Machine Tools Market Size 2025-2029

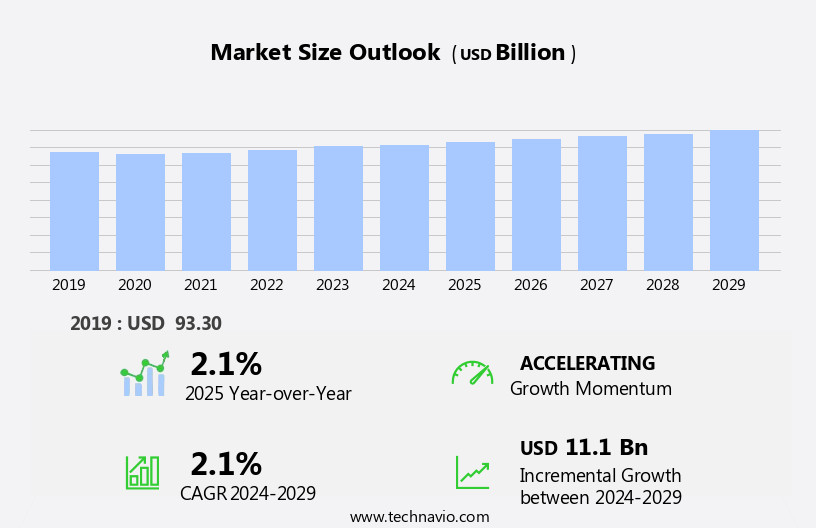

The machine tools market size is forecast to increase by USD 11.1 billion at a CAGR of 2.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising industrialization in developing countries. This trend is leading to increased demand for machine tools as these economies expand their manufacturing sectors. Another key driver is the adoption of 3D printing technology, which is revolutionizing the production process for certain machine tools and enabling the creation of complex parts that were previously difficult or impossible to manufacture. However, the market also faces challenges, most notably the high initial investment and operational costs associated with the production of machine tools. These expenses can make it difficult for smaller companies to enter the market and may limit the growth potential for some existing players.

- To capitalize on market opportunities and navigate these challenges effectively, companies should focus on cost reduction strategies, such as optimizing production processes and exploring partnerships with suppliers and customers. Additionally, investing in research and development to stay abreast of technological advancements and market trends is essential for long-term success.

What will be the Size of the Machine Tools Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and its applications across various sectors. Computer-aided manufacturing (CAM) software streamlines the manufacturing process, enabling efficient process planning and optimizing feed rates. Tool wear is mitigated through predictive maintenance and advanced tooling materials. CNC machining benefits from high-speed cutting and cutting fluids, while smart manufacturing integrates machine monitoring and machine vision for enhanced quality control. Tooling materials, such as ceramics and advanced alloys, improve part accuracy and surface finish in precision machining. Machining centers and turning centers leverage digital twins and virtual machining for improved efficiency and reduced power consumption.

- Machine control systems and CAD software facilitate multi-axis machining and 3D printing. Advanced manufacturing techniques, including additive manufacturing and high-speed machining, expand the capabilities of machine tools. Chip removal and material handling are optimized through machining software and human-machine interface (HMI) design. Spindle speed and machine control systems ensure precise machining and process optimization. The ongoing dynamism of the market is reflected in the integration of machine tools with advanced technologies, such as machine vision, predictive maintenance, and digital twins. The evolving nature of manufacturing continues to drive innovation and growth in this sector.

How is this Machine Tools Industry segmented?

The machine tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Industrial machinery

- Precision engineering

- Transportation

- Others

- Application

- High-volume production

- Precision and custom machining

- Multi-axis and complex machining

- Prototyping and low-volume production

- Product Types

- CNC Machines

- Lathes

- Milling Machines

- Grinding Machines

- Tool Type

- Metal Cutting

- Metal Forming

- Accessories

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

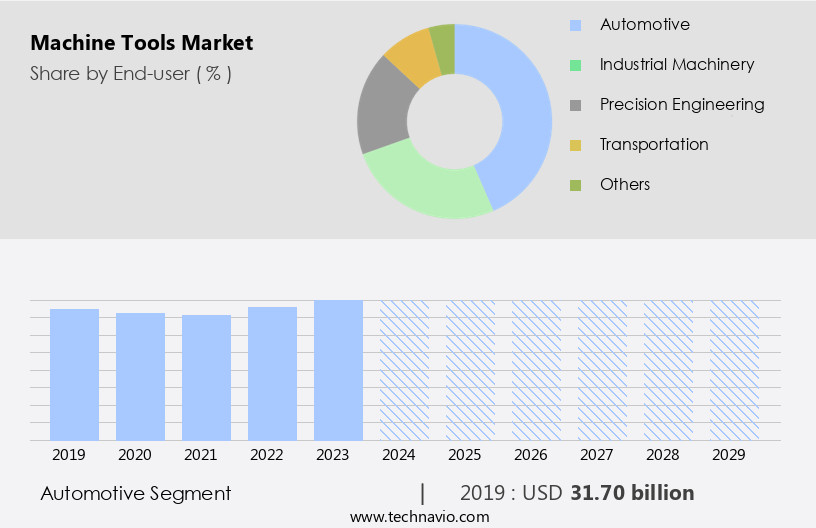

The automotive segment is estimated to witness significant growth during the forecast period.

The market experiences significant activity, particularly in the automotive sector, which holds the largest revenue share. The increasing adoption of advanced machine tools is driven by the growing complexity of automobile manufacturing, necessitating high-precision solutions for producing intricate vehicle components. CNC milling machines and cutting tools are extensively utilized in this segment for manufacturing components such as transmission cases, engine cylinder heads, flywheels, wheels, pistons, and gearboxes. Machine monitoring, predictive maintenance, and smart manufacturing are key trends shaping the market. Machine monitoring systems enable real-time analysis of machine performance, optimizing production efficiency and reducing downtime. Predictive maintenance, utilizing machine learning algorithms and data analytics, allows for the identification and resolution of potential issues before they cause significant damage.

Smart manufacturing integrates machine tools with advanced technologies such as computer-aided design (CAD), computer-aided manufacturing (CAM), and machining software, streamlining production processes and enhancing part accuracy. Additive manufacturing, machine vision, and digital twins are emerging technologies gaining traction in the market. Additive manufacturing, or 3D printing, enables the production of complex geometries and customized components, reducing material waste and production time. Machine vision systems provide real-time inspection and measurement capabilities, ensuring part quality and reducing errors. Digital twins, virtual replicas of physical machines, facilitate predictive maintenance and process optimization. Machine shops rely on various machine tools for metal fabrication, including drilling machines, turning centers, and multi-axis machining centers.

Tooling materials, cutting speed, feed rate, and cutting fluids are essential factors influencing tool life and overall production efficiency. Precision machining and surface finish are critical considerations for industries such as aerospace and defense, where high-quality components are essential. Power consumption is a significant concern for machine tool manufacturers and users, with high-speed machining and advanced manufacturing processes requiring substantial energy inputs. Human-machine interface (HMI) systems improve operator experience and productivity, while spindle speed and tool wear management are essential for maintaining optimal machine performance. In conclusion, the market is witnessing dynamic growth, driven by advancements in technology and increasing demand for high-precision manufacturing solutions across various industries.

The Automotive segment was valued at USD 31.70 billion in 2019 and showed a gradual increase during the forecast period.

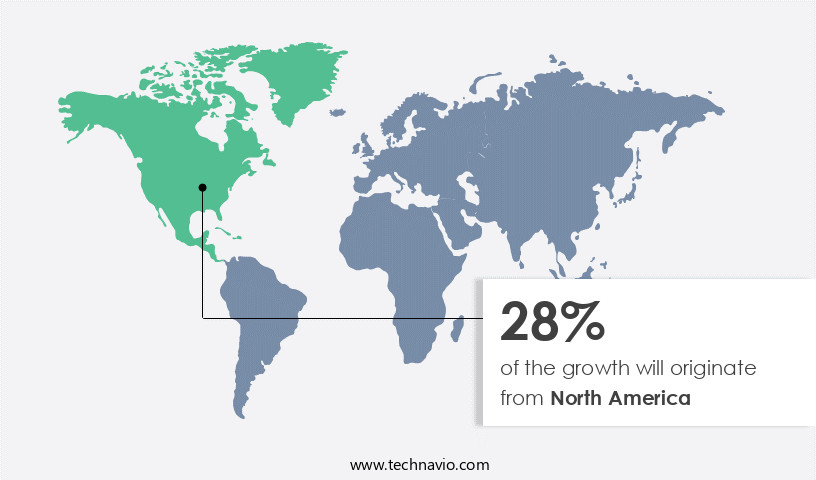

Regional Analysis

North America is estimated to contribute 28% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific region. This trend is driven by the expanding manufacturing industries in countries like China, Japan, India, Taiwan, and South Korea. Hybrid machining for medical device manufacturing and digital twins for shipbuilding enhance customization, driving efficiency in Asia-Pacific and North America.Machine tools, which operate using numerical control, are increasingly being adopted for cutting hard substances into precise shapes and sizes. These tools minimize the effort required for various operations, including cutting, forming, drilling, grinding, and abrading, while ensuring uniformity and eliminating unwanted variations. Machine monitoring, cam software, feed rate, tool life, predictive maintenance, power consumption, and process optimization are essential features that enhance machine tool efficiency.

Advanced manufacturing technologies such as additive manufacturing, machine vision, and digital twins are revolutionizing the industry. CNC machining, turning centers, and machining centers are common types of machine tools used for metal fabrication and precision machining. Smart manufacturing, computer-aided design (CAD), and computer-aided manufacturing (CAM) software streamline the manufacturing process, while tool wear, cutting speed, cutting tools, cutting fluids, and surface finish are critical factors influencing tool performance. Machine control systems, multi-axis machining, and spindle speed are other essential aspects of machine tools. The integration of human-machine interface (HMI), high-speed machining, and advanced manufacturing techniques is enabling improved part accuracy, quality control, and material handling. The market is also witnessing the emergence of 3D printing, virtual machining, and process optimization techniques to enhance productivity and reduce costs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market thrives on innovations enhancing production. Hybrid machining boosts automotive manufacturing, while eco-friendly tools align with aerospace production. Multi-axis systems optimize electronics assembly, and AI-driven optimization refines metal fabrication. Smart manufacturing supports infrastructure development, while modular designs aid energy sector. Energy-efficient systems enhance medical device manufacturing, and digital integration improves defense equipment. Automated workflows management ensure precision engineering, and lightweight components streamline shipbuilding.

CNC machines for automotive manufacturing target automotive sector, while milling machines for aerospace production appeal to aerospace sector. Additive manufacturing for precision engineering suits SMEs, and AI-driven optimization for metal fabrication draws industrial machinery. Eco-friendly tools for infrastructure development align with energy sector, while multi-axis systems for electronics assembly boost electronics sector. Smart manufacturing for energy sector promotes sustainability, and robotics automation for defense equipment ensures reliability.

What are the key market drivers leading to the rise in the adoption of Machine Tools Industry?

- In developing countries, the primary catalyst fueling market growth is the rising industrialization trend.The market is experiencing significant growth due to the increasing industrialization in developing countries. As these nations undergo economic transformation, there is a growing demand for advanced manufacturing equipment to support their burgeoning manufacturing sectors. Machine tools, which are essential for cutting, shaping, and forming materials, play a crucial role in fulfilling the needs of various industries, including automotive, aerospace, electronics, and consumer goods. Advancements in machine tools technology, such as multi-axis machining, digital twins, measurement systems, and process optimization, are driving innovation and efficiency in manufacturing processes. High-precision machine tools enable superior surface finish, while increased spindle speed and turning centers facilitate faster production.

- Virtual machining and CNC programming further streamline manufacturing processes, allowing for greater flexibility and customization. Additionally, emerging technologies like 3D printing are transforming the machine tools landscape, offering new possibilities for prototyping and manufacturing complex components. Machine control systems are also becoming increasingly sophisticated, enabling real-time monitoring and optimization of manufacturing processes. In conclusion, The market is experiencing robust growth, fueled by the expanding manufacturing sectors in developing countries and advancements in technology. The need for efficient and precise machinery to support these industries is paramount, and machine tools continue to play a vital role in meeting the demands of various industries and applications.

What are the market trends shaping the Machine Tools Industry?

- The adoption of 3D printing technology is an emerging market trend. This advanced manufacturing process offers numerous benefits, including increased efficiency, reduced production costs, and the ability to create complex designs that were previously impossible with traditional manufacturing methods.

- The market is experiencing significant growth due to the adoption of advanced technologies such as additive manufacturing, also known as 3D printing. This innovative technology is revolutionizing traditional manufacturing processes by creating physical objects directly from digital designs, layer by layer. Its versatility and flexibility enable the production of complex geometries, customized components, and prototypes across various industries. Additive manufacturing offers several benefits, including reduced time-to-market, design iteration without expensive tooling, on-demand production, localized manufacturing, and mass customization. These advantages are transforming supply chain dynamics and minimizing inventory costs. As a result, the demand for advanced additive manufacturing systems, including metal and polymer printers, is increasing, leading to significant investments in cutting-edge 3D printing technologies.

- Moreover, machine tools are essential in machine shops for workpiece handling and machining operations. Machine monitoring systems, cam software, and feed rate optimization are crucial for enhancing productivity and tool life. Predictive maintenance and power consumption management are other critical areas of focus for machine tool manufacturers. Machine vision technology is also gaining popularity for quality control and inspection applications. Drilling machines are a vital category of machine tools, used extensively in various industries for drilling, boring, and tapping operations. Overall, the market is dynamic, with ongoing advancements in technology and evolving industry requirements shaping its landscape.

What challenges does the Machine Tools Industry face during its growth?

- The machine tool industry faces significant challenges due to high initial investments and operational costs in production, which can hinder industry growth.

- The market faces substantial challenges due to high initial and operating costs. Machine tools, which include technologies like Computer-Aided Manufacturing (CAM), CNC machining, and machining centers, require significant investment for purchase, installation, training, and setup. These expenses make it difficult for small- and medium-sized enterprises (SMEs) to adopt advanced machining technologies. Furthermore, ongoing operational costs, such as maintenance, repair, energy consumption, and tooling, add to the total cost of ownership and impact profitability. Tool wear and process planning are critical factors influencing the market's dynamics. Tooling materials and cutting tools play a significant role in determining the efficiency and longevity of machining processes.

