Motorcycle Accessories Market Size 2024-2028

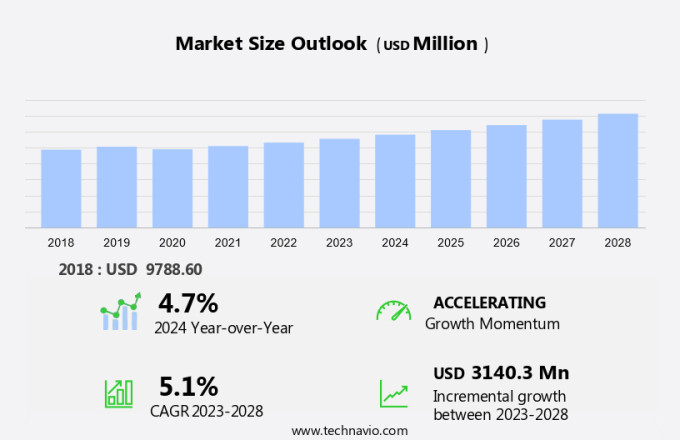

The motorcycle accessories market size is forecast to increase by USD 3.14 billion, at a CAGR of 5.1% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing sales of motorcycles. This trend is fueled by the rising preference for two-wheelers as a cost-effective and convenient mode of transportation, particularly in densely populated urban areas. A notable development in the market is the introduction of helmets equipped with anti-pollution technology. These innovative products cater to the growing concerns of consumers regarding air quality and health, offering a unique value proposition. However, the market landscape is not without challenges. Fluctuating raw material prices pose a significant threat to the profitability of manufacturers.

- The volatility in prices of materials such as plastics, metals, and rubber can lead to increased production costs and impact the competitiveness of the market. Companies must closely monitor these trends and adapt their strategies to mitigate the risks and maintain their market position. Effective supply chain management and diversification of raw material sources are crucial strategies for managing this challenge.

What will be the Size of the Motorcycle Accessories Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping its various sectors. Aftermarket parts remain a significant driving force, as riders seek to customize their bikes for enhanced performance and aesthetics. Security systems, including alarms and immobilizers, gain popularity due to increasing concerns for bike safety. Motorcycle tires, whether street or off-road, undergo continuous advancements to cater to diverse riding styles and terrains. Chain cleaning solutions and protective gear, such as riding jackets and pants, ensure optimal bike maintenance and rider safety. Riding groups and motorcycle clubs foster a sense of community among enthusiasts, while full exhaust systems and audio systems add to the overall riding experience.

Turn signals and replacement parts ensure bike functionality, while tank bags and tail bags cater to riders' storage needs. Performance tuning, exhaust systems, and motorcycle racing continue to push the boundaries of motorcycle capabilities. Navigation systems, bluetooth intercoms, and charging systems enhance the convenience and safety aspects of riding. Brake lines, disc brakes, lithium-ion batteries, and adjustable suspensions are essential components undergoing continuous innovation to improve bike performance and rider experience. Custom parts, electrical systems, and track days cater to the more adventurous riders, while crash bars, engine guards, and sissy bars offer added protection. The market's continuous dynamism reflects the evolving needs and preferences of riders across various sectors, ensuring a diverse and innovative landscape.

How is this Motorcycle Accessories Industry segmented?

The motorcycle accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Aftermarket

- OEM

- Product

- Protective gear

- Frames and fittings

- Electrical and electronics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- China

- India

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Application Insights

The aftermarket segment is estimated to witness significant growth during the forecast period.

The aftermarket market in the US is witnessing significant growth, fueled by consumers' increasing demand for enhanced functionality and personalization. Notable accessories driving this trend include luggage racks, alarm systems, cast wheels, handlebar risers, slip-on mufflers, navigation systems, performance tuning, and performance exhausts. Motorcycle racing and off-road riding enthusiasts seek brake lines, protective gear, charging systems, spoked wheels, motorcycle covers, tail bags, and adventure riding equipment. Motorcycle repair shops offer adjustable suspensions, riding jackets, disc brakes, lithium-ion batteries, custom parts, electrical systems, track days, air filters, chain lube, and parts replacement services. Motorcycle clubs and riding groups foster a community for motorcycle enthusiasts, promoting the sale of aftermarket motorcycle tires, off-road tires, chain cleaning tools, motorcycle speakers, motorcycle repair tools, and full exhaust systems.

