Low Harmonic Drives Market Size 2024-2028

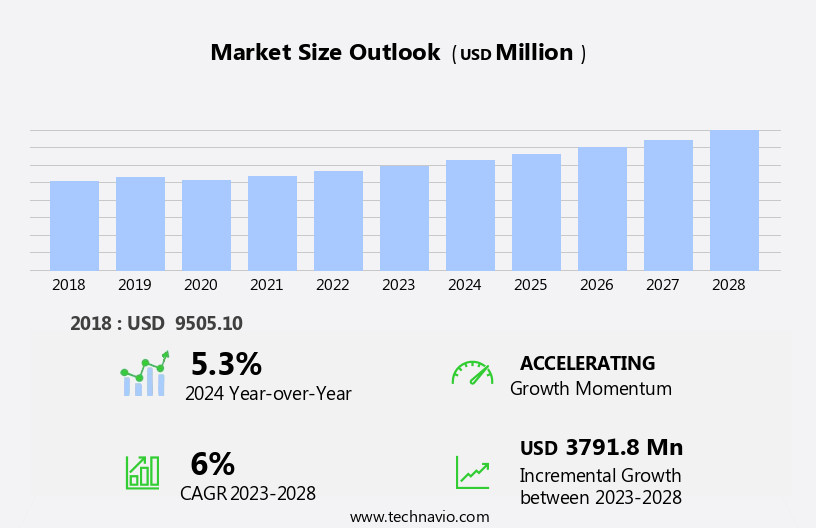

The low harmonic drives market size is forecast to increase by USD 3.79 billion at a CAGR of 6% between 2023 and 2028.

- The market is witnessing significant growth due to stringent regulatory standards enforcing energy efficiency companies are increasingly focusing on new product launches to cater to this demand. Renewable energy is another significant market for low harmonic drives, as they ensure unity power factor and reduce harmonic distortions In the power wiring and transformers.

- However, the high initial costs associated with low harmonic drives remain a challenge for market growth. Compliance with regulations, such as the Energy Independence and Security Act (EISA) and the European Union's Ecodesign Directive, is driving the adoption of low harmonic drives in various industries. Moreover, the benefits of energy savings and improved system performance are further boosting market growth. Despite these growth factors, the high upfront costs of low harmonic drives can hinder market expansion. Nonetheless, the long-term cost savings and the increasing focus on energy efficiency are expected to offset these costs, making low harmonic drives an attractive investment for businesses.

What will be the Low Harmonic Drives Market Size During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for efficient industrial products and electricity consumption. With the EPA's focus on the power sector to reduce carbon emissions, energy efficiency has become a top priority for businesses across various industries. Low harmonic drives offer a solution to this challenge by minimizing harmonic distortions In the AC power grid. Oil and gas exploration activities, including shale exploration and offshore drilling, are major consumers of low harmonic drives. These industries require compact systems with high power outputs to operate complex equipment, leading to a growing demand for low harmonic drives.

- Despite their benefits, the high switching costs associated with low harmonic drives may hinder market growth. However, the increasing awareness of energy efficiency and the potential for cost savings In the long run are expected to offset these costs. The taxonomy of low harmonic drives includes low voltage drives and medium voltage drives, as well as active supply units. The sinusoidal waveform of electricity is essential to understanding the importance of low harmonic drives in mitigating harmonic distortions and ensuring the reliable and efficient operation of industrial equipment.

How is this Low Harmonic Drives Industry segmented and which is the largest segment?

The low harmonic drives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Low voltage drives

- Medium voltage drives

- End-user

- Oil and gas

- Food and beverage

- Water and wastewater treatment

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

- The low voltage drives segment is estimated to witness significant growth during the forecast period.

Low voltage drives play a crucial role In the global market for low harmonic drives, delivering sustainable, efficient, and dependable solutions for diverse applications. Operating below 1,000 volts, these drives function as advanced controllers that regulate motor speeds, featuring power ratings ranging from 125 hp to 2,500 hp. By fine-tuning the frequency and voltage supplied to motors, low voltage drives optimize energy efficiency and operational flexibility. This energy optimization matches motor speed to load demands, leading to substantial cost savings and environmental advantages without sacrificing performance. Moreover, these drives ensure precise control over industrial processes, maintaining optimal performance and product quality.

Their adaptability enables them to effortlessly handle fluctuating loads and evolving process requirements, ensuring consistent operation under varying conditions. In industries such as food and beverages, water treatment, mining, pulp, paper, power utilization, and renewable energy, low voltage drives contribute to reducing energy losses and minimizing harmonic distortions in AC power grids. By generating sinusoidal waves with low harmonic content, these drives minimize the need for expensive harmonic filters and transformers, ultimately improving power outputs and maintaining unity power factor. Compact systems and power wiring further enhance the versatility and ease of integration for various applications.

