Metal Forging Market Size 2025-2029

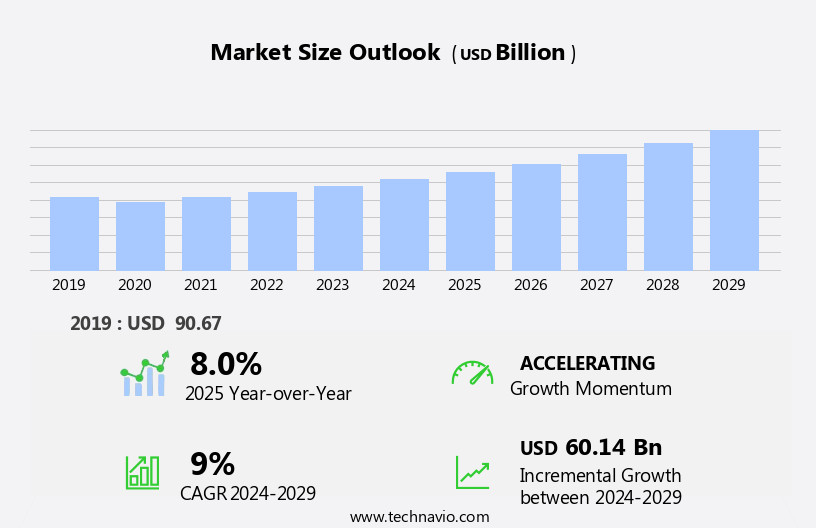

The metal forging market size is forecast to increase by USD 60.14 billion, at a CAGR of 9% between 2024 and 2029.

- The market is characterized by robust growth, driven by the high demand for advanced materials and alloys in various industries, including automotive, construction, and aerospace. Key materials in this market include steel, aluminum, stainless steel, titanium, magnesium, carbon steel, and others. This trend is fueled by the increasing infrastructure development across the globe, leading to a surge in demand for metal forged components. However, the market faces significant challenges, with rising raw material costs posing a major threat to profitability. The increasing prices of raw materials, such as steel and aluminum, are putting pressure on forging companies to pass on these costs to their customers or absorb them, which can impact their competitiveness. To navigate these challenges, companies must focus on optimizing their production processes, exploring alternative raw materials, and developing innovative solutions to reduce material usage and improve efficiency.

- Additionally, strategic partnerships, mergers and acquisitions, and collaborations can help forging companies expand their product offerings, enter new markets, and enhance their competitive position. Overall, the market presents significant opportunities for growth, but companies must navigate the challenges posed by raw material costs and remain agile to capitalize on emerging trends and customer demands.

What will be the Size of the Metal Forging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by advancements in technology and the diverse requirements of various sectors. Hammer forging, a traditional technique, continues to coexist with modern forging methods such as impression die forging and roll forging. The demand for high-performance materials, including magnesium and titanium forgings, is on the rise due to their superior material properties, such as corrosion resistance and high strength. Forging presses play a crucial role in shaping these materials, with advancements leading to higher pressures and greater precision. Quality control measures, including non-destructive testing techniques like radiographic testing and magnetic particle testing, ensure the production of flawless components.

Forging defects, such as surface cracks and internal flaws, are relentlessly addressed through innovations in forging processes and surface treatments, including shot peening and stress relieving. The applications of forged components span across numerous industries, including automotive, aerospace, energy, medical, and industrial machinery. The need for dimensional tolerances and safety standards necessitates ongoing improvements in forging processes and materials, such as high-strength low-alloy steels and stainless steels. Forging alloys, including powder metallurgy and closed die forging, are increasingly utilized to meet the unique demands of each sector. Surface finish and heat treating are essential considerations in forging processes, with advancements in these areas leading to improved fatigue strength and impact resistance.

The dynamic nature of the market ensures that forging will remain a vital component of manufacturing processes, adapting to the ever-evolving needs of industry.

How is this Metal Forging Industry segmented?

The metal forging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Carbon steel

- Aluminum

- Stainless steel

- Others

- Application

- Automotive

- Aerospace and defense

- Others

- Type

- Shafts

- Gears

- Bearings

- Others

- Method

- Open die forging

- Closed die forging

- Seamless rolled ring forging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