The market's evolution also includes the integration of advanced technologies, such as audio systems, tank bags, turn signals, and bluetooth intercoms, enhancing the overall riding experience.

The Aftermarket segment was valued at USD 7.83 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is witnessing significant growth, with new players entering the scene. In May 2023, SpeedKore, known for its custom carbon-fiber muscle cars, announced its expansion into the market. This move introduces a new line of custom parts designed for American V-twin touring and bagger motorcycles. These accessories are engineered for superior performance, style, and durability, hand-crafted in the US by skilled artisans using aerospace-grade, prepreg carbon-fiber laminate. Each part is CAD-designed for perfect fitment and utilizes original equipment (OE) mounting locations, ensuring easy installation without modifications or drilling. Notable accessories include luggage racks, alarm systems, cast wheels, handlebar risers, slip-on mufflers, street tires, navigation systems, performance tuning, performance exhaust, motorcycle racing, off-road riding, brake lines, protective gear, charging systems, spoked wheels, motorcycle covers, tail bags, adventure riding, motorcycle speakers, motorcycle repair, adjustable suspensions, riding jackets, disc brakes, lithium-ion batteries, custom parts, electrical systems, track days, air filters, chain lube, street riding, bluetooth intercoms, riding pants, crash bars, sissy bars, engine guards, engine tuning, shock absorbers, brake pads, motorcycle clubs, aftermarket parts, security systems, motorcycle tires, off-road tires, chain cleaning, riding groups, full exhaust systems, audio systems, tank bags, turn signals, and parts replacement.

SpeedKore's commitment to quality and innovation is evident in their accessories, which cater to various riding styles and preferences. The market's evolution includes advancements in technology, materials, and customization, with a focus on enhancing safety, comfort, and performance for motorcycle enthusiasts.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Accessories Industry?

- The significant increase in motorcycle sales serves as the primary catalyst for market growth.

- The market is witnessing notable growth due to the increasing sales of motorcycles. This trend is particularly prominent in regions with high motorcycle ownership rates, such as Mugla, Turkey. In the first half of the year, Mugla recorded 20,404 motorcycle sales, making it a leading province in motorcycle ownership per capita. With a population of 1.1 million, Mugla now has over 264,570 motorcycles, equating to one in four residents owning a motorcycle. This surpasses even Istanbul, with its larger population of 15.6 million and 701,765 motorcycles. In the first half of 2024, Mugla achieved a significant milestone as motorcycle sales and registrations outpaced those of automobiles.

- Motorcycle enthusiasts in this region invest in various accessories to enhance their riding experience and ensure safety. These include track day essentials like air filters and chain lube, as well as street riding necessities such as bluetooth intercoms, riding pants, crash bars, sissy bars, engine guards, engine tuning, shock absorbers, brake pads, and motorcycle club memberships.

What are the market trends shaping the Motorcycle Accessories Industry?

- The development of helmets incorporating anti-pollution technology is a significant trend in the market. This innovative technology aims to improve the functionality and safety of helmets by shielding users from harmful air pollutants.

- The market is experiencing growth in the development of advanced helmet technology, specifically those with anti-pollution features. This trend responds to the increasing awareness of air quality concerns for motorcycle riders, particularly in urban areas. An illustrative instance is the anti-pollution helmet created by Shellios Technolabs in 2023, an Indian startup based in Delhi. Named PUROS, this helmet incorporates sophisticated air purifying components, such as a Brushless DC blower fan, an H13-grade HEPA filter (EN 1822), an electronic circuit, and a microUSB charging port for the Li-ion battery.

- These elements collaborate to filter out pollutants from the air before it reaches the rider, ensuring a cleaner riding experience. This innovation underscores the market's dynamic nature, with manufacturers focusing on addressing rider needs through technological advancements.

What challenges does the Motorcycle Accessories Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry, impacting its growth trajectory.