- Advanced tooling materials, like ceramics and advanced alloys, can help improve tool life and reduce overall costs. Moreover, the adoption of smart machine manufacturing technologies, such as Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM), can help optimize process planning and improve overall productivity. Cutting speed and cutting fluids are essential considerations for machining operations. Increasing cutting speeds can help reduce cycle times and improve productivity, but they also put additional stress on cutting tools and increase the risk of tool wear. Cutting fluids help cool the workpiece and lubricate the cutting edge, reducing friction and wear.

- However, they can also add to the overall cost of machining. In conclusion, the high initial and ongoing costs associated with machine tools present significant challenges for both manufacturers and end-users. However, advancements in tooling materials, process planning, and smart manufacturing technologies offer opportunities to improve efficiency, reduce costs, and enhance productivity.

Exclusive Customer Landscape

The machine tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the machine tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, machine tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Yamazaki Mazak Corporation (Japan) - This company specializes in providing a comprehensive range of machine tools for various industrial applications. Our product offerings encompass metal cutting drills, boring tools, thread mills, reamers, and roller burnishing tools, among others. Each tool is meticulously engineered for optimal performance and durability. By utilizing advanced technologies and materials, we ensure our tools deliver precise results, enhancing overall productivity and efficiency for our clients. Our commitment to innovation and quality sets US apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Yamazaki Mazak Corporation (Japan)

- DMG MORI Co., Ltd. (Japan)

- Trumpf Group (Germany)

- Haas Automation Inc. (United States)

- Amada Co., Ltd. (Japan)

- Okuma Corporation (Japan)

- Makino Milling Machine Co., Ltd. (Japan)

- Doosan Machine Tools Co., Ltd. (South Korea)

- GF Machining Solutions (Switzerland)

- Hurco Companies Inc. (United States)

- Chiron Group SE (Germany)

- Hermle AG (Germany)

- Hyundai WIA Corporation (South Korea)

- JTEKT Corporation (Japan)

- Komatsu NTC Ltd. (Japan)

- Mitsubishi Heavy Industries Machine Tool Co., Ltd. (Japan)

- Sodick Co., Ltd. (Japan)

- Spinner Werkzeugmaschinenfabrik GmbH (Germany)

- Tornos SA (Switzerland)

- Bharat Fritz Werner Ltd. (India)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Machine Tools Market

- In March 2024, Haas Automation, a leading machine tool manufacturer, unveiled its new HAAS UMC-750 universal machining center, featuring a larger work envelope and improved cutting capabilities (Haas Automation Press Release). This innovation caters to the growing demand for high-performance machining solutions in industries such as aerospace and automotive.

- In July 2025, Siemens and DMG Mori, two major players in the machine tool industry, announced a strategic partnership to integrate Siemens' digital manufacturing software with DMG Mori's machine tools (Siemens Press Release). This collaboration aims to provide customers with seamless digitalization and improved production efficiency.

- In September 2024, Makino Milling Machines, Inc. Completed the acquisition of Swiss-type machining specialist, Hermle Machine Tool Technology, expanding its product portfolio and strengthening its presence in the high-precision machining market (Makino Milling Machines, Inc. Press Release). This strategic move allows Makino to cater to the increasing demand for advanced machining technologies in industries like medical devices and automotive.

Research Analyst Overview

The market is experiencing significant advancements, with a focus on cost reduction and digital transformation. Machine upgrades, such as tool wear analysis and tooling optimization, are essential for maintaining competitiveness. Data analytics plays a pivotal role in identifying trends and improving process monitoring. Laser cutting and plasma cutting technologies continue to dominate the industry, while composite materials and plastics processing gain traction. Lean manufacturing and just-in-time (JIT) production are key strategies for enhancing energy efficiency and reducing waste. Flexible manufacturing systems and mass customization are driving innovation, with artificial intelligence and machine learning enabling predictive maintenance and tooling management.

Quality assurance remains paramount, with cloud computing facilitating real-time collaboration and supply chain management. Environmental impact is a growing concern, with machine tools adopting energy-efficient solutions and adhering to sustainability standards. Rapid prototyping and operator training are essential for staying competitive in today's dynamic business landscape. Tooling design and maintenance services are crucial for ensuring optimal performance and longevity of machine tools. Process monitoring and continuous improvement are key to staying ahead of the competition in this ever-evolving market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Machine Tools Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2025-2029 |

USD 11.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Machine Tools Market Research and Growth Report?

- CAGR of the Machine Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the machine tools market growth of industry companies

We can help! Our analysts can customize this machine tools market research report to meet your requirements.