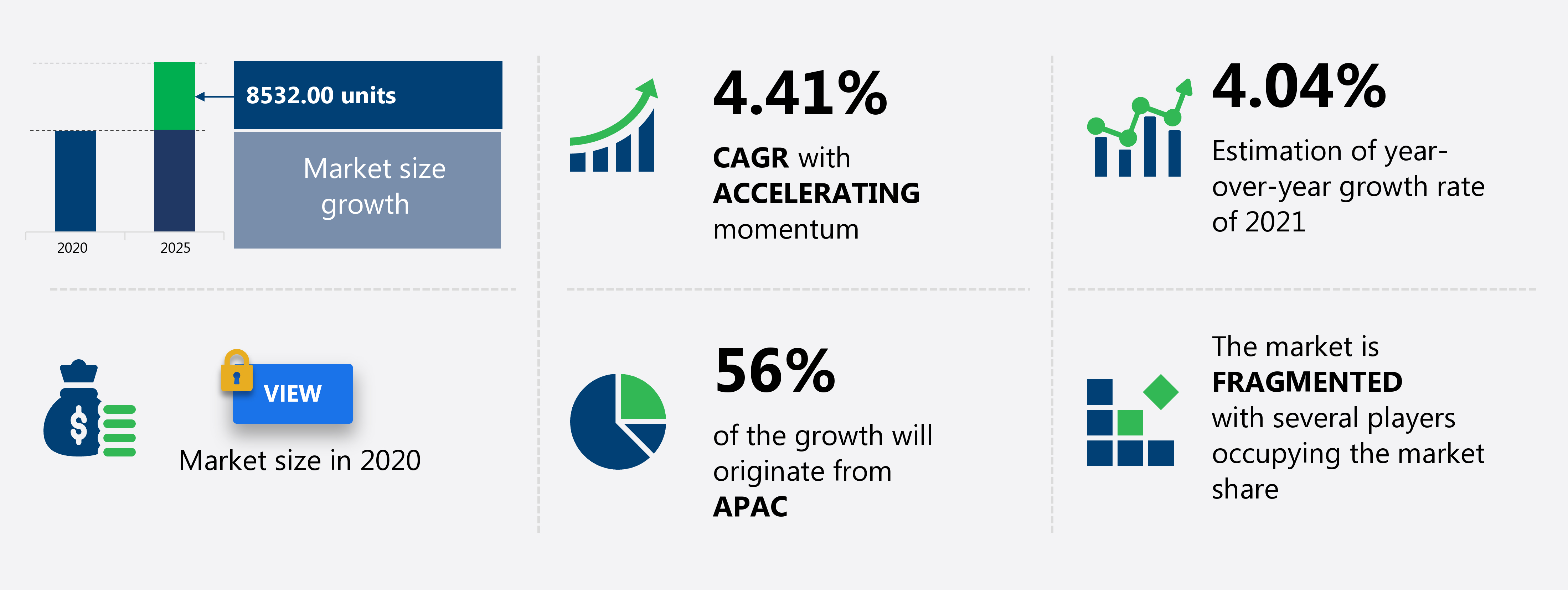

The natural gas refueling stations market share is expected to increase by 8532.00 units from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.41%.

This natural gas refueling stations market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers market segmentation by technology (CNG and LNG), type (fast-fill stations and time-fill stations), and geography (APAC, North America, Europe, MEA, and South America). The natural gas refueling stations market report also offers information on several market vendors, including Atlas Copco AB, Clean Energy Fuels Corp., Dover Corp., Exxon Mobil Corp., GAIL (India) Ltd., Gilbarco Inc., GreenLine, Ingersoll Rand Inc., Linde Plc, and Torrent Gas Pvt. Ltd., among others.

