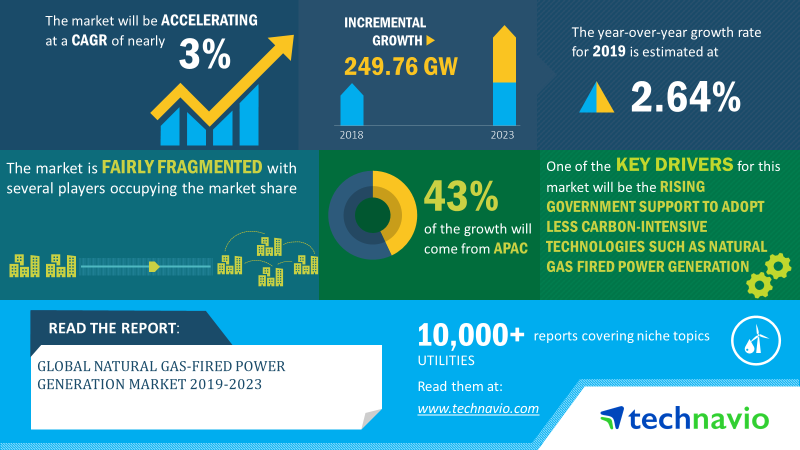

The global natural gas-fired power generation market size will grow by 249.76 GW during 2019-2023. The natural gas-fired power generation industry research report provides a detailed analysis of the market based on type (CCGT and OCGT) and geography (APAC, Europe, MEA, North America, and South America). The report analyzes the market's competitive landscape and offers information on several natural gas-fired power generation companies including Chubu Electric Power Co. Inc., RWE AG, Southern Co., Tokyo Electric Power Company Holdings Inc., and Uniper SE.

The global natural gas-fired power generation market is expected to witness a CAGR of 2.79% during the forecast period. Certain factors that are driving the market growth include rising global energy demand, rising government support, and growth in natural gas production.

Key Insights on Natural Gas-fired Power Generation Market – Global Forecast 2019-2023

Browse ToC and LoE with selected illustrations and example pages Natural Gas-fired Power Generation Market

The rapid growth in global energy demand is due to robust economic growth. The growth in the global energy demand was propelled by countries such as China and the US, which accounted for more than 70% of the growth in global energy demand. Further, there is a rapid growth in global electricity demand which is propelled by emerging economies such as China and India. The electrification of global energy systems is propelled by various factors such as the electrification of heat and transportation sector, the growth in the number of electronically connected devices, and digitalization of modern economies. Hence, with the increase in energy demand, the global natural gas-fired power generation market is expected to grow during the forecast period.

Natural Gas-Fired Power Generation Industry Overview

- The government support to the adoption of clean energy technologies will be one of the primary drivers of the natural gas-fired power generation market. With the high demand for energy and growing focus on reducing carbon emissions, the need for less-carbon-intensive technologies like natural gas-fired power generation is also growing.

- Use of coal-fired power generation has decreased across the world and further boosting the demand for natural gas-fired power generation.

- Development of battery storage-augmented gas turbines will be one of the critical natural gas-fired power generation market trends. Battery storage-augmented gas turbines are highly productive when compared to traditional gas turbines.

- Battery energy storage systems (BESS) reduce GHG emissions, enhance primary frequency response and voltage support, and ensures smooth transient response with lesser turbine thermal stress.

- The development of technologically advanced gas turbines will enhance the efficiency of natural gas-fired power plants and consequently fuel the growth of the natural gas-fired power generation market at a CAGR of nearly 3% during the forecast period.

Natural Gas-Fired Power Generation Market Report Offers:

- A complete backdrop analysis, which includes an assessment of the parent market

- Important changes in market dynamics

- Market segmentation up to the second or third level

- Historical, current, and projected size of the market from the standpoint of both value and volume

- Reporting and evaluation of recent industry developments

- Market shares and strategies of key players

- Emerging niche segments and regional markets

- An objective assessment of the trajectory of the market

- Recommendations to companies for strengthening their foothold in the market

Top Companies in Natural Gas-Fired Power Generation Market

The global natural gas-fired power generation market is fairly fragmented. To help clients improve their revenue share, the natural gas-fired power generation market research report provides an analysis of the market's competitive landscape and offers information on the products offered by various companies. Key insights provided by the natural gas-fired power generation market analysis report will enable companies to make informed business decisions.

The report offers a detailed analysis of several leading natural gas-fired power generation companies, including:

- Chubu Electric Power Co. Inc.

- RWE AG

- Southern Co.

- Tokyo Electric Power Company Holdings Inc.

- Uniper SE

Market Segmentation

Natural Gas-Fired Power Generation Market Forecast by Type

- The combined cycle gas turbine (CCGT) segment held the largest natural gas-fired power generation market share in 2018 because of its environmental and economic benefits.

- However, the market share of the CCGT segment will decrease, and the open cycle gas turbine (OCGT) segment will emerge as the market leader by the end of the next five years.

Natural Gas-Fired Power Generation Market Analysis by Region

- North America accounted for the largest natural gas-fired power generation market share in 2018 because of the increasing production of natural gas and the development of highly efficient natural gas technology.

- North America's contribution to the growth of the natural gas-fired power generation market size will decrease, but it will dominate the market throughout the forecast period.

Major Highlights of the Natural Gas-Fired Power Generation Market – Global Forecast 2019-2023

- CAGR of the market during the forecast period 2019-2023

- Detailed information on factors that will accelerate the growth of the natural gas-fired power generation market during the next five years

- Precise estimation of the global natural gas-fired power generation market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the natural gas-fired power generation industry across APAC, Europe, MEA, North America, and South America

- A thorough analysis of the market's competitive landscape and detailed information on several vendors

- Comprehensive details on factors that will challenge the growth of natural gas-fired power generation companies

Reasons for Purchase

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the natural gas-fired power generation market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

We can help! Our analysts can customize the natural gas-fired power generation market research report to meet your requirements. Get in touch