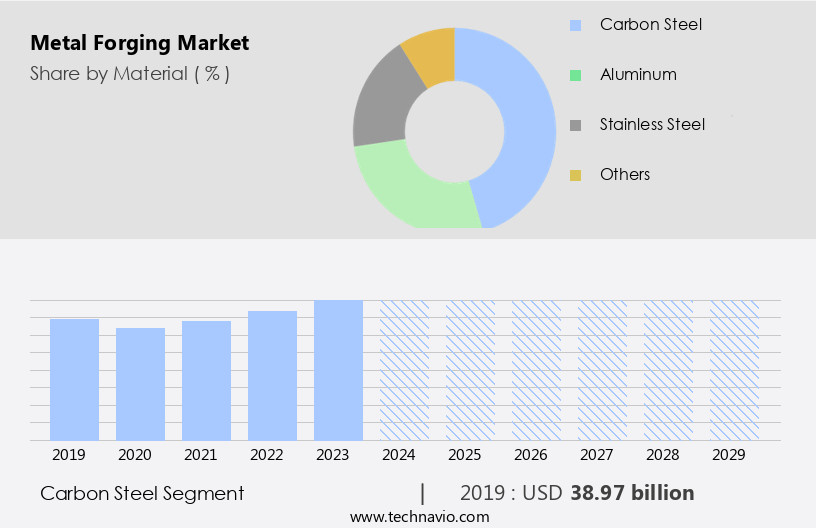

By Material Insights

The carbon steel segment is estimated to witness significant growth during the forecast period.

In the dynamic world of metal forging, carbon steel continues to dominate the market due to its cost-effectiveness and versatile applications. With a lower material cost compared to stainless steel, carbon steel is extensively used in industries such as automotive and machinery, where high demand is driven by consumer spending, industrial production, and technological advancements. Carbon steel forging is a crucial process in metalworking, which shapes and forms this iron-carbon alloy. The process is integral to manufacturing various products, including automotive components, industrial machinery, appliances, and consumer goods. Surface cracks, a common forging defect, can be mitigated through non-destructive testing techniques such as magnetic particle testing and dye penetrant testing.

Forging presses, available in various sizes and capacities, facilitate the production of carbon steel forgings. The forging process can be categorized into die forging, open die forging, and impression die forging, each with distinct advantages and applications. Hot forging, a high-temperature process, enhances the material properties, including impact resistance and dimensional tolerances, making it suitable for aerospace applications. Precision forging, a specialized technique, ensures accurate shapes and sizes, while heat treating and stress relieving further improve the yield and tensile strength. Alternative materials, such as high-strength low-alloy steels, titanium, magnesium, and aluminum, are gaining popularity due to their unique properties.

These materials are used in various industries, including energy applications, medical devices, and industrial machinery, where high strength, corrosion resistance, and fatigue strength are essential. Forging alloys, such as tool steels and stainless steels, are specifically designed to meet the requirements of various industries. Surface treatments, including shot peening and surface coatings, further enhance the material properties and improve the surface finish. Quality control measures, such as ultrasonic testing and radiographic testing, ensure the production of defect-free forgings. In conclusion, the market is driven by the diverse applications of carbon steel and the growing demand for alternative materials.

The market is characterized by continuous innovation, with advancements in forging technologies, materials, and non-destructive testing techniques. Safety standards and regulations play a crucial role in ensuring the production of high-quality forgings.

The Carbon steel segment was valued at USD 38.97 billion in 2019 and showed a gradual increase during the forecast period.

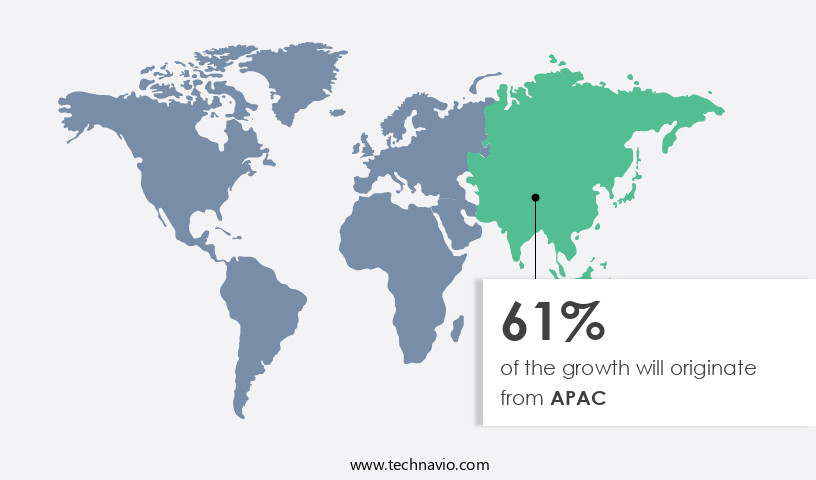

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic and evolving market of metal forging, various industries across the Asia Pacific (APAC) region exhibit significant demand. The automotive sector, with major markets in China and India, drives a substantial portion of this demand, as forged metal components such as engine parts, axles, and chassis components are crucial for the production of automobiles. Simultaneously, APAC's rapid urbanization and infrastructure development necessitate robust and durable forged steel components for bridge construction, building projects, and transportation networks. Moreover, the energy sector in APAC is expanding to cater to the increasing demands of industries and urban populations. Forged components, particularly in high-strength low-alloy steels and titanium, are indispensable for energy applications due to their superior properties, including corrosion resistance, impact resistance, and high tensile strength.

