Intimate Wash Market Size 2024-2028

The intimate wash market size is forecast to increase by USD 116.4 million at a CAGR of 4.49% between 2023 and 2028. The market is experiencing significant growth, driven by shifting consumer preferences towards premium personal care products and increasing demand for herbal concepts. Western influences have played a key role in this trend, with consumers seeking out organic and natural ingredients for their feminine hygiene needs. Product innovation is also a major factor, as companies introduce new offerings to cater to this market. Another trend in the market is the presence of colorants and fragrances in intimate wash products, which cater to consumers' desires for enhanced sensory experiences. However, challenges remain, such as the presence of colorants and other synthetic ingredients in some products, which may raise concerns among health-conscious consumers.

What will be the Size of the Market During the Forecast Period?

The intimate wash care market, a significant segment of the Personal Hygiene industry, has witnessed steady growth in recent years. The market offers a wide range of products, including Sanitary pads, Tampons, Panty liners, and Menstrual products, all designed to prioritize Softness, Absorbency, and Performance. The growing focus on vaginal health has driven interest in vaginal prebiotic products. The intimate wash market is expanding, driven by the growing preference for non-government regulated, high-quality, and premium products. Gel-based intimate washes are gaining popularity due to their gentle yet effective cleansing properties, making them a preferred choice for consumers seeking comfort and hygiene. These gel formulations are often enriched with natural ingredients, ensuring a mild, non-irritating experience. As consumer awareness of personal care increases, there is a rising demand for premium intimate wash products that offer added benefits, such as pH balance, moisturization, and odor control. The market is evolving with brands focusing on providing safe, gel-based products that cater to diverse consumer needs, establishing a strong presence in the product market for intimate hygiene.

Market Segmentation

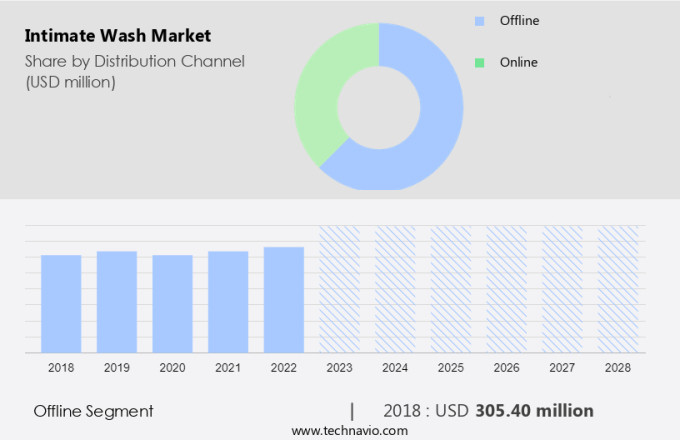

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. Intimate wash products, including herbal concepts and premium offerings, have gained significant traction in the feminine hygiene Market, driven by Western influences and increasing demand for personal care solutions. The market is witnessing product innovation, with manufacturers focusing on catering to the unique needs of consumers. The emerging opportunities in this sector are attracting family welfare organizations and government bodies, with some countries implementing GST on menstrual products such as sanitary pads, tampons, and panty liners. Retailers are adapting to these trends by expanding their offerings and implementing new strategies. While offline distribution channels, including hypermarkets, supermarkets, and department stores, continue to generate revenue, there has been a noticeable decline in sales due to the shift towards online shopping.

In response, retailers are introducing better pricing strategies and wider assortments to remain competitive. Specialty stores and retailing formats such as convenience stores, clubhouse stores, and health and beauty stores remain significant sales channels for intimate wash products. As consumers seek out high-quality and specialized offerings, manufacturers and retailers must continue to innovate and adapt to meet their evolving needs.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 305.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

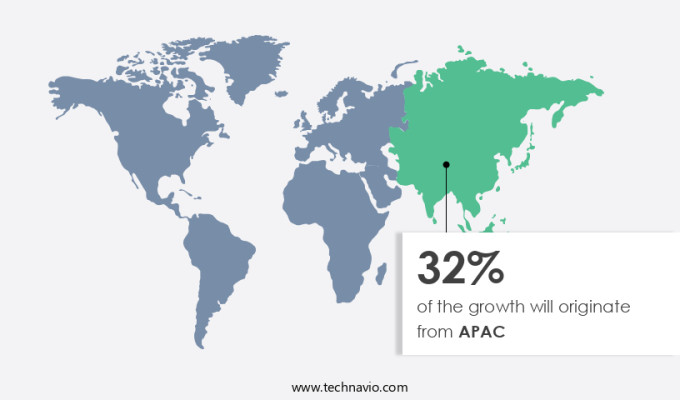

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market dominates the global intimate wash industry due to a strong focus on personal hygiene and health. Countries such as the United Kingdom, Germany, Italy, Spain, and France have a high demand for these products. The growing disposable income and increasing awareness of health and wellness are key factors driving the market. Tradition, culture, and education play significant roles in the region's purchase decisions. In Europe, education on feminine hygiene starts at a young age, making it a priority for consumers. Intimate wash products are available through various channels, including brick-and-mortar stores and online platforms, catering to the rising trend of e-commerce.

