Integration Platform As A Service (IPaaS) Market Size 2025-2029

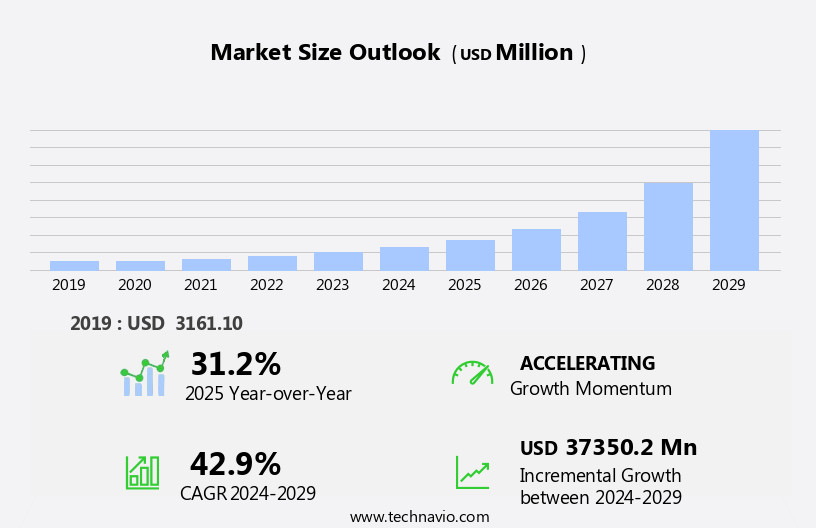

The integration platform as a service (IPaaS) market size is forecast to increase by USD 37.35 billion, at a CAGR of 42.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of digital transformation initiatives. Businesses are recognizing the need for seamless data integration and process automation to remain competitive in today's fast-paced digital economy. IPaaS solutions enable organizations to connect various applications and systems, streamlining workflows and enhancing operational efficiency. However, the market faces notable challenges. Security and data privacy concerns continue to be a major obstacle, as organizations grapple with the complexities of managing sensitive data across multiple platforms. Ensuring data security and privacy is a top priority, as breaches can result in significant reputational damage and financial losses.

- Additionally, the integration of legacy systems with modern applications can pose technical challenges, requiring specialized expertise and resources. Companies seeking to capitalize on the opportunities presented by the IPaaS market must address these challenges effectively, investing in robust security measures and partnering with experienced service providers to ensure successful implementations.

What will be the Size of the Integration Platform As A Service (IPaaS) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. IPaaS solutions facilitate seamless data integration, enabling entities to connect and synchronize data from multiple sources. These platforms offer a range of capabilities, including message broker services, data mapping, data lakes, agile development, and SaaS integration. ETL processes and batch processing are integral components of iPaaS, ensuring data transformation and data warehousing. Security protocols and user interface (UI) design are essential considerations, with hybrid integration and open source solutions gaining popularity. Data mining and reporting dashboards provide valuable insights, while metadata management and data governance ensure data quality.

Microservices architecture and user experience (UX) are increasingly important, with compliance standards and service orchestration ensuring seamless workflow automation. Support services and professional services offer valuable assistance, while performance monitoring, training resources, and community forums foster user engagement. Cloud integration, monitoring tools, and real-time processing are key features, with subscription models and alerting systems providing flexibility and scalability. Predictive analytics and Big Data analytics offer advanced capabilities, while deployment models cater to on-premises integration needs. The iPaaS market's continuous dynamism reflects the evolving nature of data integration requirements and the ongoing pursuit of innovative solutions.

How is this Integration Platform As A Service (IPaaS) Industry segmented?

The integration platform as a service (IPaaS) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Large Enterprises