What will the Natural Gas Refueling Stations Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Natural Gas Refueling Stations Market Size for the Forecast Period and Other Important Statistics

Natural Gas Refueling Stations Market: Key Drivers and Challenges

Based on our research output, there has been a negative impact on the market growth during and post the COVID-19 era. The demand for cleaner fuels is notably driving the natural gas refueling stations market's growth, although factors such as the fall in oil prices may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic's impact on the natural gas refueling stations market industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Natural Gas Refueling Stations Market Driver

Natural gas is a clean and affordable alternative to fossil fuels such as diesel, gasoline, and fuel oil. It is used in vehicles in compressed or liquefied form. Carbon dioxide emissions have been growing in accordance with an increase in economic activities. Efforts by countries across the world in decarbonizing the power system by shifting to renewable energy have helped in controlling carbon dioxide emissions. The burning of natural gas results in less pollution, which explains its increasing use in the transportation sector; thus, driving the global natural gas refueling stations market growth.

Key Natural Gas Refueling Stations Market Challenge

Natural gas can be easily substituted by gasoline and diesel. Global oil prices have witnessed a steep decline in recent times. This significant decline in oil prices is attributed to the supply-demand imbalance of crude oil in the global market. Cost-benefits of natural gas over conventional fuels were one of the major driving factors pushing the use of natural gas as a fuel in the transportation industry. However, the multi-year decline in oil prices has made switching to alternative fuel vehicles a less attractive proposition. Thus, the fall in oil prices is expected to impede natural gas refueling stations market growth during the forecast period.

This natural gas refueling stations market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Who are the Major Natural Gas Refueling Stations Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Atlas Copco AB

- Clean Energy Fuels Corp.

- Dover Corp.

- Exxon Mobil Corp.

- GAIL (India) Ltd.

- Gilbarco Inc.

- GreenLine

- Ingersoll Rand Inc.

- Linde Plc

- Torrent Gas Pvt. Ltd.

This statistical study of the natural gas refueling stations market encompasses successful business strategies deployed by the key vendors. The natural gas refueling stations market is fragmented, and the vendors are deploying growth strategies such as distinguishing their products and service offerings through clear and unique value propositions to compete in the market.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments while maintaining their positions in the slow-growing segments.

The natural gas refueling stations market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Which are the Key Regions for Natural Gas Refueling Stations Market?

For more insights on the market share of various regions Request for a FREE sample now!

56% of the market’s growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for natural gas refueling stations in APAC. Market growth in this region will be faster than the growth of the market in South America, North America, MEA, and Europe.

Growing concerns over the rising air pollution and the impact on the health of the populations in APAC are driving the need for adopting alternative fuels such as natural gas that are less harmful to the environment will facilitate the natural gas refueling stations market's growth in APAC during the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Technology Segments in the Natural Gas Refueling Stations Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The natural gas refueling stations market's growth-share by the CNG segment will be significant during the forecast period. CNG is a popular fuel for passenger vehicles as it is easier to store in vehicles. Also, it is cheaper than LNG, diesel, and gasoline, making it an ideal choice for an urban fleet. A CNG station can be a fast-fill or a time-fill station. CNG transportation from refineries or utilities to the stations can be carried out through existing gas pipelines or tankers, which is not the case for LNG transportation. Hence, it is possible to supply CNG directly from the refineries to the stations. This eliminates the need for storage tanks. The inherent benefits of CNG over other fuels have resulted in the rise in the number of CNG vehicles in urban areas.

This report provides an accurate prediction of the contribution of all the segments to the growth of the natural gas refueling stations market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Natural Gas Refueling Stations Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.41% |

|

Market growth 2021-2025 |

8532.00 units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.04 |

|

Regional analysis |

APAC, North America, Europe, MEA, and South America |

|

Performing market contribution |

APAC at 56% |

|

Key consumer countries |

China, the US, Russian Federation, Japan, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Atlas Copco AB, Clean Energy Fuels Corp., Dover Corp., Exxon Mobil Corp., GAIL (India) Ltd., Gilbarco Inc., GreenLine, Ingersoll Rand Inc., Linde Plc, and Torrent Gas Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Natural Gas Refueling Stations Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive natural gas refueling stations market's growth during the next five years

- Precise estimation of the natural gas refueling stations market's size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the natural gas refueling stations industry across APAC, North America, Europe, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of the natural gas refueling stations market's vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch