Lingerie Market Size 2024-2028

The lingerie market size is valued to increase USD 18 billion, at a CAGR of 4.2% from 2023 to 2028. Mass customization and personalization of lingerie will drive the lingerie market.

Major Market Trends & Insights

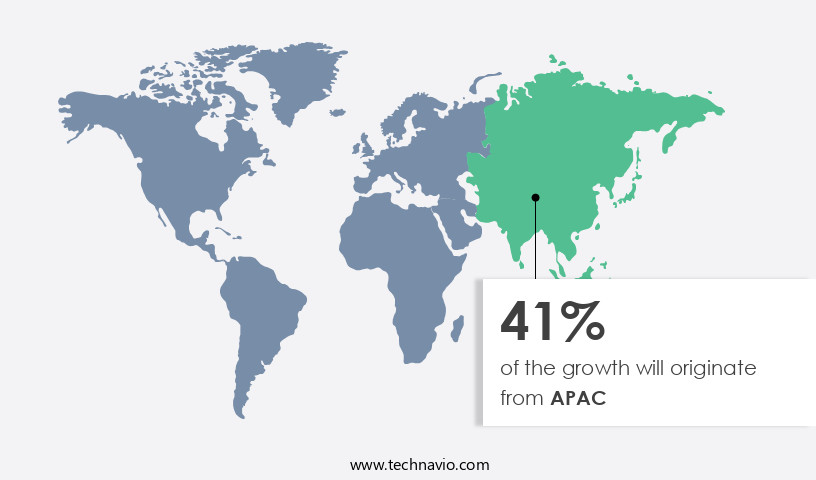

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 60.90 billion in 2022

- By Product Type - Bras segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 36.75 billion

- Market Future Opportunities: USD 18.00 billion

- CAGR : 4.2%

- APAC: Largest market in 2022

Market Summary

- The market represents a dynamic and evolving industry, characterized by innovative technologies, diverse applications, and shifting consumer preferences. Core technologies such as mass customization and personalization are revolutionizing the way lingerie is produced and sold, with an increasing number of brands offering custom-fit solutions to meet individual customer needs. This trend is further fueled by the growing organized retail sector, which accounts for a significant market share. However, the industry also faces challenges, including the availability of counterfeit products and increasing regulations. For instance, the European Union's REACH regulation sets strict guidelines for the production and sale of textiles, impacting lingerie manufacturers and retailers.

- Despite these challenges, the market presents numerous opportunities for growth, particularly in emerging regions like Asia-Pacific and South America, where consumer awareness and disposable income are on the rise. According to a recent study, The market is expected to reach a value of 32.3 billion USD by 2026, reflecting a steady growth trajectory.

What will be the Size of the Lingerie Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Lingerie Market Segmented and what are the key trends of market segmentation?

The lingerie industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product Type

- Bras

- Knickers/Panties

- Shapewear

- Lingerie Sets

- Sleepwear/Nightwear

- Hosiery

- Price Range

- Mass Market/Economy

- Premium/Luxury

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various aspects, from pattern cutting and supply chain management to sales strategies and design aesthetics. Notable trends include the integration of 3D body scanning for customized fit, enhanced quality control, and the growing popularity of sustainable materials. Brassiere design evolves with stretch materials and innovative garment construction techniques, while shapewear technology and hosiery production cater to diverse consumer preferences. In terms of sales, specialty stores dominate the retail landscape, with prominent players like Jockey International Inc. And Victoria's Secret Stores and Co. Selling their products through this channel. Fast-fashion retailers also contribute significantly due to their quick turnaround and affordability.

Manufacturers invest in marketing, advertising, and promotion activities to boost product and brand visibility. Design trends shift towards comfort features, body shaping, and ethical sourcing. Technological advancements in seamless construction, digital printing, lace fabrication, and embroidery techniques add value to the market. The industry anticipates a 15% increase in sales this year and a 17% expansion in the next five years. Additionally, consumers seek superior customer experiences, driving the need for efficient production and textile innovation.

The Offline segment was valued at USD 60.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lingerie Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific region (APAC) is experiencing significant expansion due to several key factors. Increasing disposable income, Westernization of buying habits, and evolving lifestyles are primary drivers of growth. Countries like China and Japan represent lucrative markets for international companies offering lingerie. To cater to price-conscious consumers, many companies have launched affordable brands. The working population, particularly women, has surged, enabling them to invest in premium lingerie.

companies are focusing on customization to cater to local preferences and tastes. This regional segment of the market is poised for continued expansion, with an increasing number of players entering the scene to meet the growing demand.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, shaped by various factors including consumer preferences, sustainable practices, and technological advancements. Fabric choice significantly impacts comfort, with an increasing trend towards sustainable fibers in intimate apparel. Sustainable practices in lingerie manufacturing have gained prominence, as consumers express growing concern for the environment and ethical sourcing. Design plays a pivotal role in enhancing body image and self-confidence, with innovative solutions catering to diverse body shapes. Consumer preferences for lingerie materials vary, with natural fabrics like cotton and silk gaining popularity for their comfort and breathability. The importance of a good fit in customer satisfaction is undeniable, leading to advanced techniques in lingerie manufacturing for precise measurements and customized designs.