The aerospace industry also contributes to the market, requiring precision forging and advanced surface treatments like shot peening and surface coatings for components with stringent dimensional tolerances and fatigue strength requirements. Additionally, medical applications utilize forged components in various implants and surgical instruments, emphasizing the importance of non-destructive testing techniques like magnetic particle testing and radiographic testing for ensuring quality and safety. The forging process itself encompasses various techniques, including hammer forging, die forging, and press forging, which cater to diverse industry needs. Furthermore, the integration of advanced technologies like heat treating, stress relieving, and powder metallurgy enhances the overall quality and performance of forged components.

Tool steels, stainless steels, magnesium forgings, aluminum forgings, and forging alloys are some of the essential materials used in the metal forging industry. The market continues to evolve, with an emphasis on improving forging presses, enhancing surface finishes, and addressing internal flaws through advanced manufacturing techniques. Safety standards and quality control measures remain crucial in the metal forging industry, ensuring that forged components meet the stringent requirements of various industries. Roll forging, impression die forging, and closed die forging are some of the techniques that contribute to the production of high-quality forged components. In conclusion, the market in APAC is characterized by its diverse applications across various industries, including automotive, infrastructure, energy, aerospace, and medical.

The demand for forged components is driven by the need for strength, durability, and precision, and the market continues to evolve through technological advancements and the integration of advanced manufacturing techniques.

Market Dynamics

The Metal Forging Market is thriving, driven by demand for forged steel components, aluminum forgings, and titanium forgings in automotive forging and aerospace forging applications. Closed die forging and precision forging deliver high-quality parts, while sustainable forging processes and lightweight forging solutions meet eco-conscious demands. Eco-friendly forging techniques and high-strength alloy forging support industries like oil and gas. The market is shaped by forged steel components for automotive industry, aluminum forgings for aerospace applications, titanium forgings for defense sector, closed die forging for precision components, sustainable forging processes for renewable energy, lightweight forging solutions for electric vehicles, eco-friendly forging techniques for construction, AI-driven forging optimization for industrial machinery, green forging practices for wind turbines, and high-strength alloy forging for oil and gas.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Metal Forging Industry?

- The market is significantly driven by the high demand for advanced materials and alloys.

- The market is driven by the increasing demand for high-performance materials with superior strength, durability, and corrosion resistance. Advanced alloys, such as stainless steels and forging alloys, are increasingly being used to produce precision components for various industries. These materials offer enhanced properties, making them ideal for applications in sectors like aerospace, automotive, and energy, where components must withstand extreme conditions and high stress levels. Advanced materials and alloys are essential for industries requiring components with exceptional fatigue strength and resistance to high temperatures. In the energy sector, for instance, components made from these materials are used in power generation and transmission applications, where high temperatures and extreme conditions are common.

- Moreover, the demand for lightweight materials is on the rise, particularly in the automotive and consumer goods industries. The use of aluminum forgings and cold-forged components in these industries helps reduce weight, leading to improved fuel efficiency and energy savings. Safety standards and regulations, including non-destructive testing (NDT), are crucial in ensuring the quality and safety of forged components. Heat treating and open die forging processes are used to enhance the properties of these materials, further increasing their desirability for various applications.

What are the market trends shaping the Metal Forging Industry?

- One significant market trend emerging in the business landscape is the rising infrastructure development. This sector is experiencing substantial growth, with professionals and investors alike recognizing its potential for long-term returns.

- The market experiences steady growth, driven by the infrastructure sector's demand for forged components. Infrastructure development is a crucial element in economic growth and urbanization, necessitating various metal forged parts for transportation networks, such as roads, bridges, tunnels, and railways. Renewable energy infrastructure, including wind turbines and solar farms, also relies on metal forging for structural support and essential components. As countries prioritize clean energy investments, the demand for forged metal parts in infrastructure projects continues to increase. Quality control plays a significant role in the metal forging industry. Techniques like impression die forging, roll forging, and press forging ensure the production of precise and consistent parts.

- Stress relieving and radiographic testing are essential quality control measures to identify and address internal flaws, ensuring the durability and reliability of forged components. Forging hammers and industrial machinery are essential tools in the metal forging process. Powder metallurgy is another innovative technology used to enhance the properties of forged metals. The surface finish of forged components is crucial for their functionality and appearance, and various techniques are used to improve it. Tool steels are commonly used in metal forging due to their strength, durability, and ability to maintain their shape under extreme conditions.

- The metal forging industry continues to innovate, exploring new materials and technologies to meet the evolving demands of various industries.

What challenges does the Metal Forging Industry face during its growth?

- The metal forging industry faces significant growth challenges due to escalating raw material costs, a critical factor that necessitates close attention and strategic planning.

- The market faces rising raw material costs as a significant challenge. The expense of raw materials, primarily metals and alloys, is a substantial production cost factor for forged components. This cost increase directly impacts the bottom line for metal forging businesses, potentially reducing profit margins and making it harder for companies to compete and thrive. The metal industry is influenced by various price fluctuations, including supply and demand dynamics, geopolitical tensions, and currency exchange rates. These factors contribute to the volatility of raw material prices, making it challenging for companies to effectively plan and budget. Consequently, the price instability may hinder the growth of the market during the forecast period.

- In the forging process, various techniques are employed to shape and form metal, such as hammer forging and die forging. Forging defects, like surface cracks, can compromise the material properties, including corrosion resistance and tensile strength. To ensure product quality, testing methods like magnetic particle testing and dye penetrant testing are used to detect and address these defects. Forging presses are essential equipment in the metal forging industry, with magnesium forgings being a popular application due to their lightweight and high strength properties. These components are commonly used in automotive applications, further emphasizing the importance of maintaining high-quality standards.

Exclusive Customer Landscape

The metal forging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal forging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal forging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aichi Steel Corp. - This company specializes in manufacturing metal forged products, encompassing eAXLE components, engine components, chassis components, transmission components, and driveline parts, delivering high-quality solutions for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aichi Steel Corp.

- Ajax Tocco Magnethermic Corp.

- Alicon Castalloy Ltd.

- All Metals and Forge Group

- Allegheny Technologies Inc.

- Aluminum Precision Products

- American Axle and Manufacturing Inc.

- Arconic Corp.

- Asahi Forge Corp.

- Bharat Forge Ltd.

- Bluewater Thermal Solutions

- Bruck GmbH

- Consolidated Industries Inc.

- Farinia SA

- Fountaintown Forge Inc.

- Larsen and Toubro Ltd.

- Mitsubishi Steel Mfg. Co. Ltd.

- Pacific Forge Inc.

- Patriot Forge Co.

- Scot Forge Co.

- Sumitomo Heavy Industries Ltd.

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Forging Market

- In January 2024, ThyssenKrupp AG, a leading global steel producer, announced the launch of its new forging line in Germany, expanding its capacity by 50,000 tons per year. This investment aimed to strengthen its market position and meet the growing demand for high-quality forged components in the automotive and aerospace industries (ThyssenKrupp AG Press Release, 2024).

- In March 2024, ArcelorMittal, the world's largest steel and mining company, entered into a strategic partnership with ForgeMasters, a US-based forging solutions provider. The collaboration aimed to develop advanced forging technologies and expand ArcelorMittal's forging capabilities, enabling it to cater to the evolving needs of the automotive and energy industries (ArcelorMittal Press Release, 2024).

- In May 2024, Voestalpine AG, an Austrian steel group, completed the acquisition of the forging business of US-based company, BFGoodrich Forgings. The acquisition added significant capacity and expertise in the aerospace sector to Voestalpine's portfolio, making it a major player in the global forging market (Voestalpine AG Press Release, 2024).

- In January 2025, the European Union approved new regulations on the sustainability of raw materials used in forging processes. The regulations aimed to promote the use of recycled metals and reduce the carbon footprint of the forging industry, aligning with the EU's Green Deal initiative (European Commission Press Release, 2025).

Research Analyst Overview

- The global forging industry is experiencing significant advancements, particularly in the areas of automation and digitalization. Closed-die forging continues to dominate the market, with Isopress forging and fluid forging gaining traction due to their ability to produce complex shapes and high-quality components. The future of forging lies in the integration of robotics, Computer-Aided Manufacturing (CAM), Computer-Aided Design (CAD), and process optimization. Electromagnetic forming and incremental forming are emerging technologies that offer process efficiency and cost savings. Sustainability is a key focus, with LCA and digital twins being used to reduce waste and improve product performance. The industry is also exploring the potential of additive manufacturing (AM) and forging simulation to expand its capabilities and remain competitive.

- Process optimization and microstructure analysis are essential for ensuring product quality and meeting customer demands. Overall, the forging industry is undergoing a digital transformation, with automation and sustainability being the driving forces behind its growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Forging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 60.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Japan, India, South Korea, UK, Canada, Australia, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Forging Market Research and Growth Report?

- CAGR of the Metal Forging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal forging market growth of industry companies

We can help! Our analysts can customize this metal forging market research report to meet your requirements.