Military Body-Worn Camera Market Size 2025-2029

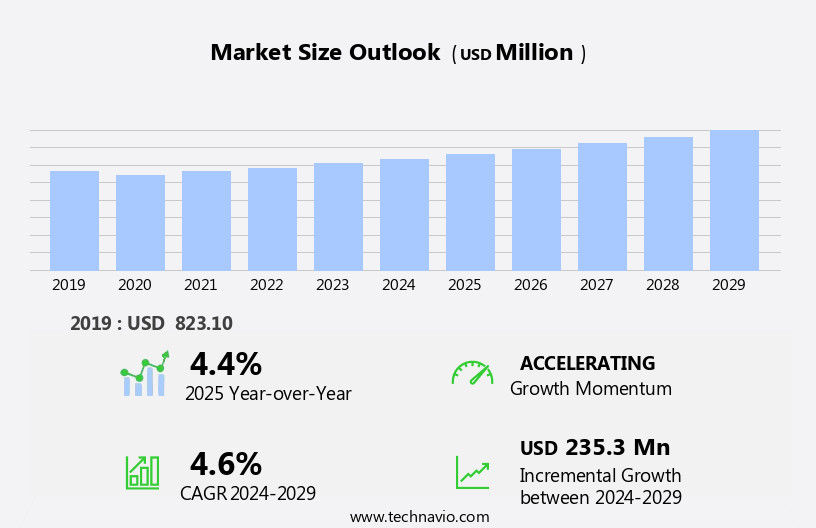

The military body-worn camera market size is forecast to increase by USD 235.3 million, at a CAGR of 4.6% between 2024 and 2029.

- The market is driven by the increasing adoption of these devices to support military operations and training. The integration of auto-recording capabilities in body-worn cameras enhances transparency and accountability, making them an essential tool for military personnel. However, challenges persist in the form of complications with the continuous rolling of body-worn cameras. This issue arises due to the large amount of data generated, which requires significant storage capacity and efficient management. As a result, military organizations must invest in advanced data management solutions to ensure uninterrupted recording and effective data utilization. Companies in the market can capitalize on this need by offering integrated body-worn camera systems with robust data management solutions.

- Additionally, the integration of artificial intelligence and machine learning algorithms can help automate data processing and analysis, further enhancing the value proposition of body-worn cameras for military applications. In conclusion, the market presents significant opportunities for companies that can address the challenges of data management and offer integrated solutions to meet the evolving needs of military organizations.

What will be the Size of the Military Body-Worn Camera Market during the forecast period?

The body-worn camera market continues to evolve, driven by the expanding use cases across various sectors, including law enforcement and military applications. Compliance regulations and software licenses are essential considerations, necessitating ongoing maintenance costs. Facial recognition technology and location data enhance user experience, while power management and secure storage ensure evidence capture. Military standards and remote control features cater to tactical operations, with high-definition video and motion detection providing situational awareness. User interface design, charging options, and data analytics are crucial elements, addressing privacy concerns and enabling cloud storage. Video and audio recording capabilities are integral, with military applications requiring night vision capabilities, weather resistance, and shock resistance.

Deployment strategies, network infrastructure, and operational protocols are essential for effective implementation. Cost analysis, including deployment costs, battery life, and data storage costs, plays a significant role in return on investment. Ethical considerations and officer safety are paramount, with wireless connectivity, network security, and data encryption ensuring data security. Live streaming, data analysis tools, and voice control offer additional functionality, while image stabilization and noise reduction enhance video quality. The market's continuous dynamism is reflected in ongoing advancements, such as data management software, gps tracking, and object detection. These features contribute to evidence admissibility and operational efficiency, making body-worn cameras an indispensable tool for modern security and surveillance applications.

How is this Military Body-Worn Camera Industry segmented?