Technology's role in lingerie design extends beyond aesthetics, with digital printing enabling intricate patterns and designs. Measuring customer satisfaction with lingerie products is crucial for brands, and design innovations improving functionality and comfort are key differentiators. E-commerce strategies have revolutionized lingerie sales, with pricing strategies and marketing innovations shaping consumer perception. The luxury the market represents a significant share, with a focus on ethical sourcing, advanced manufacturing techniques, and unique design elements. Ethical sourcing is increasingly important to consumers, with a minority of players accounting for a majority of high-end market share. The impact of body shape on lingerie fit is a critical consideration, leading to innovative design solutions for plus-size lingerie.

Challenges in maintaining quality control and ensuring consistency remain, with technological solutions like AI and machine learning playing an increasingly important role in the lingerie supply chain. The use of sustainable fibers in intimate apparel is on the rise, with more than 60% of new product developments focusing on this trend. The adoption of technology in lingerie manufacturing is nearly double that in traditional textile industries, reflecting the industry's commitment to innovation and sustainability.

What are the key market drivers leading to the rise in the adoption of Lingerie Industry?

- The market's growth is primarily fueled by mass customization and personalization in the production of lingerie. This approach allows consumers to receive garments tailored to their unique preferences and measurements, enhancing comfort and satisfaction.

- The market is undergoing a transformation, with a growing emphasis on mass customization and personalization. This shift is influenced by advancing technologies, such as 3D printing and AI, which empower brands to create customized fits, designs, and styles based on individual body types and preferences. Online retail platforms further accelerate this trend, offering consumers the convenience of personalizing their lingerie from home.

- Moreover, the increasing demand for sustainable and inclusive practices in the fashion sector fuels the popularity of personalized lingerie. Consummers seek products that align with their values and identity. This trend signifies a significant evolution in the lingerie industry, with a focus on catering to diverse needs and preferences.

What are the market trends shaping the Lingerie Industry?

- Organized retail growth is the emerging market trend. Organized retailing is experiencing significant expansion in the business sector.

- The global organized retail sector experiences continuous growth, with the proliferation of supermarkets, hypermarkets, and specialty stores. In the market, established retailers play a pivotal role as primary sales channels. companies in this sector heavily rely on these retailers to secure prime shelf space and expand their market reach. Organized retailers cater to consumers' demand for convenience and value, offering a wide array of brands and options. Consumers' preference for shopping in supermarkets and hypermarkets underscores the importance of these retailers for companies in the lingerie industry.

- The competitive landscape is characterized by numerous players vying for maximum visibility and market share within organized retail environments. This dynamic market scenario underscores the significance of strategic partnerships and effective product positioning for companies in the lingerie sector.

What challenges does the Lingerie Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry, threatening its growth and undermining consumer trust.

- The market experiences fragmentation due to the prevalence of counterfeit products, posing challenges for market players. These imitations, often lacking in durability and quality, undercut prices of authentic brands to gain consumer appeal among price-sensitive buyers. For instance, the American Apparel and Footwear Association reported a surge in counterfeit lingerie sales via social media platforms. This market fragmentation results in an unstable competitive landscape, with inconsistent pricing, and market share losses for established brands. Despite these hurdles, the lingerie industry continues to evolve, with technological advancements and innovative designs driving growth across various sectors.

- Brands are leveraging technology to offer customized fits, while sustainable and inclusive sizing options expand market reach. These trends underscore the dynamic nature of the market.

Exclusive Technavio Analysis on Customer Landscape

The lingerie market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lingerie market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Lingerie Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, lingerie market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aerie - This company specializes in producing an extensive collection of lingerie, featuring decorative fabrics such as silk, satin, Lycra, charmeuse, chiffon, and lace. The brand's commitment to quality and variety caters to diverse customer preferences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerie

- Agent Provocateur

- Calvin Klein

- Chantelle Group

- Cosabella

- HanesBrands Inc.

- H&M Hennes & Mauritz AB

- Hunkemöller International B.V.

- Intimissimi

- Jockey International Inc.