- SMEs

- Service

- API management

- B2B integration

- Data integration

- Cloud integration

- Others

- Deployment

- Public cloud

- Private cloud

- Hybrid cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

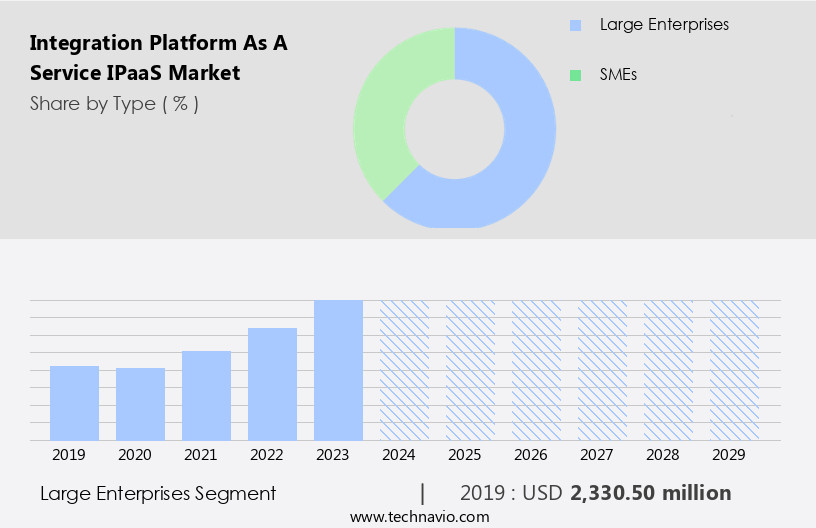

The large enterprises segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth as businesses seek to connect and integrate disparate systems and data sources. IPaaS offers a scalable and flexible solution for large enterprises with complex IT landscapes, enabling seamless integration of cloud-based applications, on-premises systems, and data lakes. Pricing strategies vary, from subscription models to pay-as-you-go, making iPaaS an affordable option for businesses of all sizes. Data integration and transformation are key functions of iPaaS, facilitating real-time processing and data warehousing. Data mapping and modeling are essential for effective data integration, while metadata management ensures data accuracy and consistency. Security protocols are a critical consideration, with encryption, alerting systems, and API management essential for safeguarding data.

Agile development and microservices architecture are driving innovation in iPaaS, enabling faster development and deployment of applications. User interface (UI) and user experience (UX) are increasingly important, with reporting dashboards and data visualization tools providing valuable insights. Compliance standards and workflow automation are also key features, ensuring regulatory compliance and streamlining business processes. Hybrid integration is a growing trend, enabling seamless integration between cloud and on-premises systems. Open source and proprietary software are both used in iPaaS solutions, with data mining and predictive analytics providing valuable insights from data. Service orchestration, support services, and professional services ensure smooth implementation and ongoing support.

IPaaS plays a crucial role in digital transformation initiatives, enabling businesses to adapt to changing needs and handle increasing data volumes. ETL processes, batch processing, and data lakes are essential components of iPaaS, providing a comprehensive solution for data integration and management. Performance monitoring, training resources, and community forums are also valuable features, ensuring optimal performance and user experience.

The Large Enterprises segment was valued at USD 2.33 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the way in 2024. This region's dominance is attributed to the high demand for efficient integration and connectivity solutions, driven by the technological advancements and digital transformation initiatives of organizations in the US and Canada. IPaaS plays a pivotal role in enabling seamless integration of various applications, data sources, and systems, including cloud-based and on-premises solutions. Pricing strategies, such as subscription models, are driving the adoption of iPaaS, offering flexibility and cost savings to businesses. Agile development and microservices architecture are also key trends, allowing for faster deployment and scalability.

Data integration, data mapping, and data transformation are essential components of iPaaS, facilitating the seamless flow of data between systems. Data security is a top priority, with iPaaS providers implementing robust security protocols, data encryption, and alerting systems to protect sensitive information. User experience (UX) and user interface (UI) are also important considerations, ensuring ease of use and efficient workflows. Compliance standards, such as HIPAA and GDPR, are being met through iPaaS solutions, enabling organizations to adhere to regulatory requirements. Hybrid integration, open source, and API management are other key features of iPaaS, allowing for the integration of various systems and applications.

Data mining, reporting dashboards, and predictive analytics are also valuable capabilities, providing insights and enhancing decision-making. Data warehousing, data modeling, and data visualization are essential for effective data management and analysis. IPaaS solutions are being used to support various integration scenarios, including ETL processes, batch processing, real-time processing, and service orchestration. Support services and professional services are also available to help businesses optimize their iPaaS implementations and ensure successful integration projects. Overall, the iPaaS market is evolving to meet the needs of businesses, offering flexible, efficient, and secure integration solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic business landscape, the market plays a pivotal role, offering agile and scalable solutions for seamless data and application integration. IPaaS empowers organizations to connect various systems, APIs, and data sources, fostering efficient workflows and real-time data synchronization. This cloud-based technology caters to diverse industries, enabling integration of SaaS applications, on-premises systems, and big data platforms. IPaaS solutions provide essential features such as drag-and-drop interfaces, pre-built connectors, workflow automation, and data transformation tools, ensuring seamless integration and improving overall business agility. Additionally, iPaaS ensures data security, compliance, and reliability, making it a preferred choice for digital transformation initiatives.

What are the key market drivers leading to the rise in the adoption of Integration Platform As A Service (IPaaS) Industry?

- The significant increase in digital transformation initiatives serves as the primary catalyst for market growth.

- IPaaS (Integration Platform as a Service) solutions are essential for businesses undergoing digital transformation, enabling seamless integration of cloud-based applications and services with on-premises systems. IPaaS simplifies the migration process, allowing organizations to accelerate their cloud adoption journey and reap the benefits of a cloud-architecture. With the increasing use of multiple applications and systems to support business processes and enhance customer experience, integration complexities can arise. IPaaS platforms address these challenges by offering pre-built connectors, data mapping, and transformation tools.

- Furthermore, iPaaS supports hybrid integration, open source technologies, and microservices architecture, ensuring data quality and metadata management. Additionally, iPaaS provides reporting dashboards, data mining capabilities, user experience (UX) focus, workflow automation, and data governance features, making it an indispensable tool for businesses in today's data-driven landscape.

What are the market trends shaping the Integration Platform As A Service (IPaaS) Industry?

- Business process automation is gaining increasing popularity in the market, serving as a significant trend for professionals. This adoption streamlines operations, enhances efficiency, and fosters productivity.

- IPaaS (Integration Platform as a Service) solutions have become essential for businesses seeking to streamline and automate their processes in today's digital landscape. These platforms offer workflow and process automation capabilities, enabling organizations to integrate systems, automate repetitive tasks, and orchestrate complex workflows across various applications. By automating business processes, companies can achieve faster time-to-market, increased productivity, and cost savings. However, as automation becomes more prevalent, there is a growing need for better visibility into these processes. IPaaS platforms must provide comprehensive monitoring and analytics tools to track and analyze performance, efficiency, and effectiveness. This requirement will drive the evolution of iPaaS solutions to meet the integration demands of automated processes, ultimately fueling market growth during the forecast period.

- Moreover, iPaaS platforms offer various support services, including professional services and training resources, to help businesses implement and optimize their integrations. They also provide data visualization capabilities and subscription models to cater to diverse business needs. Additionally, real-time processing and community forums ensure seamless integration experiences and quick issue resolution. In summary, the increasing demand for automation and the need for better process visibility are key drivers for the growth of the iPaaS market. These platforms offer essential capabilities, including service orchestration, monitoring, analytics, and support services, to help businesses streamline their operations and gain a competitive edge.

What challenges does the Integration Platform As A Service (IPaaS) Industry face during its growth?

- Security and data privacy concerns represent a significant challenge to the industry's growth, necessitating robust measures to protect sensitive information and maintain trust with customers.

- Integration Platform as a Service (IPaaS) enables organizations to transfer and integrate data between different systems and platforms. Security and data privacy are paramount in this process, necessitating robust encryption, access controls, and adherence to data protection regulations. While cloud services offer numerous benefits, security and compliance concerns have been hindering their adoption, particularly in the context of public cloud solutions. Regulations such as the General Data Protection Regulation (GDPR) impose restrictions on data storage locations. IPaaS solutions must address these concerns through advanced monitoring tools, data transformation capabilities, data warehousing and modeling, predictive analytics, and big data analytics.

- Additionally, API management and alerting systems are essential components of a comprehensive IPaaS solution. Deployment models, including both on-premises integration and cloud-based options, cater to varying organizational requirements. IPaaS providers must ensure their offerings are secure, reliable, and compliant to meet the evolving needs of businesses.

