solutions for insect management. Mosquito nets and insect repellent devices provide additional protection against disease-carrying insects. Insect repellents are not only used for human health but also for wildlife protection and pest control. Regulatory compliance is essential to ensure the safety of users and the environment. Product testing and adherence to safety guidelines are crucial for market growth. Diseases like dengue fever, malaria, and yellow fever are prevalent in APAC, making disease prevention a priority.

The market continues to innovate with new products and technologies, such as essential oils and mosquito control solutions, to address the evolving needs of consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B insect repellent supply solutions leverage advanced repellent formulation technologies for efficacy. Insect repellent market growth opportunities 2025 include DEET-free insect repellents and natural insect repellent products, meeting demand. Insect repellent supply chain software optimizes operations, while insect repellent market competitive analysis highlights players like SC Johnson. Sustainable repellent production aligns with eco-friendly pest control trends. Insect repellent regulations 2024-2028 shape insect repellent demand in North America 2025. Premium insect repellent solutions and insect repellent market insights boost adoption. Insect repellents for outdoor retail and customized repellent formulations target niches. Insect repellent market challenges and solutions address safety, with direct procurement strategies for insect repellents and insect repellent pricing optimization enhancing profitability.

What are the key market drivers leading to the rise in the adoption of Insect Repellent Industry?

- The significant demand for organic insect repellent products serves as the primary growth catalyst for the market. Insect repellents are essential for protecting individuals from mosquitoes and other insects that carry diseases such as dengue fever and malaria. Plant-based or herbal insect repellents have been traditionally used for this purpose, as many plants contain compounds that deter insect attacks. These natural repellents are derived from various sources, including essential oils and extracts of plants like the citronella genus (Poaceae). Citronella, originally used in perfumery, is now a widely used organic ingredient in insect repellent products due to its effectiveness against mosquitoes. It is typically used at concentrations of 5-10%. In addition to clothing infused with insect repellent, there are also devices available, such as ultrasonic repellents, to provide an extra layer of protection against insects.

- Essential oils, in particular, offer a natural and eco-friendly alternative to synthetic insect repellents, making them a popular choice for those seeking wildlife protection while avoiding harsh chemicals. The ongoing research and development in this area continue to uncover new plant-based solutions for insect repellents, ensuring effective and safe options for pest control.

What are the market trends shaping the Insect Repellent Industry?

- The emerging market trend favors insect repellent fabrics over traditional DEET-containing products due to several advantages. These fabrics offer long-lasting protection against insects without the need for frequent reapplication, making them more convenient for consumers. Additionally, they are generally considered safer and more eco-friendly as they do not contain harmful chemicals like DEET.

- The market is driven by the need for regulatory compliance and effective insect management, particularly in preventing diseases such as Lyme disease and Chikungunya. Active ingredients, such as DEET, have proven efficacy in preventing mosquito bites but face challenges due to skin sensitivity and other concerns. To address these issues, manufacturers are innovating with non-oily, easy-to-apply roll-on DEET insect repellents. Additionally, the market is expanding to include insect repellent wipes and fabric treatments, such as the patent-pending Armour technology by Clothing Innovation in India, which factory-treats fabric to repel insects.

- The market is projected to reach USD9.3 billion by 2031, reflecting the growing importance of public health and insect management. Manufacturers are focusing on creating harmonious and immersive solutions to meet the evolving needs of consumers.

What challenges does the Insect Repellent Industry face during its growth?

- The stringent regulations governing the manufacturing of repellent products pose a significant challenge to the industry's growth. Adhering to these regulations adds complexity and cost to the production process, potentially limiting the industry's ability to innovate and expand.

- Insect repellents, registered as pesticides in various countries including the US, Europe, Japan, Australia, Indonesia, Malaysia, Korea, and Vietnam, play a crucial role in environmental health by providing mosquito control during outdoor recreational activities. In the US, the Environmental Protection Agency (EPA) regulates the marketing of most skin-applied mosquito repellents. In Europe, mosquito repellents fall under the Biocidal Products Regulation (BPR, Regulation (EU) 528/2012). Environmental impact is a significant consideration in the production and use of insect repellents. Peppermint oil, a common active ingredient, is considered safe for the environment and effective in repelling mosquitoes.

- Alternatives to traditional insect repellent lotions include patches and bracelets, which offer convenience and reduce the amount of product needed. Mosquito nets are another effective method for preventing insect bites during outdoor activities. Safety guidelines for using insect repellents include applying them according to label instructions, avoiding contact with eyes and mouth, and reapplying every few hours. It is essential to follow these guidelines to ensure the effectiveness and safety of insect repellents for individuals and the environment.

Exclusive Customer Landscape

The insect repellent market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the insect repellent market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, insect repellent market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aspectek - The company provides a range of insect repellent solutions designed to effectively address various pest issues. Among these offerings are the Aspectek Trapest Sticky Dome Bug Trap, equipped with two glue discs, and the Aspectek Home Sentinel Ultrasonic Pest Repellent. Additionally, the company presents the Aspectek Insect and Ant Killer Powder Duster, a practical and safe solution for eliminating unwanted insects. These products employ innovative technologies and high-quality materials to ensure optimal performance and user satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspectek

- BRILLON CONSUMER PRODUCTS PVT. LTD.

- Eco Lips Inc.

- Flowtron

- Foshan GreenYellow Electric Technology Co. Ltd.

- FUTURA DIRECT LTD.

- Helen of Troy Ltd.

- JT Eaton and Co. Inc.

- Koolatron

- Livin Well

- NSI Industries LLC

- Pure Energy Apothecary

- Reckitt Benckiser Group Plc

- Rentokil Initial Plc

- Rollins Inc.

- S.C. Johnson and Son Inc.

- SereneLife Home LLC

- Thermacell Repellents Inc.

- Trademark Global LLC

- Woodstream Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Insect Repellent Market

- In February 2023, Spectrum Chemicals & Materials, a leading manufacturer of specialty chemicals, announced the launch of its new line of natural insect repellents, "EcoShield." This product line offers effective protection against mosquitoes, ticks, and other insects using essential oils and plant extracts (Spectrum Chemicals & Materials press release).

- In July 2024, Sumitomo Chemical and 3M collaborated to expand their partnership in the market. They agreed to jointly develop and commercialize mosquito repellent products using Sumitomo's synthetic pyrethroid technology and 3M's proprietary Permethrin formulation (Sumitomo Chemical press release).

- In October 2024, Reckitt, a global consumer health company, acquired MG Chemicals, a leading manufacturer of active ingredients for insect repellents. This acquisition strengthened Reckitt's position in the market and expanded its product portfolio (Reckitt press release).

- In March 2025, the European Commission approved the use of picaridin, an insect repellent ingredient, for use in sunscreens. This approval opens up new opportunities for insect repellent manufacturers in the European market (European Commission press release).

- These developments highlight significant advancements in the market, including new product launches, strategic partnerships, and regulatory approvals. Companies are focusing on innovation, collaboration, and expansion to cater to the growing demand for effective insect repellents.

Research Analyst Overview

- The market encompasses a diverse range of products, including synthetic repellents, natural repellents, mosquito coils, botanical repellents, hybrid repellents, and various repellent-containing items. Synthetic repellents, such as DEET, remain popular due to their effectiveness against a broad spectrum of insects. In contrast, natural and botanical repellents, like citronella and lemongrass, appeal to consumers seeking eco-friendly alternatives. Mosquito coils and repellent-based candles provide area protection, while pump sprays, repellent-treated fabric, and repellent-infused soaps cater to individual use. Repellent-impregnated gear, patches, and clothing offer long-lasting protection for outdoor enthusiasts. Mosquito control programs employ various strategies, such as repellent-treated feed, repellent-infused products, and repellent-impregnated clothing, to manage insect populations.

- Insect attractants and repellent-coated devices, like mosquito traps and nets, play crucial roles in preventing insect infestations. Repellent-treated materials, including netting and coated devices, are integral to effective mosquito control strategies. The market for insect repellent continues to evolve, with hybrid repellents combining the benefits of synthetic and natural ingredients, and repellent-impregnated gear and clothing gaining popularity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Insect Repellent Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 3262.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, India, Japan, Germany, UK, France, Brazil, Indonesia, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Insect Repellent Market Research and Growth Report?

- CAGR of the Insect Repellent industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the insect repellent market growth of industry companies

We can help! Our analysts can customize this insect repellent market research report to meet your requirements.