The major players in the market include Procter & Gamble, with its popular brand Tampax, and other notable brands addressing issues such as fungus, bacteria, viruses, inflammation, and allergic reactions. The pH level of intimate wash products is crucial for maintaining optimal feminine health. Public toilets and other shared facilities have also led to the development of convenient and discreet packaging for men's intimate wash product.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Changing consumer perception about feminine hygiene products is the key driver of the market. The rise in the number of working women in both developed and developing countries has led to an increase in demand for menstrual care and intimate wash products. Women's busy lifestyles and growing awareness about personal hygiene have fueled this trend. Intimate wash products, including menstrual cups and sanitary pads, offer benefits such as balancing pH levels, reducing vaginal discharge, and minimizing the risk of infections. These conditions can cause discomfort, bad odor, itching, and burning sensations. Counterfeit and low-quality products pose a significant challenge in the market. Unilever and other leading companies in the menstrual care industry have taken steps to address this issue by focusing on product quality and consumer education.

Intimate wash products are available through various sales channels, including supermarkets, pharmacies, and online platforms. Infections and diseases, such as bacterial vaginosis and yeast infections, are common among women. Intimate wash products can help prevent these conditions by maintaining proper hygiene and cleansing the genital area. Deodorizing properties in these products also help women feel fresh and confident throughout the day. It is crucial for women to prioritize their health and invest in high-quality intimate wash products. By doing so, they can protect themselves from complications and maintain optimal vaginal health. Companies in the menstrual care industry must continue to innovate and offer effective solutions to meet the evolving needs of their consumers.

Market Trends

The growing popularity of organic products is the upcoming trend in the market. In the intimate wash care industry, personal hygiene and health are top priorities for consumers in developed countries, including the US, Canada, Germany, Spain, France, and the UK. Approximately one out of every five users of intimate wash products are at risk of bacterial vaginosis and other infections, with around 84% of these individuals being unaware of their exposure. To address these concerns, manufacturers have begun exploring the use of more natural ingredients in their products. Organic intimate wash care products offer a safer and healthier alternative to conventional washes, as they are typically free of petrochemicals, parabens, glycerine, and animal products.

These natural washes are gaining popularity among consumers, with nearly 95% of organic options providing a superior choice. The e-commerce platforms have made it easier for consumers to access these natural intimate wash care products, allowing them to shop from the comfort of their own homes. As consumers become more conscious of their health and the potential risks associated with conventional intimate washes, the demand for organic options is expected to continue growing.

Market Challenge

The presence of colorants is a key challenge affecting the market growth. Intimate hygiene products, including those sold at drug stores and e-commerce platforms, have come under scrutiny due to concerns over the safety of certain ingredients. Artificial colors used in these products have been linked to irritation and potential health risks, such as infections. A recent petition to the Food and Drug Administration (FDA) calls for clearer guidelines on the use of colorants in feminine care items. Moreover, some chemicals not authorized by the FDA have been found in intimate washes, which could negatively impact women's health. The FDA has taken action against companies like Laclede Inc. for using unapproved colorants in their products.

Further, eco-friendly alternatives, such as reusable cloth pads and organic tampons, have gained popularity as consumers become more conscious of their health and the environment. Brands like Hindustan Unilever, with their VWash line, and Glenmark offer organic options. In the market, there is a growing demand for eco-friendly and natural intimate hygiene products.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Biozoc Inc - The company offers intimate wash, which is an herbal vaginal wash of 100ml packing.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Combe Inc.

- Corman SpA

- Healthy Hoohoo

- Imbue Natural

- INLIFE Pharma Pvt. Ltd.

- Ketzet Ltd

- Kimberly Clark Corp.

- Laclede Inc.

- Lemisol Corp.

- Lifeon Labs Pvt. Ltd.

- Nutraceutical Corp.

- Ontex BV

- Oriflame Cosmetics S.A.

- Prestige Consumer Healthcare Inc.

- Sanofi SA

- The Honey Pot Co. LLC

- Unilever PLC

- Walgreens Boots Alliance Inc.

- Zeta Farmaceutici Spa

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The intimate wash care market, a significant segment of the personal hygiene industry, caters to the health and well-being of individuals. This market encompasses a wide range of products designed for both men's and women's intimate care. These products include gels, natural washes, and conventional cleansers. Western influences and herbal concepts have led to the innovation of premium, eco-friendly brands. The demand for intimate care products is driven by factors such as personal cleanliness, health concerns, and societal norms. The feminine hygiene market, a key component of the intimate wash care industry, includes sanitary napkins, tampons, and panty liners. These products are essential for maintaining menstrual hygiene and addressing complications like fungus, bacteria, and viruses. Men's intimate care products cater to the health-conscious population, focusing on issues like urinary tract infections and inflammation.

Further, brand loyalty and price are crucial factors influencing consumer choices in this market. Absorption technology and softness are key considerations for sanitary napkins and menstrual cups. Emerging opportunities lie in the production of organic, eco-friendly brands, and the development of reusable cloth pads and organic tampons. The sales channel for intimate wash care products includes drug stores, e-commerce platforms, and specialty stores. Counterfeit and low-quality products pose a challenge to market growth. Public health concerns, such as the risk of infections and diseases, have led to increased awareness and demand for high-quality intimate care products. Companies are investing in research and development, with Procter & Gamble and Hindustan Unilever leading the way. The market is expected to continue growing, driven by the need for effective, safe, and eco-friendly products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 116.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.22 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, UK, China, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Biozoc Inc, Combe Inc., Corman SpA, Healthy Hoohoo, Imbue Natural, INLIFE Pharma Pvt. Ltd., Ketzet Ltd, Kimberly Clark Corp., Laclede Inc., Lemisol Corp., Lifeon Labs Pvt. Ltd., Nutraceutical Corp., Ontex BV, Oriflame Cosmetics S.A., Prestige Consumer Healthcare Inc., Sanofi SA, The Honey Pot Co. LLC, Unilever PLC, Walgreens Boots Alliance Inc., and Zeta Farmaceutici Spa |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch