Luxury Footwear Market Size 2025-2029

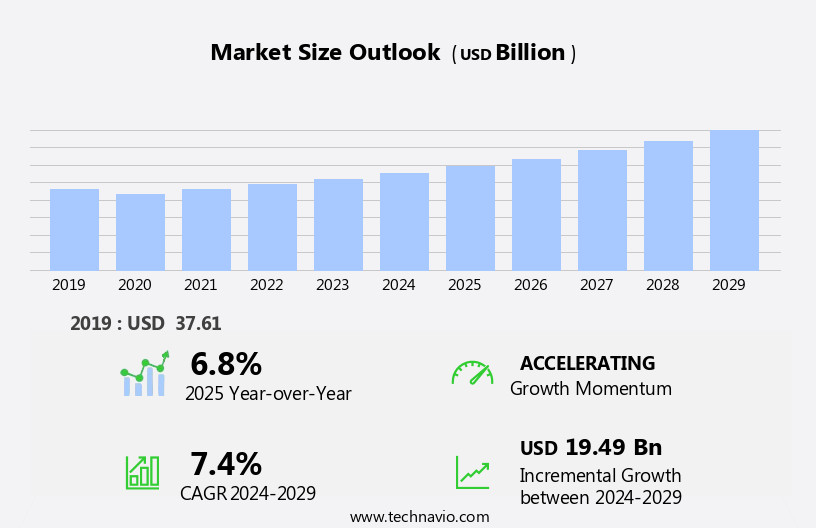

The luxury footwear market size is forecast to increase by USD 19.49 billion, at a CAGR of 7.4% between 2024 and 2029.

- The market is driven by the increasing demand for exclusive designer collections and customized footwear. Consumers are willing to pay a premium for unique, high-quality footwear that sets them apart from the crowd. This trend is particularly prominent among the affluent demographic, who seek to express their individuality and status through their fast fashion choices. However, the market faces significant challenges. Rising labor costs and fluctuating raw material prices put pressure on manufacturers to maintain profitability. These costs are further compounded by the need for high-quality materials and craftsmanship that are synonymous with luxury footwear. To navigate these challenges, companies must explore cost-effective production methods and innovative sourcing strategies.

- Additionally, they must maintain a strong brand image and focus on customer experience to justify the high price points. By addressing these challenges and capitalizing on the growing demand for luxury footwear, companies can differentiate themselves in a competitive market and secure long-term success.

What will be the Size of the Luxury Footwear Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by various market dynamics and applications across diverse sectors. Brands strive to differentiate themselves through sole construction and product development, while retail distribution channels expand to include fashion shows, e-commerce platforms, and brand partnerships. Pricing strategies are influenced by customer reviews and brand positioning, with after-sales support and customer service playing crucial roles in fostering brand loyalty. Social media marketing and influencer collaborations are essential tools for reaching target audiences, with arch support and ankle support becoming increasingly prioritized for comfort and functionality. Patent leather and other high-quality materials are sourced ethically and sustainably, reflecting the industry's growing focus on ethical production and quality control.

Direct-to-consumer sales and investment opportunities further shape the market, as brands seek to streamline supply chain management and water resistance becomes a desirable feature for consumers. The growth potential of the market is significant, with brand identity and inventory management remaining key considerations for market success.

How is this Luxury Footwear Industry segmented?

The luxury footwear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Formal shoe

- Casual shoe

- Distribution Channel

- Offline

- Online

- End-user

- Women

- Men

- Children

- Price Range

- High-end

- Mid-range

- Entry-level

- Material

- Leather

- Suede

- Synthetic

- Exotic Materials

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

. By Product Insights

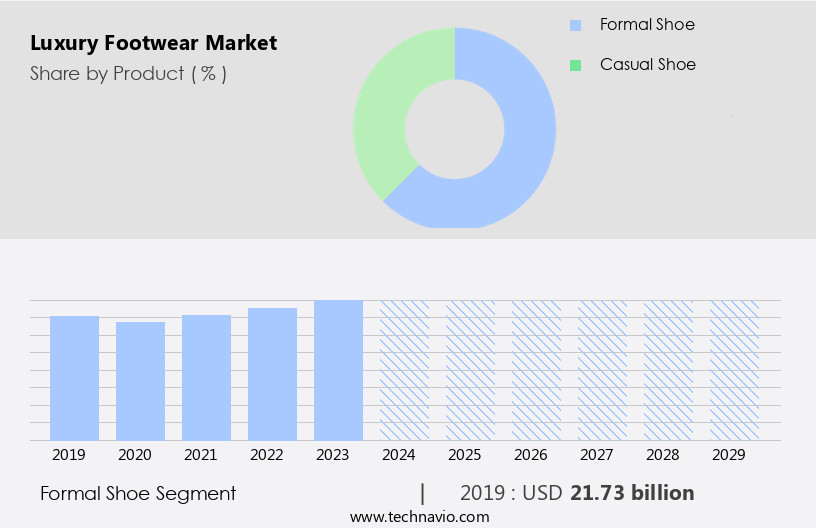

The formal shoe segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of formal shoes, primarily crafted from leather and synthetic materials. Brands prioritize product development, focusing on innovative sole constructions, ankle support, and arch support to cater to diverse customer needs. Retail distribution channels include high-end retailers, e-commerce platforms, and direct-to-consumer sales. Fashion shows serve as a platform for showcasing new collections, while brand partnerships and influencer marketing strategies enhance brand positioning. Customer reviews play a significant role in shaping purchasing decisions, with factors like pricing strategies, after-sales support, and ethical production influencing customer loyalty. Material sourcing, inventory management, and quality control are crucial aspects of supply chain management.

Leather goods, including formal shoes, continue to be in demand due to their durability and versatility. Marketing campaigns emphasize brand identity, targeting various demographics, and addressing specific customer preferences. Social media marketing and customer service are essential components of a comprehensive marketing strategy. Returns and exchanges, along with water resistance and patent leather finishes, are features that add value to the customer experience. The formal shoe market exhibits substantial growth potential, driven by increasing brand loyalty and the trend of owning multiple pairs for different occasions. Investment opportunities exist in this sector, particularly in areas such as sustainable production, advanced technology, and unique designs. Overall, the formal shoe market is a dynamic and evolving industry that prioritizes customer satisfaction and innovation.

The Formal shoe segment was valued at USD 21.73 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

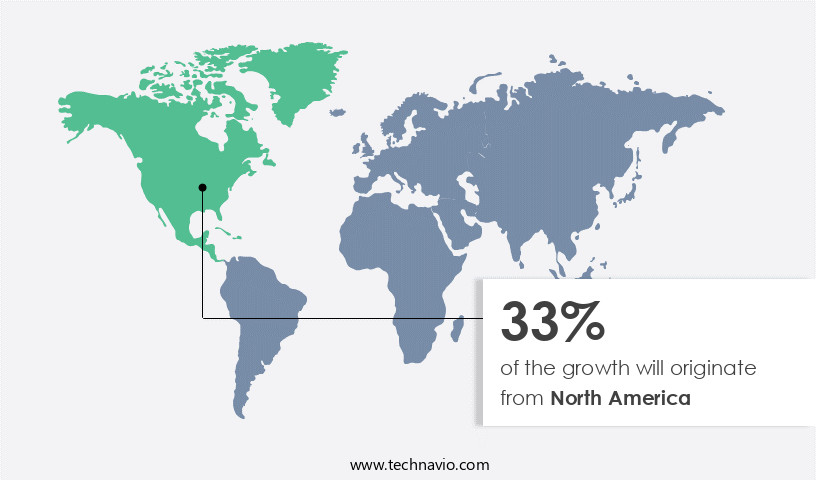

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experiences significant growth due to the presence of a large customer base with high disposable income and an increasing number of high-net-worth individuals. Innovative product launches, the increasing popularity of online shopping platforms, and the growing trend towards eco-friendly materials are key drivers fueling market expansion. Furthermore, the demand for customized luxury footwear is on the rise, adding to the market's momentum. Luxury footwear brands cater to diverse customer segments, focusing on superior sole construction, product development, and brand partnerships to differentiate themselves. Retail distribution channels include high-end retailers, e-commerce platforms, and fashion shows, with marketing campaigns utilizing social media marketing, influencer marketing, and customer reviews to engage customers.

After-sales support, such as returns and exchanges, and customer service, are essential components of the customer experience. Brand positioning and identity are crucial elements of the marketing, with an emphasis on quality control, ethical production, and water resistance. Material sourcing, including the use of patent leather boot and arch support, is a critical aspect of product development. Inventory management and pricing strategies are essential for maintaining a balance between supply and demand, ensuring the availability of desirable products while maximizing revenue. Direct-to-consumer sales and investment opportunities present new avenues for growth in the market. The market's future potential is promising, with a focus on sustainability, comfort, and unique designs appealing to a wide target audience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Luxury Footwear Industry?

- The surge in consumer interest for luxury, exclusive designer collections serves as the primary market catalyst.

- The market is driven by the preference of consumers for high-quality materials and designer labels. Leather, textiles, and synthetics are popular choices for luxury footwear due to their aesthetics and durability. Designer collections, including leather shoes, moccasins, and stilettos for women, command a premium price in the market. Fashion shows, trade exhibitions, and trade fairs provide a platform for manufacturers to launch their new products or collections, increasing consumer interest. After-sales support and marketing campaigns are essential for brand positioning and customer retention.

- Effective supply chain management is crucial for timely delivery and maintaining product quality. Direct-to-consumer sales and partnerships with high-end retailers are investment opportunities for luxury footwear brands. Bata, a leading company, showcases its Disney footwear collection, featuring various Disney characters, to cater to the demand for exclusive and limited-edition designs.

What are the market trends shaping the Luxury Footwear Industry?

- The trend in the footwear market is shifting towards customized luxury shoes that cater to individual preferences. This growing demand for personalized footwear represents an emerging market trend.

- The market experiences a significant emphasis on personalization and customization, with consumers in developed regions like the Americas and Europe showing a growing preference for bespoke footwear. This trend is also gaining traction in emerging economies such as China and India. In the premium footwear segment, leading companies cater to this demand by offering customized products that boast an aesthetic appeal. Customization options range from design elements like logos, colors, and buckles to more intricate choices such as embroidery and adding names. Material sourcing plays a crucial role in the luxury footwear industry, with a focus on high-quality leather and innovative materials.

- Brands strive to build and maintain customer loyalty through excellent customer service, social media marketing, and influencer partnerships. Returns and exchanges are also critical aspects of the market, with companies ensuring a seamless process to enhance the overall shopping experience. Arch support and comfort are essential considerations for consumers, with many luxury brands investing in advanced technologies to provide superior cushioning and support. Patent leather remains a popular material choice due to its durability and sleek appearance.

What challenges does the Luxury Footwear Industry face during its growth?

- The luxury footwear industry faces significant challenges due to escalating labor costs and volatile raw material prices, which negatively impact industry growth.

- The market exhibits significant growth potential, driven by the increasing demand for high-quality, stylish, and ethically produced footwear. Brands strive to establish a strong identity within their target audience by focusing on inventory management, ensuring water resistance, and maintaining rigorous quality control. However, rising production costs in Asian countries, such as China, India, Indonesia, Bangladesh, and Vietnam, pose a challenge for manufacturers. To mitigate these expenses, companies are adopting advanced technologies, forming collaborations, and automating their manufacturing processes. Ethical production and sustainable practices are becoming increasingly important to consumers, which is leading to a growing emphasis on transparency and traceability throughout the supply chain.

- Overall, the market is dynamic and evolving, requiring companies to remain agile and responsive to changing consumer preferences and market trends.

Exclusive Customer Landscape

The luxury footwear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury footwear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury footwear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Luxury Retail - This esteemed company specializes in the production and distribution of luxurious footwear. Our product range includes the Sant Eulalia Leather Oxford, Bolgheri Leather Derby, and Trento Leather Oxford. Each design is meticulously crafted from premium leather sources, ensuring durability and sophistication.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Luxury Retail

- Online Platforms

- Department Stores

- Boutiques LVMH Moët Hennessy Louis Vuitton (France)

- Kering SA (France)

- Hermès International S.A. (France)

- Salvatore Ferragamo S.p.A. (Germany, operations)

- Tod's S.p.A. (Germany, operations)

- Jimmy Choo PLC (United Kingdom)

- Christian Louboutin (France)

- Manolo Blahnik (United Kingdom)

- Burberry Group plc (United Kingdom)

- Bally Shoe Factories Ltd. (Germany, operations)

- Church's (United Kingdom)

- A.Testoni (Germany, operations)

- Berluti (France)

- Sergio Rossi (Germany, operations)

- Alexander McQueen (United Kingdom)

- Golden Goose (Germany, operations)

- Stuart Weitzman (United States)

- Cole Haan (United States)

- Anta Sports Products Ltd. (China)

- Belle International Holdings Ltd. (China)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Footwear Market

- In February 2024, Italian luxury fashion house Prada announced the launch of its new sustainable footwear line, "Prada Re-Nylon," made from recycled materials, marking a significant stride towards eco-friendly production in the market (Prada, 2024).

- In May 2024, LVMH Moët Hennessy â Fashion Group, the world's largest luxury goods company, entered into a strategic partnership with Rent the Runway, a leading fashion rental platform, to expand its presence in the rental market and offer its customers a wider range of luxury footwear options (Rent the Runway, 2024).

- In November 2024, Kering, the luxury group behind brands such as Gucci and Balenciaga, revealed a major investment of â¬1 billion in digital transformation, which includes the development of advanced technologies for custom-made footwear production and online sales channels (Kering, 2024).

- In January 2025, Nike announced the acquisition of Footasylum, a UK-based retailer specializing in streetwear and sportswear, expanding its reach in the European market and gaining access to Footasylum's strong presence in the luxury sneaker segment (Nike, 2025).

Research Analyst Overview

- In the market, brand awareness is paramount for success. Luxury fashion events provide an excellent platform for brands to showcase their latest offerings and engage with customers. The customer experience extends beyond the purchase, with shoe repair and custom shoemaking services enhancing the value proposition. Goodyear welt and Blake stitch construction ensure durability, while ortholite insoles provide comfort. Brands leverage shoe care products, such as shoe polish and shoe trees, to promote customer loyalty. French calfskin and Italian leather are popular choices for their elegance and durability. Limited edition releases and celebrity endorsements generate buzz and drive market penetration.

- Brands invest in anti-slip technology and waterproof membranes to cater to practical needs. Online reviews and customer testimonials provide valuable insights for potential buyers. Heel height and return on investment are crucial factors in the decision-making process. Vibram soles offer superior traction, adding to the overall value proposition. Brand ambassadors and fashion magazines further boost brand visibility and credibility. Shoe size standards ensure a perfect fit, enhancing the overall shopping experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Footwear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 19.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, UK, Japan, Canada, India, Germany, France, South Korea, Italy, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Footwear Market Research and Growth Report?

- CAGR of the Luxury Footwear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury footwear market growth of industry companies

We can help! Our analysts can customize this luxury footwear market research report to meet your requirements.