The military body-worn camera industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

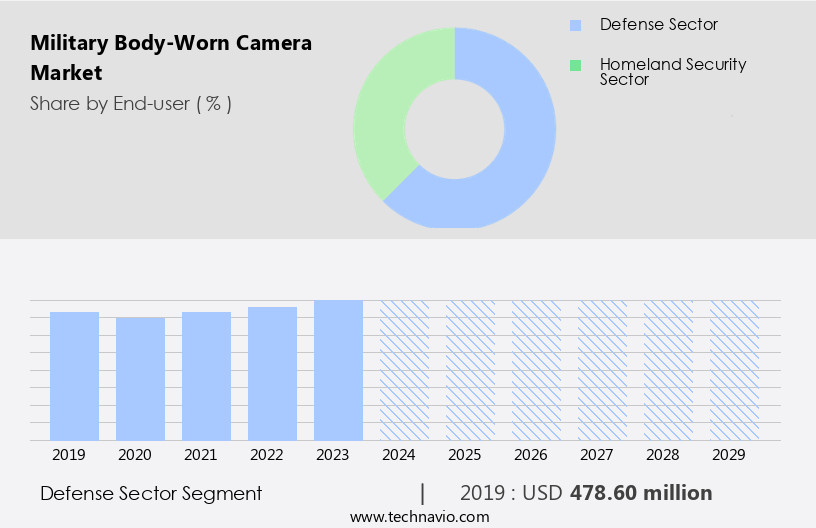

- End-user

- Defense sector

- Homeland security sector

- Product Type

- Body-worn cameras

- Helmet-mounted cameras

- Chest-worn cameras

- Smart glasses

- Tactical wearable cameras

- Technology

- High definition cameras

- 4K resolution cameras

- Infrared cameras

- Thermal cameras

- Motion sensing and automatic recording

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The defense sector segment is estimated to witness significant growth during the forecast period.

The market has witnessed significant growth and innovation over the past few years. Initially used for recording enemy positions and movements during military operations, these cameras now offer advanced features such as real-time GPS tracking, high-definition video and audio recording, and motion detection. Compliance with military standards ensures secure storage and data encryption, while facial recognition technology enhances situational awareness. User experience is prioritized through power management, user interface, and remote control capabilities. Military applications extend beyond tactical operations, with body-worn cameras supporting training and support, data analytics, and cloud storage. Privacy concerns are addressed through data management software and remote access.

Advanced features include night vision capabilities, low-light performance, and weather resistance. Ethical considerations and officer safety are ensured through operational protocols and wireless connectivity with secure networks. Battery life, deployment costs, and network infrastructure are crucial factors in the market. Body-worn cameras are increasingly being used for evidence capture and admissibility in legal proceedings, making their deployment strategies essential. Shock resistance, data encryption, and data analysis tools further enhance their functionality. Voice control, image stabilization, and cost analysis contribute to the overall efficiency and effectiveness of these devices. Object detection and noise reduction technologies improve the quality of evidence captured.

The market trends include the integration of AI and machine learning for object detection and data analysis, as well as the development of wearable devices with advanced features like live streaming and image stabilization. Despite these advancements, challenges remain, such as ensuring data security and maintaining operational protocols to maximize the return on investment.

The Defense sector segment was valued at USD 478.60 million in 2019 and showed a gradual increase during the forecast period.

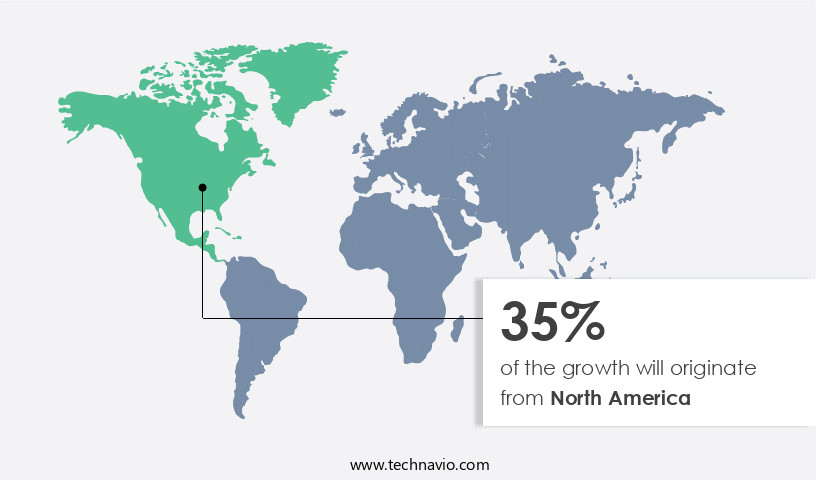

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC, including Australia, is experiencing substantial growth. Compliance with regulations and legal requirements drives the adoption of body-worn cameras in law enforcement applications. Australia is projected to become one of the top users of these cameras worldwide. The use of body-worn cameras by police forces in the country is increasing, with numbers comparable to those in countries like India, China, and Singapore. The first body-worn cameras were deployed in Western Australia in 2007, and Victoria began trials in 2012. In 2015, NSW police invested USD4 million to equip frontline officers with these devices.

Software licenses, maintenance costs, and user experience are crucial factors influencing the market. High-definition video, motion detection, and remote control are essential features. Facial recognition and location data offer enhanced capabilities, while privacy concerns necessitate secure storage and data management. Power management, user interface, and charging options are essential for operational efficiency. Military applications of body-worn cameras include training and support, data analytics, and evidence capture. Military standards ensure the durability and reliability of these devices. Cloud storage, cost analysis, and data security are significant considerations. Body-worn cameras offer situational awareness, officer safety, and evidence admissibility.

Low-light performance, weather resistance, and shock resistance are essential features for military use. Ethical considerations, battery life, and operational protocols are crucial factors in deployment strategies. Wireless connectivity, network security, and data encryption are vital for secure data transmission. Night vision capabilities, tactical operations, and live streaming enhance the functionality of body-worn cameras. Data analysis tools, voice control, image stabilization, and data storage costs are essential features for effective use.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Military Body-Worn Camera Industry?

- Body-worn cameras play a crucial role in driving the market, particularly in supporting military operations and training.

- Body-worn cameras have become essential tools in military operations, providing valuable footage during tactical situations and training exercises. These devices have evolved from simple recording devices to advanced technologies incorporating features such as live streaming, data security, shock resistance, and voice control. Data security is ensured through data encryption and data management software, while image stabilization and noise reduction enhance the quality of footage. Moreover, data analysis tools enable object detection and real-time analysis of footage, which can be crucial in mission-critical scenarios. Cost analysis and data storage costs are significant factors in the deployment strategies for body-worn cameras.

- Shock resistance and durability are essential for withstanding harsh military environments. Incorporating GPS systems and other advanced technologies, such as heartbeat and health monitoring, offer additional benefits for soldiers in the field. With the increasing adoption of body-worn cameras by military forces worldwide, it is essential to consider the cost-effectiveness and efficiency of these technologies in military operations. The future of body-worn cameras in the military lies in their ability to provide real-time data analysis, improve situational awareness, and enhance the safety and effectiveness of military personnel.

What are the market trends shaping the Military Body-Worn Camera Industry?

- Body-worn cameras with auto-recording capabilities are currently a mandated and emerging market trend in professional settings. This feature ensures that all relevant footage is captured, maintaining accountability and transparency.

- Body-worn cameras have become an essential tool for law enforcement agencies to ensure transparency and accountability in their interactions with the public. However, concerns regarding the inconsistent usage of these cameras, particularly during volatile or dangerous situations, have arisen. Forgetting to turn on the camera during confrontations can lead to queries from higher officials. To address this issue, the market has seen the emergence of new technology, such as the auto-recording feature. This functionality enables the body-worn camera to automatically initiate recording when specific triggers are activated, like turning on the lights and siren or deploying a stun gun.

- By automating the recording process, law enforcement officers can focus on ensuring public safety while the camera captures crucial footage. This technology enhancement not only increases the effectiveness of body-worn cameras but also strengthens the trust between law enforcement agencies and the communities they serve.

What challenges does the Military Body-Worn Camera Industry face during its growth?

- The integration and continuous rolling of body-worn cameras present significant challenges that hinder the growth of the industry, as complexities in their implementation and maintenance persist.

- Body-worn cameras have gained significant attention in law enforcement applications due to their ability to provide evidence for transparency and accountability. However, the adoption of these devices has faced resistance from some personnel due to privacy concerns and regulatory compliance. The continuous recording of footage necessitates secure storage and user-friendly software to manage the data efficiently. Compliance with regulations regarding data retention and access is essential. Moreover, facial recognition technology and location data can add value to body-worn cameras but also raise concerns regarding privacy and potential misuse. Power management is another critical factor, as the cameras must function for extended periods.

- Maintenance costs and software licenses are ongoing expenses that must be considered. To address these challenges, advancements in power management, secure storage, and user experience are crucial. The industry is focusing on developing body-worn cameras that prioritize privacy while maintaining evidence capture capabilities. Additionally, clear guidelines on data retention, access, and public release are necessary to ensure legal compliance and public trust. In conclusion, body-worn cameras offer numerous benefits for law enforcement but also present challenges related to privacy, data management, and regulatory compliance. Addressing these concerns through technological advancements and clear guidelines is essential for widespread adoption and successful implementation.

Exclusive Customer Landscape

The military body-worn camera market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the military body-worn camera market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, military body-worn camera market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axon Enterprise Inc. - The company specializes in supplying military-grade body-worn cameras, featuring unlimited high-definition video recording, advanced audio technology, a full-shift battery, pre-event buffer, and robust security measures. These cameras offer uncompromised performance and reliability, enabling law enforcement agencies to capture and preserve evidence with utmost clarity and precision. With unlimited video storage and long-lasting battery life, these devices ensure uninterrupted documentation of critical incidents. The pre-event buffer function captures footage before an incident occurs, providing valuable context and enhancing accountability. The cameras' advanced security features safeguard sensitive data, ensuring the integrity of evidence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axon Enterprise Inc.

- B Cam Ltd.

- Black Mamba Protection LLC

- Defender LLC

- Digital Ally Inc.

- GoPro Inc.

- Intrensic LLC

- Martel Electronics

- Motorola Solutions Inc.

- Panasonic Holdings Corp.

- Pinnacle Response Ltd.

- Pro Vision Solutions LLC

- Reveal Media Ltd.

- Safe Fleet Acquisition Corp.

- Transcend Information Inc.

- Wolfcom

- ZEPCAM BV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Military Body-Worn Camera Market

- In February 2023, Axon, a leading provider of connected public safety technologies, announced the launch of its newest body-worn camera, the Axon Body 4, featuring advanced AI capabilities and improved data management systems (Axon Press Release). This development underscores the company's commitment to enhancing body-worn camera technology with artificial intelligence, enabling more efficient data processing and analysis.

- In November 2022, Leica Geosystems, a Hexagon company, and Panasonic Corporation entered into a strategic partnership to develop and market body-worn cameras for public safety applications. This collaboration combines Leica's expertise in geospatial technology and Panasonic's experience in camera manufacturing, aiming to deliver innovative solutions that integrate location data with video footage (Leica Geosystems Press Release).

- In July 2021, Vievu, a body-worn camera manufacturer, secured a USD12 million Series C funding round, led by Meritech Capital Partners. This investment will support the company's continued growth and product development, including the expansion of its AI capabilities and the introduction of new body-worn camera models (Meritech Capital Partners Press Release).

- In March 2020, the U.S. Department of Defense issued a mandate requiring all military personnel to wear body-worn cameras by 2025. This significant policy change reflects growing concerns over accountability and transparency in military operations and is expected to drive increased demand for body-worn camera solutions in the defense sector (Department of Defense Press Release).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing demand for advanced security solutions. Real-time data transmission and remote viewing are key features, enabling real-time incident response and remote monitoring. Data sharing among team members is facilitated through secure data collaboration platforms, ensuring data preservation and governance. Cybersecurity measures, such as data encryption algorithms and authentication protocols, are essential to protect digital evidence from unauthorized access. Helmet and vest mounting options provide flexibility for various operational scenarios. Firmware updates and software upgrades ensure the latest features, including video analytics, object tracking, and activity recognition, are implemented.

- Data synchronization and anonymization are crucial for maintaining data privacy and integrity. Threat detection and incident response are enhanced through artificial intelligence and machine learning capabilities. Cloud and edge computing enable data storage and processing, adhering to data retention policies and chain of custody requirements. Remote playback, forensic analysis, and data redaction tools support comprehensive incident investigation. Advanced analytics and machine learning enable proactive threat detection and activity recognition, enhancing overall security and operational efficiency.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Military Body-Worn Camera Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 235.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Russia, Canada, India, Brazil, UK, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Military Body-Worn Camera Market Research and Growth Report?

- CAGR of the Military Body-Worn Camera industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the military body-worn camera market growth of industry companies

We can help! Our analysts can customize this military body-worn camera market research report to meet your requirements.