Meltblown Polypropylene Market Size 2024-2028

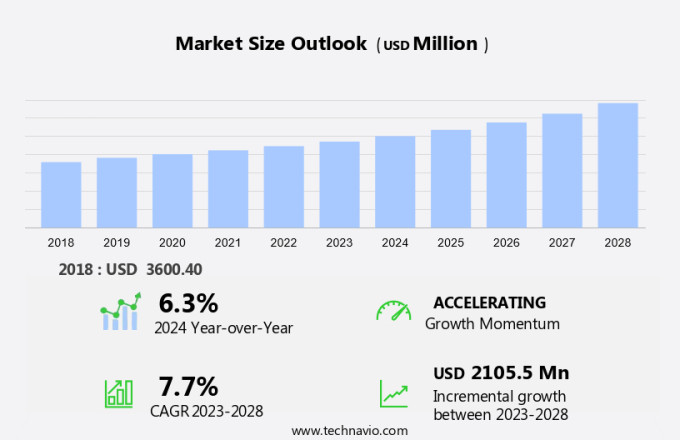

The meltblown polypropylene market size is forecast to increase by USD 2.11 billion at a CAGR of 7.7% between 2023 and 2028.

- The Meltblown Polypropylene (MBPP) market is experiencing significant growth due to its increasing applications in various industries. One key trend driving market expansion is the expansion of the global healthcare industry, particularly in the production of medical garments and filtration systems. These applications include pre-filtration in desalination processes and aseptic filtration in food and beverage industries, such as fruit juices and beer. Strategic partnerships among market companies are also contributing to market growth. However, fluctuations in the pricing of raw materials used for MBPP fabric production pose a challenge to market growth. For instance, the cost of chemicals like propylene monomer and additives can significantly impact the final price of MBPP products.

- Despite these challenges, the market is expected to continue growing due to the increasing demand for MBPP in various industries. The report provides a comprehensive analysis of market trends, growth drivers, and challenges, offering valuable insights to stakeholders and investors. In the US market, the demand for MBPP is particularly high in the healthcare and filtration industries. The report covers an in-depth analysis of the US market, providing insights into market size, growth potential, and competitive landscape.

What will be the Size of the Market During the Forecast Period?

- Meltblown polypropylene (MBPP) is a versatile plastic material widely used in various filtration applications due to its unique properties. This material plays a significant role in addressing numerous challenges in diverse industries, including fluid filtration, energy demand, aerosol filtration, water purification, and industrial hygiene. MBPP finds extensive use in filtration applications, such as particle removal, bacteria removal, and impurities removal, in various sectors. In the beverage industry, MBPP is employed to ensure water safety and maintain water quality, while in the air quality sector, it is used to enhance air filtration efficiency. The increasing demand for water safety and sustainable water management has fueled the growth of the filtration market. According to market analysis, the global filtration market is expected to witness significant growth due to stringent government regulations and the rising awareness of water quality. Membrane filtration, a filtration technology that utilizes membranes to separate particles from a liquid, is gaining popularity due to its high filtration efficiency and cost-effectiveness.

- Moreover, MBPP is an essential component in membrane filtration due to its excellent filtration performance and cost-effective production. Moreover, the integration of nanotechnology and membrane technology in filtration systems has led to innovative filtration designs and improved filtration performance. These advancements have resulted in cost-effective filtration solutions for various industries, including pollution control, biotechnology, and water treatment. Process optimization and resource management are crucial aspects of filtration systems. MBPP offers a sustainable solution by providing high filtration efficiency and reducing the need for frequent filter replacements. Furthermore, the use of MBPP in filtration systems contributes to environmental sustainability by minimizing waste and reducing energy consumption. Filtration trends indicate a shift towards sustainable filtration solutions that offer high filtration efficiency, cost-effectiveness, and environmental sustainability. MBPP, with its unique properties, is poised to play a significant role in meeting these requirements and driving the growth of the filtration market.

- In conclusion, the use of MBPP in filtration applications is a growing trend due to its excellent filtration performance, cost-effectiveness, and sustainability. The increasing demand for water safety, sustainable water management, and air quality, coupled with government regulations, is expected to fuel the growth of the filtration market. MBPP, as a key component of filtration systems, is set to play a vital role in addressing these challenges and shaping the future of the filtration industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Standard meltblown technology

- Advanced meltblown technology

- End-user

- Healthcare and medical

- Industrial and automotive

- Consumer goods

- Construction

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Technology Insights

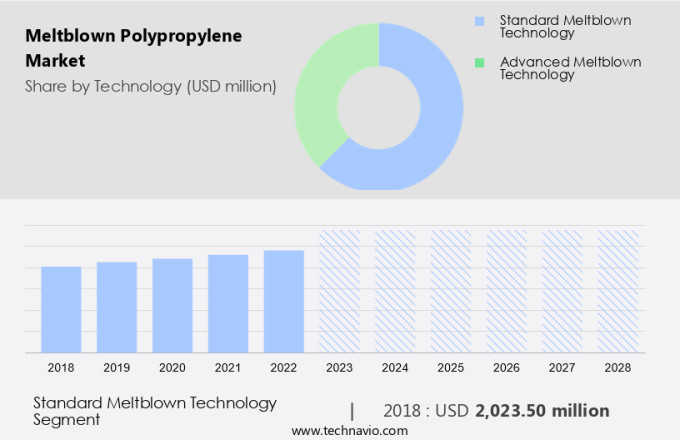

- The standard meltblown technology segment is estimated to witness significant growth during the forecast period.

Meltblown Polypropylene (MBPP) is a significant component in the manufacturing of nonwoven fabrics, with applications spanning various industries such as healthcare, filtration, hygiene, and packaging. The production process of MBPP involves melting polypropylene pellets in an extruder, which are then forced through fine nozzles under high pressure. Simultaneously, high-velocity hot air is blown across the molten fibers, causing them to elongate and form microfibers. These microfibers, ranging from 1 to 5 microns in diameter, are subsequently collected on a conveyor belt or rotating drum to create a fabric layer. The meltblown process is renowned for generating fabrics with ultra-fine fibers, offering exceptional filtration capabilities, barrier properties, and absorbency.

In the realm of food and beverage, MBPP is employed in the production of bottles and containers, providing enhanced protection against bacteria and preserving the freshness of soft drinks and other consumables. With urbanization and the subsequent increase in demand for convenient and hygienic solutions, the market for MBPP is poised for growth. In the realm of industrial applications, MBPP is utilized in various filtration systems, including air, water, and gas filtration, ensuring the removal of impurities and contaminants. The versatility and accessibility of MBPP make it a preferred choice for numerous industries, contributing to its expanding market presence. Despite the initial investment in the production process, the long-term cost savings and benefits derived from the use of MBPP make it a worthwhile investment for businesses.

Get a glance at the market report of share of various segments Request Free Sample

The standard meltblown technology segment was valued at USD 2.02 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) region is a significant driver of The market, fueled by a burgeoning industrial sector, escalating healthcare requirements, and heightened consumer focus on hygiene. Key players in this region include China, India, Japan, and South Korea, whose strong manufacturing industries and substantial populations contribute significantly to market expansion. In China, the world's leading producer of meltblown polypropylene, the market has witnessed remarkable growth, especially post-COVID-19 pandemic, due to the growth in demand for PPE and filtration materials. India is also experiencing considerable growth in this sector, with increasing investments in healthcare and hygiene, as well as expansion in the automotive and construction industries.

Moreover, meltblown polypropylene filters are essential in various industries, including healthcare settings, where they ensure high-efficiency filtration solutions for clean water and air. These filters play a critical role in removing contaminants and maintaining a sterile environment, making them indispensable in hospitals, laboratories, and pharmaceutical facilities. In the automotive sector, meltblown polypropylene filters are utilized in engine air filters, cabin filters, and fuel filters, ensuring optimal performance and longevity. Production technologies for meltblown polypropylene have advanced significantly, enabling manufacturers to produce filters with superior filtration capabilities and enhanced durability. The use of lubricants during the production process helps improve the quality and consistency of the filters, ensuring they meet the stringent requirements of various industries.

Safety is a top priority in the production and application of meltblown polypropylene filters, with manufacturers adhering to strict regulations and guidelines to ensure the well-being of workers and end-users. In conclusion, the Asia-Pacific region's industrial growth, healthcare needs, and consumer awareness of hygiene are fueling The market's expansion. China and India are leading contributors to this growth, with their strong manufacturing industries and large populations. Meltblown polypropylene filters are crucial in various industries, including healthcare, automotive, and construction, providing high-efficiency filtration solutions for clean water and air. Production technologies have advanced, enabling the creation of superior filters with enhanced durability and filtration capabilities. Safety remains a top priority in the production and application of these filters.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Meltblown Polypropylene Market?

Expansion of the global healthcare garments industry is the key driver of the market.

- Meltblown polypropylene plays a significant role in various industries, particularly in healthcare and water treatment, due to its high-efficiency filtration properties. In healthcare, this material is extensively used in producing disposable protective garments such as surgical masks, gowns, and drapes. The growing demand for these items, driven by the ongoing COVID-19 pandemic and the expanding healthcare sector, highlights the importance of meltblown polypropylene in maintaining hygiene and safety. In water treatment applications, nanofiber-based meltblown polypropylene filters are increasingly being used for wastewater treatment and ensuring the quality of drinking water. Environmental regulations continue to drive the need for advanced filtration systems, making this material a preferred choice for water treatment plants.

- Moreover, the electronics industry also utilizes meltblown polypropylene for various applications, including filter media and protective coatings. The healthcare and water treatment industries are experiencing growth, with the former projected to reach USD650 billion in the US alone by 2027. The water treatment market is expected to reach USD316.4 billion by 2028, driven by increasing regulations and the growing demand for clean water. The use of meltblown polypropylene in these industries is expected to continue growing, making it a valuable investment opportunity for businesses.

What are the market trends shaping the Meltblown Polypropylene Market?

Strategic partnerships among market players are the upcoming trends in the market.

- Meltblown polypropylene is a high-demand material in various industries, including desalination, pre-filtration, and aseptic filtration of fruit juices and beer. companies in this market are forming strategic partnerships to enhance their capabilities and meet the increasing market needs. For example, in July 2023, Berry Global collaborated with Deaconess Midtown Hospital and Nexus Circular to promote the safe recycling of sterile plastic packaging and meltblown polypropylene materials from the hospital. This initiative aims to divert around 500 pounds of clean plastic from landfills weekly, primarily from surgical packaging and unused protective gowns. Such collaborations enable companies to share resources, technological advancements, and optimize supply chains, which are crucial for producing high-quality polypropylene materials.

- Moreover, the global market for meltblown polypropylene is expected to grow significantly due to its wide applications and the increasing demand for sustainable and eco-friendly solutions. Companies are investing in research and development to introduce innovative products and expand their customer base. The market is competitive, with key players focusing on pricing strategies and offering customized solutions to cater to diverse customer needs.

What challenges does Meltblown Polypropylene Market face during the growth?

Fluctuations in prices of raw materials used for melt-blown fabrics are key challenge affecting the market growth.

- Meltblown polypropylene fabrics encounter challenges due to the unpredictability of raw material costs, specifically polypropylene, which is derived from petroleum. Fluctuations in global oil prices impact polypropylene prices significantly. These price fluctuations can stem from various causes, including geopolitical tensions, supply chain disruptions, and production level changes. These uncertainties result in inconsistent expenses for manufacturers, potentially affecting their profitability and pricing decisions.

- For instance, in February 2024, polypropylene prices experienced an increase of roughly USD7 per tonne, or 0.71%, reaching approximately USD1,060 per tonne. Historically, prices have ranged from a high of USD1,684 per tonne in June 2014 to a low of around USD769 per tonne. Impurities and particulates in industrial environments can lead to airborne diseases, necessitating the use of air filtration systems in various industries, including pharmaceuticals. Meltblown polypropylene fabrics play a crucial role in air filtration applications, making their cost volatility a critical concern. Reverse osmosis systems in water treatment also utilize meltblown polypropylene membranes, further highlighting the importance of stable pricing for this material.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aggarwal Fabrics

- Ahlstrom

- Brother Filtration Equipment Co.Ltd.

- Contec Inc.

- Dawn Group

- Don and Low Ltd.

- Fitesa S.A. and Affiliates

- Foshan Rayson Non-woven Co. Ltd.

- Gessner

- Hongtek Filtration Co. Ltd.

- Hunan Mingyu Nonwovens Co. Ltd.

- LG Corp.

- LyondellBasell Industries Holdings BV

- Magnera Corp.

- Mingguan Purification Materials (Zhejiang) Co.Ltd.

- Mitsui Chemicals Inc.

- PT Multi Spunindo Jaya

- Rajshree Group of Industries

- Toray Industries Inc.

- VIMAL INDUSTRIES

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Melt-blown polypropylene filters have gained significant attention in various industries due to their high-efficiency filtration capabilities. These filters are widely used in water treatment applications, including drinking water and wastewater, to remove impurities such as bacteria, contaminants, and particulates. In healthcare settings, melt-blown polypropylene filters are essential for ensuring clean water and maintaining aseptic conditions. Environmental regulations have driven the demand for environmental friendly materials in filtration applications. Melt-blown polypropylene filters offer a sustainable solution, as they are recyclable and can be produced using Industry 4.0 technologies and industrial automation. The market for melt-blown polypropylene filters is diverse, with applications ranging from air filtration in industrial environments to pre-filtration in reverse osmosis and nanofiber-based filtration systems.

Moreover, the food and beverage industry uses these filters for aseptic filtration in the production of fruit juices, beer, and soft drinks. Pricing is a crucial factor in the market, with manufacturers focusing on increasing manufacturing capacity and implementing innovation in filtration and fiber technology advancements to reduce loss expenditures. The future of manufacturing lies in next-generation filtration systems that offer superior filtration efficiency, supply chain resilience, and smart manufacturing solutions. Melt-blown polypropylene filters are also used in various industrial applications, such as electronics manufacturing, metal plating, and desalination, where high-efficiency filtration is necessary to ensure product quality and safety. The growing urbanization trend and the increasing demand for clean water and air are expected to drive the growth of the melt-blown polypropylene filter market in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2024-2028 |

USD 2.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.3 |

|

Key countries |

China, US, India, Japan, Germany, Canada, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch