Menstrual Cups Market Size 2024-2028

The menstrual cups market size is forecast to increase by USD 367.8 million at a CAGR of 4.38% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of product innovations and customizations. These advancements cater to the diverse needs of consumers, enhancing the overall user experience. Furthermore, businesses are adopting strong strategies to expand their market share, contributing to the market's growth. Additional advantages encompass the preference for alternative options and tax exemptions on menstrual and feminine hygiene products. However, the market faces challenges from the strong presence of substitute products, such as tampons, sanitary napkins, and pads. Despite these challenges, the market is expected to continue its growth trajectory due to the rising awareness of healthier and more sustainable menstrual options. This market trends and analysis report provides a comprehensive study of the growth factors, challenges, and future opportunities in the market.

What will be the Size of the Menstrual Cups Market During the Forecast Period?

- The market represents a growing segment within the broader feminine hygiene industry, driven by increasing consumer awareness and preference for sustainable, reusable menstrual products. Menstrual cups, typically made from medical-grade silicone, thermoplastic elastomer, or natural rubber, are designed to collect menstrual fluid within a bell- or bowl-shaped container. These alternatives to disposable tampons and sanitary pads offer several advantages, including leak-free use, longer lifespan, and reduced environmental impact. The shift towards reusable menstrual products is fueled by concerns over plastic waste, chemicals, fibers, and dyes found in disposable menstrual items.

- Additionally, government awareness campaigns and the normalization of menstruation discussions contribute to the market's expansion. Hormone therapy and other medical conditions may influence the choice of menstrual products, with them being a viable option for some users. Factors such as the increasing awareness of reusable menstrual products as well as menstrual drugs, new product launches, and strong marketing strategies adopted by key companies, such as digital marketing and e-commerce platforms, to increase the sales will drive the growth of this segment during the forecast period.

How is this Menstrual Cups Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Reusable menstrual cups

- Disposable menstrual cups

- Distribution Channel

- Retail

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Product Insights

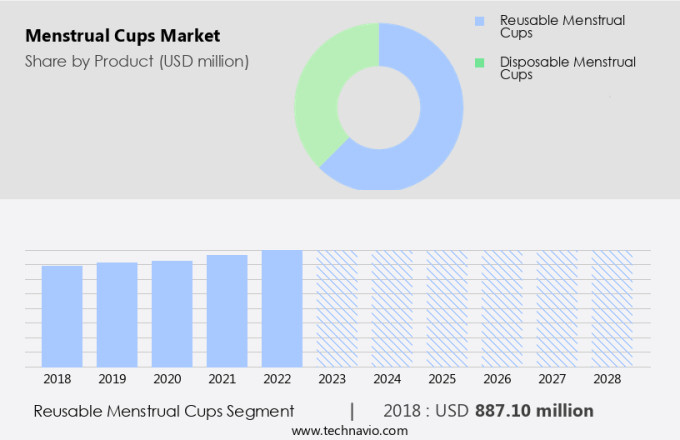

- The reusable menstrual cups segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing adoption of reusable menstrual products. Key factors driving this trend include the eco-friendly nature, extended wear time, and comfort. They are made from medical-grade silicone, thermoplastic elastomer, or natural rubber, ensuring durability and flexibility. These reusable alternatives offer leak-free protection, reducing the risk of bacterial infections and toxic shock syndrome associated with disposable products. Digital media platforms and awareness campaigns are playing a crucial role in increasing visibility and endorsement among adolescent girls and younger generations, who are increasingly making eco-conscious choices for their care.

Furthermore, hospital pharmacies, retail pharmacies, drug stores, and online pharmacies are major distribution channels for menstrual cups. companies are also leveraging digital campaigns to expand their reach and educate consumers about proper hygiene practices and menstruation health management. The rising acceptance of innovative solutions for menstrual management in developed nations has prompted market players to introduce novel reusable alternatives for femtech devices.

Get a glance at the Menstrual Cups Industry report of share of various segments Request Free Sample

The reusable menstrual cups segment was valued at USD 887.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

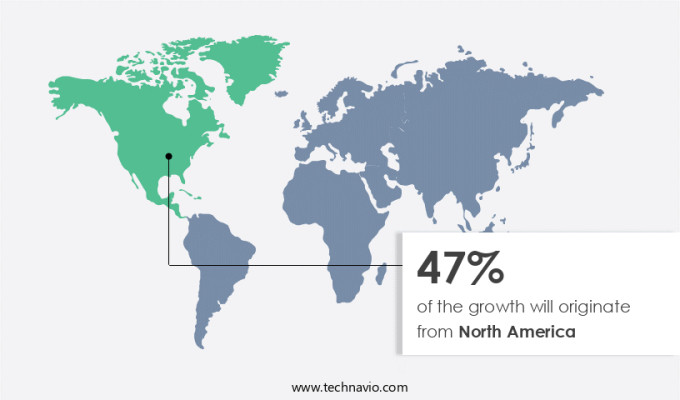

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to expand due to increasing awareness about menstrual hygiene, a strong market presence of key players, and the launch of new eco-friendly products. They are typically made of medical-grade silicone, thermoplastic elastomer, or natural rubber, offer leak-free protection, comfort, and extended wear time. These reusable alternatives to disposable tampons and sanitary pads have gained popularity due to their reusable nature, eco-friendly menstrual care, and flexibility. Despite their advantages, concerns regarding bacterial infection and allergic reactions to certain materials persist. companies are addressing these concerns through proper hygiene practices and comprehensive education campaigns.

The younger generation, particularly millennials and Generation Z, are increasingly making eco-conscious choices, contributing to the market's growth. Digital media platforms and awareness campaigns have played a significant role in increasing the visibility and endorsement of sustainable menstruation. The market is segmented into silicone and latex segments, with hospital pharmacies, retail pharmacies, drug stores, online pharmacies, and online stores as key distribution channels. The market's growth is also influenced by government awareness campaigns, hormone therapy, and the working women population. Despite the benefits, misconceptions and inhibitions surrounding them hinder their widespread adoption. To address these challenges, companies are focusing on extending wear time, improving usability, and addressing common misconceptions through educational campaigns.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Menstrual Cups Industry?

Increasing number of product innovations and customizations is the key driver of the market.

- The market is experiencing significant growth due to increasing consumer awareness and preference for eco-friendly, reusable menstrual products. They are made of medical-grade silicone or thermoplastic elastomer, offer leak-free protection and extended wear time, making them a popular alternative to disposable products like tampons and sanitary pads. Manufacturers are innovating and customizing menstrual cups to cater to various consumer needs and preferences. This includes offering different sizes and shapes to accommodate anatomy and flow, ensuring a comfortable and secure fit for all ages and body types. Additionally, the introduction of latex-free and allergy-friendly options has expanded the market, addressing the needs of sensitive users.

- The eco-friendly nature is a significant factor driving their adoption. They reduce waste, contributing to the reduction of plastic waste pollution and solid waste disposal. Furthermore, awareness campaigns and digital media platforms have increased the visibility and endorsement of sustainable menstruation, particularly among adolescent girls, younger generations, and working women. Despite these advantages, there are misconceptions and inhibitions surrounding menstrual cups, including concerns about bacterial infection and toxic shock syndrome. Proper hygiene practices and comprehensive education can address these concerns, increasing adoption rates and dispelling misconceptions. The market is segmented into silicone and latex.

What are the market trends shaping the Menstrual Cups Industry?

Growing business strategies is the upcoming market trend.

- Menstrual cups, made of medical-grade silicone, thermoplastic elastomer, or natural rubber, have gained popularity as eco-friendly and reusable alternatives to traditional menstrual hygiene products such as tampons and sanitary pads. These reusable cups collect menstrual fluid in a bell or bowl shape, which can be emptied and reused, reducing waste and minimizing plastic waste pollution and solid waste disposal. Despite their benefits, they face challenges in terms of comfort, usability, and proper hygiene practices. companies have addressed these concerns through awareness campaigns and comprehensive education, emphasizing the flexibility, softness, and leak-free protection offered by menstrual cups. The younger generation, particularly millennials and Generation Z, are increasingly making eco-conscious choices for their care, driving the adoption rate of menstrual cups.

- However, concerns regarding bacterial infection, toxic shock syndrome, and allergic reactions to materials like latex and thermoplastic elastomers persist. companies and healthcare professionals advocate for proper hygiene practices and the importance of using reusable menstrual cups made of medical-grade silicone to ensure safety and comfort. The market is expected to grow due to the increasing awareness of menstruation health management and the eco-friendly nature of these products. Hospital pharmacies, retail pharmacies, drug stores, and online pharmacies have started stocking menstrual cups, expanding their availability to a wider audience. Digital campaigns and endorsements by popular figures have also contributed to the visibility and adoption of menstrual cups.

What challenges does the Menstrual Cups Industry face during its growth?

The strong presence of substitute products is a key challenge affecting the industry growth.

- The market faces hindrances due to the widespread use of traditional menstrual hygiene products, such as sanitary pads and tampons. Menstrual cups, made of medical-grade silicone, thermoplastic elastomer, or natural rubber, offer reusable and eco-friendly alternatives to disposable products. However, the comfort and usability of menstrual cups, particularly during the initial adoption phase, may deter some women. Bacterial infection and toxic shock syndrome are concerns associated with the use of menstrual cups, but proper hygiene practices can mitigate these risks. The eco-conscious younger generation, including millennials and Generation Z, are increasingly embracing sustainable menstruation choices, driving the demand for reusable menstrual cups.

- Despite the benefits, such as extended wear time, flexibility, and softness, they face challenges in gaining widespread adoption. Misconceptions and inhibitions surrounding menstrual cups, coupled with the convenience and affordability of disposable products, hinder their growth. The market includes various segments, such as the silicone segment and the latex segment, which cater to diverse consumer preferences. Hospital pharmacies, retail pharmacies, drug stores, online pharmacies, and online stores offer menstrual cups for sale. Digital media platforms and awareness campaigns play a crucial role in increasing visibility and endorsement of eco-friendly menstrual care. The shift towards sustainable menstruation and environmental consciousness is reducing the ecological footprint of menstrual products.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anigan Inc.

- Blossom Cup

- Diva International Inc.

- FemmyCycle

- Fleurcup

- Intimina

- Jaguara s.r.o.

- koloXo

- Lena Cup LLC

- Lune Group Oy Ltd.

- Me Luna GmbH

- Merula GmbH

- Mildcares

- MonthlyCup AB

- Mooncup Ltd.

- Ruby Cup

- Saalt

- Sckoon Inc.

- The Flex Co.

- THE KEEPER Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment within the broader feminine hygiene industry. This market is driven by various factors, including increasing awareness around menstrual health management, a growing emphasis on eco-consciousness, and the desire for more comfortable and durable alternatives to traditional menstrual products. They are reusable devices designed to collect menstrual fluid instead of absorbing it, like disposable sanitary pads or tampons. They are typically made of medical-grade silicone or thermoplastic elastomers, materials that ensure a flexible and leak-free fit. The reusable nature makes them an attractive option for those seeking to reduce their environmental footprint, as they generate less solid waste compared to disposable products.

However, despite their advantages, they face challenges in terms of adoption rates. Misconceptions and inhibitions surrounding menstrual cups, particularly regarding their insertion and cleaning, hinder their widespread use. Additionally, the high upfront cost and the need for proper hygiene practices may deter some consumers. The menstrual cup market can be segmented into silicone and latex cups. While both materials offer similar benefits, silicone cups are more popular due to their durability and flexibility. Government awareness campaigns about menstrual health and conditions like polycystic ovarian syndrome (PCOS) and endometriosis drive demand for safer and more comfortable solutions.

Furthermore, hospital pharmacies, retail pharmacies, drug stores, and online pharmacies all offer menstrual cups as part of their product offerings. Digital campaigns and awareness initiatives on various platforms, including social media, have played a crucial role in increasing visibility and promoting the adoption of menstrual cups. The younger generation, particularly millennials and Generation Z, is increasingly embracing eco-conscious choices in their personal care routines. This demographic is more likely to adopt due to their sustainability and reusable nature. Furthermore, campaigns and endorsements from popular figures and organizations have contributed to the growing popularity of menstrual cups. Despite the benefits, there are concerns regarding their safety, specifically about allergic reactions to the materials used. The strong presence of substitute products, such as organic sanitary pads, cotton cloth rags, period panties, and tampons, is hindering the growth of the market.

|

Menstrual Cups Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.38% |

|

Market Growth 2024-2028 |

USD 367.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.12 |

|

Key countries |

US, UK, Germany, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.