Get a glance at the Low Harmonic Drives Industry report of share of various segments Request Free Sample

The Low voltage drives segment was valued at USD 6.47 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) market for low harmonic drives is witnessing notable expansion due to increasing industrial activity and the demand for energy-efficient industrial products. In sectors like food and beverages, countries such as China, India, and Japan are experiencing significant growth. For instance, India's food processing sector is projected to reach USD1,274 billion by 2027 from USD866 billion in 2022. This growth necessitates advanced processing, packaging, and refrigeration technologies that minimize harmonic distortions. Low harmonic drives play a vital role in optimizing motor and equipment performance in food processing applications, ensuring energy efficiency and compliance with energy standards. These drives reduce power losses and improve power factor to unity, making them an essential component in various industries, including water treatment, mining, pulp and paper, and power utilization.

In the context of renewable energy generation and oil exploration activities in APAC, low harmonic drives contribute to the reduction of harmonic distortions In the AC power grid, ensuring stable power outputs. Compact systems, transformers, active supply units, control units, motor inverters, and other components of low harmonic drives are integral to maintaining the integrity of power wiring and minimizing energy losses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Low Harmonic Drives Industry?

Stringent regulatory standards for energy efficiency is the key driver of the market.

- The global market for low harmonic drives is experiencing significant growth due to increasing regulations focusing on energy efficiency and environmental protection. Strict guidelines mandate the reduction of energy consumption and emissions across various industries, leading organizations to adopt advanced technologies like low harmonic drives. These systems minimize harmonic distortions in electricity, ensuring compliance with international standards such as IEC 61000-3-2. By using low harmonic drives, industries can not only avoid penalties but also enhance operational efficiency. Electricity consumption is a major concern for industries, particularly those in Oil and Gas, Renewable Energy, Food and Beverages, Water Treatment, Mining, Pulp and Paper, and Power Utilization.

- In Oil Exploration, both onshore and offshore, low harmonic drives are used to optimize power outputs and reduce energy losses. In the context of Renewable Energy generation, these drives help maintain a unity power factor, ensuring efficient energy transfer and minimizing energy losses. Low harmonic drives are increasingly being adopted in various applications, including water pumping systems, compressors, and fans. Compact systems with motor inverters, control units, and active supply units are popular choices due to their energy efficiency and ease of installation. Power wiring and transformer efficiency are also improved with the use of low harmonic drives, contributing to overall energy savings.

- In summary, The market is driven by regulatory pressures and the need for energy efficiency across various industries. Compliance with international standards and the resulting operational benefits make low harmonic drives an attractive investment for organizations seeking to minimize energy consumption and reduce emissions.

What are the market trends shaping the Low Harmonic Drives Industry?

Increasing focus of vendors on new product launches is the upcoming market trend.

- The Low Harmonic Drives (LHD) market is experiencing significant growth due to the increasing demand for efficient industrial products and energy efficiency. LHDs, which mitigate harmonic distortions in electricity consumption, are becoming increasingly important for various industries, including Oil and Gas, Renewable Energy Generation, and Mining. These industries require large electric motor systems, leading to harmonic distortions and power losses In the AC power grid. LHDs, including compact Low Voltage Drives and Medium Voltage Drives, offer several advantages, such as unity power factor, improved power wiring, and reduced harmonic distortions. Advanced technologies, like Active Supply Units, Control Units, Motor Inverters, and Sinusoidal Wave, are being integrated into these systems to ensure optimal performance and energy efficiency.

- Major players In the market, such as ABB and Delta Electronics, are investing heavily in research and development to introduce new, innovative solutions. These new offerings include advanced harmonic mitigation techniques, improved control algorithms, and enhanced power electronics, resulting in lower energy losses and higher power outputs. The Food and Beverages, Water Treatment, and Pulp and Paper industries are also adopting LHDs due to their energy-saving capabilities and reduced maintenance costs. In the Oil and Gas sector, LHDs are being used in offshore exploration, shale exploration, and oil exploration activities to improve pump efficiency and reduce electricity consumption, thereby lowering pump prices and overall operational costs.

- In conclusion, The market is witnessing substantial growth due to the increasing demand for energy-efficient industrial products and the need to address harmonic distortions in various industries. Market leaders are focusing on innovation and advanced technologies to maintain a competitive edge and meet evolving industry requirements.

What challenges does the Low Harmonic Drives Industry face during its growth?

High initial costs associated with low harmonic drives is a key challenge affecting the industry growth.

- The global market for low harmonic drives is driven by the growing demand for efficient industrial products and the need to reduce electricity consumption and energy losses. Low harmonic drives, which minimize harmonic distortions and improve energy efficiency, are particularly beneficial for industries such as Oil and Gas, Renewable energy generation, and Power utilization. However, high initial costs represent a significant barrier to adoption, especially for Small and Medium Enterprises (SMEs). The advanced technology, materials, and manufacturing processes involved in producing low harmonic drives contribute to their higher price tag compared to conventional drive systems. For instance, while a standard Variable Frequency Drive (VFD) might cost between USD2,000 and USD5,000, low harmonic drives can range from USD5,000 to USD15,000 or more.

- This substantial cost increase can deter SMEs from investing In these advanced technologies, despite their long-term energy savings and improved power quality benefits. Industries are increasingly adopting low harmonic drives to reduce energy losses and improve power outputs. Power wiring, transformers, and unity power factor are also crucial components of the system. Harmonic distortions and power wiring issues can lead to problems In the AC power grid, affecting the sinusoidal wave and overall system performance.

- Therefore, the importance of low harmonic drives in mitigating these issues and ensuring efficient energy usage cannot be overstated.

Exclusive Customer Landscape

The low harmonic drives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the low harmonic drives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, low harmonic drives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The company specializes in low harmonic drives, providing innovative solutions through offerings such as the ACS880-31, ACS880-37, and ACS880-37LC models. These drives deliver superior performance by minimizing harmonic distortion, ensuring efficient power conversion and enhancing system reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Cone Drive

- Danfoss AS

- Delta Electronics Inc.

- Eaton Corp plc

- Fuji Electric Co. Ltd.

- Harmonic Drive LLC

- Invertek Drives Ltd

- KEB America Inc.

- Mitsubishi Electric Corp.

- Nidec Corp.

- OJ Electronics AS

- OMRON Corp.

- Rockwell Automation Inc.

- Sango Automation Ltd

- Schneider Electric SE

- Siemens AG

- WEG S.A

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of industrial products designed to improve the energy efficiency of electrical systems. These drives, which are used to control the speed and direction of electric motors, minimize the production of harmonics and harmonic distortions In the electrical power output. Harmonics are unwanted frequencies that can disrupt the sinusoidal waveform of the AC power grid, leading to increased energy losses and higher power consumption. The demand for low harmonic drives is driven by several factors. First, there is a growing emphasis on energy efficiency in various industries, including oil and gas, renewable energy generation, and manufacturing.

In the oil and gas sector, exploration activities, whether onshore or offshore, require the use of large electric motors for drilling and production operations. These motors can generate significant harmonic distortions, leading to increased energy consumption and higher operating costs. By using low harmonic drives, oil and gas companies can reduce their energy usage and lower their carbon footprint. Similarly, In the renewable energy sector, the use of low harmonic drives is essential to ensure the stability of the power grid. Renewable energy sources, such as wind and solar, can generate harmonics that can disrupt the power grid and cause power quality issues.

By using low harmonic drives, renewable energy generators can minimize the production of harmonics and ensure a stable power output. Another factor driving the growth of the market is the increasing use of compact systems and power wiring in various industries. As industrial processes become more automated and efficient, there is a growing trend towards the use of compact systems and power wiring. However, these systems can be more susceptible to harmonic distortions, which can lead to increased energy losses and reduced system performance. By using low harmonic drives, manufacturers can ensure that their systems operate efficiently and effectively, while minimizing energy losses and reducing maintenance costs.

The market can be segmented into low voltage drives and medium voltage drives. Low voltage drives are typically used in applications where the power requirement is less than 1000 volts, while medium voltage drives are used in applications where the power requirement is greater than 1000 volts. Both types of drives offer similar benefits in terms of energy efficiency and harmonic reduction. The control unit, active supply unit, and motor inverter are the key components of a low harmonic drive system. The control unit regulates the speed and direction of the motor, while the active supply unit provides the necessary power to the motor.

The motor inverter converts the DC power from the active supply unit into AC power for the motor. By using advanced control algorithms and filtering techniques, these components work together to minimize harmonic distortions and ensure a clean power output. The food and beverages, water treatment, mining, and pulp and paper industries are among the key end-users of low harmonic drives. These industries rely heavily on electric motors for various processes, and the use of low harmonic drives can help them reduce energy consumption and improve system performance. For example, In the food and beverages industry, low harmonic drives can be used to control the speed of pumps and conveyors, while In the mining industry, they can be used to power drills and conveyor belts.

In conclusion, the market is driven by the growing demand for energy efficiency and harmonic reduction in various industries. These drives offer significant benefits in terms of energy savings, improved system performance, and reduced maintenance costs. The market can be segmented into low voltage and medium voltage drives, and the key components include the control unit, active supply unit, and motor inverter. The food and beverages, water treatment, mining, and pulp and paper industries are among the key end-users of low harmonic drives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2024-2028 |

USD 3.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Low Harmonic Drives Market Research and Growth Report?

- CAGR of the Low Harmonic Drives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the low harmonic drives market growth of industry companies

We can help! Our analysts can customize this low harmonic drives market research report to meet your requirements.