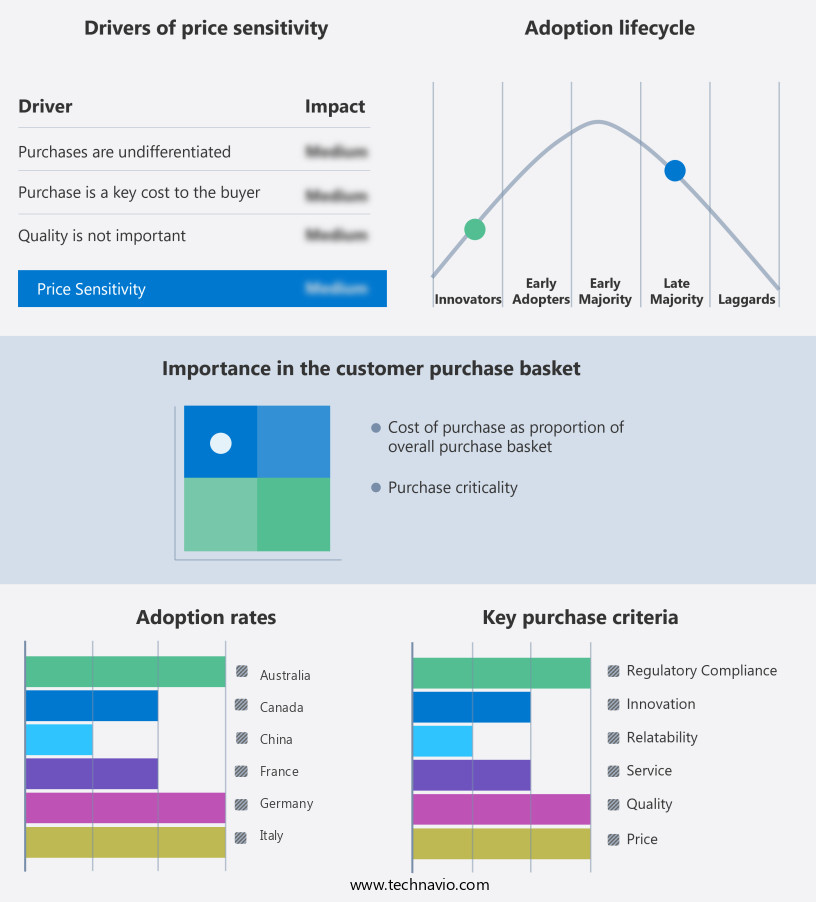

Exclusive Customer Landscape

The integration platform as a service (IPaaS) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the integration platform as a service (IPaaS) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, integration platform as a service (IPaaS) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adeptia Inc. - The company specializes in Integration Platform as a Service (iPaaS) solutions, including Boomi's multi-tenant offering.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adeptia Inc.

- Boomi LP

- Celigo Inc.

- DBSync

- Flowgear

- Informatica Inc.

- International Business Machines Corp.

- Jitterbit Inc.

- Microsoft Corp.

- MuleSoft

- Oracle Corp.

- QlikTech international AB

- SAP SE

- SEEBURGER AG

- SnapLogic Inc.

- Software AG

- TIBCO Software Inc.

- UiPath Inc.

- Workato Inc.

- Zapier Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Integration Platform As A Service (IPaaS) Market

- In January 2024, Microsoft announced the general availability of Microsoft Power Automate Desktop, an on-premises version of its IPaaS offering, expanding its reach to organizations with strict data security requirements (Microsoft Press Release).

- In March 2024, IBM and Salesforce signed a multi-year agreement to expand their partnership, with IBM becoming Salesforce's preferred public cloud provider, enhancing the integration between their services (IBM Press Release).

- In May 2024, Dell Technologies completed the acquisition of Boomi, a leading IPaaS provider, significantly increasing Dell's presence in the integration market and expanding its cloud capabilities (Dell Technologies Press Release). In April 2025, MuleSoft, a leading IPaaS company, announced the launch of its new Anypoint Platform 7.0, featuring advanced capabilities in API management, security, and connectivity, strengthening its position in the market (MuleSoft Press Release).

- These developments demonstrate the continued growth and evolution of the IPaaS market, with major players expanding their offerings, forming strategic partnerships, and making significant acquisitions to strengthen their positions and cater to the diverse needs of organizations.

Research Analyst Overview

- In the market, automation plays a significant role in testing and deploying integrations, with automated testing becoming increasingly popular for ensuring seamless data flow between applications. Serverless computing is another trend, enabling businesses to build and run applications without managing infrastructure, reducing costs and improving scalability. Disaster recovery and business continuity are crucial aspects of iPaaS solutions, providing high availability and fault tolerance to ensure uninterrupted operations. Event-driven architecture and API gateways are key technologies in iPaaS, enabling real-time data processing and secure access to APIs. Capacity planning and change management are essential for managing integration projects, while project management tools help teams collaborate and streamline workflows.

- Company management and compliance auditing are critical for ensuring security and regulatory compliance. Cost optimization is a significant factor in iPaaS adoption, with ML and AI-powered integration solutions offering predictive analytics and automation to reduce costs and improve efficiency. Service discovery and fault tolerance are essential for ensuring seamless integration between applications and microservices. Risk assessment and API security are also critical components of iPaaS solutions, providing businesses with the tools they need to mitigate risks and protect sensitive data. Technology stacks and cloud-native integration are essential for modern businesses, enabling agile development and deployment of applications.

- IPaaS solutions offer a range of features, from data masking and compliance auditing to high availability and machine learning capabilities, making them an essential tool for businesses looking to streamline their integration processes and optimize their technology investments.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Integration Platform As A Service (IPaaS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.9% |

|

Market growth 2025-2029 |

USD 37350.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

31.2 |

|

Key countries |

US, Germany, China, France, Canada, Japan, Australia, UK, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Integration Platform As A Service (IPaaS) Market Research and Growth Report?

- CAGR of the Integration Platform As A Service (IPaaS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the integration platform as a service (ipaas) market growth of industry companies

We can help! Our analysts can customize this integration platform as a service (ipaas) market research report to meet your requirements.