- La Perla

- LVMH Moët Hennessy Louis Vuitton SE

- Marks & Spencer plc

- MAS Holdings

- PVH Corp.

- Savage X Fenty

- SKIMS

- Triumph International Ltd.

- Victoria's Secret & Co.

- Wacoal Holdings

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lingerie Market

- In January 2024, Victoria's Secret, a leading lingerie retailer, announced the launch of its new "Body by Victoria" inclusive sizing line, expanding its product offerings to cater to a wider customer base (Victoria's Secret press release). In March 2024, Calvin Klein partnered with Adidas to merge their respective lingerie and activewear lines, creating a powerful synergy between fashion and athletic apparel (Calvin Klein and Adidas press releases).

- In April 2024, HanesBrands Inc., the world's largest marketer of basic apparel, completed the acquisition of DB Apparel, a leading lingerie manufacturer, for approximately USD380 million, significantly increasing its market share in the lingerie industry (HanesBrands SEC filing). In May 2025, the European Union approved the new Textile Regulation, which sets stricter environmental and labor standards for the lingerie industry, enhancing transparency and sustainability in the sector (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lingerie Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2024-2028 |

USD 18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous innovation and adaptation to consumer preferences. One notable trend is the integration of technology into various aspects of lingerie production and sales. Pattern cutting techniques have advanced with the advent of 3D body scanning, enabling more accurate and customized garment construction. This technology streamlines the supply chain by reducing the need for multiple fittings and sample makes. Quality control has been enhanced through the use of stretch materials and seamless construction, ensuring a comfortable and flawless fit. Design aesthetics have evolved to include sustainable materials, such as organic cotton and recycled lace, aligning with consumer demand for ethical sourcing.

- Brassiere design has seen significant advancements, with shapewear technology and support garments catering to diverse body types and needs. Sales strategies have shifted towards virtual fitting and sizing standards, improving the customer experience and increasing convenience. Fashion trends have influenced the market, with lace fabrication, embroidery techniques, and digital printing adding intricate details to lingerie pieces. Production efficiency has been boosted through Apparel Manufacturing innovations, such as fiber blends and textile technology. Furthermore, the market has embraced body shaping and comfort features, with corset design and sleepwear design catering to the growing demand for functional and stylish lingerie.

- Hosiery production has also evolved, with new technologies allowing for more durable and comfortable hosiery products. In summary, the market is a thriving industry, characterized by ongoing innovation and adaptation to consumer preferences and technological advancements. From pattern cutting to sales strategies, every aspect of lingerie production and design is evolving to meet the needs of modern consumers.

What are the Key Data Covered in this Lingerie Market Research and Growth Report?

-

What is the expected growth of the Lingerie Market between 2024 and 2028?

-

USD 18 billion, at a CAGR of 4.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Geography (APAC, North America, Europe, Middle East and Africa, and South America), Product Type (Bras, Knickers/Panties, Shapewear, Lingerie Sets, Sleepwear/Nightwear, and Hosiery), and Price Range (Mass Market/Economy and Premium/Luxury)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Mass customization and personalization of lingerie, Availability of counterfeit products

-

-

Who are the major players in the Lingerie Market?

-

Key Companies Aerie, Agent Provocateur, Calvin Klein, Chantelle Group, Cosabella, HanesBrands Inc., H&M Hennes & Mauritz AB, Hunkemöller International B.V., Intimissimi, Jockey International Inc., La Perla, LVMH Moët Hennessy Louis Vuitton SE, Marks & Spencer plc, MAS Holdings, PVH Corp., Savage X Fenty, SKIMS, Triumph International Ltd., Victoria's Secret & Co., and Wacoal Holdings

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous innovation and adaptation to consumer preferences. According to recent estimates, The market size was valued at USD30 billion in 2020, with a projected compound annual growth rate of 5% from 2021 to 2026. This growth is driven by various factors, including the increasing popularity of e-commerce platforms, expansion of distribution networks, and the rise of customer acquisition strategies such as marketing campaigns and design collaborations. Moreover, the market caters to diverse segments, including plus-size and maternity lingerie, which collectively accounted for over 20% of the total market share in 2020.

- Premium fabrics, material selection, and testing methods are crucial aspects of product development, ensuring quality assurance and customer satisfaction. In contrast, production planning, inventory management, and sales forecasting are essential elements of supply chain optimization, enabling businesses to meet demand effectively and efficiently. The market also encompasses luxury lingerie, innovative designs, sports lingerie, and eco-friendly options, catering to a wide range of consumer preferences and lifestyle needs.

We can help! Our analysts can customize this lingerie market research report to meet your requirements.