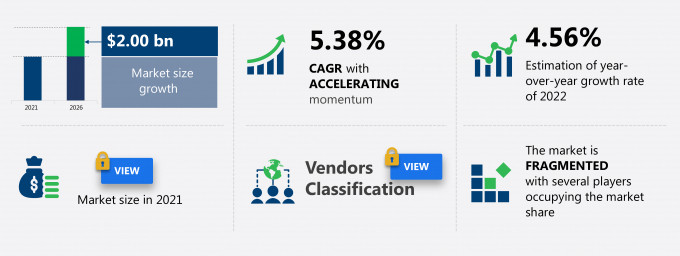

The luxury furniture market share in APAC is expected to increase by USD 2.00 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 5.38%.

This luxury furniture market in APAC research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers luxury furniture market in APAC segmentation by distribution channel (offline and online) and application (residential and commercial). The luxury furniture market in APAC report also offers information on several market vendors, including DBJ Furniture Ltd., Dynamic Furniture Industries (M) Sdn Bhd, Falcon Inc. PTE Ltd., Inter IKEA Holding BV, Kovacs Design Furniture, McMichael Furniture, Shanghai JL and C Furniture Co. Ltd., VALDERAMOBILI srl, Wegmans Furniture Industries Sdn Bhd, and Wisanka Indonesia among others.

What will the Luxury Furniture Market Size in APAC be During the Forecast Period?

Download the Free Report Sample to Unlock the Luxury Furniture Market Size in APAC for the Forecast Period and Other Important Statistics

Luxury Furniture Market in APAC: Key Drivers, Trends, and Challenges

The growing influence of different retailing channels is notably driving the luxury furniture market growth in APAC, although factors such as frequent product recalls may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the luxury furniture industry in APAC. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Luxury Furniture Market Driver in APAC

The growing influence of different retailing channels is one of the key drivers supporting the luxury furniture market growth in APAC. The growth of the global luxury furniture market is heavily influenced by the rising popularity of online as well as offline retailing channels globally. Furthermore, offline retailers include organized retailers, such as traditional stores, manufacturer-branded stores, discount stores, rental stores, warehouse clubs, and designer stores. Moreover, led by rapid industrialization globally, these organized retailers have increased in numbers and have emerged as one of the main sources of selling luxury furniture and their distribution globally. On the other hand, owing to increasing internet penetration globally, the influence of e-commerce-based shopping and online retailing has grown. Such growth is expected to have a positive impact on the growth of the market during the forecast period.

Key Luxury Furniture Market Trend in APAC

Growth in demand for luxury furniture among millennials is one of the key trends contributing to the luxury furniture market growth in APAC. The millennial population has been growing worldwide, which is an encouraging sign for vendors operating in the global luxury furniture market. For instance, in India, millennials were the major wage earners in 2019, accounting for more than 47% of the working population in the country. This increase in disposable income among the millennial population has led to an increase in the adoption of luxury furniture among them. This trend is more common in the recliner sofa and recliner chair categories of luxury furniture. Therefore, growth in the demand for luxury furniture among millennials is a vital trend, which will positively impact the luxury furniture market in APAC during the forecast period.

Key Luxury Furniture Market Challenge in APAC

Frequent product recalls is one of the factors hindering the luxury furniture market growth in APAC. The increasing number of product recalls featuring sub-categories, such as bar stools, recliner chairs, sofas, beds, and dining tables, is a major challenge that is anticipated to hinder the growth of the global luxury furniture market during the forecast period. Product recalls hamper the reputation of any sector and result in operational and financial constraints among players operating in the global luxury furniture market. There have been quite a significant number of instances of such recalls in the past few years in the luxury furniture market in APAC. Thus, such instances will negatively impact the market growth during the forecast period.

This luxury furniture market in APAC analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the luxury furniture market in APAC as a part of the global home furnishing market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the luxury furniture market in APAC during the forecast period.

Who are the Major Luxury Furniture Market Vendors in APAC?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- DBJ Furniture Ltd.

- Dynamic Furniture Industries (M) Sdn Bhd

- Falcon Inc. PTE Ltd.

- Inter IKEA Holding BV

- Kovacs Design Furniture

- McMichael Furniture

- Shanghai JL and C Furniture Co. Ltd.

- VALDERAMOBILI srl

- Wegmans Furniture Industries Sdn Bhd

- Wisanka Indonesia

This statistical study of the luxury furniture market in APAC encompasses successful business strategies deployed by the key vendors. The luxury furniture market in APAC is fragmented and the vendors are deploying growth strategies such as price, quality, innovation, brand, and variety to compete in the market.

Product Insights and News

- DBJ Furniture Ltd. - The company is involved in offering wide range of luxury furniture in bathroom such as bespoke brass, country superstar among others which fit seamlessly with your lifestyle and stand out functionally and aesthetically as per the look and design.

- Dynamic Furniture Industries (M) Sdn Bhd - The company is involved in offering wide range of luxury furniture products such as HD7458, HD7451 among others which offer high quality furniture as per the customer requirement with reference to look and design.

- Falcon Inc. PTE Ltd. - The company is involved in offering wide range of luxury furniture for hospitality and commercial to serve end products and services that fulfill every need as per the requirement.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The luxury furniture market in APAC forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Luxury Furniture Market in APAC Value Chain Analysis

Our report provides extensive information on the value chain analysis for the luxury furniture market in APAC, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the home furnishing market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Distribution Channel Segments in the Luxury Furniture Market in APAC?

To gain further insights on the market contribution of various segments Request for a FREE sample

The luxury furniture market share growth in APAC by the offline segment will be significant during the forecast period. Offline stores enable consumers to touch and feel luxury furniture as a part of the buying process, thereby enabling consumers to physically experience the product before purchasing them. This is not possible in the case of online distribution channels. Therefore, offline luxury furniture stores are prominent in developed, as well as developing countries, across the world. Growth in the offline distribution of luxury furniture is augmented by a significant increase in the number of vendors expanding and operating their offline stores across both developed and developing regions. Such expansion will lead to the growth of the global luxury furniture market through the offline distribution channel during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the luxury furniture market size in APAC and actionable market insights on post COVID-19 impact on each segment.

|

Luxury Furniture Market Scope in APAC |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.38% |

|

Market growth 2022-2026 |

$ 2.00 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.56 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

DBJ Furniture Ltd., Dynamic Furniture Industries (M) Sdn Bhd, Falcon Inc. PTE Ltd., Inter IKEA Holding BV, Kovacs Design Furniture, McMichael Furniture, Shanghai JL and C Furniture Co. Ltd., VALDERAMOBILI srl, Wegmans Furniture Industries Sdn Bhd, and Wisanka Indonesia |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Luxury Furniture Market in APAC Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive luxury furniture market growth in APAC during the next five years

- Precise estimation of the luxury furniture market size in APAC and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the luxury furniture industry in APAC

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of luxury furniture market vendors in APAC

We can help! Our analysts can customize this report to meet your requirements. Get in touch