- The market is influenced by the volatility in the prices of raw materials, particularly metals and plastics. These price fluctuations can significantly impact the production costs of motorcycle accessories, from essential components like luggage racks and brake lines to high-end customizations such as performance exhausts and cast wheels. In October 2024, key raw material prices in Asia experienced a notable increase. Iron ore prices rose by 1.6% to USD118.50 per ton, while steel prices saw a 1.4% uptick, with rebar prices in China reaching approximately USD650 per ton. These increases in raw material costs directly affect the cost of manufacturing motorcycle accessories, necessitating manufacturers to adapt and maintain profitability while staying competitive in the market.

- Motorcycle enthusiasts continue to seek out accessories that enhance their riding experience, from alarm systems and navigation systems to slip-on mufflers and handlebar risers. Performance tuning and off-road riding also remain popular trends, driving demand for performance exhausts and protective gear. Manufacturers must navigate these market dynamics while ensuring the production of high-quality accessories that meet the evolving needs and preferences of motorcycle riders.

Exclusive Customer Landscape

The motorcycle accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alpinestars USA Inc. - This company specializes in providing a diverse range of motorcycle accessories.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpinestars USA Inc.

- AltRider LLC

- Brembo Spa

- EMGO International Ltd.

- FOX Head Inc.

- Garmin Ltd.

- GIVI S.P.A.

- GoPro Inc.

- Harley Davidson Inc.

- Hero MotoCorp Ltd.

- OSRAM GmbH

- Shoei Safety Helmet Corp.

- Solacegears

- Steelbird Hi-Tech India Pvt. Ltd

- STUDDS Accessories Ltd.

- TVS Motor Co.

- Vega Auto Accessories Pvt. Ltd.

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motorcycle Accessories Market

- In February 2024, Harley-Davidson, a leading motorcycle manufacturer, introduced its new line of wireless charging motorcycle helmets in collaboration with Cardo Systems (Reuters, 2024). This innovative product launch combines the functionality of a motorcycle helmet with the convenience of wireless charging, setting a new standard in the market.

- In May 2024, Bosch and HARMAN International, both major players in the automotive and technology industries, announced their strategic partnership to develop advanced motorcycle safety systems (Business Wire, 2024). This collaboration aims to integrate connectivity, safety, and infotainment solutions into motorcycles, addressing the growing demand for advanced technology in the market.

- In August 2025, Magna Powertrain, a global automotive supplier, acquired Motorex, a Swiss manufacturer of motorcycle lubricants and care products, for an undisclosed sum (Magna Powertrain Press Release, 2025). This acquisition strengthens Magna Powertrain's presence in the market and broadens its product offerings.

- In November 2025, the European Union passed new regulations mandating the installation of Advanced Emergency Braking Systems (AEBS) in all new motorcycles starting from 2027 (European Parliament Press Release, 2025). This regulatory approval marks a significant shift in motorcycle safety standards and is expected to drive demand for motorcycle accessories that comply with the new regulations.

Research Analyst Overview

- In the dynamic motorcycle market, accessory trends reflect a focus on safety, comfort, and performance. Motorcycle insurance policies increasingly require advanced safety features, such as adaptive cruise control and lane departure warning systems. Weight reduction remains a priority through the use of materials like carbon fiber and CNC machining. Motorcycle tours and community events showcase weather-resistant and corrosion-resistant accessories, including LED lighting and wind protection. Fuel efficiency is a concern for many riders, leading to the popularity of performance upgrades and engine management systems.

- Motorcycle media and websites provide a platform for riders to share experiences and discuss the latest trends, including motorcycle laws and rider training. Safety features, such as anti-theft devices and traction control, continue to gain importance in the market. Ride height adjustment and motorcycle apps cater to rider comfort, while motorcycle magazines showcase the latest motorcycle technologies and innovations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motorcycle Accessories Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2024-2028 |

USD 3140.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.7 |

|

Key countries |

US, Canada, Italy, China, Japan, France, Germany, Brazil, Indonesia, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorcycle Accessories Market Research and Growth Report?

- CAGR of the Motorcycle Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorcycle accessories market growth of industry companies

We can help! Our analysts can customize this motorcycle accessories market research report to meet your requirements.